Joe Raedle/Getty Images News

Separating short-term trends from longer-term shifts in behavior is often a challenge. Obviously, there are changes in the way individuals and institutions behave over the short term and the long term, but unique circumstances often cause behavior that isn’t sustainable.

The pandemic in 2020 and the consumer inflation that has significantly impacted many consumers since early 2021 has clearly changed the buying habits of consumers. Few companies have benefitted more from those changing consumer habits than Walmart (NYSE:WMT).

Walmart has a very simple but effective business model; the company focuses on value, and no major retailer has been able to offer better value than Walmart on most of the various products the company sells.

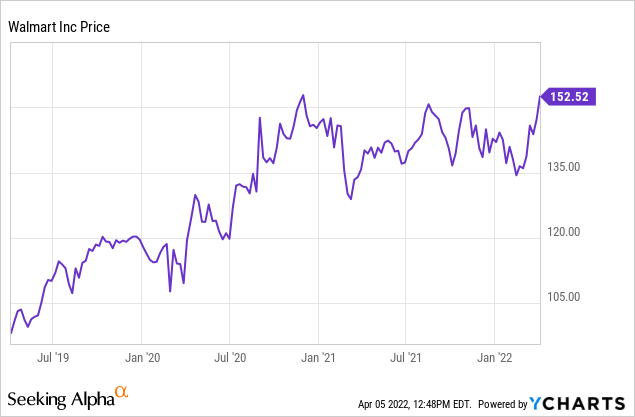

Walmart’s stock has had a big run over the last three years from the challenging conditions we’ve seen.

Walmart’s stock was trading around $115 a share in late 2019, and the stock has risen over 30% in the last two and a half years since the pandemic started.

The company did well during the pandemic, and the significant price inflation we have seen since early 2021 has benefitted Walmart as well.

