Nariman Safarov

A few months ago, I wrote a cautious article on the WD-40 Company (NASDAQ:WDFC). My main concern with WDFC was the company’s valuation, with the company trading at a trailing 46x P/E at the time.

In my opinion, there are two key skills to being a successful investor: 1) finding good companies, and 2) patiently waiting for a fair and reasonable price to acquire the shares. Even the best companies can be terrible investments if one pays too high a price for its shares.

I believe WDFC is a fantastic business. However, the price is still too high currently. My estimate of fair value is ~$150, assuming the company can return to its 55/30/25 model in the long-run.

Brief Company Overview

For those not familiar, the WD-40 Company manufactures and sells the iconic WD-40 Multi-use product – a lubricant, rust protector, cleaner and degreaser. The product’s name stands for ‘Water Displacement, 40th formula’. For decades, the WD-40 Company sold its single product, primarily through word-of-mouth marketing. However, beginning in the 1990s, the company began acquiring complimentary brands and products such as the 3-in-1 all-purpose lubricant, the Solvol heavy-duty hand cleaner, and the Spot-Shot carpet cleaner.

WD-40 Is A Fantastic Niche Business

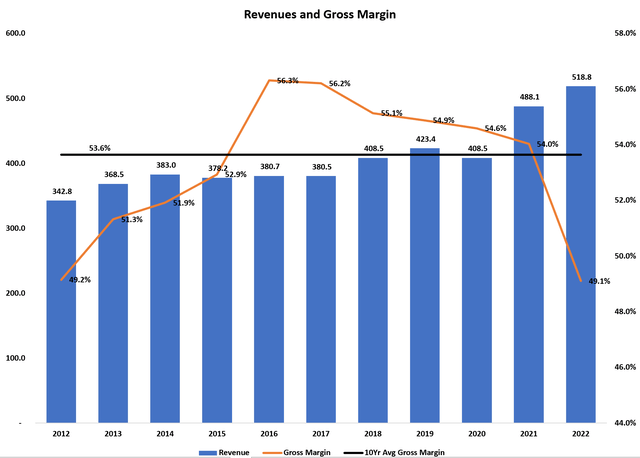

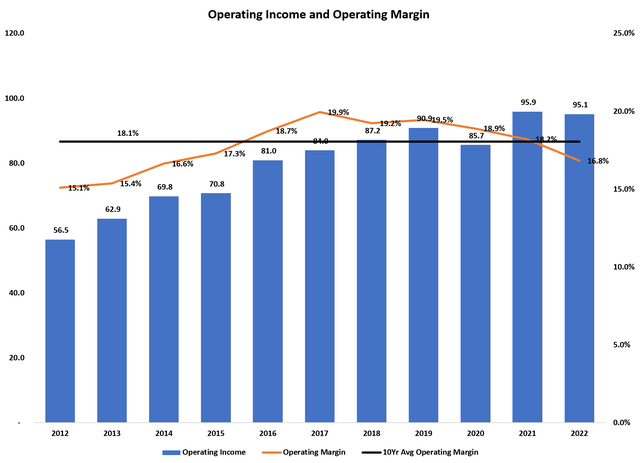

As I commented in my initial article, the WD-40 Company is a fantastic niche business with a strong moat. The company has generated long-term single digit revenue growth, 54% gross margins and 18% operating margins (Figure 1 and 2).

Figure 1 – WDFC revenues and gross margin (Author created with data from roic.ai) Figure 2 – WDFC operating income and margin (Author created with data from roic.ai)

The WD-40 Company has a corporate goal of achieving a ‘55/30/25‘ business model: 55% gross margin, 30% expenses, and 25% EBITDA margin.

