Elena Bionysheva-Abramova

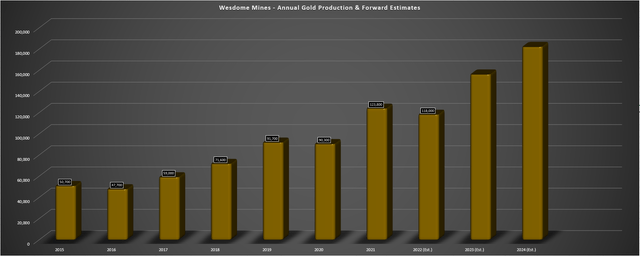

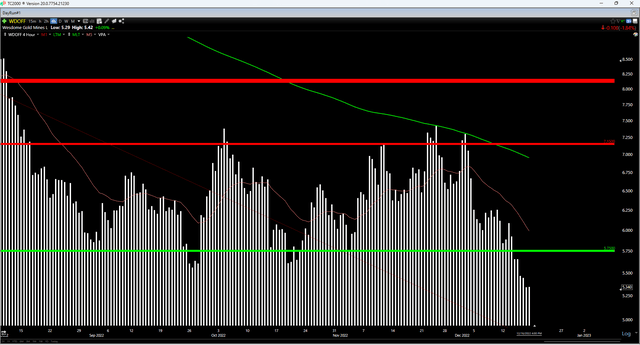

Just over two months ago, I wrote on Wesdome Gold Mines (OTCQX:WDOFF), noting that while the odds were firmly in favor of the bulls with the stock trading below US$5.95, especially with considerable negativity priced into the stock. While the stock enjoyed a 28% rally into mid-November, it made yet another lower high on a closing basis relative to September and has since broken below key support. In fact, Wesdome is one of the only gold miners that made new 52-week lows this month, a significant disappointment for investors that had become used to its outperformance (2018-2021). Let’s take a closer look at recent developments below:

Kiena Operations (Company Presentation)

All figures are in United States Dollars unless otherwise noted with a C$.

Q3 Results

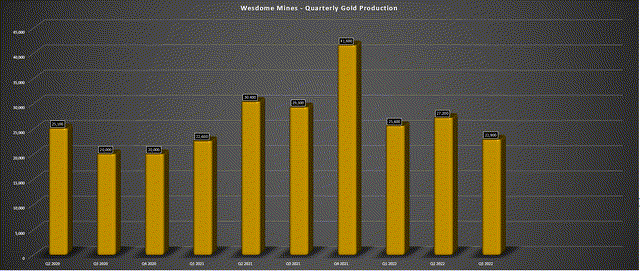

Wesdome Gold Mines (“Wesdome”) released its Q3 results last month, reporting quarterly production of ~22,900 ounces, a 22% decline from the year-ago period. This sharp decline in production and ounces sold was related to lower grades and throughput at its flagship Eagle River Mine (~52,200 tonnes processed at 10.2 grams per tonne of gold), and slower than planned development at Kiena due to supply chain headwinds. Fortunately, the company is expecting a much better fourth quarter at Eagle River after some grade underperformance in the Falcon Zone and Kiena should also have a stronger Q4 with the pastefill plant operational and the hoist refurbishment shutdown complete (contributing to excess downtime in July).

Wesdome – Quarterly Production (Company Filings, Author’s Chart)

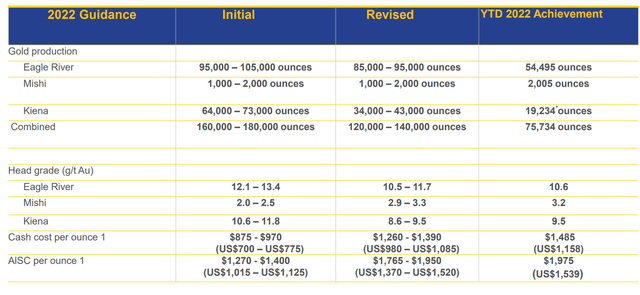

Given the softer than expected performance this year (related to grade variability at Eagle & the hoist rope manufacturing defect/leach tank failure that have since been addressed plus the impact of supply chain headwinds at Kiena and COVID-19 staffing issues), Wesdome’s production is trailing well behind initial estimates. In fact, the company has produced less gold in the first nine months of 2022 vs. the previous year period despite expecting to reach commercial production well ahead of Q4. The result is that Wesdome was forced to revise its guidance mid-point from 170,000 ounces to 130,000 ounces, but judging by the production shortfall with just one quarter to go (~75,700 ounces year-to-date), we could see Wesdome miss the low end of guidance at 120,000 ounces.

