Kevin Winter/Getty Images News

Warner Bros. Discovery (NASDAQ:WBD) has had its best trading day ever (although it’s only been a stock for a week) with the announcement that BofA sees significant upside in the company’s stock. As we’ll see throughout this article, now that the company is officially independent, that’s just the start and we expect the company to generate market beating returns.

HBO Max

WarnerMedia is a crown jewel media asset and in the middle of that crown is HBO Max.

HBO

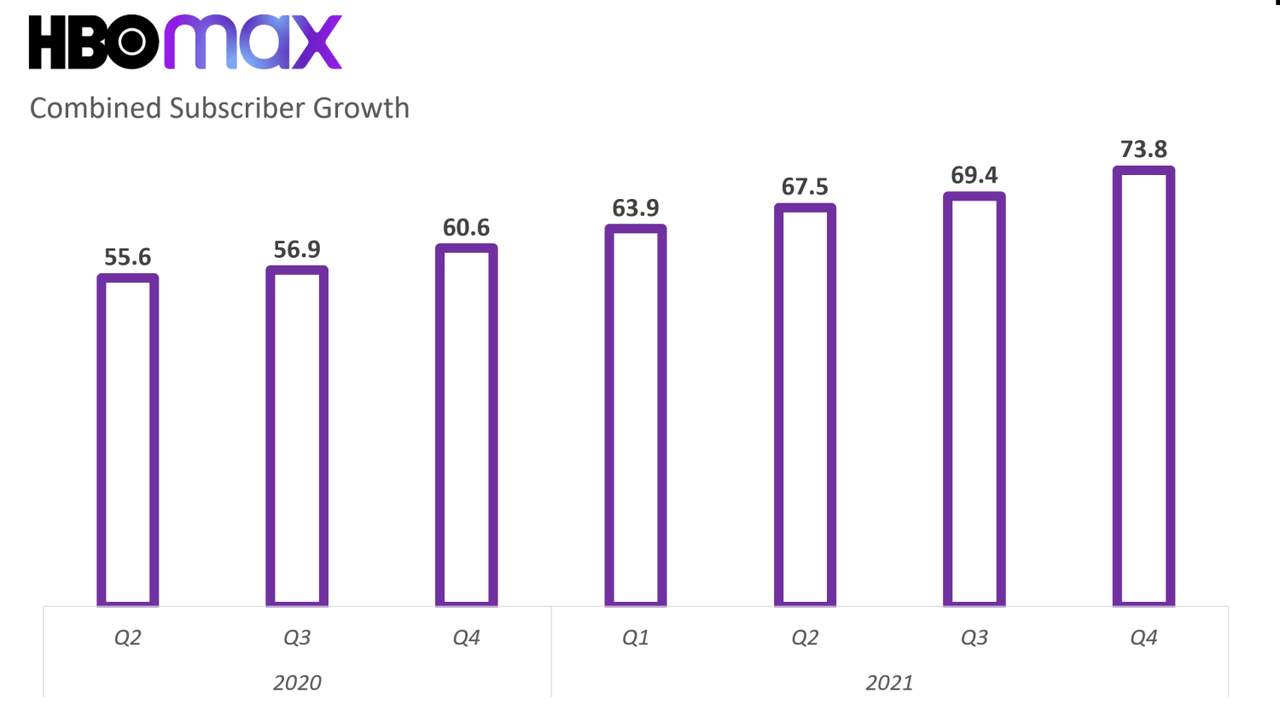

HBO Max has seen its combined subscriber count grow substantially. The company added a massive 13 million customers through 2021 and its growth rate shows no sign of slowing down. With one of the best content libraries around, in our view, HBO Max’s only true competitor in the streaming space is Netflix (NFLX).

Our reason for this is that Disney+ (DIS) has a massive content library, but has been reluctant to spend similarly on content. Apple TV+ (AAPL) has a limited content library. Amazon Prime (AMZN) is an overall subscription and is investing much less in content. However, this is part of the crux of our thesis that Amazon and Apple would both love to acquire Warner Bros. Discovery.

It’s also worth noting that Discovery has an impressive and rapidly growing subscription service as well. This service now has 22 million subscribers. How this’ll be merged into HBO Max remains to be seen; however, we expect either way HBO Max will become even larger and more valuable to customers than where it is today.

TimeWarner Financials

TimeWarner has an impressive and improving financial portfolio showing the company’s asset strength.

