cemagraphics

In my last article about Waters Corporation (NYSE:WAT), I argued that we can find better investments in the market. I wrote:

“Waters Corporation can line up in a group of high-quality businesses that are still a bit too expensive and therefore not a good investment right now. And although the stock declined about $100 from its previous all-time highs, it is still not trading for a price that I consider as acceptable. It might be annoying, but in an overvalued market it is rather difficult to identify high-quality companies that are not trading for a premium.”

Now, about eight months later, I must admit that Waters Corporation actually performed better than the broad market. While Waters Corporation declined only about 2.5%, the S&P 500 (SP500) declined about 11%. Despite this outperformance of Waters Corporation over the last few quarters, I will reaffirm my thesis that we can find better investments in the market and that Waters Corporation is only a hold.

Quarterly Results

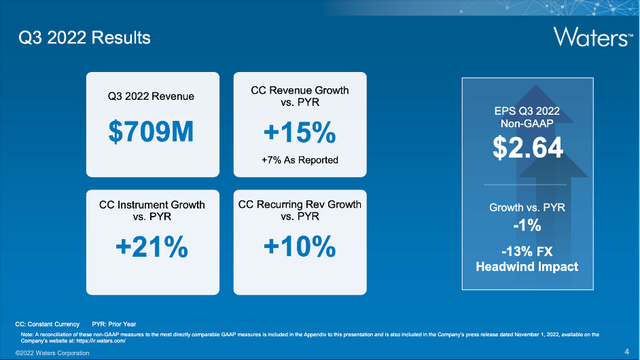

Despite being cautious about Waters Corporation stock, the third quarter results the company reported on November 01, 2022, are not the reason for our caution. Waters Corporation increased net sales from $659.2 million in Q3/21 to $708.6 million in Q3/22 – resulting in 7.5% year-over-year growth. And sales in constant currency grew 15% in the third quarter. Operating income also increased slightly, from $191.8 million in the same quarter last year to $192.0 million this quarter, while net income per diluted share stagnated and was $2.60 – the same as in Q3/21. And when asking the question why the top-line growth could not be transferred to the bottom line, Waters Corporation – like most other corporations – must deal with increased cost of sales (13.3% YoY growth).

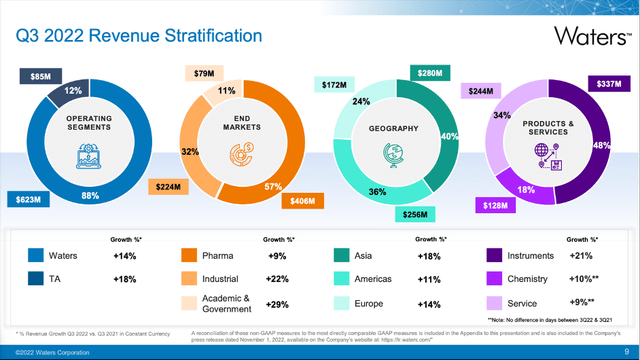

When looking at the company’s two operating segments, Waters could increase sales from $581.8 million in the same quarter last year to $623.4 million and TA could increase sales from $77.4 million to $85.2 million with growth being more or less evenly distributed between the two segments. When looking at the different geographies, revenue grew in the double digits in every region (in constant currency), but especially Asia contributed to growth (18% YoY) – being led by China (23% growth in constant currency). And when looking at the different end markets, pharma grew “only” 9% while Industrial grew 22% and Academic & Government grew even 29% (all numbers in constant currency). And while service sales increased only 9% year-over-year, instrument sales increased 21%.

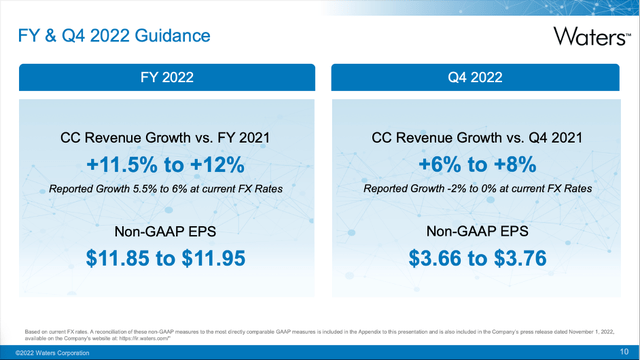

For fiscal 2022, Waters Corporation is now expecting revenue in constant currency to be between 11.5% and 12.0% and non-GAAP earnings per share are expected to be between $11.85 and $11.95.

