andresr

Weave Communications, Inc. (NYSE:WEAV) recently hired a significant number of employees, and entered the Canadian market. In my view, WEAV is in a great moment and deeply undervalued. Under my own discounted cash flow model, successful campaigns, more partnerships, and in-house product development would bring free cash flow. Yes, there are also risks from potential bad customer service or lack of reputation, but the downside risk appears quite limited.

Weave Communications: Innovative Services For Mass Communication And A Diversified Customer Base

Weave offers customer communications for small and medium-sized businesses. Clients use the company to focus on its business model as well as to maximize customer interactions outside the organization.

Among the services that impressed me, there is the ability to identify new customers that need special attention. The company also offers group messaging solutions, email marketing, and automatic response to feedback and reviews. I believe that these tools are quite innovative:

Weave provides a smarter phone system that helps businesses identify whether incoming calls are from new or current customers.

Weave provides a modern, secure group messaging solution that helps businesses and their team members communicate with each other from their work stations, allowing for faster collaboration to respond to and delight customers.

Weave Reviews helps businesses automatically request, collect, monitor and respond to reviews on sites such as Google (GOOG), or Facebook (META). Source: 10-K

The number of clients is quite impressive. As of December 31, 2021, Weave Communications reported 22k customers both in the United States and Canada. Many clients work for very different industries. I believe that the diversification is quite significant.

As of December 31, 2021, we had more than 23,800 locations under subscription and more than 22,000 customers in the United States and Canada.

These customers represented many industries with the majority being in dental, optometry, veterinary, physical therapy, home services, audiology, medical specialty services and podiatry. Source: 10-k

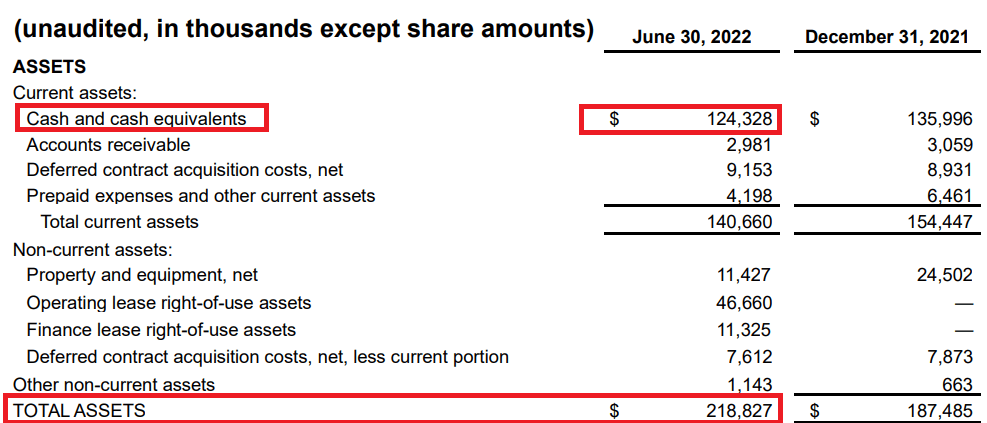

Good Financial Shape: More Assets And A Small Amount Of Debt

On June 30, 2022, Weave Communications presented cash and cash equivalents worth $124 million, a bit lower than that in 2021. Regarding the non-current assets, the company reported property and equipment worth $11.427 million and operating lease rights of use assets of $46 million. Finally, Weave Communications mentioned a total of assets of $218 million, which appears significant as compared to the figure reported in December 2021.

