Photon-Photos

The Q2 Earnings Season for the Gold Miners Index (GDX) has finally begun and was kicked off by a disappointing report from Newmont (NEM). While we should see better reports from some small-cap producers with limited/no exposure to Western Australia, where labor tightness impacted productivity, Wesdome Gold Mines (OTCQX:WDOFF) had its own challenges in Q2. These led to a massive miss on gold production estimates, with Wesdome reporting lower production/sales year-over-year. Fortunately, this looks to be a one-off, and it’s left Wesdome attractively valued. So, for those anxious to start a position in the stock, I would expect further weakness to offer a buying opportunity.

Wesdome Operations (Company Website)

Just over three months ago, I wrote on Wesdome Mines, noting that the valuation was no longer attractive, with the stock trading at $1,000/oz on reserves and at a P/NAV multiple of 1.30. At this valuation, the stock had zero room for error, and any weakness in the gold price was likely to put a ceiling on the stock. Unfortunately, not only did the gold price come under pressure, but Wesdome had a rare misstep in Q2, reporting an extremely underwhelming report after issues at both of its mines, leaving the stock 45% below its highs. The good news is that for investors that waited on the sidelines and were patient, we look to be approaching a low-risk buy zone, reinforced by the view that these issues were merely a one-off.

Q2 Production

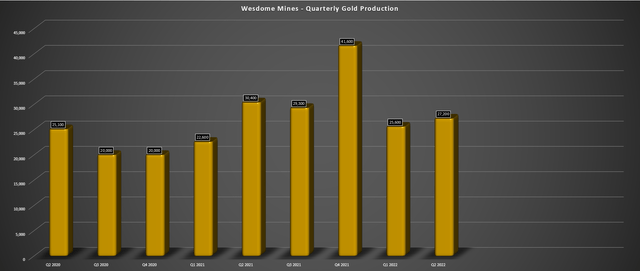

Wesdome Gold Mines (“Wesdome”) released its preliminary Q2 results earlier this month, reporting quarterly production of ~27,200 ounces of gold, a 10% decline from the year-ago period. This was especially disappointing given that production should have been up at least 10% in the period, with its second Kiena Mine ramping up towards full production this year. The company noted that it had several issues in the quarter that impacted production, and we’ll begin with its flagship Eagle River Mine below:

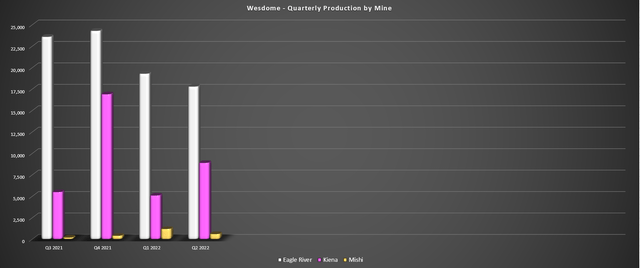

Wesdome Quarterly Production (Company Filings, Author’s Chart)

Wesdome’s Eagle River Mine had a tough Q2, reporting production of just ~17,800 ounces, a 40% decline from the year-ago period. This was due to lower throughput and much lower head grades, with the operation having processed just ~60,000 tonnes at an average grade of 9.6 grams per tonne of gold in the quarter. These figures compared unfavorably to ~63,100 tonnes at 15.1 grams per tonne gold in Q2 2021 and have placed Wesdome well behind its annual guidance, with Eagle River being its largest contributor. In fact, production is sitting at just ~52,800 ounces year-to-date, tracking at 31% of its guidance mid-point (170,000 ounces).

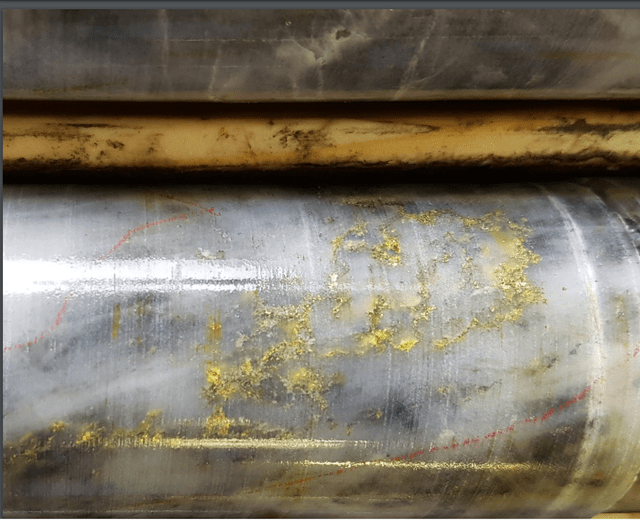

Wesdome Drill Core (Company Website)

Wesdome noted that the lower production was related to one-time issues, with a manufacturing defect on a new hoist rope that led to much lower productivity due to having to truck ore from the surface while it worked on sourcing a second new rope. Meanwhile, one of the leach tanks at the mill failed in mid-June, taking mill production offline for nearly a week. Obviously, this is quite disappointing, but the silver lining is that neither of these issues has long-term consequences and they are not like the issues we’ve seen at other underground operations in Canada, such as overbreak at the Pure Gold Mine (OTCPK:LRTNF), seismicity issues at Westwood (IAG), or poor grade reconciliation at Brucejack (PVG).

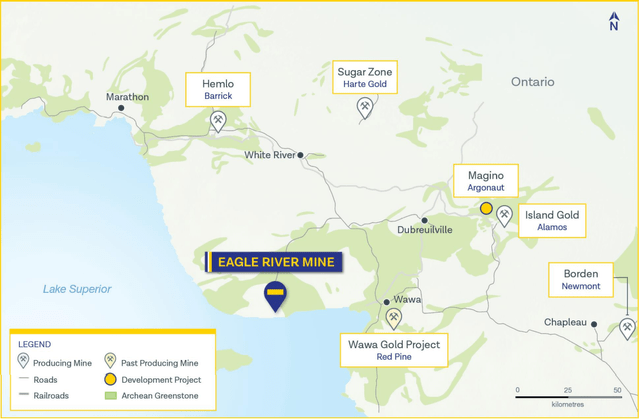

The other silver lining is that these issues have since been resolved, and the company was able to process much higher grades at Eagle River in June, but the gold sales were delayed into Q3. So, while the Q2 production results and revenue came in well below forecasts, the Q3 results should have an additional lift from the late-quarter sales, setting Wesdome up for a 40,000+ ounce quarter potentially in Q3. Of course, this assumes that there are no additional issues this quarter. The only potential issue that comes to mind is labor tightness cited in Newmont’s Q2 results, but this seemed to apply to its operations further north at Musselwhite and further east at Timmins (vs. Wesdome’s Eagle River Mine just west of Wawa, Ontario).

Eagle River Mine Location (Company Presentation)

Unfortunately, when it rains, it pours, and on top of Eagle River’s disappointing quarter, Wesdome’s new Kiena Mine also had its challenges. This left it unable to pick up the slack at Eagle River. These issues included the delayed receipt of electrical components for the paste backfill plant, leading to much lower mining rates and placing the asset 3-4 months behind its plans. The result was the production of a mere ~8,900 ounces in Q2 at Kiena, down nearly 50% from the strong quarter that the asset enjoyed in Q4 2021 (~16,900 ounces). On a year-to-date basis, Kiena has produced just ~14,000 ounces and has little hope of meeting its guidance mid-point of ~68,000 ounces this year.

Wesdome – Quarterly Production by Mine (Company Filings, Author’s Chart)

So, what’s the good news?

While the slow start to the year is disappointing, and I would be surprised if a guidance cut weren’t on deck, this is a very rare miss for Wesdome, which has otherwise performed near flawlessly vs. expectations over the past few years. When a company that has a history of consistently meeting its promises misses horribly, especially one that owns two of the highest-grade ore bodies globally, this creates a rare opportunity to place lower bids to take advantage of further selling pressure.

That said, while the Q2 production results were ugly, the Q2 results in August should also be brutal, given that revenue came in much lighter than expected at ~$48 million. The lower revenue should lead to much higher unit costs with minimal help from the gold price, which was up barely 5% on a year-over-year basis. From a sequential standpoint, we should see costs spike to their highest levels in years simultaneously as the gold price will be down from Q1 levels. So, with considerable margin compression on deck and the potential that the company will reel in its FY2022 guidance, I wouldn’t be shocked by further selling pressure on the results.

While this might disappoint current investors stuck in the stock at much higher levels that may have chased the stock in April, it’s great news for patient investors or those that want to add to their positions. Let’s look at the valuation to see if this bad news appears to be priced into the stock and whether Wesdome is offering a margin of safety.

Valuation

Based on ~144 million fully diluted shares and a share price of US$7.40, Wesdome trades at a market cap of ~$1.06 billion. This leaves the stock trading at a P/NAV multiple of 0.87x based on an estimated net asset value of $1.22 billion. This is a very reasonable valuation for a company with a solid organic growth profile and the proud owner of two of the world’s highest-grade mines in Tier-1 jurisdictions. In fact, in a better market, Wesdome could command a valuation of 1.40x P/NAV, a multiple that’s well above its peer group given its unique combination of organic growth, future margin expansion, and the fact that it’s arguably a top-10 exploration story sector-wide.

I believe a more conservative multiple for Wesdome is 1.30x P/NAV; at this multiple, I see a fair value for the stock of US$10.94. This translates to more than 45% upside from current levels, offering investors that want a position in the stock a much lower-risk buy point than when the stock was levitating higher and outperforming its peer group massively over the past three years. So, from a valuation standpoint, I see Wesdome as attractive, and the stock has finally dipped into a low-risk buy zone. Let’s take a look at the technical picture:

Technical Picture

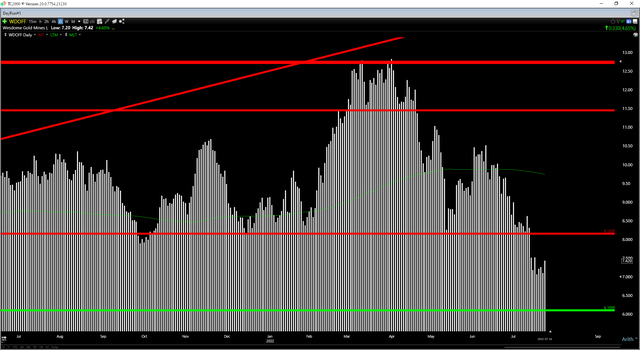

While Wesdome is now attractively valued from a fundamental standpoint, the technical picture has become messier, with the stock plunging through a key support area at US$8.00 – US$8.15. Often, major support areas will become new resistance levels, with some investors that purchased the stock at support and sat through a drawdown likely to exit at break-even or a small gain when the stock returns to their purchase price. Based on this new resistance zone at US$8.15 and the fact that the next major support level doesn’t come in until US$6.10, the reward/risk ratio comes in at 0.58 to 1.0, which does not meet my criteria of a 6 to 1 reward/risk ratio for small-cap producers.

WDOFF Daily Chart (TC2000.com)

This doesn’t mean that the stock can’t go higher, and for those less worried about potential short-term drawdowns, the valuation is the most attractive since October 2021. That said, with what could be an ugly Q2 report ahead from a margin standpoint (higher costs) and the risk of a guidance cut, I remain on the sidelines for now. However, if the stock were to dip below US$6.45, where the reward/risk ratio would improve to 6.0 to 1.0, I would view this as a low-risk buying opportunity from both a technical and fundamental standpoint.

Summary

Wesdome certainly didn’t perform to expectations in Q2, but while disappointing, the issues were largely out of its control, and they do not change the bullish long-term thesis here. This thesis is increased production, higher margins, and considerable excess processing capacity to support future growth. So, while this has undoubtedly derailed the stock short-term, I would expect further weakness to present a buying opportunity. Some investors will argue that waiting for the perfect entry on this stock could be a mistake, given that a blockbuster hole out of Kiena could light a fire under the stock.

However, I prefer to be rigid regarding new purchases, especially in cyclical bear markets for gold and the S&P-500 (SPY). Given this potential continued downward pressure, for this reason, I would not be surprised if Wesdome re-tested or undercut its low at US$6.80 before finding its ultimate low in this correction. However, with Wesdome arguably being a top-10 producer and being one of the few companies that should be able to sidestep sector-wide margin pressure in 2023/2024, I think this is a name to keep a very close eye on going forward.

Be the first to comment