Stable Business, Solid Growth

I already mentioned in my last article that Waters Corporation has several options to grow its bottom line in the years to come. And a lot of what I wrote was actually backed up by management during the last Investor Day. Aside from growing the top line (which is also including mergers and acquisitions), the company will focus on margin expansion as well as share buybacks in the years to come.

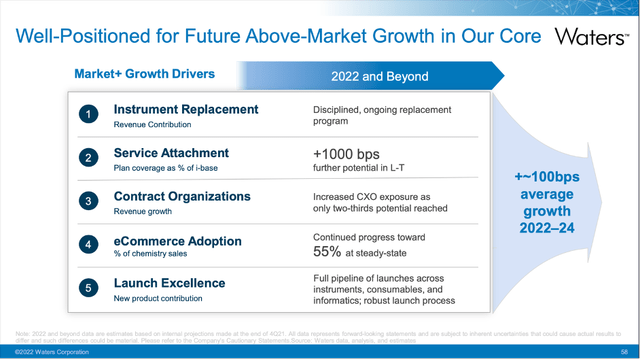

For starters, management is expecting revenue to grow in the mid-to-high single digits (in constant currency), and this is including growth drivers like instrument replacement in 2022 and beyond as well as eCommerce adoption and service attachment.

Waters 2022 Investor Day Presentation

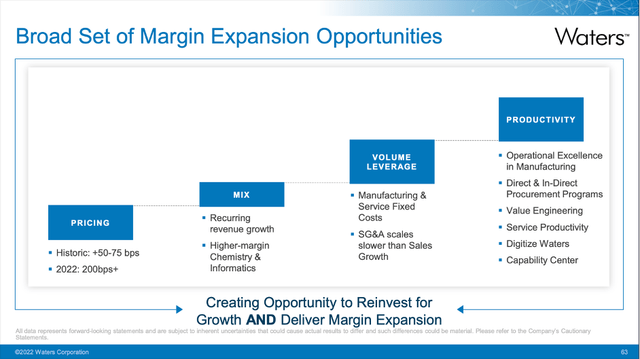

Aside from growing the top line, management is also expecting margins to increase over the next few years, and this will have a measurable effect on the bottom line. In my last article, I showed that Waters Corporation was able to increase its margins in the past, and it seems reasonable for Waters to be able to increase margins further. And margin expansion could stem from pricing, a better revenue mix with more focus on recurring revenue, and higher productivity.

Waters 2022 Investor Day Presentation

And finally, Waters Corporation will improve the bottom line by using share buybacks. In the past few years, Waters Corporation bought back shares quite aggressive. However, I also showed in my last article that Waters Corporation was buying back shares too aggressively, and the company spent more money on share buybacks than it actually should have.

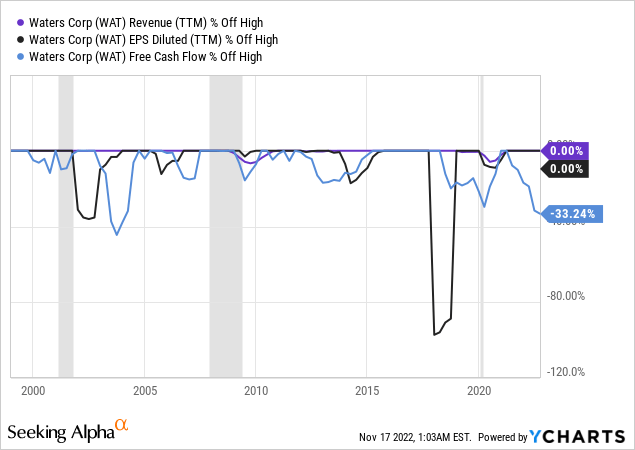

While Waters Corporations might not be able to grow the bottom line by using share buybacks in a similar way as the past decade, we are still dealing with a recession-proof business that has a wide economic moat around. We are getting many strong hints that a recession is upon us, and Waters Corporation might also be affected in a negative way in 2023 or 2024. However, when looking at the performance in the past two decades, we must see Waters Corporation as a pretty recession-resilient business.

Revenue was extremely stable with hardly any downturns, but earnings per share and free cash flow declined from time to time. On the other hand, these declines are not really going together with past recessions and obviously have other reasons. We shouldn’t rule out negative effects on Waters Corporation by a potential recession, but we can be quite optimistic these impacts won’t be extreme.

