fotoguy22/iStock via Getty Images

Earnings of Washington Trust Bancorp, Inc. (NASDAQ:WASH) will likely dip in 2022 mostly because of lower mortgage refinancing activity. Further, the provision expense will likely return to a normal level this year after significant provision reversals in 2021. On the other hand, mid-single-digit loan growth will likely support the bottom line. Further, the rate-sensitive margin will likely expand amid a rising interest-rate environment. Overall, I am expecting Washington Trust Bancorp to report earnings of $4.05 per share in 2022, down 7.7% year-over-year. The year-end target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on Washington Trust Bancorp.

Loan Growth to Remain Low Compared to the Past

Washington Trust Bancorp managed to achieve decent loan growth in 2021 despite Paycheck Protection Program (“PPP”) loan forgiveness. PPP loans outstanding declined from $199.8 million at the end of December 2020 to $38.0 million at the end of December 2021. As the outstanding loans made up just 0.9% of total loans at the end of December 2021, the remaining PPP forgiveness will have a limited impact on the total loan portfolio size.

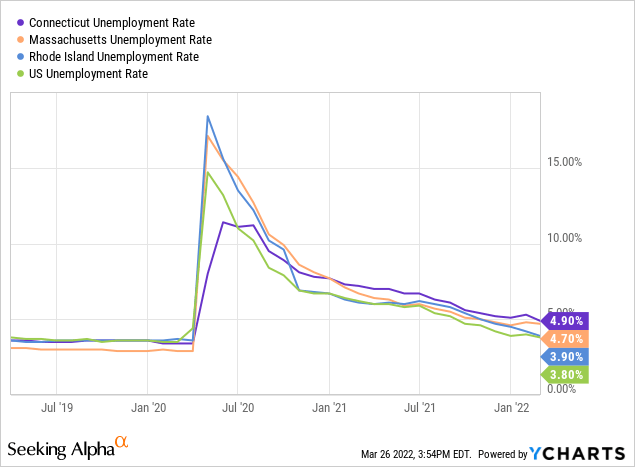

Further, economic factors will likely drive loan growth. Washington Trust Bancorp operates in Rhode Island, Connecticut, and Massachusetts. All three states had worse unemployment rates than the national average in February 2022. However, all three are now at much better levels than a year-ago period, as shown below.

The company has managed mid-to-high single-digit loan growth in the past. Considering the factors mentioned above, I’m expecting the loan growth to improve this year compared to last year but remain at the lower end of the historical trend. Overall, I’m expecting loan growth of 4% in 2022. Further, I’m expecting other balance sheet items to grow in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans | 3,348 | 3,653 | 3,866 | 4,152 | 4,234 | 4,406 | |

| Growth of Net Loans | 4.3% | 9.1% | 5.8% | 7.4% | 2.0% | 4.1% | |

| Other Earning Assets | 824 | 963 | 984 | 995 | 1,086 | 1,130 | |

| Deposits | 3,243 | 3,524 | 3,499 | 4,378 | 4,980 | 5,182 | |

| Borrowings and Sub-Debt | 814 | 973 | 1,193 | 648 | 197 | 205 | |

| Common equity | 413 | 448 | 503 | 534 | 565 | 598 | |

| Book Value Per Share ($) | 23.8 | 25.8 | 28.9 | 30.7 | 32.4 | 34.3 | |

| Tangible BVPS ($) | 19.6 | 21.6 | 24.8 | 26.7 | 28.4 | 30.3 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Margin Moderately Sensitive to Rate Changes

Washington Trust Bancorp’s loan portfolio is quite sensitive to interest rate changes because of a high proportion of variable-rate loans. According to details given in the 10-K filing, variable and adjustable-rate loans made up around 66% of total loans at the end of December 2021.

Unfortunately, the liability side is also quite sensitive to rate changes. Transaction accounts, including interest-bearing demand deposits, NOW accounts, money market accounts, and savings accounts, made up around 55% of total deposits. These transaction accounts will re-price soon after a rate hike.

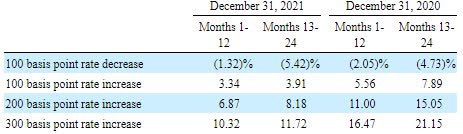

Due to the combination of rate-sensitive loans and deposits, the net interest margin is only moderately sensitive to interest rate changes. The management’s interest-rate sensitivity analysis given in the 10-K filing shows that a 200-basis points increase in interest rates can boost the net interest income by 6.87% over twelve months.

Washington Trust Bancorp 2021 10-K Filing

Considering these factors, I’m expecting the margin to increase by six basis points in the second half of 2022.

Normalization of Mortgage Refinancing Activity to Hurt Earnings

Mortgage banking income led to a significant jump in earnings for Washington Trust Bancorp in the last two years. Mortgage revenues (included in non-interest income) made up 13% of total revenues in 2021 and 21% of total revenues in 2020. In comparison, mortgage revenues made up just 7% of total revenues in 2019.

Higher interest rates this year will discourage mortgage refinancing, which will in turn drag non-interest income. The Mortgage Bankers Association expects total mortgage origination volume to decline by 34% this year. The management expects to perform better than the industry as it is expecting the decline to be in the high 20% range, as mentioned in the conference call.

It is interesting to note that in the most recent forecast, Mortgage Bankers Association has actually increased its forecast for this year. The association is now expecting a mortgage origination volume of $2,634 billion in 2022, up from the estimate of $2,600 billion given in January 2022.

Meanwhile, other fee income will likely grow at a normal rate this year. Considering these factors, I’m expecting total non-interest income to decline by 8% year-over-year in 2022.

Earnings to Dip by 7.7% Year-Over-Year

The dip in non-interest income will likely contribute to earnings decline this year. Further, I’m expecting the provision expense to return to a normal level in 2022 after last year’s high provision reversals. I’m expecting the provision expense to make up around 0.07% of total loans in 2022, which is the same as the average provision-expense-to-total-loan ratio for the last five years.

Overall, I’m expecting Washington Trust Bancorp to report earnings of $4.05 per share in 2022, down by 7.7% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 120 | 132 | 133 | 127 | 141 | 147 | |

| Provision for loan losses | 3 | 2 | 2 | 12 | (5) | 3 | |

| Non-interest income | 65 | 62 | 67 | 99 | 87 | 80 | |

| Non-interest expense | 104 | 106 | 111 | 125 | 135 | 134 | |

| Net income – Common Sh. | 46 | 68 | 69 | 70 | 77 | 71 | |

| EPS – Diluted ($) | 2.64 | 3.93 | 3.96 | 4.00 | 4.39 | 4.05 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD thousands unless otherwise specified) |

|||||||

In my last report on Washington Trust Bancorp, I estimated earnings of around $4.03 per share for 2022. I have barely changed my earnings estimates as my economic outlook has not changed much since the publication of my last report. Further, the actual results for the fourth quarter of 2021 were not surprising enough to warrant estimate revisions for this year.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Small Price Upside Warrants a Hold Rating

Washington Trust Bancorp is offering a dividend yield of 4.0% at the current quarterly dividend rate of $0.54 per share. The earnings and dividend estimates suggest a payout ratio of 53% for 2022, which is close to the five-year average of 51%. Therefore, I’m not expecting any change in the dividend level in the year ahead.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Washington Trust. The stock has traded at an average P/TB ratio of 2.11 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 19.6 | 21.6 | 24.8 | 26.7 | 28.4 | |

| Average Market Price ($) | 52.6 | 55.7 | 50.6 | 37.3 | 52.0 | |

| Historical P/TB | 2.68x | 2.58x | 2.04x | 1.40x | 1.83x | 2.11x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $30.3 gives a target price of $63.7 for the end of 2022. This price target implies a 17.3% upside from the March 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.91x | 2.01x | 2.11x | 2.21x | 2.31x |

| TBVPS – Dec 2022 ($) | 30.3 | 30.3 | 30.3 | 30.3 | 30.3 |

| Target Price ($) | 57.7 | 60.7 | 63.7 | 66.8 | 69.8 |

| Market Price ($) | 54.4 | 54.4 | 54.4 | 54.4 | 54.4 |

| Upside/(Downside) | 6.1% | 11.7% | 17.3% | 22.8% | 28.4% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.6x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.64 | 3.93 | 3.96 | 4.00 | 4.39 | |

| Average Market Price ($) | 52.6 | 55.7 | 50.6 | 37.3 | 52.0 | |

| Historical P/E | 19.92x | 14.2x | 12.8x | 9.3x | 11.8x | 13.6x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.05 gives a target price of $55.2 for the end of 2022. This price target implies a 1.5% upside from the March 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.6x | 12.6x | 13.6x | 14.6x | 15.6x |

| EPS – 2022 ($) | 4.05 | 4.05 | 4.05 | 4.05 | 4.05 |

| Target Price ($) | 47.0 | 51.1 | 55.2 | 59.2 | 63.3 |

| Market Price ($) | 54.4 | 54.4 | 54.4 | 54.4 | 54.4 |

| Upside/(Downside) | (13.4)% | (6.0)% | 1.5% | 8.9% | 16.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $59.5, which implies a 9.4% upside from the current market price. Hence, I’m maintaining a hold rating on Washington Trust Bancorp.

Be the first to comment