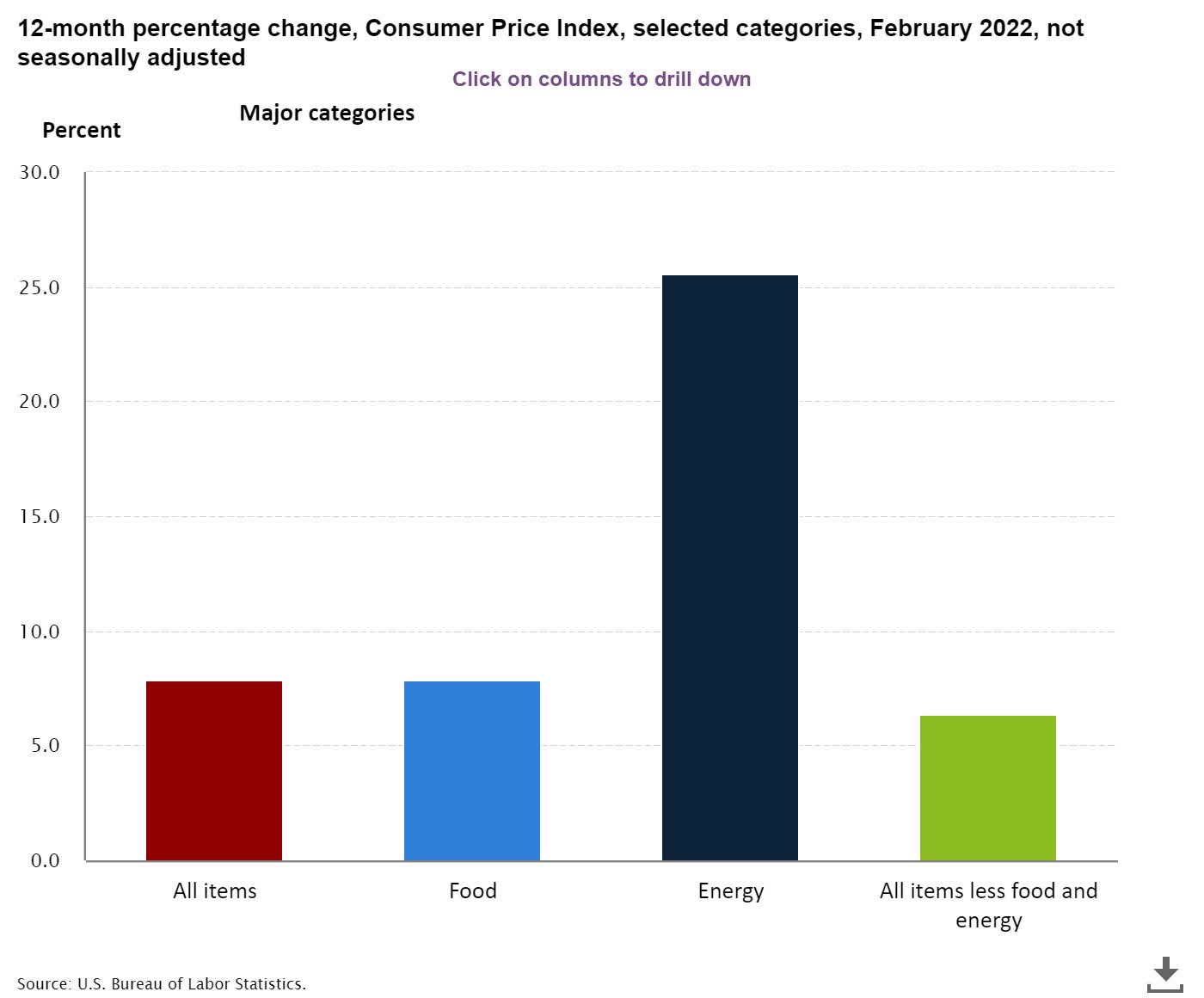

A consumer price index chart (US Gov)

Inflation has consistently been 5% or higher since early 2021, and food inflation, in particular, has significantly benefitted Walmart, as consumers have been more focused on value.

Walmart’s recent fourth quarter earnings report was predictably strong yet again, but there were some warning signs.

The company reported net sales of $572.8 billion on sales growth of 6.4% on a year-over-year basis, ecommerce sales were up 11%. Sam’s Club sales were up 9.8% and Sam’s Club membership income increased 11.3%. Full year adjusted earnings per share were $6.46 a share. Walmart also reported net margins of 2.39%, which is strong for the retail and grocery-based business that is a significantly important part of Walmart’s sales. The company bought back $9.8 billion in shares last year, representing expenditures of nearly half of the currently authorized $20 billion buyback plan announced last year.

Despite Walmart’s strong recent earnings report, there are several clear warning signs that the company’s growth and momentum are slowing. First, even though Walmart’s U.S. sales have grown by 15% over the last 2 years, sales growth this year in the US was just 6.4%. Also, ecommerce growth over the last 2 years has been 90% as the company rolled out new digital platforms, but ecommerce growth this year dropped to 11%.

A Picture of a Walmart Employee (Walmart)

Management’s guidance is also for only minimal revenue growth moving forward next year. The company guided, in 2023, for an increase in consolidated net sales of 3%, comparable sales growth of just under 3%, when including fuel, and consolidated operating income to grow at 3%. Management also expects earnings per share growth of 5-6% next year, but that growth will, of course, include the impact of the remaining $10 billion of the company’s share buyback plan.

Walmart is relying primarily on market share gains to drive growth in the US with the company’s Walmart and Sam’s Club stores, since the company already has reached a point of market saturation with the amount of stores that are open in the US. Walmart has 4,756 stores in the US, which is a very large number. Costco (COST), in contrast, has only 564 membership warehouses in the US, and Target (TGT) has 1800 stores in the US. International revenues currently represent less than 20% of Walmart’s overall current income.

Even though the company has had international revenues of nearly $120 billion each of the last 3 years, international revenue growth has been very minimal over the last several years. Walmart doesn’t have the same brands as Target or customer service that companies such as Costco offer, the Walmart business model focuses almost exclusively on value. As economic times eventually improve and at least some inflationary pressures ease, Walmart will likely lose some of the recent customers that have switched to this leading retailer.

Walmart’s stock is overpriced using a number of metrics given that the company will likely be lucky to grow sales and income at more than 3% next year, and earnings per share growth is expected to be in the mid-single digits. The company trades at 22x next year’s earnings estimates, the price to earnings growth ratio is 3, and the stock also trades at 5x book value. Walmart’s cash flow and balance sheet are strong, but the company does have nearly $60 billion in debt, the payout ratio is 45%, and the current yield is just 1.48%. Walmart’s significant buyback initiative, the company is buying nearly $10 billion in shares a year, is the only reason that this leading retailer is able to target a mid-single-digit earnings per share growth rate next year.

Walmart’s stock has done very well over the last 3 years, but the company’s international growth is minimal, and there is very little room for this leading retailer to open new stores within the US. Well, the pandemic and the significant recent inflation we have seen have clearly driven market share gains by Walmart over the last several years, the company trades with a growth multiple despite net income and revenues growing slowing significantly. Inflationary pressures will likely continue for some time, but Walmart isn’t likely to be able to retain most of their market share gains over the long run as customers eventually trade up, and the company’s recent market share gains have still only produced minimal revenue and income growth.

Be the first to comment