Erik Khalitov/iStock Unreleased via Getty Images

The following explores the potential 30% headcount reduction at Warner Bros. Discovery’s (NASDAQ:WBD) ad sales department. We perform valuation and fundamental impact analyses on material news headlines within a 12-hour turnaround framework in our Marketplace service, similar to the discussion below.

Introduction

Following the abrupt shutdown of the merely weeks old CNN+ news streaming platform under Warner Bros. Discovery’s new post-merger leadership, the combined entity’s ad sales department was called up next to the chopping block. The company was reported earlier this week that it will be reducing the department’s headcount by 30% in the near term, coinciding with mounting news of hiring freezes and layoffs across all industries ahead of upcoming macroeconomic uncertainties.

WBD stock has yet to show a turnaround that many have been anticipating post merger, given its burgeoning streaming business, leadership in media and entertainment, industry-leading ad reach, and highly coveted content library. In fact, the stock is headed toward some of the lows last seen since prior to the WarnerMedia-Discovery merger announcement on a per share basis. WBD has lost almost half of its market value since completing the spinoff due to unprecedented macro challenges spanning record inflation, quantitative tightening, ongoing COVID outbreaks, and an intensifying war in Ukraine.

Although the latest news of ad sales job cuts at WBD may be sparking renewed concerns of softening ad spending this year due to dampening consumer sentiment ahead of a possible recession, the magnitude and execution timeline of the endeavor signals that it may really just be part of the company’s post-merger talent consolidation plans. The recent development on job cuts in WBD’s ad sales department, which contributes to the majority of its annual revenues, is not expected to drive a material change to the company’s valuation prospects. Instead, the continued realization of $3+ billion in anticipated post-merger cost synergies will bolster WBD’s long-term upside potential by improving its fundamental strengths, though current macro headwinds will likely continue to weigh on the broader technology and digital media sector’s performance in the near term.

What’s Warner Bros. Discovery Doing to Its Ad Sales Team?

Reports have been circulating that WBD will be executing a plan to reduce its ad sales headcount by up to 30%. The plan involves extending “buyout offers” to U.S. ad sales team personnel beginning this week, encouraging voluntary exits as opposed to direct layoffs. The execution timeline has yet to be disclosed, but it has been reported that WBD plans to reduce its current global ad sales headcount of 3,000 to around 2,000 “over time.”

The latest development coincides with a series of hiring freezes and layoffs observed across the industry in order to cut costs and prepare for a potential growth slowdown amid sprawling macro challenges. Paired with signs of softening in ad spending this year due to waning consumer sentiment amidst rising inflation and aggressive monetary policy tightening that risks an economic recession, WBD’s latest round of ad sales job cuts are raising concerns about whether its core revenue driver may be slowing.

What are the Headwinds on Ad Spending?

Based on the most recent financial performance at WarnerMedia and Discovery prior to their merger, advertising accounted for 18% and 47% of total revenues, respectively. Advertising has been a core strength for WBD, given its diversified ad distribution channels, which all boast industry-leading reach. Yet, WBD’s heavy reliance on ad revenues have also simultaneously drawn questions about its exposure to near-term risks of a slowdown in ad spending alongside waning consumer sentiment.

Forecasts for total global advertising spending this year have been on a rolling decline in response to the economy’s struggles with keeping inflation in check given extraordinary circumstances that include a protracted pandemic and Russia’s invasion of Ukraine. Leading media intelligence MAGNA Global has trimmed its prediction on global ad spending growth this year from 12% to 9% amid growing risks of a structural economic downturn later this year. This compares to global ad spending growth of +23% year-on-year in 2021 (U.S. +26% y/y), buoyed by a brief stint of post-pandemic economic recovery.

However, WBD’s leadership in global ad distribution is expected to reduce some of the near-term impact in weakened ad spending. The anticipated growth deceleration in ad spending through digital media formats like video / over-the-top (“OTT”) streaming and traditional media formats like payTV and cinema, which WBD leads in, will be comparatively less pronounced compared to other distribution channels like social media platforms.

In linear TV, WBD currently draws the most prime-time viewership than all of ABC, CBS, NBC and Fox combined. This positions the company favorably for the 22% of total annual ad spend allocated to TV commercials. The growing subscription base of HBO Max and discovery+ also makes them attractive sources for the increasing shift in ad spending towards digital platforms.

Video streaming platforms are now home to about 23% of total ad spend in the U.S., and the figure is expected to expand further as digital advertising’s more than 60% share of the broader advertising market today is projected to grow at an 11% CAGR through 2030. The bright outlook on video streaming ad spend is further corroborated by MAGNA’s predictions – ad spending through video streaming / OTT platforms will experience the fastest growth compared to other distribution channels in 2023 (estimated at +30% y/y), which underscores strong tailwinds for WBD’s core advertising business over the longer-term.

Why is WBD Chopping Its Ad Sales Headcount?

Although recent news of WBD’s decision to cut its ad sales headcount coincides with a series of hiring freezes and layoffs observed across the industry to prepare for uncertain economic conditions ahead, the extended timeline of WBD’s latest undertaking may imply otherwise. Despite the anticipation for softening ad spending this year, which could impact the core revenue driver at WBD, the latest job cuts in ad sales is likely a result of previously planned post-merger talent consolidation efforts. The company has planned to achieve at least $3 billion in cost synergies following the WarnerMedia-Discovery merger by the end of 2023.

Looking at the extended timeline of the speculated job reductions, which will be executed through phases (i.e. buyout offer, layoff, and natural attrition), it lines up with WBD’s bigger picture plans for realizing post-merger cost synergies as opposed to swift layoffs to immediately lower near-term operating costs. The latest development also aligns with WBD CEO David Zaslav’s previous comments that “the company’s ad sales segment presents an opportunity for cuts due to a lot of overlap in roles post-merger,” as well as CFO Gunnar Wiedenfels’ plans to reduce duplication in the $5+ billion of annual marketing spend by the combined company. The decision to consolidate and reduce excess ad sales headcount is further corroborated by the impending combination of HBO Max and discovery+, alongside other operational and geographical segments, to materialize efficiencies going forward.

The latest ad sales headcount reduction, similar to the shutdown of CNN+ in April, is likely just the beginning of more aggressive, but calculated, measures to maximize realization of post-merger cost synergies. This is especially critical given the company’s ambitious deleveraging goals – WBD is currently targeting gross leverage of 2.5x to 3x within 24 months of completing the merger.

For example, the decision to pull the plug on CNN+ after investments of $300+ million by previous management was definitely not an easy feat for both the company’s leaders and investors to digest. Yet, it did prevent additional spending of $700 million from the originally approved $1 billion budget for a project that likely will not generate meaningful returns within a reasonable timeline. It was also a prescient move that has reduced WBD’s exposure to a potential subscription slowdown ahead of tightening consumer budgets due to rising inflation.

The next round of inevitable job cuts that’s going to make headlines will likely be related to WBD’s streaming business, as management moves forward with the impending merge of HBO Max and discovery+. The anticipated cost savings realized there will also complement the sales synergies from the merge of two of the largest streaming content libraries, which is a double-plus for WBD’s long-term fundamental and valuation prospects.

The decision to merge HBO Max and discovery+ also comes as a well-timed decision, as competition heightens in direct-to-consumer (“D2C”) streaming services, while consumers’ wallets slim down due to rising living costs. In addition to streaming pure-plays like Netflix (NFLX), Hulu (DIS) and Apple TV+ (AAPL), many traditional entertainment and media companies similar to WBD have also launched their own platforms, such as Paramount+ (PARA) and Peacock (CMCSA). But the number of services that households are willing to pay for is limited, especially as consumer sentiment dampens ahead of rising inflation and a potential economic recession:

In streaming, we have a massive opportunity to reach the widest possible addressable market by offering a range of tiers, all with the most compelling and complete portfolio of content. A premium and attractively priced ad-free direct-to-consumer product, a lower-priced ad-light tier, something we have had tremendous success with and is our highest ARPU (“average revenue per user”) product, and some very price-sensitive markets outside the United States, we can even offer an advertiser-only product.

Source: WBD 1Q22 Earnings Call.

Continued execution of WBD’s aggressive cost and sales synergy realization strategy, especially under the expertise of media and entertainment veterans that have shown a positive track record in turning Discovery into a “free cash flow machine,” shows promising potential for redirecting the company back on track towards positive shareholder value.

How Much will WBD Save from Ad Sales Job Cuts?

While each of WarnerMedia and Discovery had disclosed their respective advertising revenues prior to the merger, a detailed breakout of costs pertaining to the segment’s sales has not historically been provided. Based on a high level, back-of-the-napkin calculation, we expect the upcoming 30% reduction to ad sales headcount to yield close to $1 billion in annual cost savings, representing about a third of management’s targeted $3 billion in annualized post-merger cost synergies.

The estimate is derived as follows:

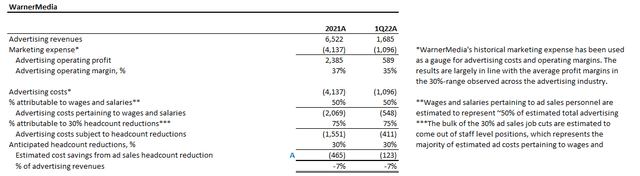

Estimated advertising cost savings (Author)

- We have taken marketing expenses pertaining to historical WarnerMedia operations as a proxy for advertising revenue related costs. The resulting advertising operating margin of 35% to 37% observed in 2021 in 1Q22 is consistent with the average profit margins in the 30%-range (vs. best-in-class margin of ~50% at $TRMR) observed across the advertising industry.

- Leaning on the reasonably conservative side, we estimate half of advertising costs are directly attributed to ad sales personnel wages and salary expense. This represents ~$2.1 billion in 2021 and $550 million in 1Q22 at WarnerMedia.

- Much of the 30% ad sales job cuts are expected to come out of the operational staff level. As such, we estimate 75% of estimated ad sales personnel wages and salary expenses to get a 30% reduction in accordance with the planned job cuts.

- As a result, the upcoming job cuts in WBD’s ad sales department pertaining to legacy WarnerMedia ad sales staff will add back about 7 percentage points to advertising margins.

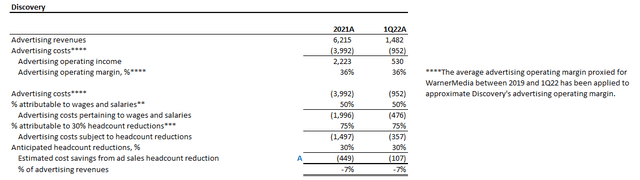

Estimated advertising cost savings (Author)

- We have taken the average historical advertising operating margin of ~36% estimated for WarnerMedia above as a proxy for advertising revenue related costs at Discovery.

- The assumed % of estimated advertising costs related ad sales personnel wages and salary expenses, and the assumed % of attributable to the upcoming job cuts is consistent with the respective 50% and 75% applied in the WarnerMedia calculation above.

- As a result, the upcoming job cuts in WBD’s ad sales department pertaining to legacy Discovery ad sales staff will add back about 7 percentage points to advertising margins.

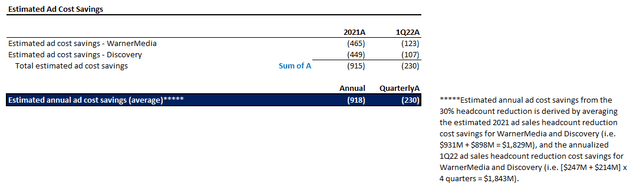

Estimated advertising cost savings (Author)

- Averaging the estimated annual and quarterly ad cost savings from upcoming job cuts based on WarnerMedia and Discovery’s actual 2021 and 1Q22 financial performance, we are expecting close to $1 billion in annualized cost synergies from merging the two legacy ad sales teams. This represents close to a third of WBD’s targeted $3 billion in annualized post-merger cost synergies.

WBD Stock Valuation Implications

As discussed in the foregoing analysis, we believe WBD’s upcoming 30% headcount reduction in its ad sales department is not a sign of downsized growth, but rather an elimination of excess spending, which is a plus for its valuation prospects. On this basis, we’re maintaining our post-spinoff price target of $45 for the stock, which is derived based on consideration of management’s targeted $3 billion in annualized cost synergies, $52 billion in consolidated revenues, and $14 billion in consolidated EBITDA by 2023. The PT represents upside potential of more than 220% based on its last traded price of $13.98 on June 14.

Even under the current market climate where valuation multiples have contracted across the board in response to tightening economic conditions, WBD continues to trade at its pre-merger, steep discount to the digital media and entertainment, and video streaming services peer group. The discount is not reflective of WBD’s ability to generate positive operating and free cash flows, as well as its fundamental growth prospects buoyed by its leading market share in ad sales, content distribution, and D2C video streaming. Although current macro headwinds will likely continue to weigh on the broader technology and digital media sector’s performance in the near term, which will consequently impact WBD’s near-term stock performance, we remain optimistic on its long-term valuation prospects.

Conclusion

In contrast to the slew of hiring freezes and job cuts across the private sector in response to a looming economic recession, WBD’s reduction of its ad sales headcount is likely part of its previously planned efforts in maximizing post-merger cost synergies. The eliminated overlap in ad sales talent will not only improve the consolidated company’s bottom line going forward, but it also will streamline operations to ensure adequate capitalization of a back-end loaded year in advertising.

While ad spending has weakened in the first half of the year due to dire macroeconomic conditions, seasonality-driven growth from back-to-school and holiday ads, alongside the addition of political ad spending later this year in the U.S. will likely help recoup some of the industry’s losses, which makes a favorable environment for industry-leading ad distributor WBD. Political ad spend ahead of midterm elections later this year is expected to reach $6.7 billion, a record 52% increase from 2018. More than $4 billion of the estimated political ad spending later this year is forecast to be spent on distribution through payTV and video streaming / OTT platforms, playing right to WBD’s strengths.

Paired with the company’s continued discipline in bolstering its balance sheet and fundamental growth trajectory, the stock remains on positive track towards realization of promising upsides over the longer term.

Be the first to comment