cemagraphics

Author’s note: This article was released to CEF/ETF Income Laboratory members on December 28, 2022. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of Friday, December 23rd, 2022.

Weekly performance roundup

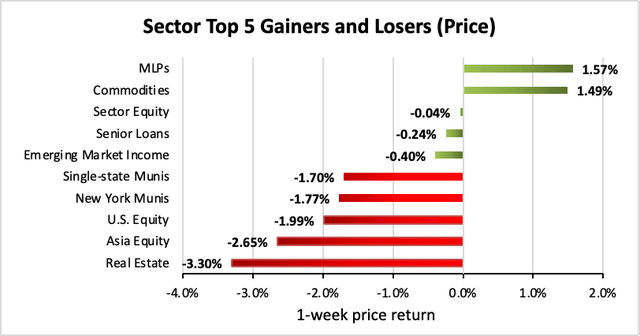

2 out of 23 sectors were positive on price (same as last week) and the average price return was -1.01% (up from -1.28% last week). The lead gainer was MLPs (+1.57%) while Real Estate lagged (-3.30%).

Income Lab

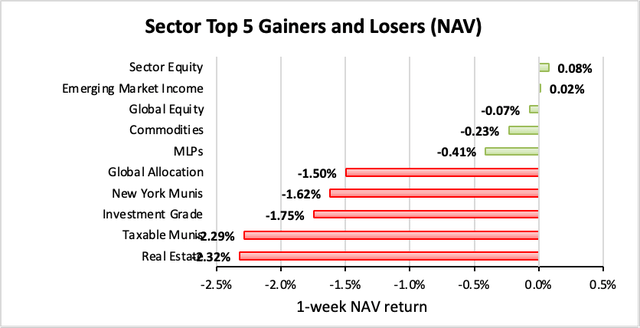

Two out of 23 sectors were positive on NAV (down from 6 last week), while the average NAV return was -0.97% (down from -0.78% last week). The top sector by NAV was Sector Equity (+0.08%) while the weakest sector by NAV was Real Estate (-2.32%).

Income Lab

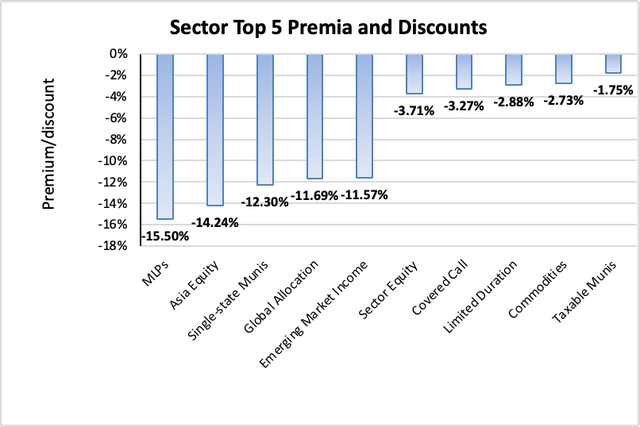

The sector with the highest premium was Taxable Munis (-1.75%), while the sector with the widest discount is MLPs (-15.50%). The average sector discount is -7.60% (down from -7.08% last week).

Income Lab

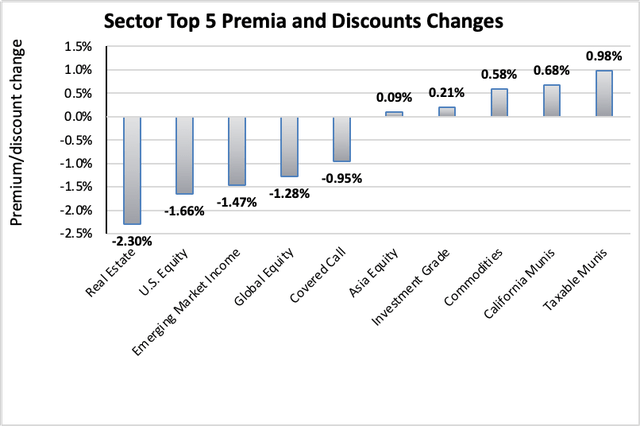

The sector with the highest premium/discount increase was Taxable Munis (+0.98%), while Real Estate (-2.30%) showed the lowest premium/discount decline. The average change in premium/discount was -0.51% (down from -0.41% last week).

Income Lab

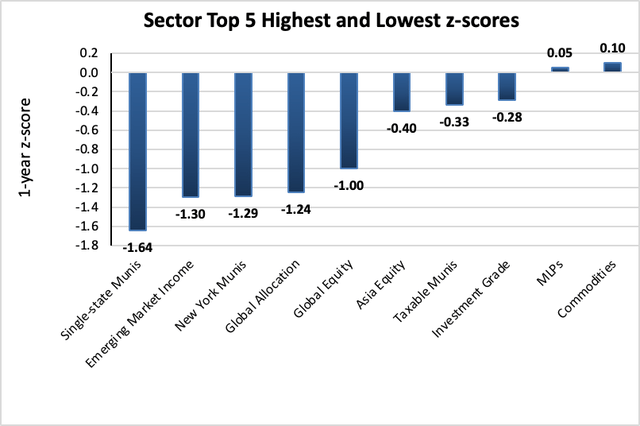

The sector with the highest average 1-year z-score is Commodities (+0.10), while the sector with the lowest average 1-year z-score is Single-state Munis (-1.64). The average z-score is -0.71 (down from -0.61 last week).

Income Lab

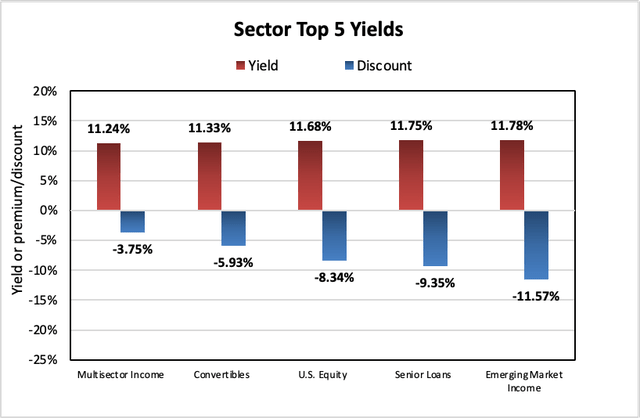

The sectors with the highest yields are Emerging Market Income (11.78%), Senior Loans (+11.75%), and U.S. Equity (+11.68%). Discounts are included for comparison. The average sector yield is 8.75% (down from 8.84% last week).

Income Lab

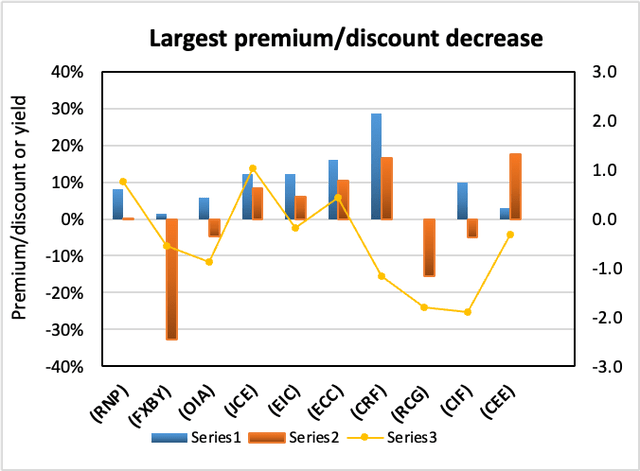

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Cohen & Steers REIT & Preferred Inc Fd | (RNP) | -9.07% | 8.07% | 0.15% | 0.8 | -8.50% | -0.20% |

| FOXBY CORP | (OTCPK:FXBY) | -8.41% | 1.52% | -32.66% | -0.6 | -9.57% | 1.73% |

| Invesco Municipal Inc Opp I | (OIA) | -6.47% | 5.72% | -4.76% | -0.9 | -7.83% | -1.56% |

| Nuveen Core Equity Alpha | (JCE) | -6.47% | 12.10% | 8.38% | 1.0 | -6.71% | 0.00% |

| Eagle Point Income Co Inc | (EIC) | -6.25% | 12.11% | 6.04% | -0.2 | -1.49% | 0.00% |

| Eagle Point Credit Company LLC | (ECC) | -5.98% | 16.00% | 10.29% | 0.4 | -4.55% | 0.00% |

| Cornerstone Total Return Fund | (CRF) | -5.76% | 28.50% | 16.61% | -1.2 | -5.32% | -0.63% |

| RENN Fund ord | (RCG) | -5.30% | % | -15.49% | -1.8 | -1.20% | -2.31% |

| MFS® Intermediate High Income | (CIF) | -4.95% | 9.87% | -4.95% | -1.9 | -5.98% | -1.09% |

| The Central and Eastern Europe Fund | (CEE) | -4.50% | 2.84% | 17.65% | -0.3 | -1.06% | 2.73% |