2022 Was An Off Year Due To Inflation And FX Volatility

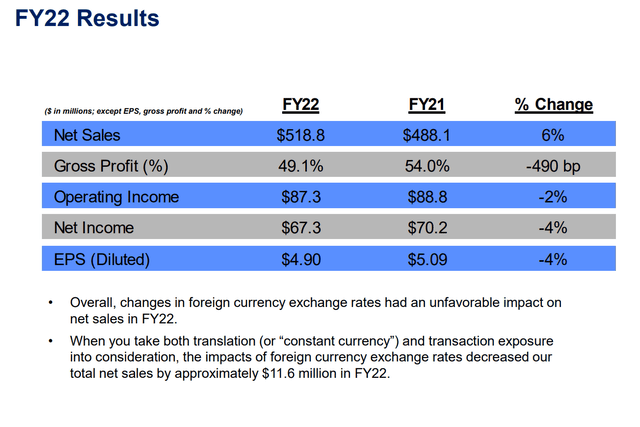

As the WD-40 product is a petroleum-based (the actual formula is a closely guarded trade secret) multi-purpose lubricant, the company’s financial results were negatively impacted in 2022 by input inflation. Although topline revenues grew 6% to $519 million in F2022, gross margins declined 490 bps to 49.1%, the lowest level since 2012 (Figure 3). Operating margins declined 140 bps YoY from 18.2% to 16.8%, and EPS fell 4% YoY to $4.90.

Figure 3 – WDFC FY2022 financial summary (WDFC Q4/2022 investor presentation)

Price Increases Should Help In F2023

To combat rising input costs, the company has been implementing a number of price increases in 2022 that should help with gross margins in the coming quarters. On the most recent quarterly earnings call, the outgoing CFO, Jay Rembolt, commented: (author highlighted important passages)

We have been implementing price increases across our business throughout 2022. However, we completed a significant round of price increases in our largest market, the U.S., in the third quarter. That resulted in a sequential improvement to the U.S. gross margin of 400 basis points in the fourth quarter compared to the third quarter of this fiscal year. We expect to experience similar positive margin increase trends as the full impact of price increases in other markets become embedded into our results.

We implemented significant price increases in Europe beginning in July through September and we began to see a recovery of EMEA’s gross margin in the first month of fiscal 2023. We will continue to see further benefits from those and other price increases in future quarters. We are confident that our action plans to rebuild margin, coupled with the advancement of our margin accretive Must-Win Battles will enable us to deliver our long-term margin goals.

– Outgoing WDFC CFO, Jay Rembolt, on Q4/2022 Earnings Call

Valuation Still Pricey

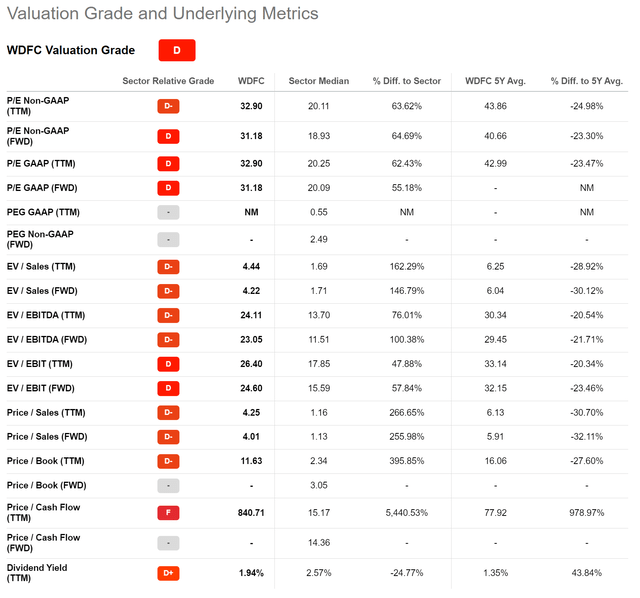

Unfortunately, almost everyone knows WDFC is a great “recession-proof” business, and its shares remain richly valued. WDFC currently trades at a trailing P/E ratio of 33x, even after a 34% decline in 2022 (Figure 4).

Figure 4 – WDFC valuation (Seeking Alpha)

DCF Valuation Suggests Shares Are Slightly Overvalued

In the long-term, I believe WDFC can return to ~55% gross margin, as the WD-40 product is nearly indispensable for everyday maintenance work (my mechanic swears by it and has several cans in his garage). It is also not an expensive product, so price increases should be well tolerated by consumers. If the company can keep a lid on expenses while effecting price increases, then a return to 25% EBITDA margin is certainly achievable.

