Erik Khalitov

Shares of Warner Bros. Discovery (NASDAQ:WBD) have revalued sharply to the downside this year with enthusiasm about the merger between AT&T’s Warner Media spin-off and Discovery not lasting long. Although Warner Bros. Media has lost about 50% of its value this year, I believe the current drop in pricing is exaggerated and Warner Bros. Discovery’s streaming business is selling at a very attractive valuation. With a restructuring already announced, investors can look forward to improving profitability and margins which could drive a revaluation of the company’s shares!

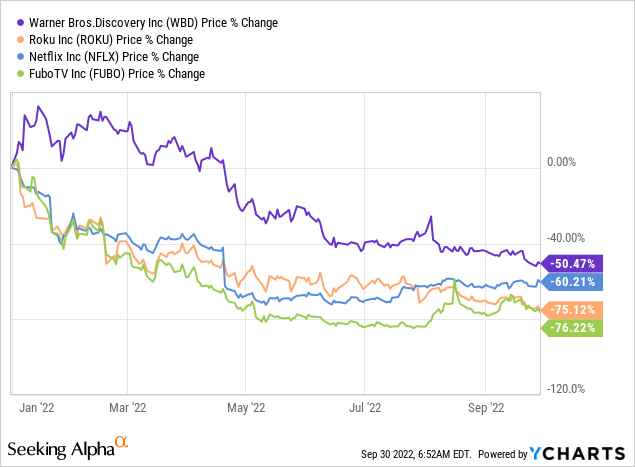

Streaming firms are out of favor

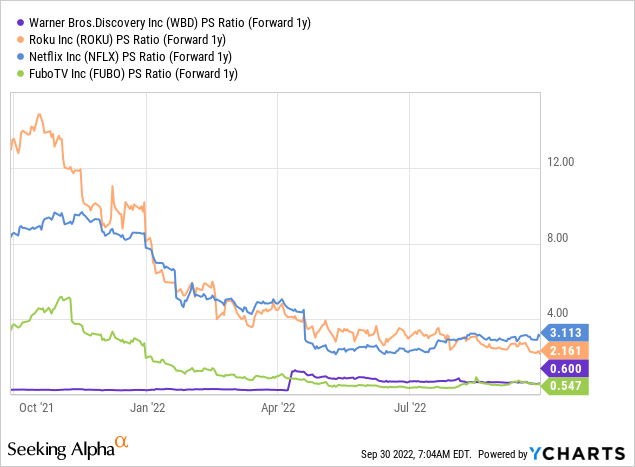

Streaming firms including Roku (ROKU), Netflix (NFLX), fuboTV (FUBO) and Warner Bros. Discovery have seen significant downside pressure on their valuations this year as investors — fearful of a slowdown in post-pandemic growth prospects — ditched shares. Warner Bros. Discovery’s shares have not fared as badly as those of fuboTV, for example, but I believe the current revaluation to the downside has now gone too far.

While I was on the fence about WBD until recently due to what I saw as growing headwinds related to the company’s restructuring, the drop in pricing creates an engagement opportunity for investors that seek long term exposure to one of the strongest streaming platforms.

In my recent work on WBD — Warner Bros. Discovery: Growing Pains — I suggested that the streaming company was not yet ripe for a purchase (which was back in August), but the rather dramatic change in valuation since August has changed the game for me quite a bit.

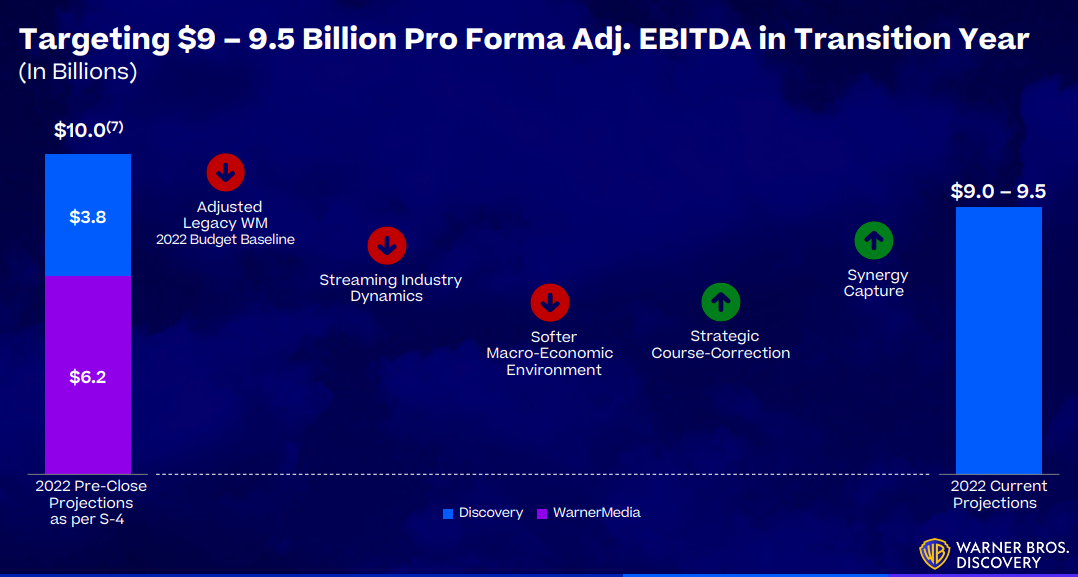

Warner Bros. Discovery is at the very beginning of a restructuring that is meant to accomplish two things: (1) The company is looking to generate $3.0B in annual synergies by FY 2024 with current cost-saving plans so far expected to lower expenses by $1.0B, and (2) WBD is targeting $9.0-9.5B in pro-forma EBITDA in FY 2022 which is expected to ramp up to $12.0B in FY 2023 as the company prioritizes driving its direct-to-consumer business to profitability.