10-Q

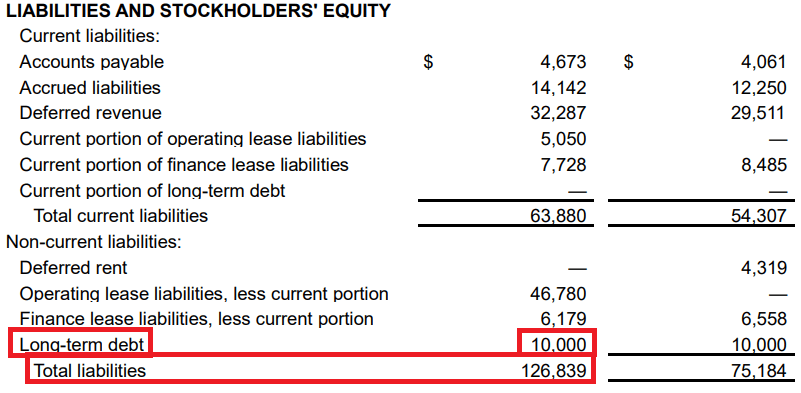

Weave Communications noted accounts payable of $4.6 million, with a total of accrued liabilities of $14 million. Regarding the non-current liabilities, we found that the operating lease liabilities were $46 million, with finance lease liabilities of $6 million. Finally, management reported long-term debt of $10 million and total liabilities of $126 million.

10-Q

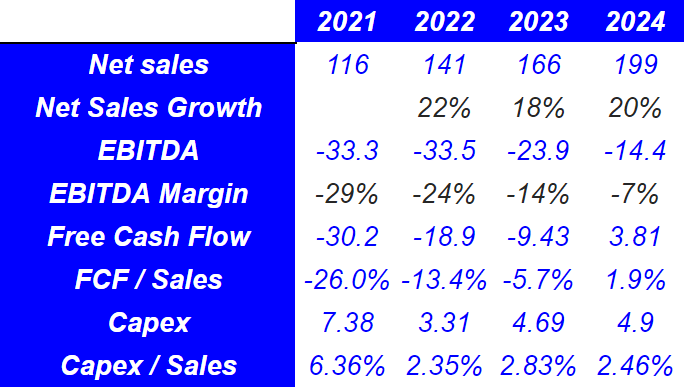

Expectations Include Double Digit Sales Growth, Increasing EBITDA Margin, And Positive Free Cash Flow

Expectations for 2024 include total sales of $199 million, with a net sales growth of 20% and EBITDA of -$14.4 million. Market analysts expect that the EBITDA margin could decrease from -24% in 2022 to -7% in 2024. Free cash flow estimates are expected to be $3.81 million, with FCF/sales of 1.9%. I would recommend readers to have a look at the numbers below. My numbers for the next decade are not far from those of other analysts.

Seeking Alpha

Conservative Case Scenario

In my view, considering the tools used by Weave Communications, the target market can be associated with the AI marketing market. The company discussed some AI services in its corporate documents:

We offer phone, AI-driven support solutions, web-chat and email-based support staff to resolve technical and operational issues for our customers, if and when such issues arise. Source: 10-k

The artificial intelligence marketing market is expected to grow at more than 28%. I would say that Weave’s sales growth could stand close to that of the target market.

AI in Marketing Market To Surpass USD 48.8 Billion by 2030 Growing at a CAGR of 28.6%. Source: GlobeNewswire

In my view, the generation of clients may not be that complicated for Weave Communications. I believe that management is using exactly what clients receive from the company. The company employs a long list of marketing tools to sign new services agreements with new clients. In this regard, I don’t know what could go wrong:

Our marketing team focuses on generating demand and increasing brand awareness through multiple strategies and a multi-channel process. Leads are generated primarily through our website through traffic driven to our website in multiple ways, including paid advertising, digital events, sponsorships, ad placements, email campaigns, social media, free content, blogs and organic searches. Source: 10-k

In my view, management will likely generate a significant number of leads thanks to partners, technology distribution companies, and integration affiliates. Management discussed these partnerships and business agreements in its last annual report:

These partners include technology integration partners, key-opinion leaders, IT-installers, buying groups, affiliates and distributors. These partners refer customers to us on a commissioned basis. These referrals are then passed to the sales team to close. We also focus on growing our channel partnership programs to promote and sell our products directly through partners. Source: 10-k

Finally, I believe that it is very relevant that management continues to finance its own engineering and product teams to offer new customization and products. Besides, if the company can successfully collaborate with a few customers while developing new solutions, new products will likely meet the demands of clients. As a result, I would say that free cash flow would likely trend north.

