cemagraphics

I’m not going to sugarcoat it. My, let’s call it “excess caution” costs me dearly sometimes. I miss out on profitable trades and may get out of positions too early when a stock becomes too expensive for me. With that as preamble, I want to write about Weis Markets, Inc. (NYSE:WMK). After a capital gain of only 18.5% on the shares, I sold about 11 months ago, and I outlined my reasoning here. Since I sold, the shares have climbed an additional 32% against a loss of about 14% for the S&P 500. It would have been better to hang on, obviously. In this piece, I want to determine whether it’s now worth biting the bullet and buying back in, or waiting for shares to inevitably drop back in price. I’ll review the updated financials, and I’ll review the valuation. Also, I’m going to drone on yet again about the power of short put options, because I never tire of doing that. I think these can be powerful tools to generate very decent risk-adjusted returns. If you’re not yet familiar with them, I recommend you familiarize yourself with their potential forthwith.

It’s “thesis statement” time. Welcome to the portion of the article where I give you the gist of my argument, so you can relieve yourself of the need to wade through my entire screed. You’re welcome. I think the financial performance this year has been spectacular, the elevated dividend remains very secure, and the capital structure remains rock solid, and I’ll not buy back in. The problem is that all of that great news is fully reflected in the stock price. I want to find disconnects between “price” and “value”, and there’s no such disconnect here, I’m afraid. I would rather miss out on future gains than risk capital, so I’m remaining on the sidelines. Also, although I did well with short puts previously, I don’t think the premia on offer for reasonable strike prices is worth it right now.

Financial Snapshot

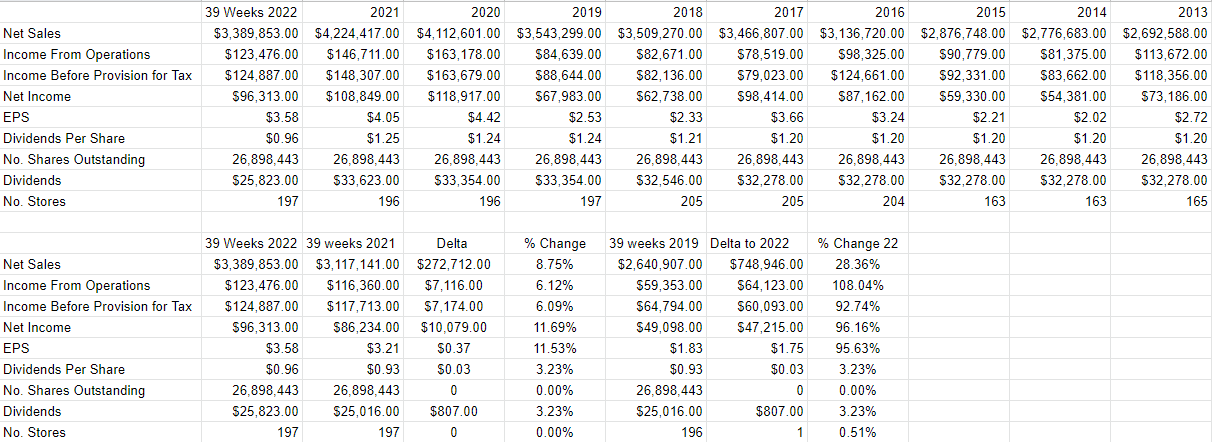

The year 2021 was very good for the company, as it set a multi-year record for revenue. Though net income was down slightly from 2020, it was still the second-highest on record. That’s relevant, in my view, because the first 39 weeks of this year saw even further improvement. Revenue for the first 39 weeks of 2022 was up by just under 9% relative to the banner year revenue of 2021. In spite of a 10% uptick in the cost of sales, and a 5% uptick in operating expenses, net income climbed 11.5% higher this year relative to last. On the back of this great financial performance, the company rewarded shareholders with a relatively rare increase in the dividend, which rose about 3.25%. Finally, the capital structure remains rock solid. The level of cash and marketable securities represents about 49% of total liabilities. This is one of those rare companies I’ve covered recently that seems to eschew debt. Given the above, I’d be very happy to buy back in at the right price.

Weis Markets Financials (Weis Markets investor relations)

The Stock

One of the most important, and most painful, lessons I ever learned is that a company is different from the stock that supposedly represents it. The stock is, in fact, often a poor proxy for the underlying business. I’ve told and written this story a few times, but I think it’s worth repeating because it highlights a mistake that less experienced investors often make. It was the late 1990s, I had bought an irresponsibly large amount of Nokia (NOK) because I knew the company was going to report rapid growth. They did as I expected, and the stock dropped about 9% in early trading hours. The company delivered very good results, but the market expected very, very good results. Since the company didn’t meet the market’s expectations, the stock was punished. There’s a powerful lesson in this example. Just because a company delivers great financial results doesn’t mean that the stock will go up. If there was that tight a relationship between the two, investing well would be much, much simpler. Ever since, I’ve drawn a distinction between “stock” and “company”, and have realized that a great company can be a terrible investment if you buy it for the wrong price. This is why I insist on only ever buying cheap stocks, and getting out of stocks when I perceive the risk of capital loss is too high. Given my experience with Weis, this obviously doesn’t always work out perfectly. When a stock is cheap, that’s a clear sign that the market’s not too optimistic about its future, so the stock is far less likely to hit the painful air pocket that Nokia did many, many years ago.

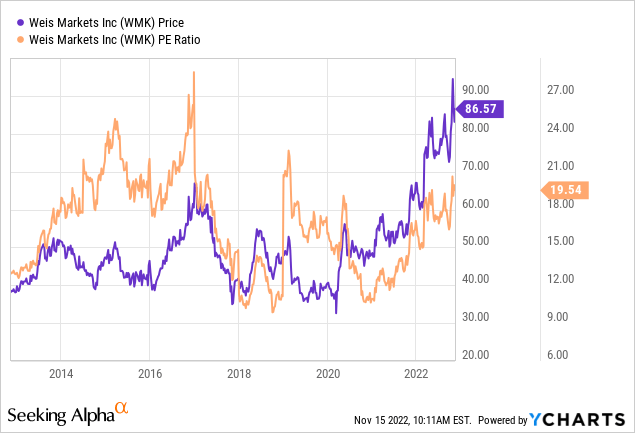

My regular readers know that I measure whether or not a stock is cheap in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of stock price to some measure of economic value, like earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both the overall market and its own history. When I last reviewed Weis, the PE was sitting at about 16.44. Earnings have risen dramatically since then, but that growth is now fully reflected in the shares as they’re about 18% more expensive now, per the following:

The current valuation isn’t unprecedented, and I would also note that when the shares have reached the current valuation in the past, they haven’t done particularly well. History may not repeat, but it tends to rhyme.

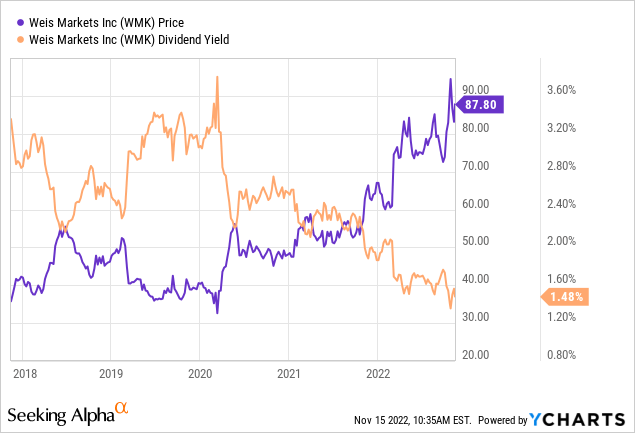

Additionally, even though the dividend has been increased, investors are being compensated with a rather paltry yield if they buy at current prices per the following:

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to Weis Markets at the moment suggests the market is assuming that this company will grow earnings at a rate of ~11.5% in perpetuity. I consider that to be a very optimistic forecast. Given the above, I can’t recommend buying at current levels. The company is growing nicely, and that’s a necessary but not sufficient precondition to make a great investment. I think there are safer investments out there. I’d rather forego a few more dollars of an upside than buy at current levels and risk losing capital.

Options Update

Just because I don’t see value at the current price doesn’t mean I wouldn’t jump at the chance to buy this stock at a much more attractive price. This attitude caused me to sell the October 2021 puts with a strike of $45 for $2.35 at the time that I wrote the article before last. I was firmly of the view that selling deep out of the money put options on a business like this created a “win-win” trade. Either the options expire worthless, in which case I collect the premium and move on, and/or the shares are “put” to me, and I’m obliged to buy a great company at a great price. That’s not a hardship. This is why I advise everyone I know, as forcefully as possible, to learn about short put options.

While I like to try to repeat success, I can’t in this case, as the premia on offer for short puts with reasonable strike prices aren’t great enough. For instance, the April 2023 puts with a strike of $60 are currently bid at $.40, which is too little to get me excited. For that reason, I recommend sitting on the sidelines until prices fall or premia rise, or both. I’d be very happy to buy back into this business, but only at the right price.

Be the first to comment