Income Lab

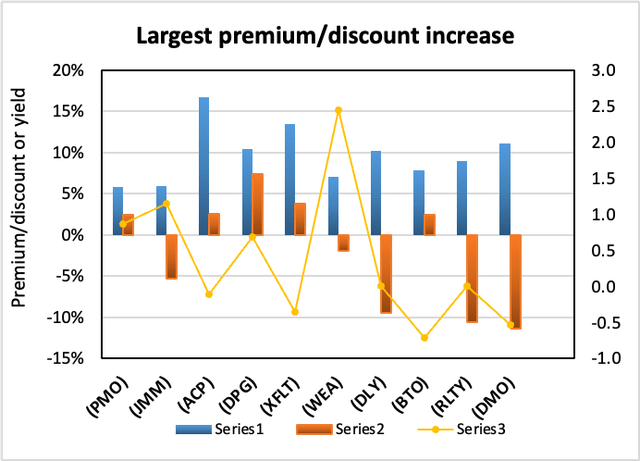

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Putnam Muni Opportunities | (PMO) | 5.51% | 5.86% | 2.46% | 0.9 | 0.28% | -1.88% |

| Nuveen Multi-Market Income Fund | (JMM) | 5.21% | 5.93% | -5.31% | 1.2 | 2.02% | -1.08% |

| abrdn Income Credit Strategies Fund | (ACP) | 4.86% | 16.74% | 2.58% | -0.1 | 4.06% | -0.85% |

| Duff & Phelps Utility and Infra Fund Inc | (DPG) | 4.09% | 10.36% | 7.39% | 0.7 | 5.05% | -0.79% |

| XAI Octagon FR & Alt Income Term Trust | (XFLT) | 3.98% | 13.42% | 3.82% | -0.4 | 0.62% | -3.23% |

| Western Asset Premier Bond | (WEA) | 3.33% | 7.07% | -1.93% | 2.4 | 0.90% | -2.07% |

| DoubleLine Yield Opportunities Fund | (DLY) | 3.10% | 10.24% | -9.41% | 0.0 | 2.40% | -0.72% |

| JHancock Financial Opportunities | (BTO) | 3.01% | 7.78% | 2.42% | -0.7 | 5.09% | 2.03% |

| Cohen & Steers Real Estate Opp & Inc Fd | (RLTY) | 2.92% | 8.95% | -10.64% | 0.0 | 0.87% | -2.62% |

| Western Asset Mortgage Opp Fund Inc. | (DMO) | 2.87% | 11.03% | -11.35% | -0.5 | 2.35% | -1.13% |

Income Lab

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

December 16, 2022 | Delaware Investments National Municipal Income Fund announces final results of tender offer.

December 8, 2022| First Trust/abrdn Emerging Opportunity Fund Announces Termination and Liquidation.

November 10, 2022| RiverNorth Opportunities Fund, Inc. Announces Final Results of Rights Offering.

November 9, 2022 | Macquarie Global Infrastructure Total Return Fund Inc. announces results of the special stockholder meeting relating to the proposed reorganization with abrdn Global Infrastructure Income Fund.

November 9, 2022 | Delaware Ivy High Income Opportunities Fund Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Income Credit Strategies Fund.

November 9, 2022 | abrdn U.S. Closed-End Funds Announce Results of Special Shareholder Meetings Relating to Proposed Reorganizations with Delaware Management Company-Advised Closed-End Funds.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

December 12, 2022 | Delaware Enhanced Global Dividend and Income Fund Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Global Dynamic Dividend Fund and Self-Tender Offer for up to 30% of Its Shares.

November 30, 2022 | Delaware Investments® Dividend and Income Fund, Inc. Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Global Dynamic Dividend Fund.

November 9, 2022 | Eaton Vance Closed-End Funds Announce Proposed Merger.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

None

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment