cjp/iStock Unreleased via Getty Images

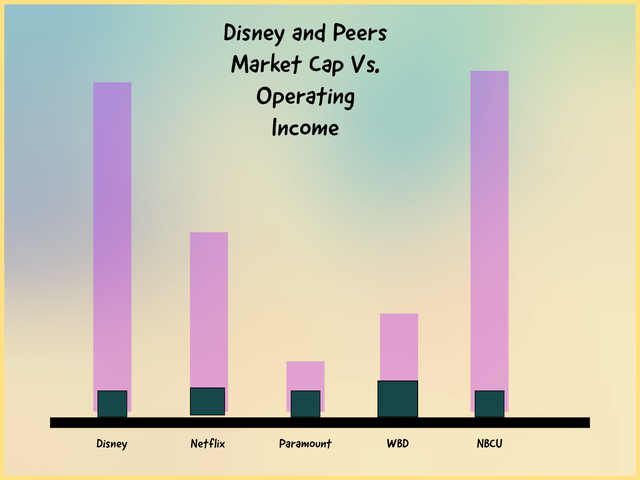

The Walt Disney’s (NYSE:DIS) iconic characters and studios have made it the best positioned company in the streaming wars in the eyes of many. Its theme parks business and its associated flywheel effect has made it the envy of all its peers as well. Yet despite its amazing hand, Disney is down 40% year-to-date. While that decline is better than that of its direct peers Netflix Inc. (NFLX) and Warner Bros. Discovery Inc. (WBD), Disney’s stock is likely to continue struggling; The company’s market cap is much higher than its peers. It sells for roughly the same market cap. as Comcast Corporation (CMCSA), which has a massive cash cow cable communications business. It is also selling at 2x and 5x the market cap of Netflix and WBD respectively.

A bigger market cap by itself is not a reason for a stock to underperform. Unfortunately for Disney, I believe the company is likely to miss its guidance on streaming subscribers, as well as analyst forecasts for profits for the next couple of years, which in my view makes further downside in the stock highly likely.

Disney is selling at a huge premium to peers (Created by author from regulatory filings)

This article will lay the case for why I believe the company could miss estimates, and offer the signs investors should keep an eye for to spot a potential end to the stock’s underperformance.

Streaming Subscribers

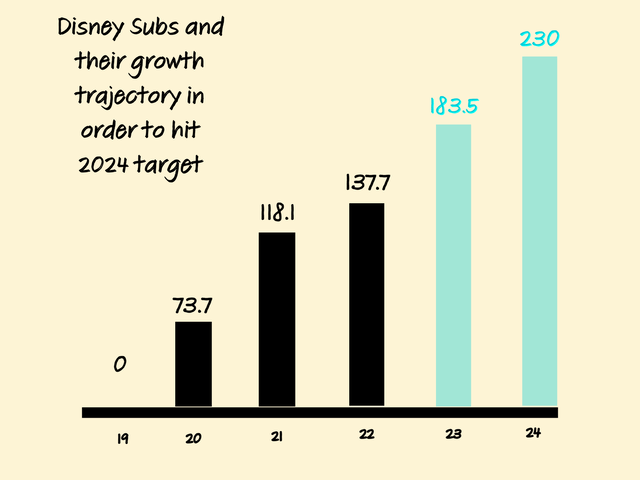

Let’s give the company some credit first; it breezed past its initial 2024 Disney+ subscriber target of 60-90 million, reaching that number in just 16 months instead of 70. Unfortunately investors are beasts always hungry for growth, and the company’s updated 230 million target looks to be out of reach.

Disney will need to reaccelerate subs growth to hit target (Created by author using regulatory filings.)

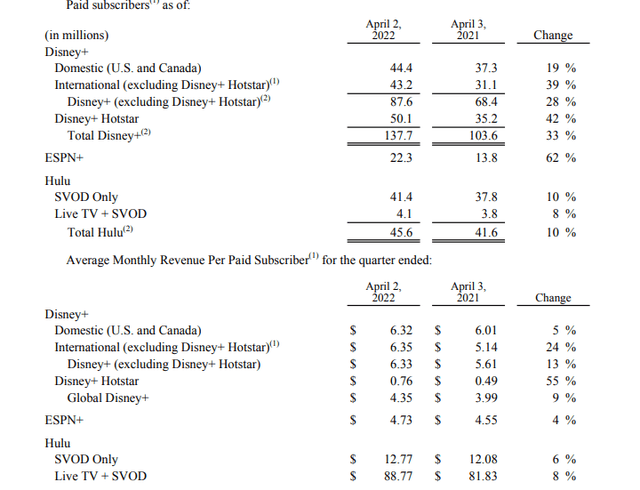

A look at Disney’s recent trend of sub adds demonstrates the size of the challenge they face; the company currently has 137.7 million and it has 10 quarters to add the remaining 92.3 million subscribers, or 9.23 million subscribers a quarter, to hit the lower-end of its target. The company added 21.7 million Disney+ subscribers over the past 3 quarters, or 7.2 million subscribers. So Disney will need to reaccelerate its subscriber growth by an additional 2 million a quarter to hit its target. Compounding matters is that 50 million of the total streaming customers are Hotstar customers, who have a negligible $0.76 in monthly ARPU. And if you thought this was bad news, Disney has lost the streaming rights to the Indian Premier League Cricket, so many of those 50 million subscribers could be lost once the current deal expires.

