Makiko Tanigawa

Investment Thesis

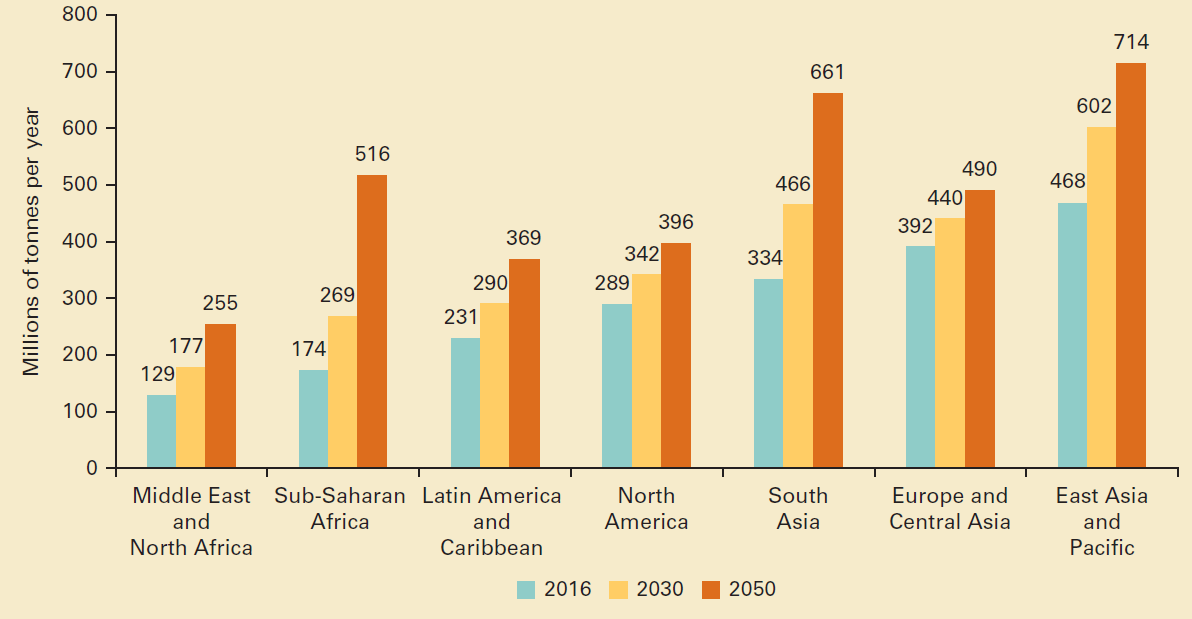

Waste Management (NYSE:WM) and Republic Services (NYSE:RSG) are the two largest public waste management companies. An unfortunate side-effect of a growing economy is that more trash is generated. Manufacturing, construction, mining, and agriculture all generate a large amount of waste, and companies like Waste Management and Republic Services have benefited from increasing economic activity for several decades. At the same time, there is a greater level of scrutiny on the impact that companies have on the environment and more social pressure to reduce this impact. But a company can’t necessarily reduce the amount of waste it generates, so instead it must spend more money to process this waste and secure services from a waste management company. This brings another tailwind to the sector.

Both companies are highly profitable companies with a well-defined economic moat. Also, both of them have bright future prospects with macro tailwinds. However, I think one company is a better choice than the other, with stronger finances and better growth prospects.

Projected Waste Generation (Data Topics)

Cappuccino Stock Rating

| Weighting | WM | RSG | |

| Economic Moat Strength | 30% | 5 | 5 |

| Financial Strength | 30% | 4 | 3 |

| Growth Rate vs. Sector | 15% | 4 | 3 |

| Margin of Safety | 15% | 4 | 4 |

| Sector Outlook | 10% | 4 | 4 |

| Overall | 4.3 | 3.9 |

Economic Moat Strength

Both Waste Management and Republic Services have a very strong and resilient economic moat, which won’t be eroded anytime soon. Waste Management is the largest waste management and recycling company, owning 260 landfill sites (largest in U.S. and Canada) and 340 transfer stations. This massive network gives pricing power, economy of scale, and brand recognition over competitors. Republic Services is smaller (198 landfill sites and 239 transfer stations) than Waste Management, but they also have a large size advantage and vast network effect compared to other competitors.

Thanks to these competitive advantages, both of them enjoy high profitability and returns on capital. EBITDA margins of Waste Management (27.5%) and Republic Services (29.6%) are almost twice that of the sector median (13.1%). Net Income Margins of Waste Management (10.3%) and Republic Services (11.5%) are also far higher than the sector median (6.7%).

