Starcevic

Overview

Grupo Aval Acciones y Valores S.A. (NYSE:AVAL), Colombia’s second-largest bank, has drastically underperformed emerging markets during the past ten months. I think now is an interesting time to catch the bottom, as weaker company and economic data could come in for Q3 2022 (expected on 17 November) and Q4 2022 as Colombia’s economic growth declines. Perceived political risks have also caused shares in Colombian equities to decline this year.

Colombia Economic Updates

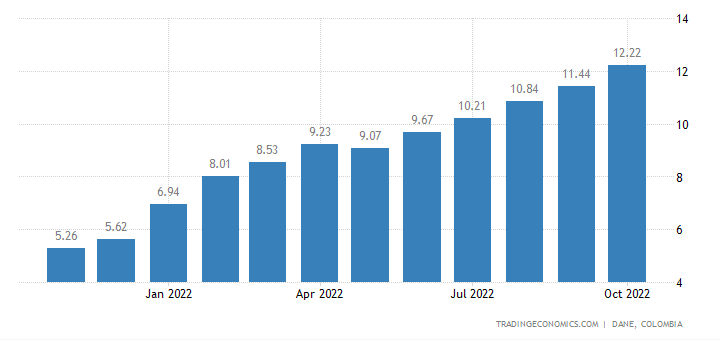

Colombia’s economy is on track to grow by around 7% this year due to rapid growth in Q2 2022. However, growth should show declines for Q3 and Q4 2022. Meanwhile, The IMF’s current growth forecast for Colombia next year is only 2.2%. There will likely be a decline in consumer credit, as rising rates are an increased source of stress for consumers. Furthermore, there is a risk that Colombia will not fully realize all of the benefits of higher commodity prices due to political changes. Colombia’s central bank raised interest rates by 100bps to 10%, as inflation has remained above 10% during the past four months. The price of other categories, like food and beverages (27%) and restaurants and hotels (16.6%), have been growing faster. The three main components of the consumer price index are housing and utilities (33.1%), food and nonalcoholic beverages (15.1%), and transport (12.9%).

Inflation

Trading Economics

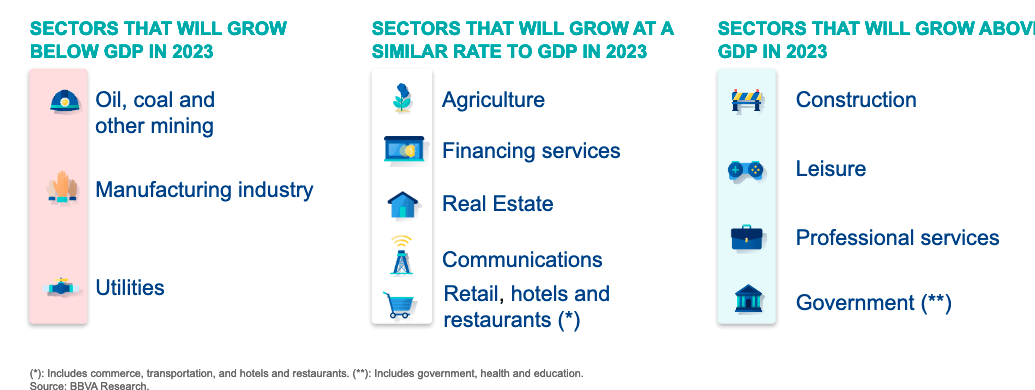

Growth Sources

Growth will be driven by construction and increased government spending, while mining and manufacturing will likely grow below the projected GDP growth rate for 2023.

BBVA

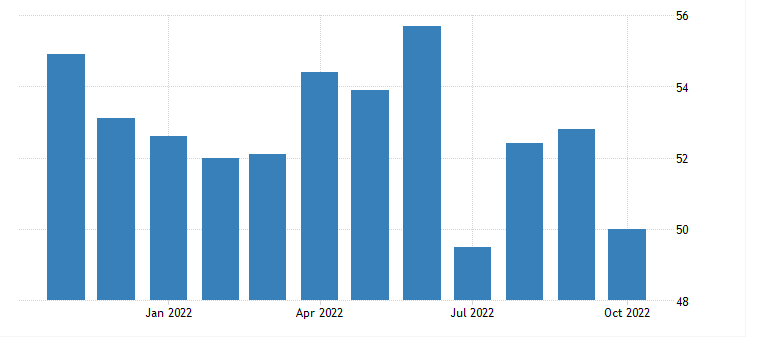

Colombia’s PMI has declined to a 12-month low, reaching 50.0 in October. Furthermore, the country’s fuel oil exports to the United States were recently half that of 2020, reducing the benefits of higher oil prices in 2022.

PMI

Trading Economics

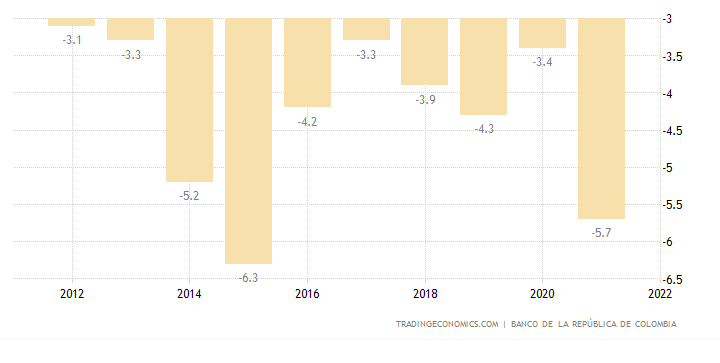

Exports and FDI

The outlook in this area is hazy, especially with the political transition that took place in August 2022. However, pessimism is likely overstated, and as I will mention later, equity valuations appear to have already priced in most of the country-specific risks and broader emerging market risks. Colombia’s government will respect already signed oil contracts, although tax reforms and the gradual renewable transition both threaten Colombia’s economic health. More extreme cases like Nigeria show how governments can fail to benefit from rising oil prices, despite being prominent oil exporters. Colombia’s current account deficit is approaching a ten-year low and was most recently 5.7%.

CA Deficit Approaches Record High

Trading Economics

FDI declined by around 47% in 2020, at 2.7% of GDP, but has since increased to over 5% of GDP in 2022. The main reason for the decline in FDI was due to lower oil prices, although there was also a notable decline in other areas like manufacturing (57% decline). The lack of political clarity may deter FDI moving forward.

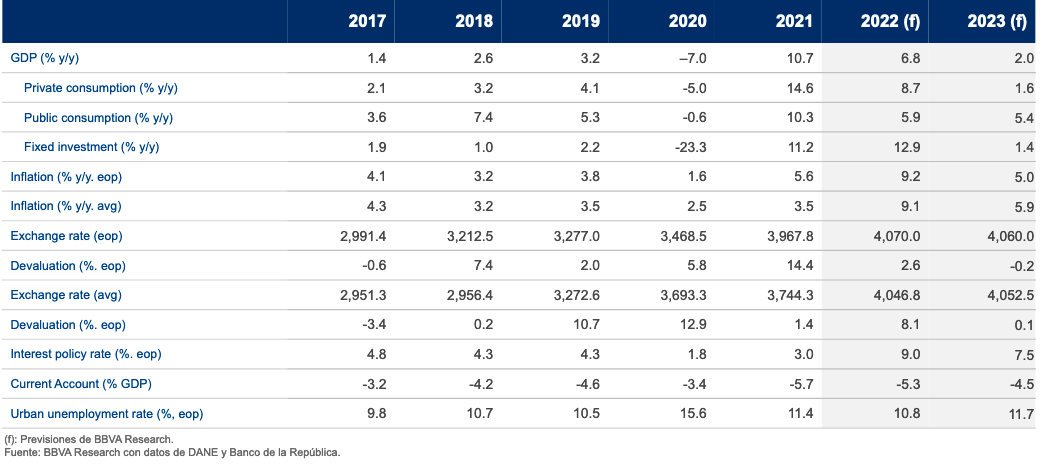

Forecasts

Growth will be driven by increased fiscal investment, while the consumption growth rate is projected to decline. There will likely be a significant decline in consumer credit, especially with rates approaching new highs.

BBVA

Factors that Could Override Political Concerns

Risks to Colombia’s economic outlook/political risks appear overstated, and Colombia has the potential to economically outperform other emerging markets. A lot of the other issues in Colombia, including inflation and rates, are common to all emerging markets. Colombia can also benefit from the rise of other commodities, including coffee, coal, and gold. This is not to mention that tourism will likely pick up in 2023, and the government has been investing in this area to promote Colombia’s ecotourism potential.

