kozmoat98/E+ via Getty Images

Waste Management, Inc., (NYSE:WM) “through its subsidiaries, provides waste management environmental services to residential, commercial, industrial, and municipal customers in North America”. The firm provides collection services, together with operating landfill gas-to-energy facilities and transfer stations.

We also published an article on Seeking Alpha in July 2022, titled: “Why Waste Management Could Be Attractive In The Current Market Environment“.

Back then, we rated WM’s stock as a “buy”. The main reasons for our rating were:

- Financial performance of WM is independent of consumer confidence

- Most of the revenue is generated within the United States, meaning that currency headwinds are not material

- Attractive dividend and share buyback history

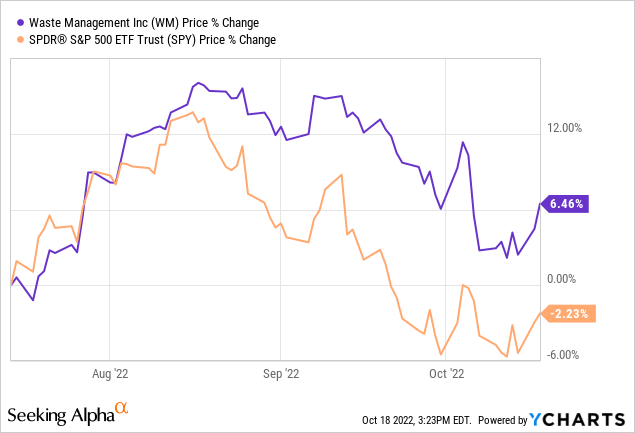

On the other hand, we also put an emphasis on the apparent overvaluation of the stock. And since our last writing, WM’s stock price has increased by another 6.5%, outperforming the broader market by about 9%.

So in today’s article, we will be focusing on the valuation of the stock. Our aim is to come up with a range of fair values, using the Gordon Growth Model.

Fair Value of WM’s Stock

Gordon Growth Model

The Gordon growth model (‘GGM’) is a relatively simple and widely recognized dividend discount model, used to value the equity of dividend paying firms. The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

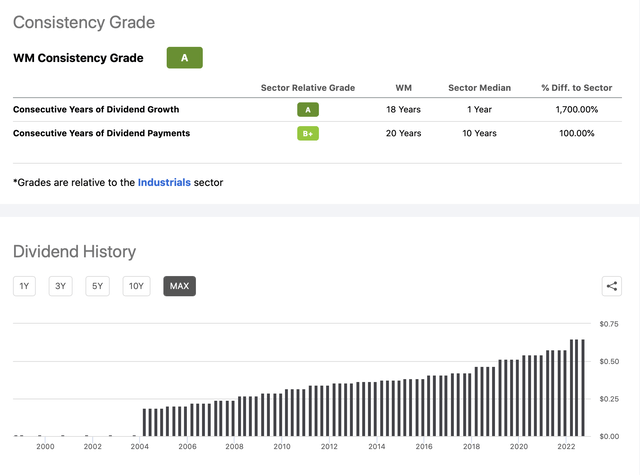

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

In our opinion, Waste Management is relatively insensitive to business cycles and has a strong track record of paying dividends and growing its dividend payments.

Dividend history (Seeking Alpha)

For these reasons, we believe that the GGM could be potentially a suitable tool to value WM’s stock.

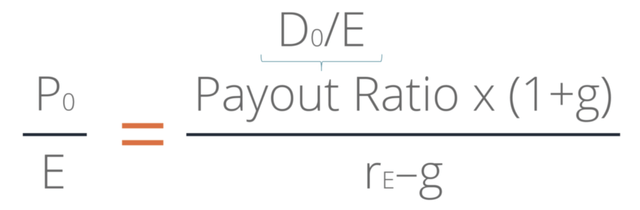

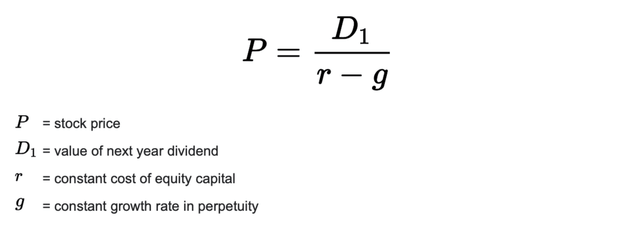

But what is actually behind the Gordon Growth Model? The model is described by the following formula:

So, to make a meaningful evaluation of the fair value of Waste Management’s stock, we have to establish a few assumptions:

1.) What is our required rate of return?

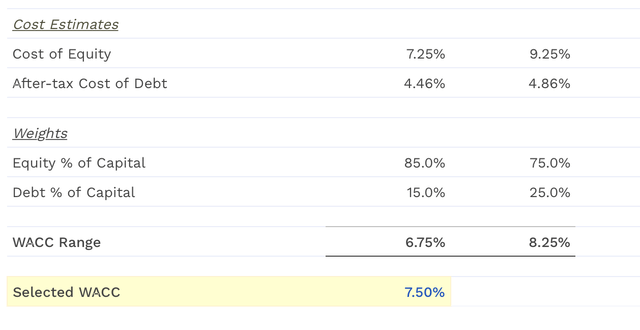

We decided to use WM’s weighted-average cost of capital (‘WACC’) for our required rate of return. The current WACC of the firm is estimated to be 7.5%.

2.) What could be a reasonable constant dividend growth rate in perpetuity?