Management also provided another guidance of 300-350 million for all its streaming services (including Hulu and ESPN+). This target seems more reasonable; current Disney DTC subscribers stand at 205.6 million, and will need to grow 94.4 million over the next 10 quarters to hit the lower end of that guidance. The company added 31.9 million subscribers over the last three quarters, or 10.6 million subscribers a quarter. While that is an impressive rate, both ESPN+ and Hulu are US only so they can’t grow as rapidly going forward. And while there is still room for growth in the US market given Netflix has 76 million subscribers in the US, I believe reaching the lower end of the 300 million is likely to be a close call at best, especially with the challenge posed by Hotstar.

Investors can point out to the new Star service that will be launched and the new regions Disney+ will expand into as a catalyst to reaccelerating sub adds and hitting the target eventually, which leads us to the second issue.

Profitability

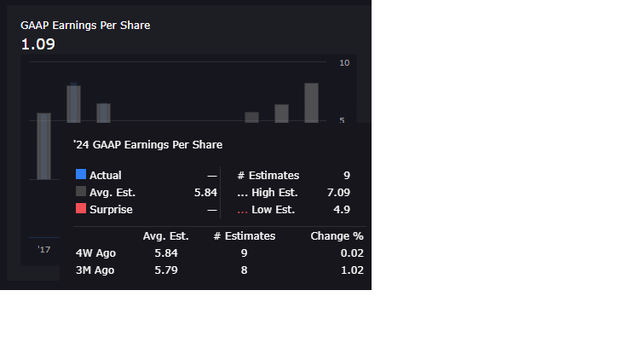

Analyst forecast for EPS (Interactive Brokers)

Consensus estimates for the company’s EPS in 2024 is $5.84 ($10.6 billion) respectively. In 2021, the company had $2 billion in net income ($1 EPS). I find it highly unlikely that that the company can go from $2 billion in profit to $10.6 billion while increasing spending on content, marketing, and technology to serve its four streaming services.

But to put everyone’s mind at ease, let’s try to look at the 2021 numbers and try to gauge how 2024 would look like.

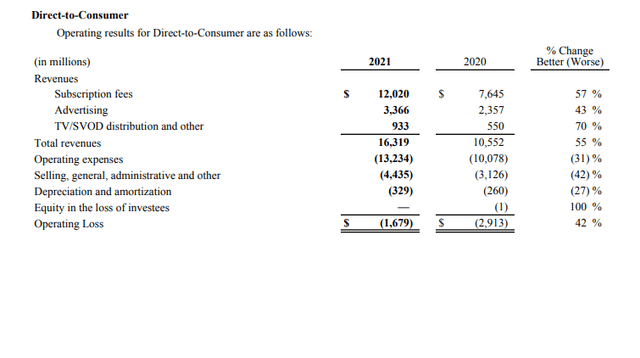

DTC Financials for 2021 (Disney)

In 2021, Disney spent $17.7 billion on its DTC business based on GAAP accounting (SG&A, amortization, marketing, etc.), and generated $16.3 billion in revenue. We can see that revenue grew faster. But since we are interested in how they will look like if Disney hits 300 million subs, let’s look at the number from a per user lens.

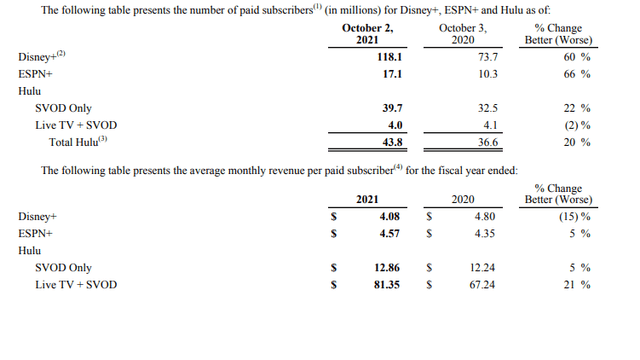

Sub no. and ARPU for Disney DTC in 2021 (Disney)

Because Disney does not break out expenses for each streaming service, we can just use per subscriber numbers for all services combined. So Disney had 179 million DTC customers in 2021, compared to 120.6 million in 2020. ARPU for all streaming subscribers grew 4.2% during that period, from $87.5 a subscriber in 2020 to $91.17 in 2021.

The operating expenses in the first picture (comprised of content, technology, and distribution costs) declined 11.5% from $83.57 per subscriber in 2020 to $73.93 in 2021. I simply divided the operating expenses by the number of subscribers at the end of the period to get a rough picture. SG&A meanwhile declined 4.4% from $25.92 per subscriber in 2020 to $24.78 in 2021.

But as the company chases its streaming subscriber target, it ends up undermining the business’ profitability.

Here is the numbers from the latest quarter:

latest subscriber numbers offers hint into Disney’s revenue challenges ahead (Disney)

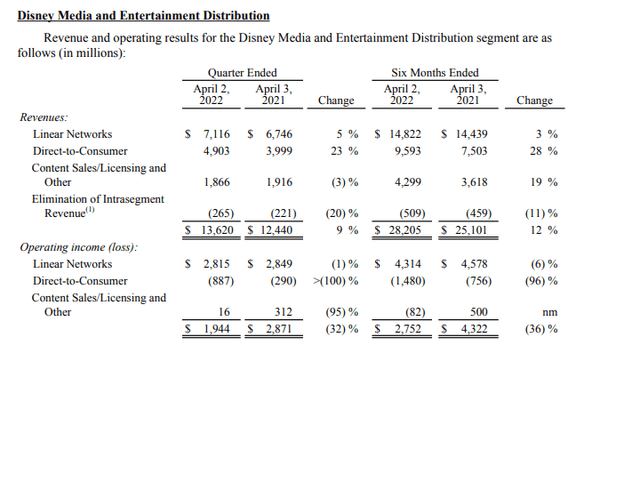

A look at the revenue and subscriber numbers shows a booming business, but supplementing that with the costs highlights the argument I’m trying to make:

Digging deeper into Disney’s expenses reveals the challenges ahead (Disney)

The growth in subscribers is big enough to keep costs per users declining, albeit at a low single digits rate of 2.5 percent compared to in October 2021 as discussed above. I reached that number by first obtaining the total costs paid (adding back operating loss to revenue). I then divided that number by the average number of subscribers at the end and beginning of each quarter.

For April 2021 it was $8.259 billion/139.8 million customers = $59.08.

For April 2022 it was $11.073 billion/192.3 million customers = $57.58.

You can see that costs per user declined ($57.58/$59.08 – 1) 2.5 percent.

As for ARPU, despite the company disclosures showing it increased in the high single digits in almost all the streaming services, ARPU per streaming customer actually went down 7%.

For April 2021 it was $7.503 billion/139.8 million customers = $53.67.

For April 2022 it was $9.593 billion/192.3 million customers = $49.89.

You can see comparing the two numbers ($49.89/$53.67 – 1) that ARPU declined just more than 7%.

An easier way might be to just look at the operating margin of the streaming business, which deteriorated to -15% in the most recent quarter from -10% in the corresponding quarter of 2021.

Since the company will need to keep the pace of the growth, and will face a challenge adding more subscribers to Hulu and ESPN+ as they grow bigger and bigger, in addition to the challenge posed by Hotstar, I hold the view that the streaming business may not be profitable by 2024 if it continues to chase its 2024 million target.

Add to that the fact that the 6% decline in the linear networks business is part of a years’ long trend of chord-cutting. So with streaming unprofitable, linear networks declining, the onus will be on the Parks and studios to add noticeably more than $8.5 billion pre-tax by 2024. Parks’ highest operating income was $6.7 billion before the pandemic, and added $5 billion after tax to 2021 income, which means the studio needs to generate at least $3.5 billion in after-tax income to have a chance of reaching the target. The studio has on average generated $3 billion in pre-tax income in the 3 years before the pandemic hit.

For those reasons, I rate the stock a sell.

The Silver Lining

Disney has fantastic, beloved IP that is has been shepherding superbly for many decades. It just finds itself in a unique situation where it has two targets that pull against one another whilst being priced at a huge premium to its competitors. TTM GAAP operating income for Disney was about $5.5 billion, roughly in line with Paramount Global (PARA) and NBCUniversal (Comcast subsidiary). The problem is Paramount is worth less than a tenth of Disney, while Comcast is worth $4 billion more, but you get the cable communications business and Sky for free. Netflix has about $6 billion in GAAP operating income, but is worth half the market cap of Disney. Disney is selling for a 33% premium to Netflix, WBD, and Paramount combined. This leaves no room for error for the company.

I have no doubts Disney’s streaming services would have 300 million subscribers and more one day, or that it could generate $10.5 billion in profit at some point. But I do not believe it can achieve both in the next couple of years, given they will need to sacrifice profits to get subscribers and vice versa. So I’m rating it as a sell for now but would look to upgrade the stock once one of the shoes drop.

I think the most likely scenario is either management will have to come out and say they won’t hit the numbers at some point over the next couple of years, or analysts at some point will have to revise their numbers lower.

Risks

There is very little doubt in my mind Disney will miss consensus on one of the two targets I discussed. One risk is that the street dismisses a miss on profits as a necessary price to pay for gaining subscribers. The decline in Netflix stock earlier this year suggests this isn’t currently the case, but this could change.

Conclusion

Analyst forecast for Disney’s profit, and the company’s subscribers target for 2024 seem high. I believe the company can hit one of those targets by 2024, but not both of them together. Given the high premium assigned to Disney compared to competitors, any miss could be costly. The potential reaction to one of those misses prompts me to rate the stock a sell for now, but I would upgrade it once the shoe drops.

Be the first to comment