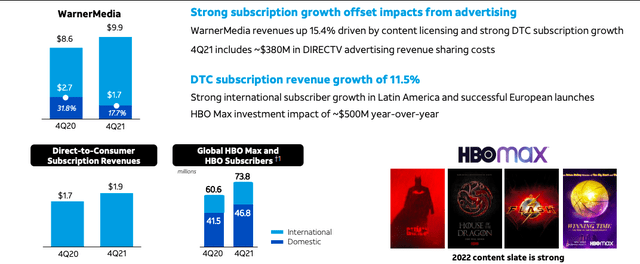

TimeWarner watched revenue increasing from $8.6 billion to $9.9 billion from YE 2020 to YE 2021, although the company’s margins were punished. Part of this was the impact from continued investment into HBO Max, along with different costs. However, despite those costs, the company’s business here still earns almost $10 billion in annual EBITDA.

With Direct to Consumer revenues increasing by almost 15% YoY, we see continued growth potential here. TimeWarner’s strong independent financials, combined with synergies and Discovery’s financials, will mean a company with strong combined financial strength.

Combined Company Financial Picture

The combined company will be a financial powerhouse, even when counting the almost $60 billion of debt taken on to form the company.

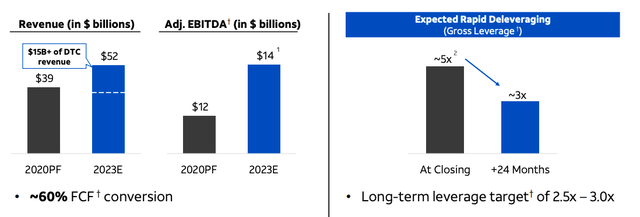

The combined company is expected to generate a massive $52 billion in 2023E revenue, although due to faster than expected growth, this number was hit in 2021. We expect revenue to be able to grow even faster going into 2023E with combined revenue for the companies passing $55 billion on their way to $60 billion.

The company expects roughly $14 billion in adjusted EBITDA with ~60% FCF conversion, however, we expect the company to outperform both these numbers. The company is working to rapidly de-leverage, and expects to go from $60 billion to $42 billion in debt at +24 months. It’s worth noting how the company reaches this target depends on expected EBITDA growth.

However, one of the takeaways is that the company’s debt load isn’t unmanageable and the company can rapidly pay it down. Depending on the company’s stock price at that point, we expect the company to pivot into shareholder returns.

Shareholder Return Potential

Warner Bros. Discovery has significant return potential for shareholders.

The company post acquisition will be earning almost $10 billion in FCF. From the market cap, this implies a roughly 15% FCF yield off the bat (or 10% by EV). The company’s EBITDA should continue to grow as DTC grows and the launch costs of that business go down. At the same time, the company’s 60% FCF conversion will expand significantly as interest earnings do.

We expect the company to use a combination of buybacks and dividends, although starting with modest dividends so that it can achieve long-term reliable dividend growth. The company could, through a combination of debt pay-down and share repurchases, set itself well to generate incredibly strong shareholder returns for those who invest at this point.

Starting at the ability to generate double-digit shareholder returns, and grow that, helps highlight why the company is a valuable investment.

Acquisition Potential

Warner Bros. Discovery, in our view, has significant acquisition potential. The company is the only large pure-play streaming and content company outside of Netflix. However, Netflix is worth twice as much as Warner Bros. Discovery and the company has a much less significant content library for a potential acquirer.

Warner Bros. Discovery’s size means, in our view, no other major streaming company (i.e. Netflix, Disney, Comcast, etc.) will be able to acquire it. However, we do expect that a major company with small streaming assets (i.e. Apple, Amazon, etc.) would be very interested in acquiring the company.

Thesis Risk

The largest risk to our thesis is competition. Media and content creation costs are increasing. Many companies are spending $10s of billions on content. Warner Bros. Discovery has the risk that it’ll be forced to compete in a market where margins are pressured or costs go up, hurting the company’s ability to generate shareholder returns.

Conclusion

Warner Bros. Discovery, after months of dreaming for this day, is finally an independent company. Thanks to analysts, the company has had an incredibly strong first week. We expected substantial selling pressure from investors treating the issuance as a free dividend from their core AT&T stock. However, regardless of week-to-week fluctuations the company is undervalued.

The company is emerging with a double-digit FCF yield and it has the ability to continue growing it substantially from there. The company could pay debt increasing its EBITDA to FCF conversion ratio and we expect in the coming years it’ll start to begin looking at shareholder rewards. This combination of assets helps highlight the company’s strength.

Be the first to comment