aluxum

Recent rate hikes by the U.S. Federal Reserve (Fed) have weighed on emerging markets (EM) debt returns, which were already weak in 2021 and the first quarter of 2022 due to investor fears about the impact of the war in Ukraine and Chinese lockdowns. The speed and extent of further monetary tightening is uncertain, and as a result, there are concerns about the impact of rate hikes on future fixed-income returns. Should investors be concerned, or could this be a buying opportunity?

In this series – based on our paper – we consider a number of fears driving concerns about the future returns of EM sovereign debt. We then assess the legitimacy of each fear when compared to the three most recent Fed rate-hiking cycles: 1999 to 2000, 2004 to 2006, and 2015 to 2018.

We discussed the first fear driving concerns about the future returns of EM sovereign debt – that sensitivity of EM debt to rising interest rates could hurt performance – in a previous post. Here, we talk about another fear: that EM debt spreads could widen as interest rate hikes hurt global growth (and change risk sentiment).

It is unclear if the current tightening cycle will have lasting repercussions for global growth. Rate hikes in 2004 to 2006 were followed by a recession, but this had more to do with bad loans in the financial system than it did with the level and direction of interest rates. The 2015-2018 rate-hiking cycle, meanwhile, was slower than expected and ended earlier than expected because the economy was showing signs of stress. Rate hikes that occurred during this period were quickly reversed. That cycle, then, is also a poor guide.

What we do know is that over the coming 12 months, global growth faces headwinds in addition to the Fed tightening monetary policy. For example, supply-chain disruptions caused by China’s zero-COVID policy and the Russia-Ukraine conflict could keep food and energy prices high. Fiscal accounts are likely to come under more pressure as governments face tough choices as to how to deal with this potential social crisis.

On the flip side, high commodity prices should support the finances of EM commodity exporters, improving their terms of trade. The balance-of-payments position of many sovereign credits in the J.P. Morgan EMBIGD is also strong. Lastly, growth fears may cause an early halt to the tightening cycle and may even cause policymakers to reverse course.

We believe these headwinds are significant enough to warrant caution, so we have revised our forecast for growth in both developed and emerging markets downward.