Warner Bros. Discovery: EBITDA Guidance

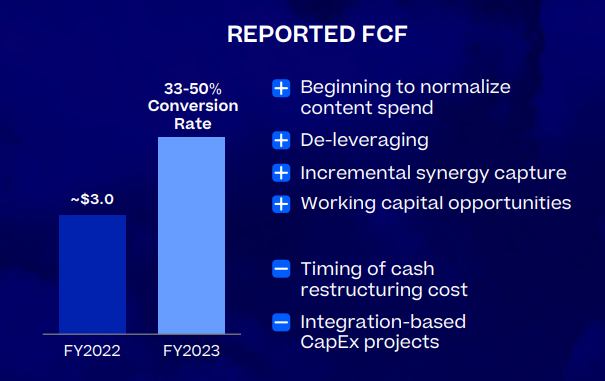

Cost-savings are a core tenet in Warner Bros. Discovery’s recovery plan that is heavily focused on the direct-to-consumer business. These cost savings are also expected to drive a material free cash flow improvement due to better conversion going forward. For the current year, WBD projects approximately $3.0B in free cash flow, which I expect to grow to $5.0-6.0B annually by FY 2025 if the company can sustain its subscriber momentum.

Warner Bros. Discovery: FCF Guidance

Growth opportunity: International markets

Warner Bros. Discovery plans to grow to 130M subscribers by FY 2025 which calculates to a total subscriber addition of 38M in the next three and a half years. A large part of this growth will come from international markets, a growth opportunity that the market may currently discount.

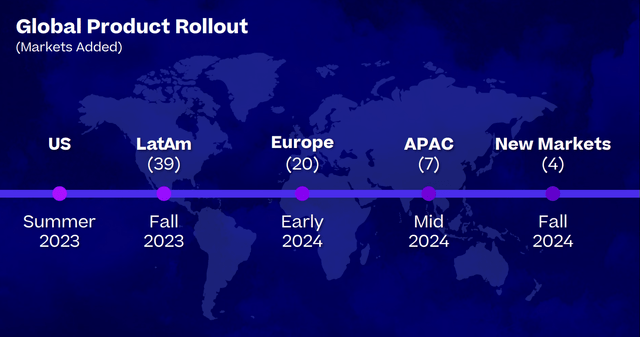

Warner Bros. Discovery is planning on making a push into the global marketplace with new product roll-outs in 2023 and thereafter. The streaming company has said that it wants to begin its international expansion by making a push into the Latin American streaming market next year. Latin America is a key geography for streaming companies due to its young, growing population and rising per capita income. Europe and the Asia-Pacific region are also going to see a growing product offering (in 2024) which indicates that WBD is set to focus more on subscriber growth in international markets going forward.

Warner Bros. Discovery: New Markets

With the U.S. and Canada showing signs of saturation due to a growing number of streaming companies competing with their subscription plans for customers, the international market may be the future for Warner Bros. Discovery.

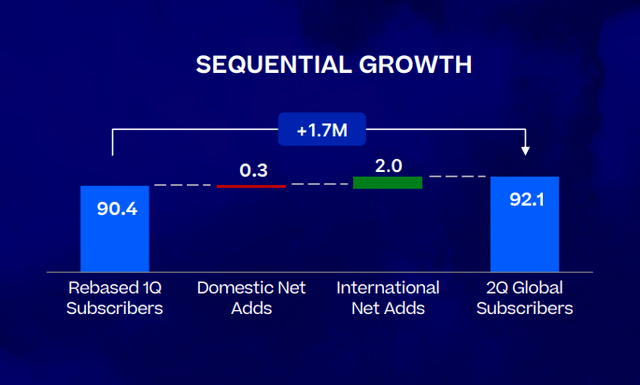

The company’s international net adds grew more than six times faster than domestic net adds in the second-quarter, indicating huge untapped potential in international markets that Warner Bros. Discovery could exploit once it consolidates its streaming platforms into one offering in FY 2023.

Warner Bros. Discovery: International Subscriber Growth Outpaces Domestic Growth

Warner Bros. Discovery valuation is attractive

Regarding revenues, WBD is expected to ramp up its revenues from an expected $45.3B in FY 2022 to $53.3B in FY 2025. Based off of revenues, Warner Bros. Discovery is — due to the steep drop in pricing — now much more attractively valued than it was back in August. WBD also compares favorably regarding its price-to-revenue ratio (0.54 X) to other streaming companies like Netflix and Roku which are much more expensive based off of revenues.

Risks with WBD

The biggest risk for WBD is the exact same risk that defines investments in other streaming companies: a lot of these companies have seen a slowdown in account, average revenue per user and top line growth post-pandemic. On top of this, Warner Bros. Discovery — just having completed the merger between Warner Media and Discovery — is in a restructuring, meaning investors may not yet fully understand the value of the streaming platform. If the restructuring is not successful, Warner Bros. Media may continue to generate continual losses in its direct-to-consumer business which may negatively impact the company’s valuation factor.

Final thoughts

I have changed my opinion on WBD and consider the risk/reward here now very attractive: Warner Bros. Discovery has lost about half of its share market value in 2022 although the company just announced a major restructuring that is aimed at controlling the company’s losses. Warner Bros. Discovery could also leverage the strength of its streaming brands and grow quickly internationally once it has rolled its streaming services into one offering (expected in FY 2023).

Of all the streaming companies, I consider WBD to be the stock with the highest rebound potential due to the strength of the Discovery+ and HBO Max streaming brands. A successful restructuring, higher margins and growing free cash flow, driven by synergies in the direct-to-consumer business, could drive an up-wards revaluation of Warner Bros. Discovery’s shares!

Be the first to comment