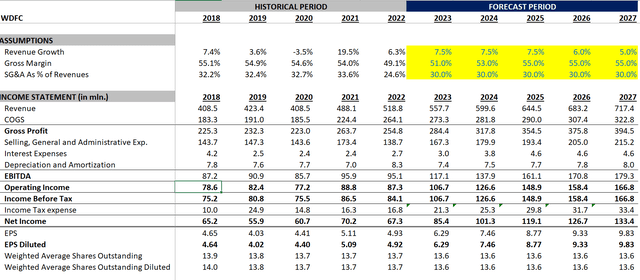

Modelling the company returning to 55% gross margin by 2025, with topline growing at 7.5% p.a. (management guidance for F2023 is 5-10% revenue growth) over the next few years tapering to 5% by 2027, I come up with the income forecast in Figure 5.

Figure 5 – WDFC financial model (Author created)

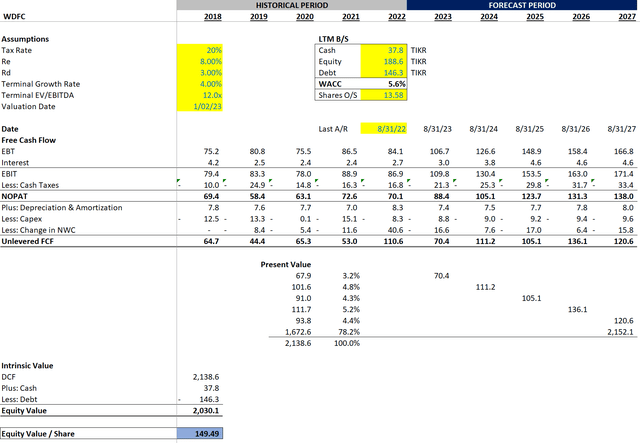

Using an exit multiple of 12x EV/EBITDA (from Figure 4 above, we can see the peer group currently trades at a 11.5x Fwd EV/EBITDA), I estimate a DCF value of $149 / share for WDFC. This valuation model also assumes an 8% equity cost of capital and 3% debt cost of capital (Figure 6).

Figure 6 – WDFC DCF valuation model (Author created)

With WDFC shares currently trading at $161 / share, I believe it is still overvalued by 8-10%. However, it is certainly getting closer to a buy point.

Risk To My Analysis

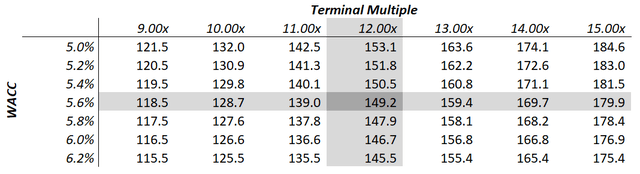

The biggest risk to my analysis is that as a premium business, perhaps an exit multiple of 12x EV/EBITDA is too conservative for WDFC. For example, if I vary the exit multiple used in my DCF analysis, I can come up with an equity valuation of $180 / share at 15x multiple (Figure 7).

Figure 7 – WDFC DCF sensitivity to WACC and EV/EBITDA exit multiple (Author created)

However, returning to my initial observation, part of the key to being a successful investor is patience. At the current share price of $161, I don’t believe there is adequate margin of safety for investors.

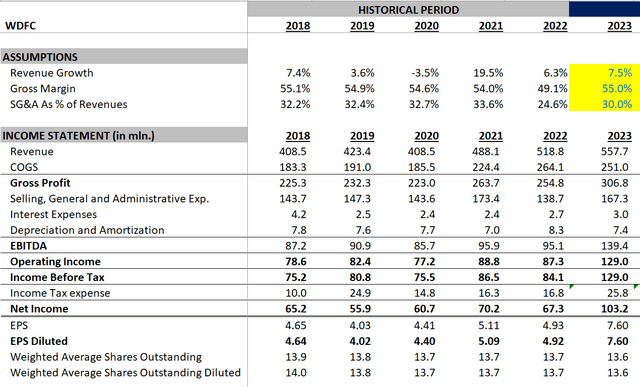

Said another way, even if the inflation challenges were to disappear overnight and the company returns to 55% gross margin and 25% EBITDA margin for F2023, the company would only be earning ~$7.60 / share, so investors would still be paying over 21x P/E at the current $161 stock price (Figure 8).

Figure 8 – WDFC would earn ~$7.60 in best case scenario for F2023 (Author created)

Conclusion

Undoubtedly, the WD-40 Company is a fantastic business that everyone should keep on their radar. However, in my estimation, the shares are still overvalued. I would be interested in acquiring shares below $150, my estimate of fair value.

Be the first to comment