Additionally, Waters Corporation also has a wide economic moat around its business which is based on switching costs. And, as I wrote in my first article about Waters Corporation, these switching costs stem mainly from three aspects:

- Researchers using equipment from Waters won’t switch equipment while working for example on new drugs. In case of pharmaceutical companies, such a process can take up to ten years.

- These equipment and instruments Waters Corporation is selling are extremely expensive and therefore make switching rather expensive after a company spent such huge amounts.

- High switching costs arise as there is often a steep learning curve and if a company would have to retrain its staff on new instruments this would be time-consuming, which is not only expensive, but a luxury companies (i.e., pharmaceutical companies) often don’t have.

In the first nine months of fiscal 2022, $728 million in sales (about 34% of total sales) were service sales and these are recurring sales – the amounts Waters Corporation can count on as it is hard for businesses to avoid these costs that arise from the instruments needing maintenance or staff training.

Intrinsic Value Calculation

Waters Corporation is without much doubt recession-proof and has a wide economic moat around its business – the problem for Waters Corporation remains the current valuation of the stock, which is still a bit too high. It is not like Waters Corporation is so unreasonably overvalued that shorting the stock is a good idea. But it is also not a clear buy in my opinion.

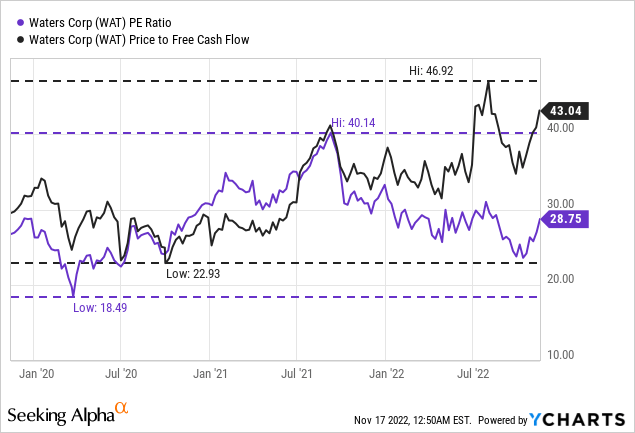

When looking at the price-earnings ratio as well as the price-free-cash-flow ratio (we are showing only the last three years as valuation multiples were extremely high a few years ago and this would disturb the entire picture), the stock is still trading for rather high valuation multiples. The P/E ratio declined a bit in the recent past – from a high of 40 in the second half of 2021 to about 29 right now. And while such a P/E ratio certainly can be justified, it needs high and consistent growth to do so. Aside from the P/E ratio we can also look at the P/FCF ratio which is around 43 right now – and in my opinion there are only a few examples where a valuation multiple close to 50 was ever justified.

Of course, we can point out that free cash flow was declining in the last few quarters and Waters Corporation might be able to generate a higher free cash flow in the coming years again. In the last four quarters, Waters Corporation was able to generate about $473 million in free cash flow while the TTM peak number was $696.5 million a few quarters ago. Hence, it makes sense to offer a few different calculations. I provide a range between a rather low FCF assumption and the rather optimistic peak and the same goes for the growth rates with an 8% growth rates (that seems definitely achievable) and a more optimistic 11% growth target for the next ten years. In ten years from now, we take 6% growth till perpetuity like always when dealing with wide economic moat companies.

|

Intrinsic Value |

8% next ten years /6% perpetuity |

11% next ten years /6% perpetuity |

|

$473 million free cash flow |

$227.08 |

$280.70 |

|

$697 million free cash flow |

$334.39 |

$413.34 |

When considering the most-likely upcoming recession in 2023 having a negative effect on the business and including a margin of safety, I would see growth rates rather close to 8% in the next ten years and not in the double-digits. Analysts are also expecting earnings per share to grow with a CAGR of 9.25% in the next five years. In my opinion, we could make the argument that Waters Corporation might be fairly valued right now, but it also seems possible for the company not being able to meet these growth targets.

Conclusion

With the U.S. stock market starting to collapse and some sectors and companies already displaying stock price declines of 50% and more, I still think we should pass on Waters Corporation for now, as we can find better investments. Of course, we should not always search for extremely cheap bargains. As Buffett said: it is better to invest in great businesses at a reasonable price. And the price for Waters Corporation might almost be reasonable, and we certainly are talking about a great business. Nevertheless, Waters Corporation stock is not on my shopping list right now.

Be the first to comment