Dmitry Koveshnikov/iStock via Getty Images

Introduction

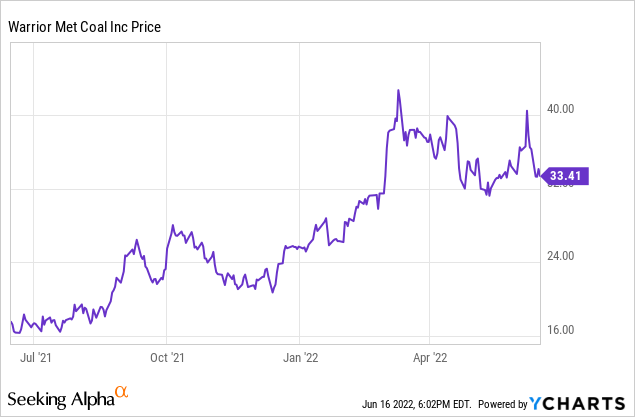

Eighteen months ago, I introduced Warrior Met Coal (NYSE:HCC) as a Top Idea here on Seeking Alpha. I was banking on an expected improvement in the coking coal price. That happened, and in an even more aggressive fashion than I ever dreamed of. Unfortunately, Warrior’s share price never reached fair value as the market was discounting the stock due to the cyclical nature, while its normal production rate was never reached due to a strike at one of the mines. I cannot and should not be unhappy with a 65% share price return (excluding dividends), especially now the stock is trading 20% down from its 2022 high, but it feels like this ‘perfect storm’ in the metallurgical/coking coal market did not yield the desired results.

A Very Strong Cash Flow Result Despite Not Selling The Entire Production

Warrior Met Coal has been able to take advantage of the high metallurgical coal prices, but unfortunately it still isn’t able to fire on all cylinders as the company is still dealing with a strike. This weighed on the production volumes, but on top of that, Warrior Met Coal did not sell every tonne that was produced during the quarter.

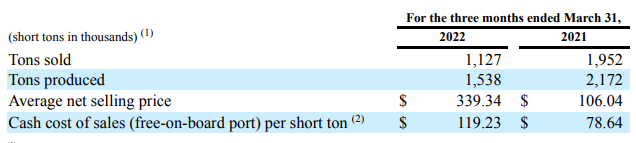

HCC Investor Relations

As you can see above, Warrior produced about 1.54 million tonnes of coal, but only sold 1.13 million tonnes. This obviously weighed on the financial results of the company, but that’s most definitely not a deterrent as this situation will very likely be reversed in the current quarter as Warrior will likely sell the additional tonnes it is/was holding in inventory.

The total revenue in the first quarter was approximately $379M and this resulted in an operating income of just under $187M, which is about 17 times higher than in the first quarter of last year. That’s remarkable, especially because the company recorded $10M in idle mine and business disruption expenses related to the strike. Also keep in mind the royalty expenses are included in the cost of sales and this, in combination with higher transportation expenses, have added about $32/t to the production cost and that explains the very sharp increase from less than $79/t to almost $120/t.

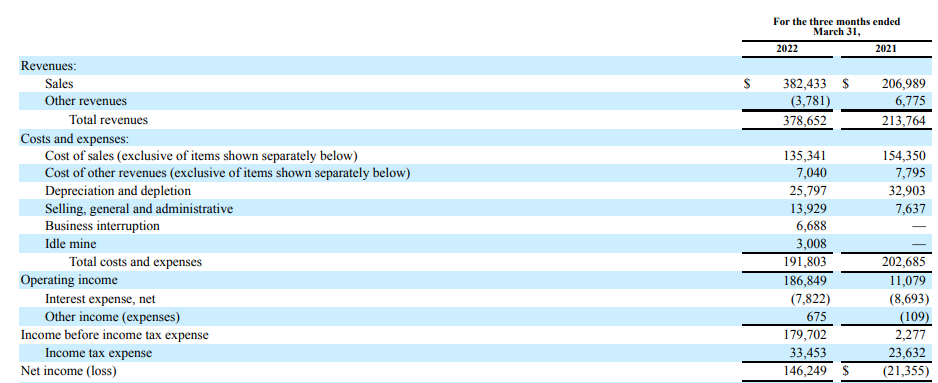

HCC Investor Relations

The interest expenses remain low, and the pre-tax income jumped to almost $180M, resulting in a net income of $146M or $2.84 per share. And again, this does not include the tonnes that have been produced but weren’t sold during the first quarter, so the $2.84 EPS is actually pretty light.

