MarsBars

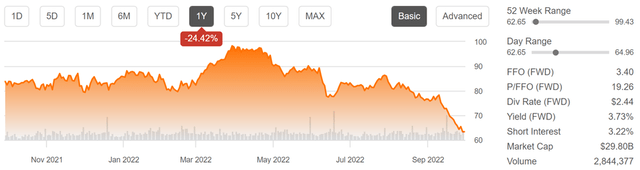

Many wonderful companies had seen their pricing get stretched in recent months, but that no longer appears to be the case. There are lots of value opportunities to be had in the current market, but diversification is key to sleeping well at night. For those seeking REIT income from a trusted brand with long-term tailwinds, they may want to consider Welltower (NYSE:WELL). Welltower is now trading well below its near-term high of $86 achieved as recently as August, and in this article, I highlight why now may be a great buying opportunity.

Why WELL?

Welltower is an S&P 500 Company with over 40 years of investing in the healthcare real estate space. It currently owns a diversified portfolio of 1,800+ healthcare properties in North America and overseas, including 100 properties in both Canada and the United Kingdom. Both of these countries have mature healthcare systems that operate in a similar fashion to the United States.

It’s no secret that Welltower has seen a tough operating environment over the past 2 years due to COVID and its impact on senior housing. However, it appears that the company is starting to turn the corner, as same-store occupancy improved by 100 basis points sequentially and 500 basis points YoY to 78.8% in the second quarter.

This accompanied same-store revenue growth of 11.5% YoY for the senior housing segment, which encouragingly is at a faster pace than same-store expense growth of 10.5%. This contributed to total same-store NOI growth of 8.7%, as the strong rebound in the senior housing segment was offset by the slower and steady NOI growth of 2.5% for the medical office portfolio.

Potential headwinds include well-publicized wage inflation in the healthcare segment, which may weigh on profitability in WELL’s SHOP portfolio. However, the aforementioned revenue outpacing expense growth shows that this trend is stabilizing. In addition, WELL is better positioned than more leveraged REITs for a rising rate environment, as it carries a BBB+ rated balance sheet and a reasonably low 44% long-term debt to capital ratio, and it pays well-covered dividend with a 71% payout ratio (based on Q2 FFO/share of $0.86). This leaves plenty of retained capital to pay down debt or fund development.

Looking forward, the long-term favorable demographics for Welltower shouldn’t be ignored, given the sizeable baby boomer population. This was highlighted by Morningstar in its recent analyst report:

The baby boomer generation is starting to enter its senior years and the 80-and-older population, which spends more than 4 times on healthcare per capita than the national average, should almost double over the next 10 years. Long term, the best healthcare companies are well-positioned to take advantage of these industry tailwinds.

In our view, Welltower will benefit from these industry tailwinds because of its portfolio of high-quality assets connected to top operators in the senior housing, skilled nursing facilities, and medical office buildings segments. The company has also spent years forming and developing relationships with many of the top operators in each segment.

These relationships allow Welltower to push revenue enhancing initiatives and cost-control efficiencies at the property level, creating net operating income growth above the industry average, and provide a natural pipeline of acquisition and development opportunities to meet the needs of its growing operating partners. Welltower’s management team is forward-thinking and should be able to produce strong internal growth and accretive external growth.

Lastly, I find WELL to be attractive after the recent material drop in share price, with it now sitting well below its 52-week high of $99 from as recently as April. At the current price of $63.33, it carries a forward P/FFO of 18.6, which I find to be reasonable considering the estimated 13% to 15% annual FFO/share growth rate over the next couple of years. Sell side analysts have a consensus Buy rating on the stock with an average price target of $91, which implies a potential one-year 47% total return including dividends.

Investor Takeaway

Welltower is a well-positioned REIT that should benefit from the long-term favorable demographics for the healthcare sector. The company’s recent operating trends are encouraging, and its shares appear attractively valued after the recent sell-off. Meanwhile, it maintains a strong balance sheet and pays a well-covered dividend. As such, I believe WELL is a compelling buy at the current price for potentially strong long-term returns.

Be the first to comment