Wesdome – Year-to-Date Results & Revised Guidance (Company Presentation)

While this has certainly put a severe dent in sentiment surrounding the stock, it’s worth noting that most of these issues are out of the company’s control. For starters, supply chain headwinds have led to much later receipt of key items for its new Kiena Mine, but the pastefill plant has finally been commissioned. This will eliminate the need for cemented rock fill, freeing up scoops, trucks, and its workforce. In addition, one major impediment to advance rates is the delayed receipt of mechanized bolters, but the company has since sourced rentals to help improve development in the interim.

Wesdome noted that it expects the receipt of these mechanized bolters by March (on track to be a year late), allowing for a much more productive operation at Kiena going forward and a solution to the challenging ground conditions in the schist and komatite rock types (footwall zones).

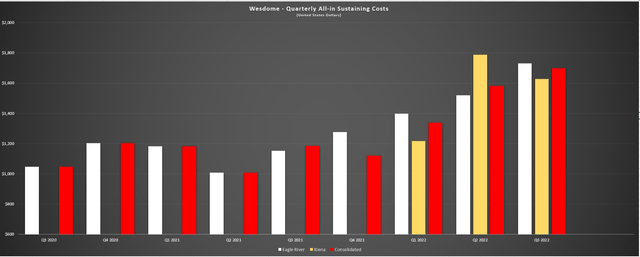

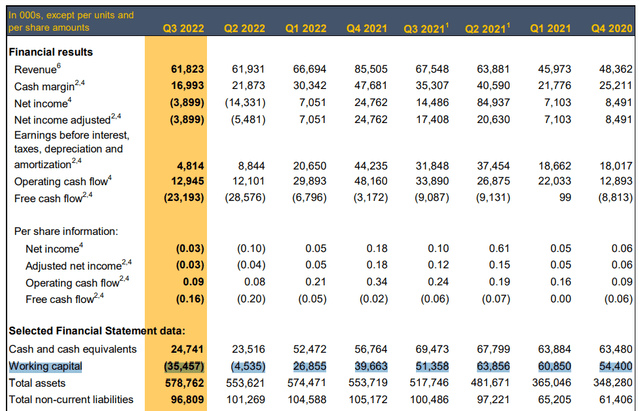

These issues have been exacerbated by more maintenance than expected at Eagle River this year and COVID-19 related headwinds that led to two underground crews being sent off site in late Q3 due to team members testing positive for the virus. Given the much lower denominator (ounces produced) combined with inflationary pressures (labor, fuel, energy, steel), it’s no surprise that the weaker results have also severely impacted costs. Unfortunately, the result is that costs have soared on a year-over-year, with consolidated all-in-sustaining costs [AISC] of $1,698/oz (Q3 2021: $1,186/oz), putting a significant dent in AISC margins when combined with a slightly lower gold price.

Wesdome – Quarterly AISC (Company Filings, Author’s Chart)

Overall, the Q3 results leave much to be desired and the company’s impressive track record of growing through cash flow with no financings may come to an unfortunate end if it does choose to use its newly announced ATM. That said, while the 8% decline in revenue (C$61.8 million) and cash flow from operations (C$12.9 million) was disappointing, I don’t see any reason to be overly harsh on Wesdome for these results with this being the result of a convergence of negative developments. That said, the company could have been a little more conservative with guidance with this being the first year of commercial production at Kiena, and the consequence of this tough year is that Wesdome ended the quarter with a negative working capital position (C$35.5 million), and more than it planned drawn on its credit facility.