Financial Strength

As they are in a capital intensive industry, both of them carry large debt on their balance sheet. Also, their liquidity metrics (current ratio and quick ratio) are low. However, they are far away from any financial distress because their debts are very well managed. Both companies make more than enough cash to service the debt while also investing in growth. Waste Management’s covered ratio is at 8.71x, while Republic Services’ covered ratio is at 6.86x. Also, the levered free cash flow of Waste Management ($2.04 B) and Republic Services ($1.26 B) clearly demonstrate their cash generating ability.

Waste Management does get an edge over Republic Services in this category because of a higher covered ratio, higher operating cash flow, and higher free cash flow.

Growth Rate

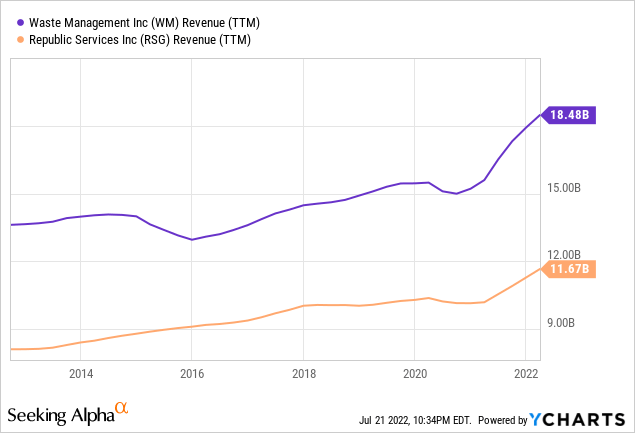

Both companies are enjoying macro tailwinds (increasing amount of trash and environmental regulations requiring greater processing services), and their sizes have trended steadily upwards. I believe Waste Management deserves a higher score than Republic Services in this category. Waste Management’s most recent revenue growth (18.45% YoY) was higher than Republic Services (14.44%), and 3 year revenue CAGR of Waste Management (6.97%) was also higher than that of Republic Services (4.98%).

Also, Waste Management has been systematically investing in automation within their facilities and equipment to reduce labor costs and lessen the impact of the labor shortage problem. As labor is the greatest expense, these investments will pay dividends in the future by allowing Waste Management to expand faster, while also manage their margin better. Waste Management already generates more revenue per employee (369k) than Republic Services (322k), and Waste Management’s Return on Capital (9.25%) is higher than Republic Services (7.48%). I expect the gap to widen in the future.

Margin of Safety

Based on the intrinsic value calculation utilizing their metrics (EBITDA, growth rate, discount rate, and etc.), both companies are substantially undervalued by the market at this point. Both Waste Management and Republic Services are undervalued by 20-30%. The fear of recession, inflation, and increasing interest rates have rocked the stock market, dragging the stock prices of both companies down. Given their economic moat, profitability, and future outlook, I expect both companies to do well in the future.

Sector Outlook

There is a strong correlation between GDP per capita and total waste generation. Greater economic activity (unfortunately) means more waste. Construction, mining, manufacturing, and agriculture all generate a large amount of solid waste, and that means more business for Waste Management and Republic Services in the future. The growth rate certainly won’t be explosive like some companies within the technology sector, but it will be nice and steady over the long term. With their vast network and other competitive edges, Waste Management and Republic Services will capture a lion’s share of the sector growth.

Relationship between GDP per Capita and Waste Generation (Research Gate)

Risks

To fight high inflation, Federal Reserve has been doing everything they can (decreasing bond purchase, increasing interest rate, and etc.), and it seems like they wouldn’t even mind triggering a recession. Even though I don’t think the recession will be severe, a slowdown seems inevitable. As mentioned before, revenues for Waste Management and Republic Services are closely tied to the level of economic activity. The recession will dampen revenue growth, and they may even experience a downturn.

Labor shortages have been causing problems for both companies, and there have been a couple of articles reporting issues with operating costs. The labor shortage can cause a slowdown in expansion and margin compression. As labor is the largest category of expense for these companies, effective management of the labor situation is critical. Both companies have increased spending on automated trucks and facilities and an expediting training program, so I expect them to be able to handle the situation, but the investor should monitor the labor market and associated costs.

Conclusion

Both Waste Management and Republic Services are solid investments. Given macro trends and their economic moat, I believe both companies will do well in the future. Between the two, I favor Waste Management. WM has better financial strength, and the growth rate has been higher. Also, thanks to its larger investment in automation, I expect WM to expand more quickly and grow margins in the future. Labor shortages are certainly challenging both companies, but I expect them to handle it and still continue their long-term growth. I believe both companies are undervalued by 20-30% at this point, and will achieve a nice upside in the long run.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment