pixelfit/E+ via Getty Images

After being almost a year in the making, Discovery (NASDAQ:WBDWV) (NASDAQ:DISCK) (NASDAQ:DISCB) and AT&T (T) have announced that their long-awaited historic deal has finally closed on Friday. We are finding ourselves on the eve of one of the biggest changes in the media business landscape, as Warner Bros Discovery is expected to begin trading the largest pure-play entertainment entities in existence on Monday morning. The company will start trading under the ticker symbol “WBD”, marking the beginning of a new journey.

Even though it remains difficult to predict short-term market movements over the course of the following weeks and months, the fundamental strength of the company, combined with its cunning leadership and rock-solid financial potential make Warner Bros. Discovery of the best investment opportunities of the year. It is a brilliant example of deep value being hidden in plain sight, as the emerging giant is on a path to becoming a streaming and media powerhouse that going to trade blows with the best of the best and attempt to lay its claim to the top of the streaming world.

Re-evaluating Warner Bros. Discovery

One of the major and rather unexpected downsides of the then AT&T and Time Warner acquisition was the inability of investors and analysts alike to adequately assign value to premium Time Warner assets such as HBO or Warner Bros, which as a result of the deal got buried under the unattractive valuation of AT&T’s legacy business. The market has clearly shown that it was more than willing to assign high-end valuations to the fast-growing streaming and media empires of Netflix (NFLX) and Disney (DIS), which are now the main WBD competitors. While shareholders of both rivals enjoyed years of lucrative capital appreciation, shareholders of AT&T were faced with consistent stagnation, decline, and disappointment throughout the years.

There is a popular saying that “Most generals are born after a battle” and in hindsight, it is not that difficult to pick apart why the then $85 billion deal did not work out in the end. While it is not easy to quantify the acquisition’s direct benefit to the telecom’s legacy operations, it is now safe to conclude that the deal failed them in gaining an edge over competitors such as Verizon (VZ) or T-Mobile US (TMUS). To make matters worse, even without something appealing as WarnerMedia, the rivals were selling at higher-end valuations throughout the period, with investors clearly taking a disliking to AT&T’s idea of building a conglomerate.

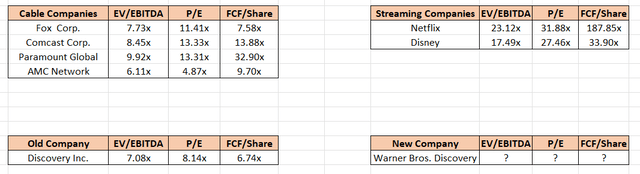

Estimated Valuation (Author Spreadsheet)

The main investment thesis here is that the current intrinsic value of the now Warner Bros. Discovery got buried beneath the rubble of AT&T’s poor decision-making, damaged reputation, and the broader unappealing nature of their legacy telecom business. The CEOs, Stankey and Zaslav have put it well, the deal “simply unlocks value”. Once Warner Bros. Discovery starts trading on the market as a stand-alone combined company next week, investors will finally have a proper chance to assign a more appropriate valuation to the new steaming and media behemoth. During the process, Warner Bros. Discovery’s valuation will slowly move from legacy cable operators such as Fox (FOXA), Paramount (PARA), AMC (AMCX), or Comcast (CMCSA) towards more attractive valuations of their new rivals.

While it does remain an open question what is going to be the extent of the re-evaluation that is going to take place, just as the question of how long is it going to take, the majority of analysts tend to agree that the closure of the deal will end up being a positive catalyst for the new company. Earlier in January, Discovery was upgraded by analyst Jessica Reif Ehrlich to a price target of $45 at Bank of America (BAC). Morningstar (MORN) long held a fair value price of $42 per share for Discovery. In a similar nature, Citigroup (C) concluded the target price for Discovery at $44 per share. The company has gone through a series of upgrades by Wall Street since the deal was announced, with targeted upside potential ranging from low double digits all the way to almost double the current stock price.

While it is true that both Amazon (AMZN) with their Amazon Prime and Apple (AAPL) with the Apple+ are trying to enter the streaming competition, the only real competitors as of now are Netflix and Disney. Furthermore, it becomes rather quite difficult to evaluate the two combined considering streaming is only a minor part of their huge business empire. Also, it is worth noting that both Disney and Netflix have a very bad run of late and are already trading at somewhat depressed prices.

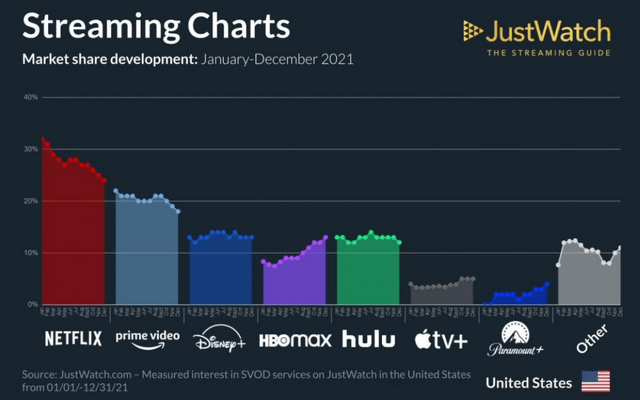

Price Projections (Author Spreadsheet)

In regards to the EV/EBITDA assumption, we should see the company generating around $10 billion in EBITDA, depending on how well synergies play out and what the costs of the merger end up being. We know that Netflix sells for 23.12x EV/EBITDA, while Disney trades at 17.49x EV/EBITDA. This is after a period of strong downforce on both stocks, historically the five-year EV/EBITDA median for Netflix is set at 79.73x, while Disney was set at 23.54x. This tells us that Warner Bros Discovery’s fair value should be north of $40 per share.

The FCF/Share projection seems to be breaking our model at first, but as it was stated multiple times in the past, Warner Bros Discovery will become a Free Cash Flow machine. WBD is fundamentally speaking a very strong company and is expected to deliver extraordinary results in this sense. This is probably the best indicator of to what extent the company remains undervalued at this point. Historically, the five-year FCF median for Netflix is set at 189.89x, while Disney was set at 23.54x. According to this, the fair value of WBD should be well beyond $50 per share.

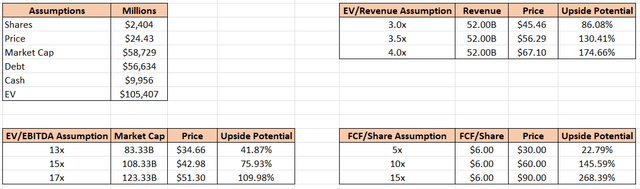

FCF Projection (Author Spreadsheet)

Our Free Cash Flow model seems to indicate a potential upside of 69%, placing the fair value per share of the company at $41.39 per share. If the assumptions are correct, Warner Bros Discovery should be to becoming a $100 billion market cap. In the projection, an EV/EBITDA multiple of 14x was assumed, with a 3% perpetual growth rate alongside with assumed low double-digit EBIT growth rate over the next five years.

Analyzing the library

Warner Bros. Discovery’s content library can be easily compared to its main competitors in both quality and quantity. In fact, it brings so much to the table that some of them might grow increasingly displeased with this merger over time. The deal itself created a worthy competitor that is by design going to trade blows with the likes of Netflix and Disney, rather than combined with the lower end of the spectrum, the likes of Amazon Prime, Apple+, or Paramount+.

It is not difficult to see how a company with such a deep content portfolio as WBD would be becoming more successful as the years progress. The content portfolio as shown in the infographic below displays the true potential and the meaning of this merger. The portfolio covers a very wide selection of content, ranging from some of the greatest cinematic achievements on one end (LoTR, HP, GoT, etc.) to some of the “low intensity” content suitable for your average Sunday family gathering (TLC, Food Network, Discovery, etc.).

WBD Content Library (Deviant Art)

Strictly quantitatively speaking, WBD’s portfolio will consist of about 200,000 hours of programming, which would already cement it at the very top of the pyramid of streaming wars. More importantly, the content covers all major categories of scripted, unscripted, news, and sports. Furthermore, the new company will carry an extremely good brand recognition internationally. WBD is already present in 220 different countries in 50 different languages.

All the streaming services have started relying on original content to grow their subscribers. Slowly, as deals are running out, all the platforms are moving their IP exclusively over to their platform. As an example, Netflix, which was a one-place stop for almost all movies or TV shows only five years ago, witnessed its library diminish as others slowly set up their streaming services taking back their IP in the process. This forced the company into a spending spree trying to build up its original content, costing shareholders a great deal of money.

Stankey and Zaslav pointed out that the two companies already spend a combined $20 billion per year on content. To put things into perspective, Netflix is spending $17 billion per year doing the same while Disney’s spending is in the area of $10 billion per year. The billionaire media mogul John Malone has agreed to relinquish his 25% controlling interest in Discovery, a move widely regarded as a huge stamp of approval for the deal.

“After over 30 years of being involved in developing Discovery as a global information and entertainment company, the opportunity to combine with WarnerMedia to create the ultimate consumer offering in its space is compelling. The industrial logic of this investment grade, synergistic combination, under the leadership of David Zaslav, is appealing. I am delighted to fully support this transaction, without asking for or receiving a premium for my high vote shares. I believe we are creating real value for shareholders and a legacy investment for my grandkids.”

John Malone, Chairman of Liberty Global – Statement

Analyzing HBO Max and Discovery+

Warner Bros Discovery is becoming a behemoth in the video streaming services space through its two main streaming services, HBO Max and Discovery+. A decision was made to opt for the option of merging the platforms together instead of bundling the services, with the theory that a bigger, broader content offering will accelerate subscriber growth. The combined streaming platform for HBO Max and Discovery+ has not yet been announced and the two streaming services will operate separately for the time being. However, we believe that a joint streaming platform will most likely see the light of the day sometime until the end of the year.

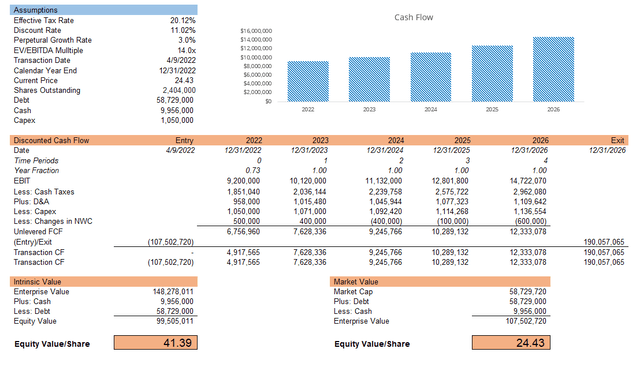

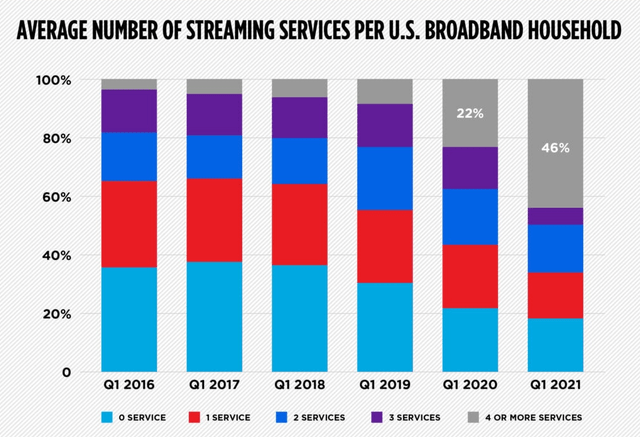

Looking at the subscription video on demand (SVOD) market in the US, we can conclude that the industry experienced remarkable growth in 2021. Based on JustWatch’s metrics HBO Max is the frontrunner which saw the largest growth at 5 percentage points. Netflix held on to its lead with 25% of the market, followed by Amazon Prime and its 19% while Disney Plus and Hulu each stood at 13% of the market. HBO Max was close by with 12%. The most important takeaway here is the obvious trends. While Disney and Netflix are experiencing a period of stagnation, HBO Max’s growth is significantly accelerating.

SVOD Market Share 2021 (JustWatch)

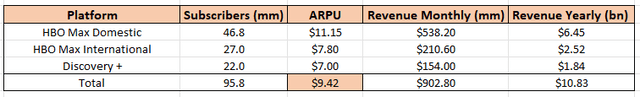

Out of the latest quarterly reports, we can conclude that the two streaming services combined have around 95.8 million subscribers globally. The real question is what ARPU potential could Warner Bros Discovery generate. Discovery+ has been reporting $7 in ARPU, while HBO Max domestic has reported $11.15 generated in ARPU. The unknown was the international ARPU for HBO Max which was always reported as “little lower than domestic” but not disclosed.

ARPU Calculation (Author Spreadsheet)

Assuming that the ARPU generated by international subscribers is significantly less than the domestic ones, but still slightly higher than Discovery+, we arrived at the conclusion the ARPU should be in the range of $7.8. From that point, we could reverse with some back of the paper math and arrive at the conclusion that the combined service as of today would generate roughly $9.42 per subscriber.

Following the yearly trends that have been recorded for both companies, we can estimate that the future combined streaming service could have around 103.8 million subscribers at the end of 2022 if created up until that point. We could then project our subscriber growth and the revenue generated by the streaming platform. With a somewhat conservative yearly growth estimate of 10% for both ARPU and the total number of subscribers, we can see that the joint streaming service could count as many as 151 million subscribers as early as 2026.

If we assume an EBITDA margin for the DTC streaming revenue of 50% and we also take for granted the management estimate for EBITDA/FCF conversion of 60% that was presented back in the May presentation, we arrive at the interesting conclusion that the streaming platform itself could generate north of $7 billion in free cash flow in 2026.

Subscriber Growth Projection (Author Spreadsheet)

The projection is rather conservative given three main reasons. First, the synergies that are expected to play themselves out in terms of the broader consumer appeal of the now “complete” streaming platform are largely not counted in. Also, Zaslav’s proven business model of offering an ad-supported subscription that is being transitioned over from Discovery+ is bound to have a positive impact on the underlying economics.

Furthermore, WBD would be at a certain point in a position to raise streaming prices, as other rivals already did. Netflix’s standard plan is currently $15.49/month in the United States after the streamer enacted three price hikes over three years. Last year Disney Plus raised its price by a dollar, to $7.99/month. Disney also upped the price of Hulu’s on-demand plans by $1 per month last fall, while the annual price of Amazon Prime membership in the U.S. just went up by 17%. This is driven both by industry changes as well as larger macroeconomic factors.

More deals are on the way

The media industry is an industry marked by decades of mergers and acquisitions, with the recent developments proving once again that industry consolidation is not a question of if, but a question of when. This deal marks what is the fourth major Hollywood consolidation in the last three years as legacy media companies adapt to the streaming revolution. It follows Disney’s takeover of much of 21st Century Fox; Viacom’s merger with CBS Corp.; and Amazon’s $8.5-billion purchase of MGM studios. Further industry consolidation has become a fact.

David Zaslav had a very interesting statement during the last year’s Allen & Company Sun Valley Conference, where top media executives meet each year to discuss new industry developments. He went on air stating that they are “not done making deals yet”, which sparked discussions of further industry consolidation after the WBD deal. This leads to one out of the two possible outcomes:

- WBD will likely look to further expand through M&A.

- Zaslav is looking to set up WBD to be acquired by a “bigger” player.

While it remains reasonable that Warner Bros Discovery would look to expand even further, the current financials make that somewhat difficult. Even if discussing a 58 billion market cap, which is most likely going to increase over the next couple of months as independent trading begins, the $57 billion in debt is creating issues. Even if successful in generating $8 billion in free cash flow, management hands largely remain tied in the upcoming period.

When it comes to companies that would be possibly looking to potentially acquire the WBD library, both Apple and Amazon seem to be the most obvious choices. Both companies have joined the streaming business with great appetite, but are currently significantly lacking in the content department. Further to the point, there are not many other companies in the space that could mount an acquisition of $100-300 billion, depending on how well WBD does post the merger.

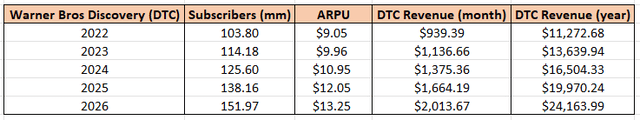

Reverse Morris Trust Rules (Wall Street Mojo)

The nature of the deal enabled it to pass smoothly through a 10-month regulatory process and close earlier than initial forecasts but might carry some unintended consequences to WBD’s post-merger M&A potential. No matter what ends up being the case, expanding or being acquired, any deal will have to wait for at least 2 years due to Section 355 regulations. One thing remains sure, we can expect much more consolidation in the streaming space in the years to come.

The contrarian angle

Not everyone remains convinced that this deal generates tremendous value for shareholders. The contrarian angle is mostly based on three different arguments that to a certain extent lean on each other:

- WBD will inherit a tremendous amount of debt.

- The streaming space is getting overcrowded.

- Streaming is an unprofitable business.

While some arguments carry more weight than others, by far the least compelling is the one regarding profitability. While this remained an ongoing issue for other rivals within the business, the new company is not expected to be affected by this. As explained previously in the article, the new company will have rock-solid financials. Furthermore, Zaslav already made a strong statement in terms of where the management will head the ship.

And now we have the resources, we plan on being careful and judicious our goal is to compete with the leading streaming services, not to win the spending war. For the breaking new franchises or reimagining and refreshing existing ones. We will have a truly scaled and diverse content engine. With IP ownership across a highly monetizable collection of IP. Perhaps most importantly, we are not solely dependent on one business model. As we reach across multiple platforms and touchpoints, every leg of the stool from linear to direct to consumer to content production and monetization.