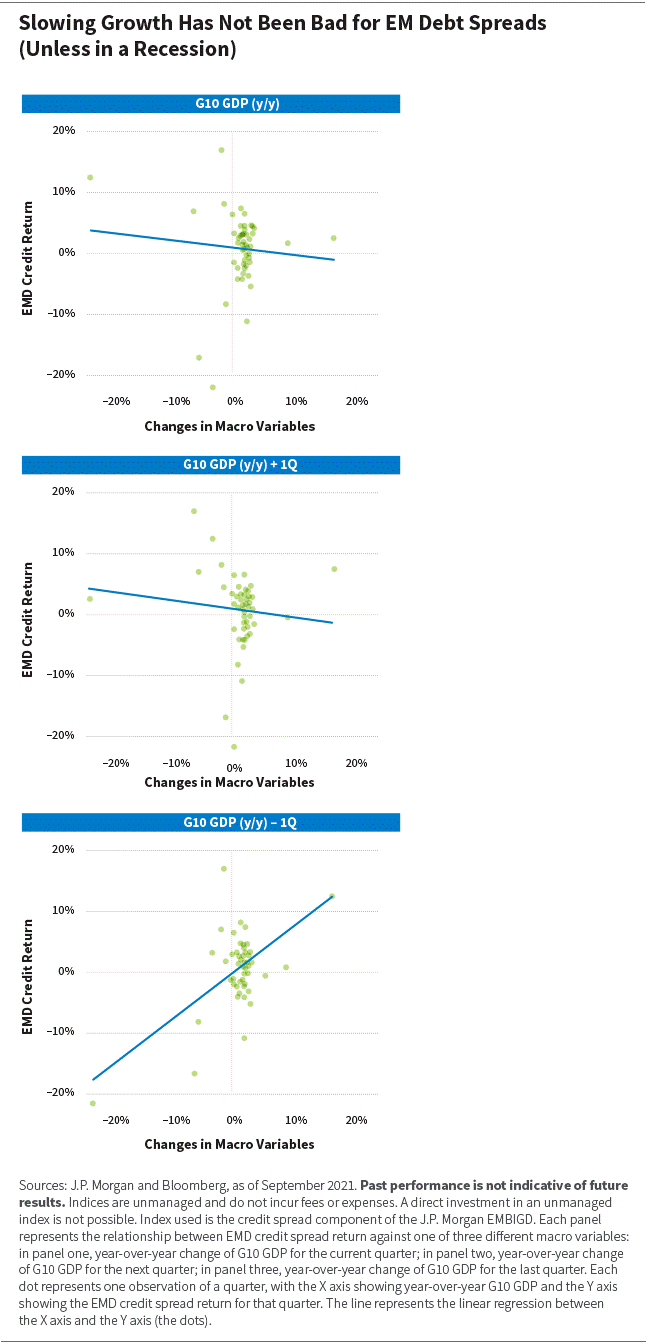

However, there is a perception that strong global growth supports EM debt returns, and this is leading to investors’ fears that interest rate hikes hurt global growth and thus widen EM debt spreads. While it is true that spreads tend to widen significantly during a global recession (such as the 2008-09 global financial crisis and 2020 COVID-19 pandemic), our research shows that there is little correlation between EM debt returns and slowing global growth – particularly when growth comes from a reasonably strong base, as it does now.

Looking back at previous Fed rate-hiking cycles, then, there is no clear pattern or trend to draw from conclusively: It is unclear if a weaker global economy will widen spreads significantly.

1999-2000: Spreads Had Already Sold Off

In the 12 months leading up to the 1999-2000 tightening cycle, spreads had already sold off considerably. They decoupled from other risk assets, such as the S&P 500 Index, as the market digested both the Asian crisis of 1997 and the Russian crisis of 1998. Oil prices doubled during this period similar to the current energy trend, and this helped spreads to recover sharply in the 12 months following the first hike.

2004-2006: Spreads Had Already Tightened

In contrast to 1999-2000, going into the 2004-2006 rate-hiking cycle, spreads had already tightened marginally. This was a favorable time for EM, with China joining the World Trade Organization (WTO) and a trend toward globalization driving a commodity boom. This supported spread tightening throughout the rate-hiking cycle, with spreads finishing close to all-time lows.

2015-2018: Spreads Tightened

Similar to the lead-up to the 1999-2000 rate-hiking cycle, spreads had widened ahead of the first rate hike in 2015. This time, however, they did so aggressively, widening approximately 60 bps going into the rate-hiking cycle.

Unlike in 2004-2006, the environment was less favorable for EM. There were concerns about a hard landing in China; oversupply in the oil sector amid a U.S. shale push was creating a commodity shock; and the Brazilian corruption scandal was creating negative sentiment.

Despite all of these EM-specific headwinds, spreads were tighter 12 months after the start of the rate-hiking cycle than when they began the cycle.

Our Verdict: Spread Widening Unlikely

Spreads have already widened significantly since June 2021, yet the global economy remains in relatively good health despite downward revision of economic forecasts.

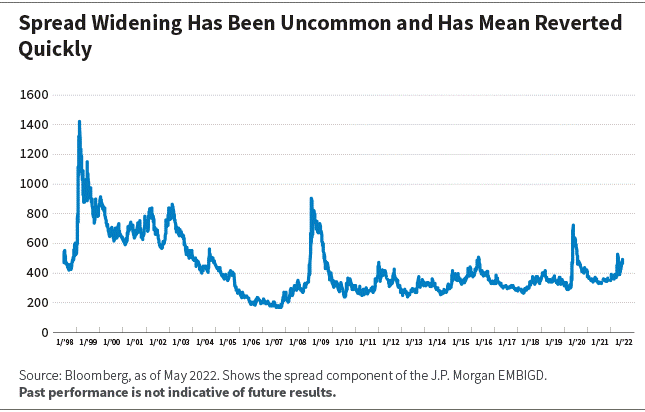

Using history as a guide, we believe meaningful spread widening from here is unlikely unless accompanied by a global recession, an event that we think is a very low probability. Since 2000, EM debt spread widening of more than 200 bps has been uncommon, and when it has happened, spreads have tended to mean revert quickly. Exhibit 3 illustrates that this has only happened a handful of times, and each time has been followed shortly by a sharp retracement in spreads.

Our expectation, then, is that spreads will mean revert to the 380 to 420 range over the next year.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment