Dilok Klaisataporn

Tiptree (NASDAQ:TIPT) is fast growing mostly with a specialty insurance lilt. There’s a bit of a special situation here involving Warburg Pincus which bought a stake that valued the company way higher than where it is, and with small dilution pressure even though it’s an emerging company, there seems to be a pretty authoritative upside. Peers in these markets do great, and pricing remains strong in their insurance markets. Moreover, they own shipping vessels that they’ve just sold for a great return, and have therefore simplified their business by getting rid of some of these orthogonal holdings. Their operating run-rate PE is low, and there’s clearly something the market is missing here. Looks like a buy.

Key Q3 Considerations

The first thing to mention is related to Tiptree’s marine business. This is part of Tiptree Capital, and here all that’s going on is that they own dry bulk and product vessels that they would charter out. They’ve sold it all now, and the market valuation of their assets is about 15% of their market cap, and the gains amounted to around 10% of their market cap – so they managed to score about a 50% average gain across the four vessels that they owned. A nice win of cash that drives down debt. The business gets simplified too, they have no more marine assets within Tiptree Capital, only a mortgage business.

The rest of their company is the Fortegra insurance business, which Tiptree has given a minority interest in to Warburg Pincus. We said in our last article that the implied value from the sale of the stake to WP valued Tiptree at $800 million.

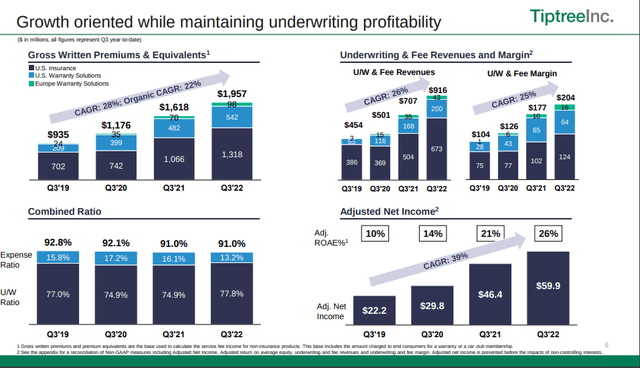

This is an interesting business with quite a few advantages. It tackles a lot of specialty markets like warranty and E&S. There are pretty pricing constructive markets in insurance. Pricing is up, and in Tiptree’s case they are growing underwriting and making good money. With the Warburg Pincus affiliation, it could get them into the executive insurance markets as well, or something else that’s specialty with respect to WP’s portfolio companies. These specialty markets are highly valued, as you see with RLI Corp (RLI).

Bottom Line

There’s another matter to consider which is quite attractive: there’s pretty limited scope for dilution by share-based compensation, despite the fact that this is an emerging company. We see dilution risks at around 10% at a maximum assuming all shares are vested. It’s pretty limited. Moreover, on an operating net income level, the residual businesses after the sale of the marine assets is enough to bring the PE down to approximately 10x considering the dilution effects and excluding investment gains from the marine business while considering the value of those assets, but including those made in the insurance business since it’s mostly driven by tightening cycles which are quite smooth.

RLI is a good peer to consider how far a company can get in specialty insurance markets if they stay disciplined. The premium growth rates are pretty similar, and they are benefiting similarly from constructive pricing in their shared E&S market, although RLI has more markets than TIPT. TIPT trades at a P/B that’s around 1.5x, while RLI is at 4x – so there could be a lot of upside. TIPT is still dealing with volatility from its mortgage business, and earnings performance has been a little all over the place. But it Q3 we are seeing constructive trends even when wiping away investment gains made in the quarter within the insurance business, with net income up slightly. When taking the straight EBT, it looks really good.

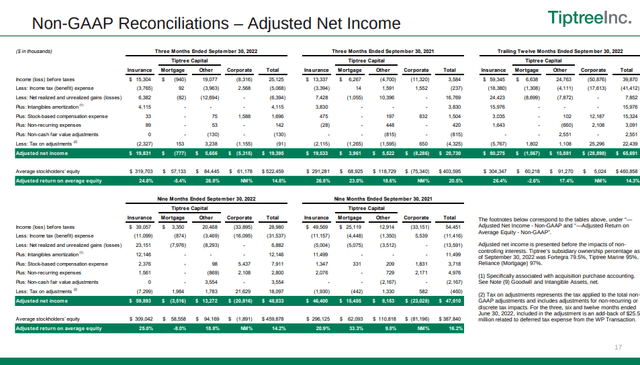

IS with Reconciliations (TIPT Q3 2022 Pres)

Overall, the multiple is pretty low giving about 9% earnings yield, there’s upside on the precedent transaction of WP buying into Fortegra, and you even have peers like RLI to see substantial upside there. Since the $800 million is sort of the base case scenario in terms of revaluation, that gives you about 35% more to go from current prices. A tidy buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment