Joe Raedle

Back in March of this year – when inflation was really beginning to show signs of taking off – Tesla (TSLA) CEO Elon Musk tweeted:

Elon Musk Tweet (Twitter)

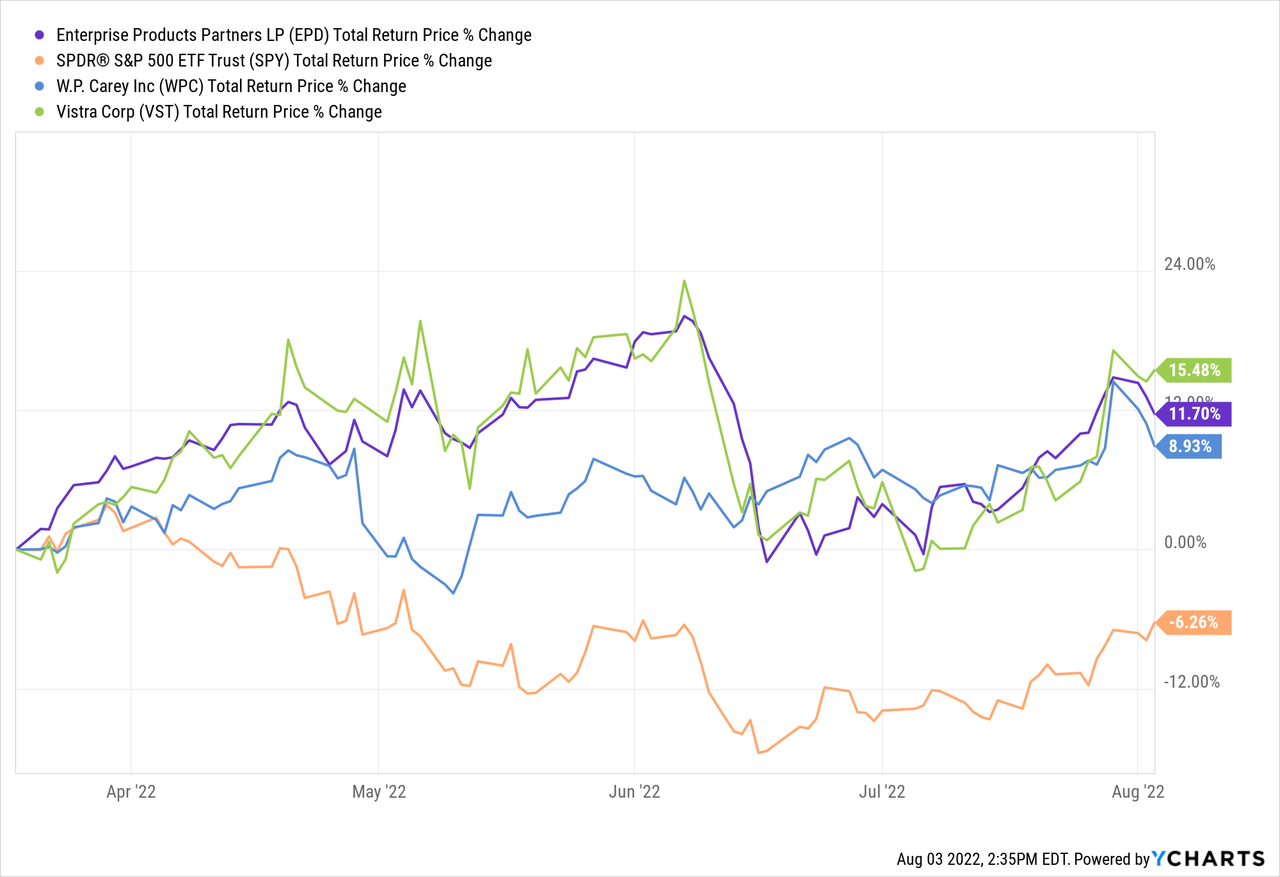

For us at High Yield Investor, this was music to our ears as we like to invest in real asset businesses as much as possible. In addition to their inflation protection, they also tend to be more defensive, harder to replace, and generate more stable cash flows than other businesses. As a result, they are typically easier to value and also generally return more capital to shareholders. Three businesses that we particularly liked at the time of his tweet that we shared with readers were Enterprise Products Partners (EPD), W. P. Carey (WPC), and Vistra Corp (VST). Since then, they have all crushed the stock market (SPY) along with our broader Core Portfolio:

Moving forward, we believe that inflation will likely remain elevated relative to historical norms and plan to continue investing in real asset focused businesses as a result.

Here are two big reasons why inflation is likely to remain at elevated levels:

#1. The Federal Reserve Will Not Be Able To Raise Rates Much Further

Elon Musk himself recently tweeted that inflation might be coming down, stating:

Inflation might be trending down. More Tesla commodity prices are trending down than up fwiw.

However, while it is very possible that inflation will peak this summer, it is unlikely that inflation rates will quickly fall back to sub-3% levels as we have become accustomed to. One of the big reasons for this is that the Federal Reserve might not be able to raise interest rates much further moving forward.

Already, the Chairman of the Federal Reserve – Jerome Powell – has indicated that interest rates have reached or are at least near their “neutral level” and may not need to go much higher. However, several prominent investors and economists such as Larry Summers and Bill Ackman expressed alarm and strong disagreement with this assessment because the interest rates are far below the inflation rate and – even if inflation subsides some – inflation rates are very likely to remain well above interest rates.

The reason why the Federal Reserve is likely eager to cease interest rate hikes is three-fold:

(1) The U.S. economy is already in decline with GDP falling for two quarters in a row. More interest rate hikes will only further compound this problem and potentially even accelerate the GDP declines. Taking responsibility for a deep recession is the last thing the Federal Reserve wants and would greatly weaken its credibility even further.

(2) There is a massive debt burden across the U.S. economy, ranging from trillions and trillions of dollars in household and corporate debt to the out-of-control government debt. This means that even slight increases in debt servicing costs will place a large strain on the economy. As a result, interest rates cannot go too high and certainly cannot remain too high for very long, otherwise the economy will likely collapse.

(3) There is significant political pressure on the Federal Reserve to accommodate the economy with midterm elections right around the corner and the 2024 presidential election not too far off either. As a result, the Federal Reserve is unlikely to get too aggressive with interest rates, for fear of inducing an economic crash that would contradict the political interests of those in power.

#2. Supply Constraints Remain In Place

On top of the upper limit on the Federal Reserve’s ability to raise interest rates, there remain some meaningful supply constraints that could get even worse in the not too distant future.

Russia – one of the world’s largest producers of energy and other vital commodities – is currently being aggressively attacked with sanctions, resulting in lower supply and higher prices around the world. On top of that, China – effectively the world’s factory – has already had to shut down much of its production earlier this year due to its zero-toleration policy for COVID-19. The supply chain disruptions could get even worse if China decides to invade Taiwan as it could lead to a combination of sanctions on and from China as well as a disruption of the global semiconductor supply chain, of which Taiwan is an integral member through major semiconductor powerhouses like the Taiwan Semiconductor Manufacturing Company (TSM).

Food supplies are also being strained due to record-breaking heat across many global agricultural locations as well as the impacts of the war in Ukraine (one of the world’s main grain exporters).

Investor Takeaway: Some Of Our Top Picks

With the likelihood that inflation remains elevated for the foreseeable future, now is as good a time as any to invest in inflation-resistant real asset businesses, especially ones that remain on sale. While the three we picked before have performed at a high level and are no longer the most opportunistic in the market today, two others that we like a lot right now are:

Energy Transfer (ET) is a leading midstream business that has one of the largest and best-diversified portfolios in the industry. It boasts a freshly deleveraged investment grade balance sheet, defensive cash flows that stem from long-term, fixed-fee, commodity price resistant contracts, and excellent distribution coverage. It also has strong inflation protection thanks to energy’s positive correlation with high inflation levels and the inflation escalators attached to its pipeline contracts. When combined with its 8.1% distribution yield and steep discount to peers and its own history on an EV/EBITDA basis, ET offers investors outstanding risk-adjusted total return and current yield potential.

Rio Tinto (RIO) is one of the largest and most respected miners in the world today, with a focus on iron ore production alongside a plethora of other metals and minerals. It owns world-class assets and has generated outstanding returns on invested capital. Meanwhile, it has a stellar balance sheet and pays out a high percentage of its cash flows to shareholders. Thanks to a recent sharp pullback in the share price and a hefty 9.03% dividend yield, the total return potential here is phenomenal while presenting shareholders with moderate long-term risk.

At High Yield Investor, our strong performance is being fueled by an opportunistic focus on high yielding, undervalued, high quality, real asset businesses. With inflation likely to remain elevated for the foreseeable future, we believe that continuing to follow Elon Musk’s sage investment advice will likely continue delivering superior total returns.

Be the first to comment