Our engineering and product teams strategically approach the design of products to serve our broad customer base while also developing customized features and products to meet the specific needs of each SMB vertical. Our engineering team also coordinates the use of open source technologies with code developed in-house to provide a cohesive experience to the customer. Source: 10-k

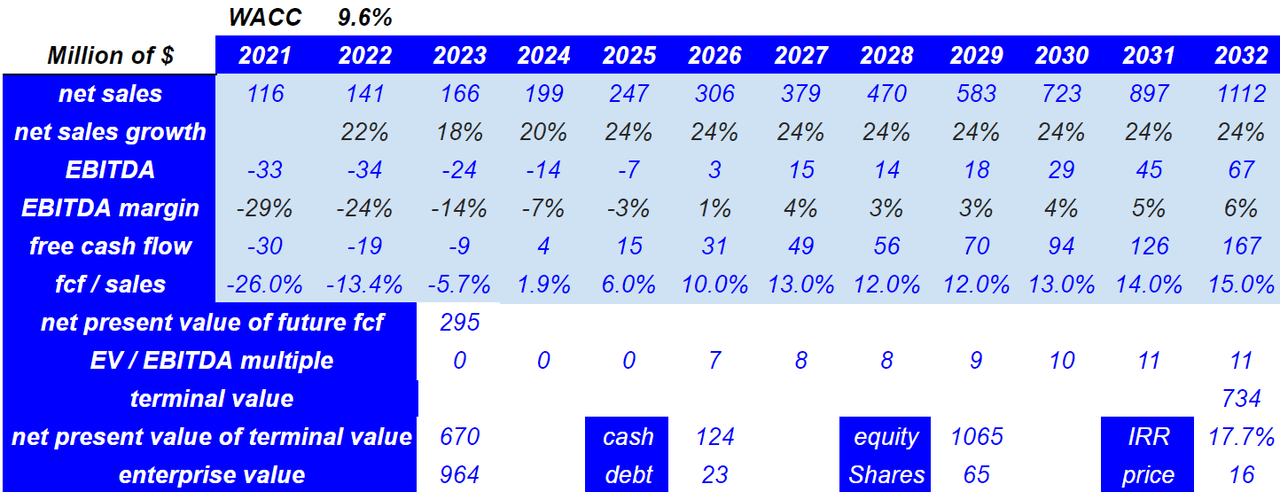

By 2032, I expect net sales of $1.112 billion, showing net sales growth of 24%, and EBITDA around $67 million. I would also expect an EBITDA margin of 6%, and I foresee 2032 free cash flow of $167 million with FCF/sales of 15%. The net present value of future FCF resulted in $295 million in 2023.

With an EV/EBITDA multiple of 11x, I obtained a terminal value of $734 million and a NPV of terminal value of $670 million. If we assume cash of $124 million, the results include equity of $1.06 billion and an internal rate of return of 17.7%. Finally, with a share count of 65 million, the implied price would be $16.

My DCF Model

Diminishing Sales Growth Or Reputational Damage Could Push The Stock Price Down To $5

Under detrimental conditions, I would say that the company’s expansion could diminish in the near future. Keep in mind that Weave Communications launched operations in Canada very recently, and increased its headcount significantly in the last two years. In sum, growth decline will likely occur in the near future as larger organizations grow slowly. As a result, certain investors may sell their stakes, which would result in higher cost of equity. The stock price could also decline if the demand for the stock decreases.

We have also recently expanded operations outside the United States including launching sales operations in Canada in 2020 and establishing engineering and administrative operations in India in 2021.

We expect our growth rate will decline in the future as a result of a variety of factors, including the increasing scale of our business and as we achieve higher penetration rates in our existing vertical markets. Source: 10-k

In the annual report, management accepted that it received criticism from customers from time to time. If the company faces a loss of reputation because clients post detrimental commentaries in the social media, the company’s reputation could be affected. As a result, management could lose clients, and revenue growth wouldn’t be as large as expected.

From time to time, our customers have complained about our platform and products, such as complaints about our pricing and customer support. If we do not handle customer complaints effectively, then our brand and reputation may suffer, our customers may lose confidence in us and they may reduce or cease their use of our products. In addition, many of our customers post and discuss on social media about internet-based products and services, including our platform and products. Source: 10-k

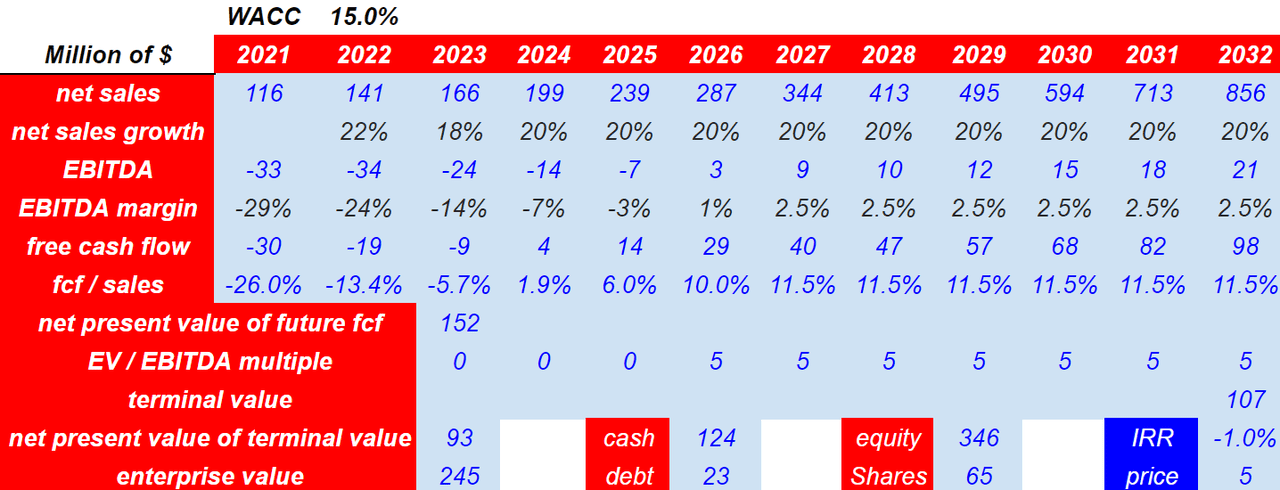

Under the previous assumptions, I foresee 2032 net sales of $856 million with net sales growth of 20% and expected 2032 EBITDA of $21 million with an EBITDA margin of 2.5%. Also, with free cash flow of $98 million and FCF/sales of 11.5%, the NPV of future FCF would be $152 million.

If we use a conservative multiple EV/EBITDA of 5x and a WACC of 15%, the NPV of the terminal value would be $93 million. Besides, with cash of $124 million and debt of $23 million, equity would stay close to $346 million. Finally, with a share count of 65 million, the implied fair price would be $5 per share.

My DCF Model

Conclusion

With cash in hand and a lot of momentum from the recent expansion into Canada, Weave Communications appears too cheap at its current market price. In my opinion, if the company’s marketing campaigns continue to work, and more partnerships are signed, the stock price would most likely increase. The company also has sufficient liquidity to finance further in-house product development as well as to enhance sales growth. Even considering risks from detrimental feedback from clients in the social media or slow growth, the company appears undervalued.

Be the first to comment