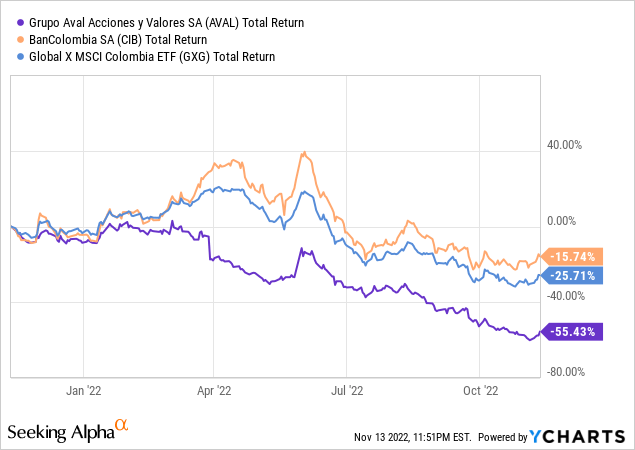

MSCI

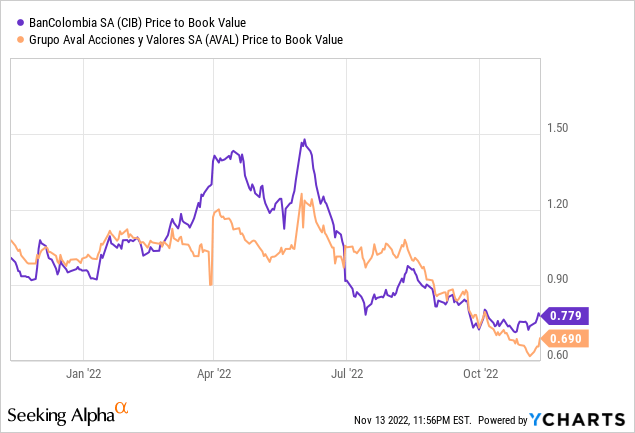

What is key to note is Colombia has still outperformed emerging markets YTD, despite concerns over inflation and political risks. Furthermore, MSCI Colombia (52% financials) still trades at over a 50% discount to MSCI emerging markets, even after its relative out-performance. Examining these facts makes it hard to be bearish on Colombia, as banks are trading at attractive valuation. Furthermore, other emerging markets with clear political narratives trade at a valuation to MSCI Emerging Markets. It’s hard to make the case that the political risks have not been priced in at all. Grupo Aval is an interesting option in Colombia to monitor, as it has had a greater YTD decline relative to peers.

YCharts

The stock is down around 55% YTD, and other options like the exchange-traded fund (“ETF”) Global X MSCI Colombia ETF (GXG) have been a safer bet. Grupo Aval provides excellent exposure to Colombia’s economy, and now could be a good time to accumulate, especially if Q3-Q4 earnings are disappointing. I will consider accumulating shares before and maybe after the Q3 earnings results this Thursday.

Company Overview

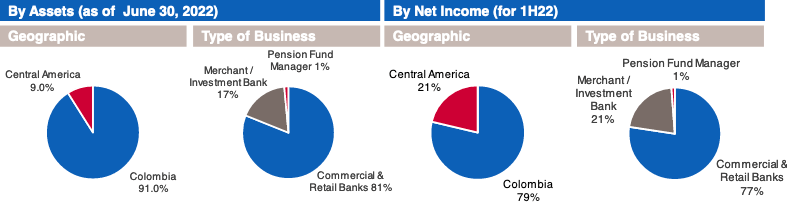

Grupo Aval provides investors with exposure to Colombia (over 90% of assets) and other Central American countries.

AVAL

The bank has over 20% market share in most areas, making it rank 2nd in Colombia in most areas.

|

Market Share |

Market Position |

|

|

Assets |

23.8% |

Second |

|

Gross Loans |

24.1% |

Second |

|

Deposits |

24.6% |

Second |

|

Corporate Lending |

27.5% |

Second |

|

Consumer Lending |

26.4% |

First |

|

Payroll Lending |

44.7% |

First |

|

Credit Cards |

18.6% |

Second |

|

Auto Loans |

24.7% |

Second |

|

Income |

35.0% |

First |

Grupo Aval also has a leading position in private pension and severance fund management in Colombia, ranking first in both AUM and net income. I am also bullish on Bancolombia SA and prefer both of these banks over the Global X MSCI Colombia ETF. Two key differences to note about the two banks are as follows:

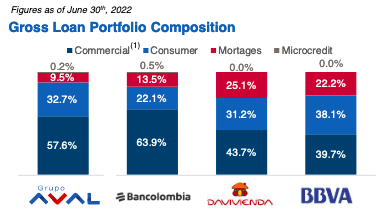

Mortgages: Grupo Aval has a heavier focus on mortgages, as its mortgage as a % of total loans is 4 percentage points higher than that of its rival Bancolombia S.A. (CIB).

Consumer Credit: Grupo Aval has a heavier focus on consumer credit, which is an area that will likely experience declining growth moving forward. Consumer credit has increased substantially since 2020, but will likely decline in subsequent quarters.

AVAL

Bancolombia is the best bet if you want to bet on corporations in Colombia, rather than betting on consumers. Moreover, it has been a safer bet in terms of financial and stock price performance.

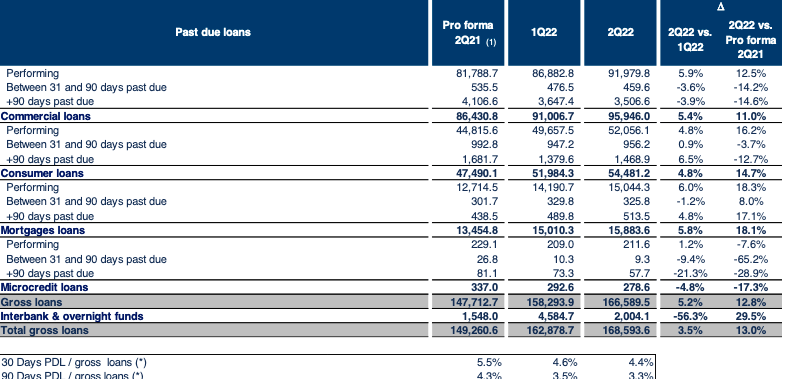

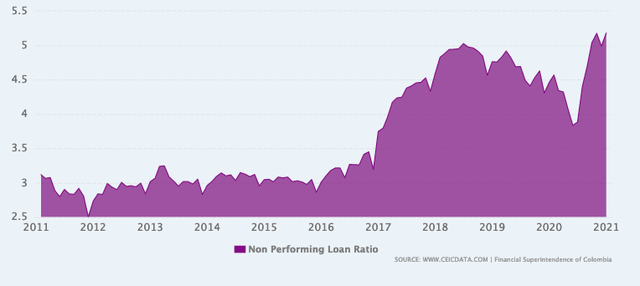

NPLs: As of June 2022, Grupo Aval’s NPLs ( 90+ days) were higher than that of all its peers, including Bancolombia, Davivienda, and BBVA. The bank’s NPLs could increase moving forward in Q3 or Q4 2022. I would bet on Bancolombia continuing to outperform, but still prefer investing in both banks due to the divergence in share price performance.

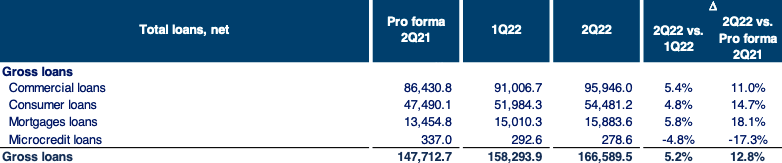

Loan Growth: Gross loans grew by 12.8% YoY during Q2 2022, as Colombia’s economy grew by 11% during the same period. Moreover, the bank’s NPLs (90+days) fell by 94 basis points to reach 3.3%.

AVAL

Loan growth was spearheaded by growth in consumer loans and mortgage loans, two areas which will likely experience a decline in growth in subsequent quarters. This is because Colombia’s economic growth will be lower in the next two quarters, and also because consumer credit will be a specific area that declines.

AVAL

The value of Consumer and mortgage loan NPLs rose by 14.7% and 18.1% QoQ during Q2 2022, respectively. Overall, NPLs as a % of total loans declined slightly during Q2 2022 on the back of stronger economic conditions. However, there is a room for an uptick in NPLs during Q3 and Q4 2022, and Grupo Aval could be hit harder that other banks due to its strong consumer focus.

NPLs in Colombia are currently at a 10 year high, and could increase slightly in the coming quarters.

Valuation

Grupo Aval traded at over 8x earnings at the end of 2020, so there is ample room for multiple expansion if there is more political and economic clarity.

YCharts

Both banks also traded above book value earlier in 2022. Overall, I think 2023 could be a good time to accumulate banks in Colombia, as Colombia is one of several countries that offers a margin of safety due to its lower valuation, on both a relative and historical basis.

Be the first to comment