We Are

The SPDR S&P Global Dividend ETF (NYSEARCA:WDIV) is a dividend oriented ETF with very global exposures. North American elements only make up around 40% of this ETF, and a lot of the exposures are in foreign financials. That’s what ends up giving us pause. Financials are not as well exposed in Europe compared to in the US. While the rest of the utility exposures are more than solid, WDIV doesn’t have a strong appeal to us.

WDIV Breakdown

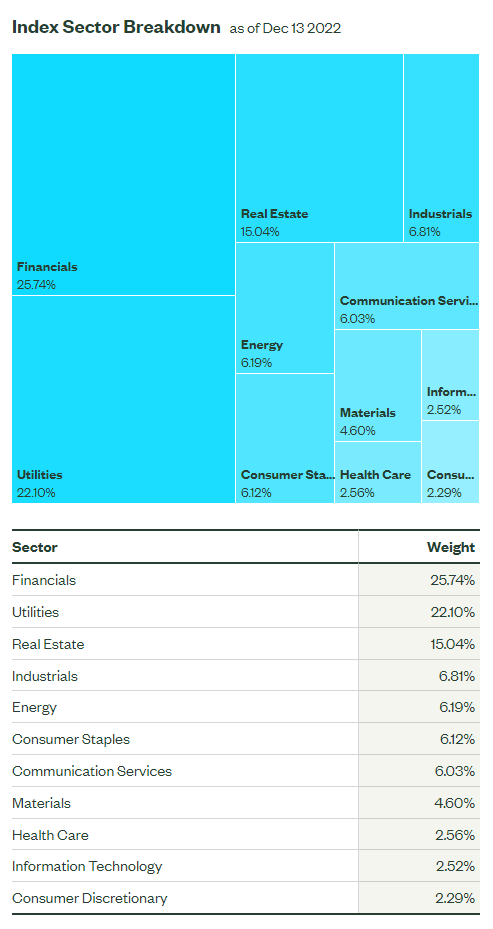

Let’s have a look at the sectoral breakdown first.

Sector Breakdown (ssga.com)

Utility exposures feature heavily, otherwise there’s a lot of real estate and financial exposures. The utility exposures aren’t too bad. The US exposures are being supported in their renewable energy transition, and there’s quite a few solid, regulated utilities in the mix including Enagas (OTCPK:ENGGY), and others that have very stable economics like Rubis (OTCPK:RBSFY) that are not commodity price levered. EDP (OTCPK:EDPFY) is another much-loved European utility pick that features good positioning with respect to the renewable energy transition and a solid, asset rotation PE model to play into a hot market for renewable and infrastructure assets. There are some HKD denominated exposures, which does mean some Chinese political exposure here.

Bottom Line

The problem is the rest of the exposures, which are more sensitive to interactions with their geographies.

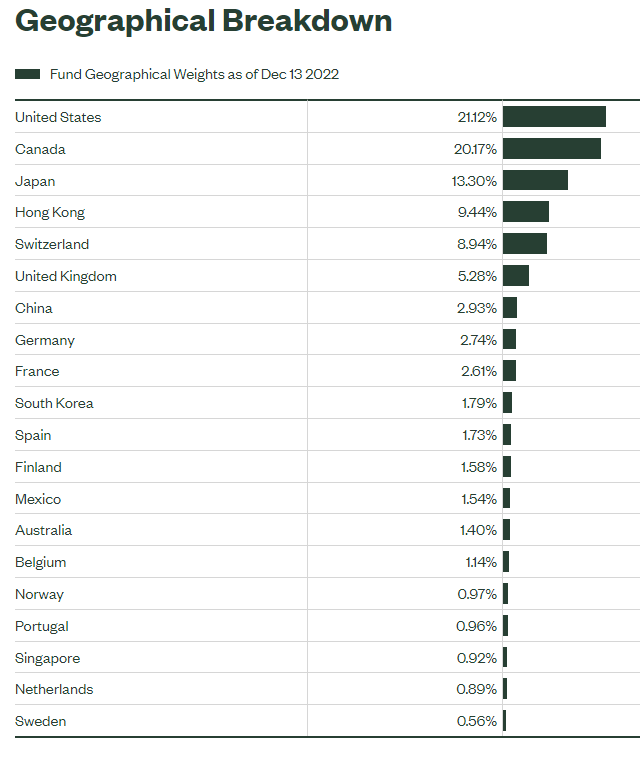

Geographical Breakdown (ssga.com)

They weren’t lying by calling it a global ETF. There’s a lot of foreign exposures. While North America takes a strong skew at 41%, Japan is a close second, followed by Hong Kong, and then European nations and the UK. Besides Hong Kong, which generally has the issue that Chinese influence is growing there, and therefore the onset of state capitalism becomes more likely to the detriment of shareholders, the other exposures give us a lot of concern economically.

A big part of our house view focuses on the fact that the more Europe and the UK hurt in relation to the war, the less the US has to sacrifice to achieve lower inflation. In other words, the pain of Europe is the salvation of the US in a soft landing.

While utilities exposures are resilient, as well as consumer staples, cyclical exposures are not benefiting from a non-North American slant. Cost pressures on Europe render their monetary policy less effective, meaning financials in Europe and the UK lose out meaningfully compared to US peers, both on FX effects but also on failure to grow net-interest margins. EU also tends to be less shareholder friendly when it comes to regulated businesses. A lot of the financial exposures are in the UK or European. Japan has their demographic issues that makes any deflationary pressure not worth the risk, and therefore their NIMs also lag the US. Japanese financials feature quite heavily, with their stock market skewing towards financials and consumer discretionary already.

WDIV has a PE of 12.5x, which is a little lower than average, but the yield ends up being lower than 5% net of the pretty high expense ratios. None of these numbers really stand out relative to the reasonably high Hong Kong exposures and exposures to disadvantaged European and Japanese financials. WDIV is a pass.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment