Justin Sullivan/Getty Images News

Investment Thesis

- The strong brand image of Walmart (NYSE:WMT) in combination with its ability to offer its customers lower prices than most of its competitors, provides the company with a wide economic moat.

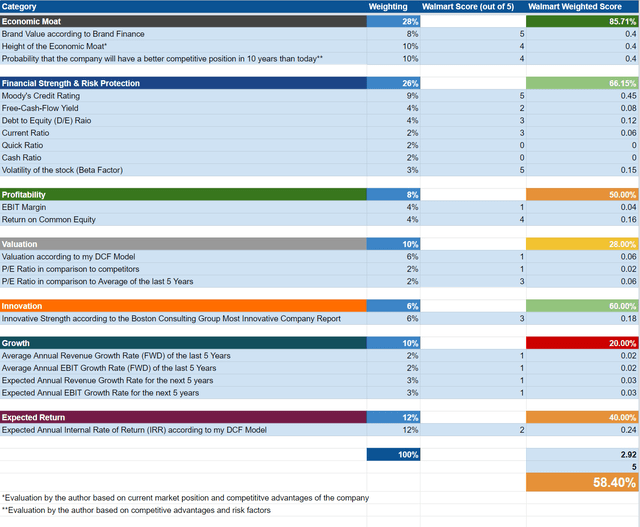

- According to my HQC Scorecard, Walmart is rated with a high score in the category Economic Moat (85.71 out of 100 points) and relatively high in the Financial Strength & Risk Protection category (66.15 out of 100 points) as well as in the category Innovation (60 out of 100 points).

- At the same time, Walmart is rated with a significantly lower score in the categories Profitability (50%), Expected Return (40%), Valuation (28%) and Growth (20%).

- Walmart’s characteristics make the company attractive for investors aiming to reduce the volatility of their investment portfolio while investing with a long-term horizon.

- I rate Walmart as a hold: Walmart has strong competitive advantages, but its current valuation and low growth rates do not make it currently an attractive investment from my point of view.

Walmart’s Competitive Advantages

In the fiscal year 2022, Walmart generated a revenue of $573 billion. This makes it the largest company in the world by revenue. Walmart operates about 15,500 stores and clubs in 24 different countries and employs 2.3 million associates around the world (1.6 million in the U.S. alone).

Walmart offers its clients a deep assortment of products via its website Walmart.com, its mobile apps and in store. With its Every Day Low Price (EDLP) strategy, the company is able to offer its customers lower prices in comparison to most of its competitors.

There are several factors giving Walmart the ability to offer its customers lower prices than its competitors: One of which is the fact that Walmart has a hugely reliable customer base. It is estimated that approximately 90% of all Americans live within 15 miles of a Walmart store. Additionally, Walmart has strong bargaining power over its suppliers because a lot of brands depend on sales via Walmart stores. Furthermore, Walmart usually works directly with the manufacturers who produce the products they sell. For this reason, Walmart can buy the products at a lower price and is therefore able to pass this lower price on to its customers.

At the same time, Walmart has managed to become one of the most important brands in the world. According to a ranking by Brand Finance, Walmart is currently the 5th most valuable brand in the world. Brand Finance currently estimates the brand value of Walmart at around $111,918 million. In this ranking, Walmart is positioned behind Apple, Amazon, Google and Microsoft. It also ranks one position higher compared to the previous year.

Walmart’s strong brand image and its ability to offer lower prices to its customers than most of its competitors, provides the company with a very strong competitive advantage.

Walmart’s Valuation

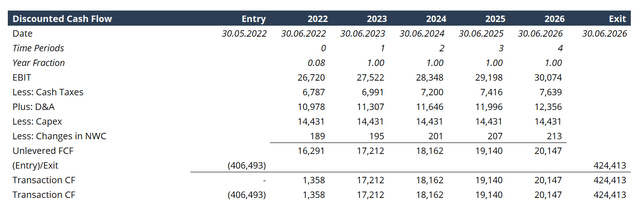

Discounted Cash Flow (DCF)-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of the company. The method calculates a fair value of $111.69 for Walmart. At the current stock price, this results in a downside of 12.5%.

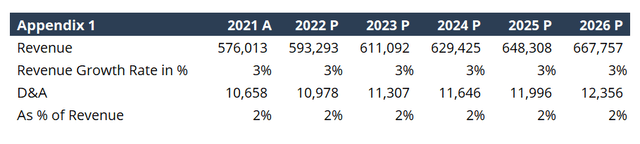

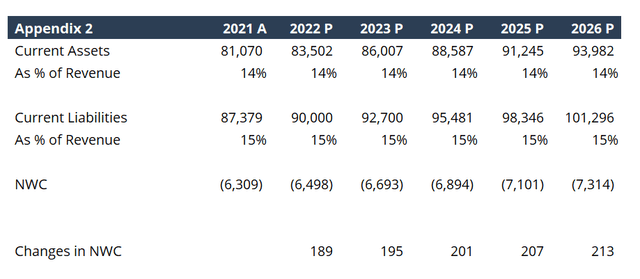

I assume a Revenue Growth Rate and EBIT Growth Rate of 3% for Walmart over the next 5 years. Next, I assume a Perpetual Growth Rate of 3%. I have used Walmart’s current discount rate (WACC) of 8.75%. Furthermore, I calculated it with an EV/EBITDA Multiple of 11.5x, which is the company’s latest twelve months EV/EBITDA.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Company Ticker |

WMT |

|

Revenue Growth Rate for the next 5 years |

3% |

|

EBIT Growth Rate for the next 5 Years |

3% |

|

Tax Rate |

25.4% |

|

Discount Rate (WACC) |

8.75% |

|

Perpetual Growth Rate |

3% |

|

EV/EBITDA Multiple |

11.5x |

|

Transaction Date |

06.06.2022 |

|

Fiscal Year End |

31.01.2022 |

|

Current Price / Share |

$127.63 |

|

Shares Outstanding |

2,754 |

|

Debt |

$66,817 |

|

Cash |

$11,817 |

|

Capex |

$14,431 |

Source: The Author

Based on the above assumptions, I calculated the following results (in $ millions except per share items):

Source: The Author Source: The Author Source: The Author

Terminal Value

|

Perpetual Growth |

$360,888 |

|

EV/EBITDA |

$487,938 |

|

Average |

$424,413 |

Source: The Author

Market Value

|

Market Cap |

$351,493 |

|

Plus: Debt |

$66,817 |

|

Less: Cash |

$11,817 |

|

= Enterprise Value |

$406,493 |

|

Equity Value/Share |

$127.63 |

Source: The Author

Intrinsic Value

|

Enterprise Value |

$362,594 |

|

Plus: Cash |

$11,817 |

|

Less: Debt |

$66,817 |

|

= Equity Value |

$307,594 |

|

Equity Value/Share |

$111.69 |

Source: The Author

Market Value vs. Intrinsic Value

|

Market Value |

$127.63 |

|

Upside |

-12.5% |

|

Intrinsic Value |

$111.69 |

Source: The Author

Relative Valuation Models

Walmart’s P/E (FWD) Ratio

Walmart’s P/E Ratio is currently 21.11. This is 11.93% below its average P/E Ratio from the last five years, which is 23.97. Walmart’s current P/E Ratio is 7.15% higher than the sector median (19.70).

Walmart’s Beta

The stock of Walmart has a Beta of 0.50, which is below that of the broader stock market (with a Beta of 1). Walmart’s Beta of 0.50 shows that an investment in the company could contribute to a reduction in the volatility of your investment portfolio.

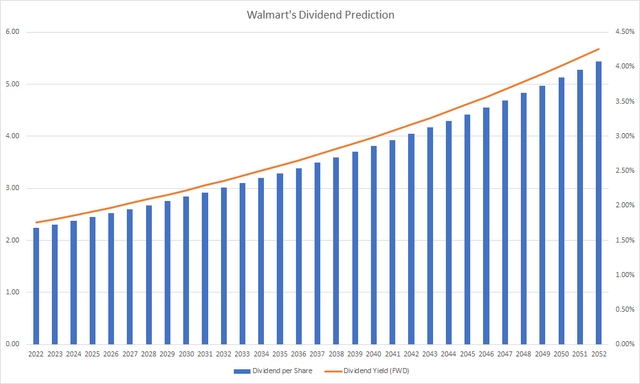

Walmart’s Dividend

The average growth rate over the last five years of Walmart’s dividend has been 1.98%. I assume an average future growth rate of about 3% per year (this is also in line with the assumptions of the Perpetual Growth Rate of 3% that I used for the DCF Model). If you were to assume that Walmart was able to increase dividends by an average of 3% per year over the next 30 years and you would buy the Walmart stock at the current price of $127.63 per share, you would get the following results for the company’s dividend shown in the graphic below.

In my opinion, Walmart has the potential to raise its dividend by 3% per year due to its competitive advantages including its strong brand image and its ability to offer lower prices compared to most of its competitors. Furthermore, Walmart has a low Payout Ratio of only 27.23%, which helps to drive future dividend increases.

If Walmart was able to raise its dividend by 3% per year over the next 30 years, after 30 years you would get back 87.76% of your investment from receiving dividend payments (no tax on dividend has been included in this calculation):

|

Year |

Dividend per Share |

Dividend Yield (FWD) |

Accumulated Dividend |

|

2022 |

2.24 |

1.76% |

1.76% |

|

2032 |

3.01 |

2.36% |

22.48% |

|

2042 |

4.05 |

3.17% |

50.33% |

|

2052 |

5.44 |

4.26% |

87.76% |

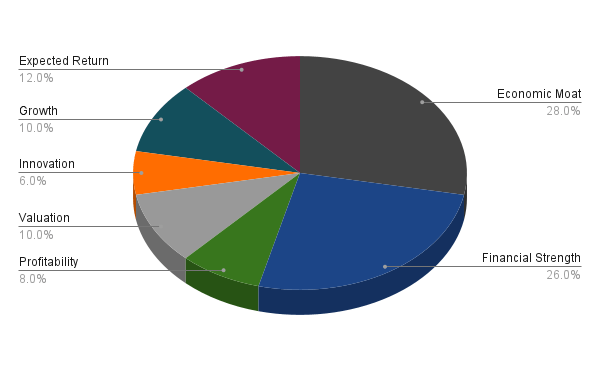

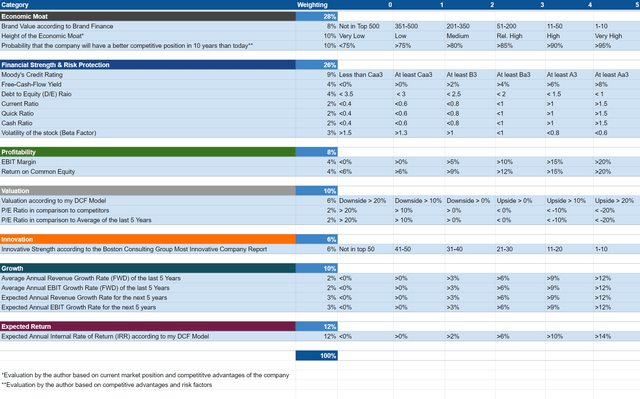

My High-Quality Company (HQC) Scorecard for Long-Term Investors

How the HQC Scorecard Works

The aim of the High-Quality Company (HQC) Scorecard for Long-Term Investors I have developed is to help investors identify particularly high-quality companies in order to make successful long-term investments. My HQC Scorecard rates companies up to a maximum of 100 points. Various categories with different weightings are included in the evaluation process: The category Economic Moat accounts for 28% of the overall rating, the category Financial Strength & Risk Protection for 26% and the Profitability of the company for 8%. The Valuation of the company is weighted at 10%, the Innovation Factor at 6%, the Growth Factor at 10% and the Expected Return makes up 12% of the overall rating.

Composition of the HQC Scorecard by Categories

Source: The Author

The categories of Economic Moat and Financial Strength have the highest weighting. This is due to the fact that, if the company were to go bankrupt, the rating of the other factors would then be meaningless. For this reason, my scorecard places particular emphasis on the fact that companies with strong competitive advantages and financials have higher ratings, because these factors contribute to the fact that these companies will be able to survive in the long-term. Furthermore, I believe that companies with a high economic moat are more likely to be able to deliver excellent results in the long term. The Expected Annual Internal Rate of Return is also given relatively high importance accounting for 12%.

Approximately 56% of the categories of my HQC Scorecard are based on pure (financial) data, while about 44% of the factors are based on my personal evaluation.

Overview of the Items of the High-Quality Company (HQC) Scorecard for Long-Term Investors

In the graphic below you can find the individual items and weighting for each category of my HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. In the graphic below you can see the conditions that must be met for each point of every item that is rated.

Walmart According to my High-Quality Company (HQC) Scorecard for Long-Term Investors

My High-Quality Company (HQC) Scorecard for Long-Term Investors indicates that Walmart performs particularly well in the categories of Economic Moat (85.71 out of 100 points), and relatively well in the Financial Strength & Risk Protection category (66.15 out of 100 points) as well as in the category Innovation (60 out of 100 points). However, Walmart performs less well in the categories of Profitability (50 out of 100 points), Expected Return (40 out of 100 points) (calculated as the Expected Annual Internal Rate of Return (IRR) with my DCF Model) and Valuation (28 out of 100 points). The company has its lowest rating in the category of Growth (20 out of 100 points).

According to the HQC Scorecard I have developed, the overall score of Walmart is 58.40 out of 100 points.

This score strengthens my opinion that Walmart does have a high economic moat; but due to the current valuation of the company and the low growth prospects, which contribute to a relatively low expected return from a Walmart investment, I currently rate the company as a hold.

Risks

One of the risks of an investment in Walmart is the relatively small revenue growth perspective of the company. Walmart has limited growth perspectives due to the fact that it’s already very large in terms of revenue and that the retail sector in general only grows with low growth rates. The global average annual retail industry growth rate is estimated to be around 4% until 2025.

Another risk for Walmart could result from the company not being able to predict new consumer trends and preferences or changes in the shopping patterns of their customers. This could affect the demand for Walmart’s products and services and thus affect the financial results of the company.

Another risk I see for Walmart is the strong competition that the company has from Amazon (AMZN). In particular, Amazon’s high spending in Research & Development (R&D) could contribute to the fact that Walmart will lose market share to its competitor. In 2020, Amazon was the company that spent the most in R&D worldwide ($42.7 billion). Additionally, Walmart has strong competition from other retailers and wholesalers. This competition can further affect Walmart’s EBIT-Margin, which is only 4.23%.

However, I believe that Walmart will stand out against its competitors over the long-term, because of its competitive advantages. In particular, its strong brand image combined with the fact that it can offer the lowest prices, gives Walmart a strong competitive advantage.

The Bottom Line

My Discounted Cash Flow Model indicates that Walmart is currently overvalued with a downside of 12.5%. The DCF Model calculates a fair value of $111.69 for the company. The fact that Walmart’s current P/E Ratio of 21.11 is 7.15% higher than the sector median, which is 19.70, gives us yet another indicator that the company is currently overvalued.

According to the High-Quality Company (HQC) Scorecard for Long-Term Investors, which I have developed, Walmart scored 58.40 points out of 100. My HQC Scorecard shows that the company has a wide economic moat and strong financials. However, it also indicates that Walmart does not offer high growth perspectives and it shows that its valuation is currently not very attractive.

With an average dividend growth per year of 1.98% in the last 5 years and a dividend payout ratio of 27.23%, the company has scope for future dividend increases.

I expect Walmart to increase its dividend with a dividend growth rate of about 3% annually in the years to come.

In my opinion, at Walmart’s current valuation, the stock is attractive for investors who want to expand their investment portfolio with a stock that reduces the volatility of their portfolio. Walmart’s low Beta of only 0.50 is an indicator that you can reduce the volatility of your investment portfolio through an investment in Walmart.

I rate Walmart as a hold. In my opinion, Walmart has strong competitive advantages, which help the company to stand out against its competitors in the long-term: Especially with the company’s strong brand image and its ability to offer lower prices in comparison to most of its competitors. However, the current valuation and Walmart’s relatively low growth perspectives contribute to my hold rating for the company at the current stock price.

Thank you for reading and I would appreciate any feedback on this article!

Be the first to comment