David Zaslav, CEO – Discovery Q4 Earnings Call

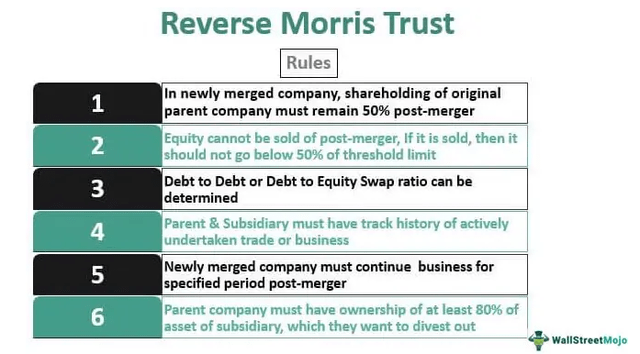

As to the idea of the new company finding itself in a very crowded space, that is a fact. However, we need to take a more in-depth look at this. Most studies and surveys find that the average household subscribes to three or four streaming platforms. While it remains the truth that WBD can mount a reasonable enough campaign to top the streaming world over the next decade, the reality is that it doesn’t really need to. They only need to remain near the top, that is to be attractive enough to be that one out of the three or four streaming services.

Streaming Services Per US Household (Parks Associates )

The reasoning here is that other streaming platforms, especially those with less compelling offerings should be much more worried about this than WBD should. The depth of the Warner Bros Discovery portfolio allows their marketing team to mount a very compelling “one-stop-shop” campaign, as the new platform now covers a very broad range from scripted, non-scripted, sports, and news with more than 200,000 hours of content. In the best case, the quality and quantity of their library are going to allow them to stay on the top or at least near the top, while at worst it is going to be always immensely attractive to other major players in the space, looking to expand their streaming libraries.

The question of the debt is by far the most serious issue that the new management will face. Warner Bros Discovery will start trading next week on the exchanges with close to $57 billion in debt. It was initially planned that AT&T would be contributing $43 billion, while Discovery was supposed to retain the total of its $15 billion debt. However, given some positive developments, the figure ended up being slightly less than that, but still a major burden. The argument here is that the amount of debt is almost surely going to way down on the company as it tries to compete in a cut-throat competitive streaming business, especially given the risen interest rates environment which is making WBD’s position that much more difficult.

Management has already expressed confidence that they will be able to significantly reduce the company’s gross debt in just a couple of years. They expect that they will be able to lower their Debt/EBITDA leverage to around 3.0x in two years. Given that we know the debt and can roughly tell this year’s EBITDA, with a bit of a back of the paper math, we conclude that management expects to cut down some $18 billion of debt in two years.

What is often overlooked is that Discovery’s management already delivered on a similar promise back in 2017. Zaslav and Wiedenfels excelled in this back in 2017 when Discovery took on a significant amount of debt in order to acquire Scripps. Back then, Discovery ended 2017 with a 5.77x gross leverage, only to have had it already cut down to 3.55x in 2019. Zaslav pointed this out during the Q3 earnings call:

On the integration side, we’re really lucky. We got 2 big tent poles here. One is Gunnar will be the CFO of this company. He did – he’s done an exceptional job. He led the initiative with Scripps, where we said we’d be less than 3.5x levered 2 years later, and we did it in less than a year. And we said we’d deliver $350 million, and we delivered over $1 billion. And all of that was just cost not revenue synergy. He came up with these targets and he’s quite confident in those targets. And so Gunnar will be kind of the lead horse. He’ll talk to it.

David Zaslav – CEO, Discovery Q3 Earnings Call

Being a free cash flow machine is definitely going to make the deleveraging process that much easier, however, it remains to be seen to what degree of success will Zaslav navigate the burdens of debt. This downside remains one of the major issues with the deal that keeps analysts and investors worried alike.

Thoughts and final conclusion

Warner Bros Discovery is a behemoth that is going to hit the streaming industry seemingly overnight. WBD has the ability to utilize its strong brand recognition, international exposure, as well as the quality, quantity, and depth of its content library to compete with the likes of Disney, Amazon, and Netflix. As we have shown in the article, analyzing the company both through comparable company analysis as well as a discounted cash flow analysis reveals that the company remains significantly undervalued at the current price.

As previously noted, it remains difficult to predict short-term market fluctuations in the following weeks and months. We have seen that AT&T shareholders claiming their WBD distribution generated a strong down-pressure on the stock in the last week with the stock hitting the low 20s at one point. This could create some further selling pressure down the road. The news breaking on Friday gave it a 5% lift in a single day, but I would argue that the safest road is to approach this from a long-term perspective. From a personal standpoint, I believe that Warner Bros. Discovery remains to be one of the best investment opportunities of the year and is occupying a significant portion of my investment portfolio remaining my highest conviction play.

Be the first to comment