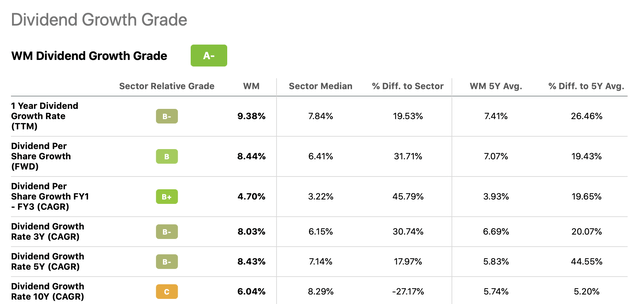

To answer this question, we have to take a closer look at WM’s dividend payment history and try to define a reasonable long term trend. Important to note here that the growth rate has a substantial impact on the calculated fair value. Assuming unrealistically high growth rates can lead to a significant overestimation of the fair value. For this reason, we rather like to stay on the conservative side.

Dividend growth (Seeking Alpha)

Based on historical dividend growth rates, a range of 3% to 6% appears to be an appropriate choice.

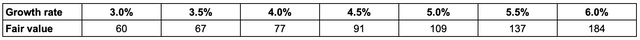

The following table shows the results of our fair value calculation (in USD) using a 7.5% required rate of return and the above defined range of constant sustainable dividend growth rate.

As WM’s stock is currently trading above $160, we believe that there is little room for upside, based on this dividend discount model.

For this reason, we do not recommend starting a new position or adding to existing positions at the current price levels.

Justified P/E Ratio

Price multiples are often used separately from present value models. On the other hand, the GGM could be a suitable tool to relate fundamentals through a discounted cash flow model. This method allows to determine the so-called justified P/E ratio.

Justified P/E (corporatefinanceinstitute.com)

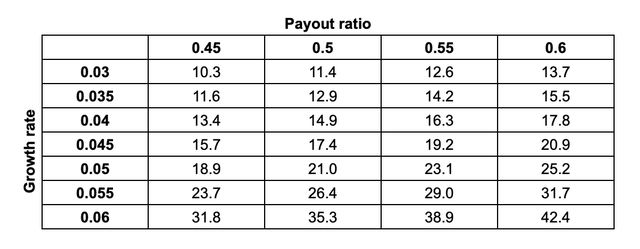

For this calculation, we keep our previously established required rate of return assumption of 7.5%. For the estimated dividend growth rate we also stick to our above-mentioned 3%-6% range.

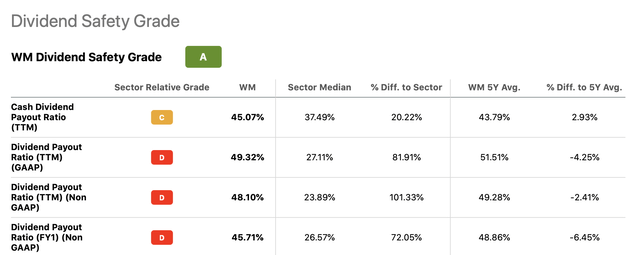

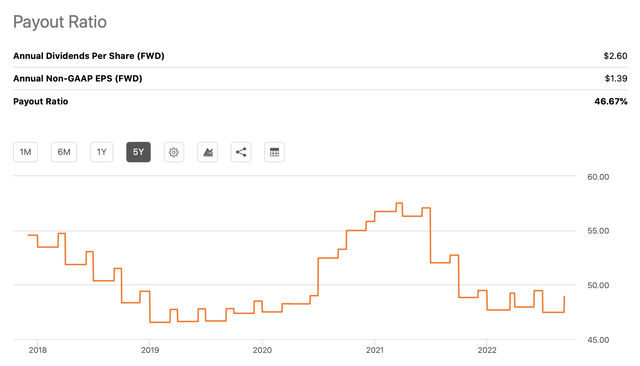

Now, we have to find a reasonable assumption for the payout ratio. The following table and chart show the firm’s dividend payout ratio over the previous years.

Payout ratios (Seeking Alpha) Payout ratio (Seeking Alpha)

Based on this data, a range of 45% to 60% appears to be appropriate. By using the defined assumptions and setting them in to the justified P/E formula, we get the following matrix of justified P/E results.

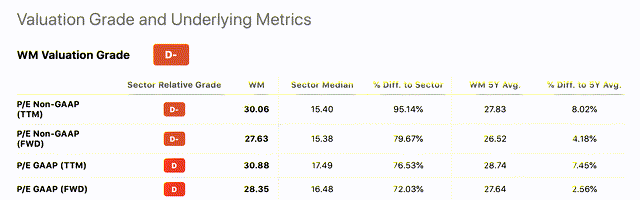

So let us see, how the firm’s current valuation compares with these results.

Valuation metrics (Seeking Alpha)

P/E Non-GAAP (‘TTM’) of 30x is substantially higher than both the sector median and the firm’s own 5 yr average. Further, 30x is on the higher end of our calculated range. To justify the firm’s current P/E, we either have to look at column of our most aggressive payout ratio assumption or at the row of the most aggressive dividend growth assumption.

Because of this, we see little room for upside from the current price levels, based on the justified P/E calculations.

To Sum Up

We like Waste Management’s business because its financial performance is relatively independent of consumer confidence, most of its revenue is generated within the United States and they have an attractive dividend and share buyback history.

On the other hand, because of the valuation of the stock, we are becoming more cautious on Waste Management. Both the Gordon Growth Model and the Justified P/E calculations indicate that the stock does not have much upside potential. WM’s stock also appears to be overvalued compared to its sector median and its own 5 year average.

For these reasons, we rate WM’s stock as “hold” now.

Be the first to comment