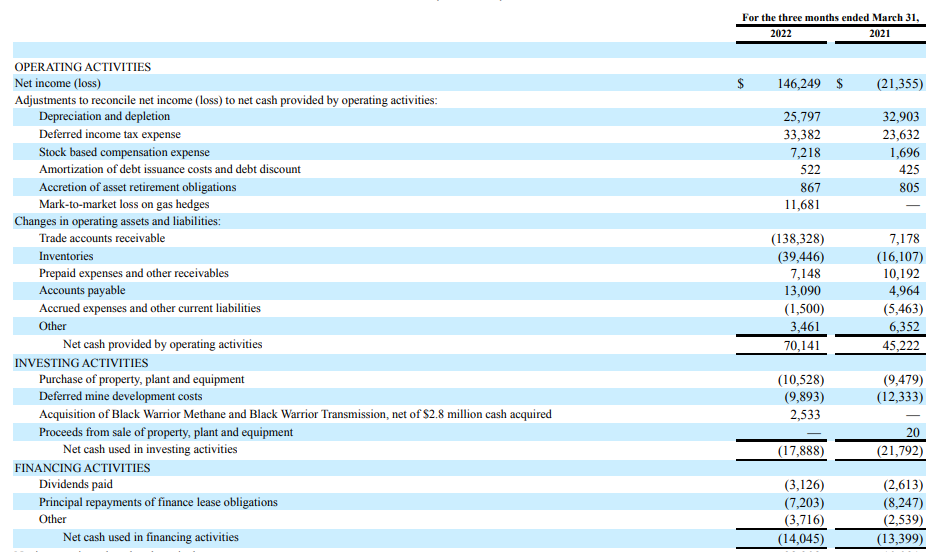

The exceptionally strong metallurgical coal price (with an average realized price north of $330 per short ton in Q1) obviously also has an immediate impact on the free cash flow result. Don’t be alarmed by the fact the reported operating cash flow was just $70M. This includes an investment of $155M in working capital elements (mainly an increase in receivables as the higher met coal price increases the value of the invoices). So, on an adjusted basis, and after including the $7M in lease payments as well, the operating cash flow was $218M.

HCC Investor Relations

The total capex was just around $20M, which means Warrior Met Coal generated about $198M in free cash flow. Keep in mind this includes a $33M deferral of income taxes and on a normalized basis the free cash flow would have been approximately $165M or $3.20/share. That exceeds the reported net income due to the difference between the depreciation expenses and cash capex, and the non-cash loss related to gas hedges.

The Balance Sheet Is Getting Stronger, But The Strike Has An Opportunity Cost

Although the total amount of receivables exploded and the net cash position increased remained relatively low, the balance sheet is getting stronger by the week. The net cash position increased to $94M (up from just $55M as of the end of 2021) but the working capital (defined as current assets minus current liabilities) increased sharply from $505M to $685M. And the current quarter will likely show another few hundred million dollars hitting the balance sheet as we can expect the total amount of tonnes sold to increase towards 2 million short tons in the current quarter before falling back to the average of 1.5 million tonnes per year in Q3 and Q4. That’s not a certainty though as on the conference call, Warrior’s management was discussing issues at the port, so perhaps we’ll have to wait for Q3 to see the excess inventory levels being sold into the market.

Meanwhile, the metallurgical coal prices remain relatively strong. Sure, they are no longer trading at record levels, but the futures market seems to indicate a coking coal price of around $300/t in the next few months and quarters appears to be likely. And that will allow Warrior Met Coal to generate hundreds of millions in free cash flow per semester.

Investment Thesis

I’m very happy my call in December 2020 worked out phenomenally, but in hindsight, the share price reaction to what was a perfect storm on the coking coal market was not exactly what I had expected. I don’t expect the coking coal prices to substantially increase from here on, and I think the best is now behind us. Fortunately, this allowed Warrior to fix the balance sheet, allowing it to head into the down cycle in a very strong financial position.

I currently still have a long position in Warrior Met Coal and I continue to write put options and call options to either add at lower prices or try to sell my position at higher prices.

Be the first to comment