Recent Developments

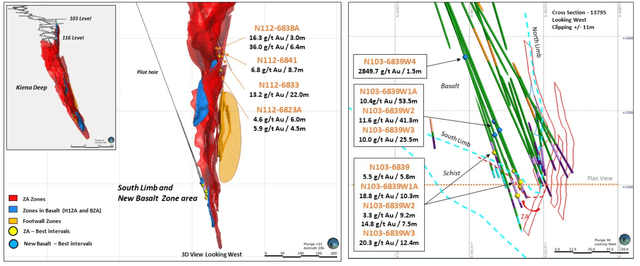

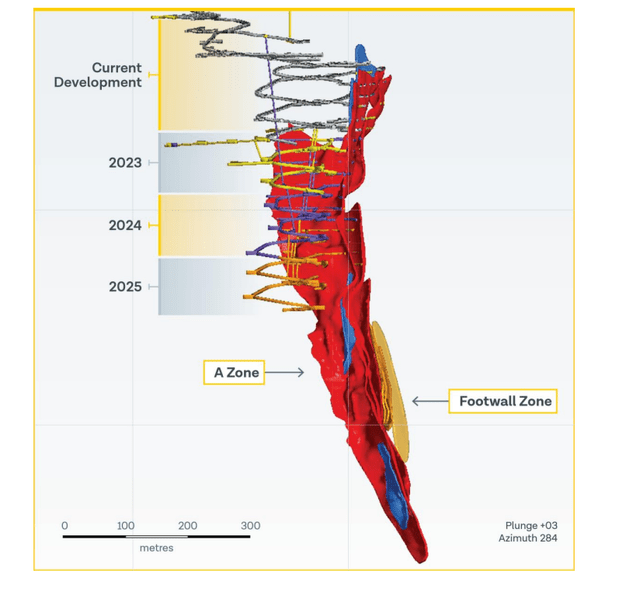

In addition to declaring commercial production last month, Wesdome announced additional exploration results last month, with the Kiena Deep A Zone continuing to surprise on the upside. Over the past 18 months, Wesdome has already identified the Footwall Zones and the South Limb area as potential areas for reserve growth, with additional mineralization in the basalt in the hanging wall of the A Zone. While true widths are unknown, the new zone’s highlights include 53.5 meters of 10.39 grams per tonne of gold, 41.3 meters of 11.55 grams per tonne of gold, 25.5 meters of 9.98 grams per tonne of gold, and 1.5 meters of 2,850 grams per tonne of gold. These are phenomenal intercepts and could significantly increase ounces per vertical meter and provide more working faces, a positive development due to the excess capacity at the Kiena Mill.

South Limb & New Basalt Zone Area (Company News Release)

Meanwhile, when it comes to regional exploration, Wesdome reported solid results from the Presqu’ile Zone, which lies 1.4 kilometers northwest of the Kiena Mine. Highlights of recent drilling include 3.3 meters of 24.3 grams per tonne of gold, 9.4 meters of 30.0 grams per tonne of gold, 3.8 meters of 45 grams per tonne of gold, and 3.5 meters of 27.6 grams per tonne of gold. These are all exceptional intercepts, especially given their closer proximity to the surface. Historic drilling at Presqu’ile defined a resource of 353,000 tonnes at 7.1 grams per tonne of gold (~81,000 ounces) in the inferred category, and given the recent exploration success, Wesdome is looking at options to fast-track an exploration ramp from the surface.

Unfortunately, while the declaration of commercial production and recent exploration results were both positive, this was overshadowed by the softer Q3 operational results, the weaker balance sheet, and the recent establishment of an At-The-Market Equity Program for up to C$100 million in shares. Given that Wesdome has significant capacity left on its secured credit facility, I wouldn’t expect a significant amount of share sales under this ATM program. Still, it’s possible that with US$40 million already drawn, interest rates rising, and a higher spread depending on its net leverage ratio, the company may prefer to have other options available for padding its balance sheet in case interest rates do continue their upward trajectory.

Wesdome – Annual Gold Production & Forward Estimates (Company Filings, Author’s Chart & Estimates) Kiena Mine Development (Company Presentation)

The other negative development is that while 2023 should be a much better year, the slower pace of development in 2022 has placed the mine significantly behind on planned development, suggesting that production will come in well behind its previous FY2023 plans (2021 TR) of ~68,000 ounces. Based on this and assuming just over 50,000 ounces in 2023 at Kiena, we could see consolidated production of fewer than 155,000 ounces next year, well below my previous estimates of ~170,000 ounces. This isn’t the end of the world, but it’s not ideal for a company that was commanding a large premium to its peer group due to consistently over-delivering on promises over the past few years.

Valuation & Technical Picture

Based on ~145 million fully diluted shares and a share price of US$5.35, Wesdome trades at a market cap of $783 million, a significant decline from its peak market cap of ~$1.80 billion earlier this year. Since Wesdome has one of the better organic growth stories sector-wide, with two ultra-high-grade mines in Tier-1 jurisdictions with excess processing capacity, the stock rightfully commanded a premium relative to its peer group. However, after a very challenging year and the stock appearing on track to miss its already revised guidance, it’s understandable that the stock has come back in line with its peer group. In fact, the stock now trades at a more attractive valuation of 0.70x P/NAV compared to an estimated net asset value of ~$1.11 billion.

Using what I believe to be a fair multiple of 1.20x P/NAV to reflect Wesdome’s unique position as a company in safe jurisdictions with two of the top 10 highest-grade gold mines globally, I see a fair value for the stock of ~$1.35 billion [US$9.30 per share]. However, this price target is contingent on no shares being sold under its new At-The-Market Equity Program. Given the company’s weaker financial position (negative working capital) and the elevated interest rate on its secured credit facility, I would not rule out some share sales. This would not only put further pressure on the stock but also reduce the stock’s price target.

Wesdome – Q3 Financial Results (Company Filings)

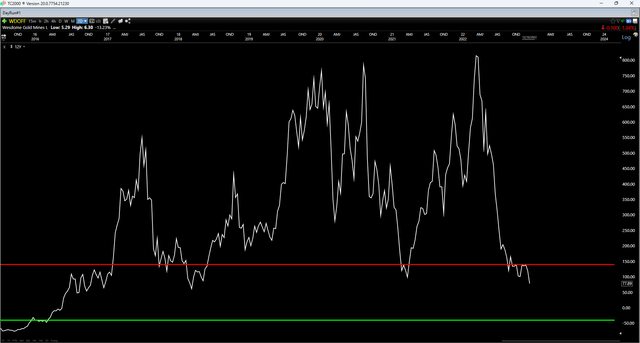

The other negative development is that while the stock bounced off support in the US$5.50 – US$5.75 region in late October, the stock has since sunk below this level and made a lower high. This has created a new potential resistance zone at US$7.15, and the stock is now hanging out below critical support, which is not ideal. The result is that the reward/risk ratio from a technical standpoint has actually worsened despite slightly lower prices, given that it’s not clear if Wesdome will be able to reclaim key support at US$5.75. Plus, it’s not nearly as oversold as it was in late October, with the current correction being more of a slow bleed.

WDOFF 4-Month Chart (TC2000.com) WDOFF Technical Indicators (TC2000.com)

Finally, while the stock has fallen precipitously, it’s still not what I’d consider long-term oversold (below indicator) due to four years of outperformance that are being unwound. This setup is less attractive than when a stock is in a long-term decline and has seen an acceleration in its downward trajectory and clear capitulation, like Argonaut Gold (OTCPK:ARNGF). This doesn’t mean that Wesdome can’t bounce from here and that the lows aren’t in, but the setup in October was more attractive than the current one. Hence, I don’t see a clear buy signal for Wesdome just yet, especially with the added uncertainty that we could see incremental selling volume coming from the company under its ATM.

Summary

Wesdome has had a rough year with several issues exacerbated by supply chain issues and with the company getting no help from the gold price from a revenue standpoint. The result is that it looks like we’ll see a miss on already revised guidance, and FY2023 is shaping up to be less robust than previously expected, with consolidated production likely to come in below 160,000 ounces. Fortunately, much of this negativity looks priced into the stock, the company has continued to see exploration success, and the gold price has firmed up, leading to improved cash flow generation going forward. That said, with Wesdome breaking critical support and the risk of minor share dilution, I prefer to watch for clearer signs of a bottom than rush in here at US$5.40.

Be the first to comment