Elan Irving/iStock via Getty Images

The cannabis space has been a tough place to invest during 2022 due to higher interest rates and inflationary pressures on consumers. Regardless, small multi-state operators (MSOs) like Jushi Holdings (OTCQX:JUSHF) retain deep values. My investment thesis remains ultra Bullish on the cannabis stock trading near multi-year lows despite solid growth.

Big Plans

The current economic environment has impacted the growth plans of a lot of retailers and curtailed growth opportunities in the cannabis space. As the economy improves, MSOs should see a boost in sales.

Jushi is one of those MSOs where the market doesn’t value the stock according to these long-term growth plans. The company is just ramping up the Virginia market and the MSO has plenty of growth opportunities in Illinois, Ohio and Pennsylvania.

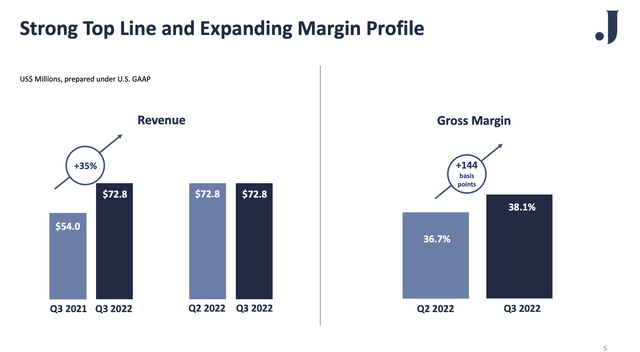

For Q3’22, Jushi reported revenues of $72.8 million, virtually flat with the prior quarter. The company reported an adjusted EBITDA profit of only $0.7 million due to low gross margins in the current business model.

The good news is that Q3 gross margins improved sequentially 144 basis points to 38.1%. The MSO is in the process of vertically integrating the business in states such as Pennsylvania and Virginia to boost gross margins.

Source: Jushi Q3’22 presentation

In Q3’22, Jushi only had branded sales at 28% of total revenues for a 600 basis point improvement from the prior quarter. In Pennsylvania, branded sales grew 90% QoQ as the company has more product from the expanded cultivation facility. The company targets reaching branded sales levels in the 50% to 60% range over time similar to where other MSOs tend to produce gross margins in the 50% range.

The low EBITDA margins will quickly reach the double-digit targets of the company and change the valuation equation with the stock. Jushi only spends a minimal $27 million per quarter on cash operating expenses.

The whole key to the business is selling more branded products from their recently built cultivation facilities to boost gross margins and revenues. The Virginia market provides the prime growth opportunity ahead with the state relaxing medical cannabis restrictions and recreational cannabis set to launch by January 1, 2024.

Jushi has 4 open dispensaries in the Virginia market in the HSA II section with plans to open additional Beyond Hello stores in Arlington and Woodbridge in the 1H of 2023. The relaxed medical cannabis rules include removing the need for expensive medical cards leading the company alone to add 8,000 new patients in Q3 with an additional 2,425 patients in October alone.

The MSO will ultimately benefit from long-term recreational sales approvals in other key states of Ohio and Pennsylvania still looking for approvals and Virginia with approval already in place. In the near term, Jushi has minimal capex requirements with the ability to shift towards a focus on operational efficiency and generating positive operating cash flows.

Deep Value

As with most smaller MSOs, the stocks trade at deep value now. Jushi once traded above $4 this year and now trades in the $1s with a fully diluted market cap of only $435 million based on 291 million shares outstanding.

Analysts expect the MSO to generate up to 30% revenue growth in 2023 leading to revenues of $385 million. Jushi only has to average $96 million in quarterly revenues to hit this target and new stores in Virginia and Ohio should make this goal easily achievable.

The company appears on pace to reach analyst targets of nearly $50 million in adjusted EBITDA for next year while Jushi would still only have margins below 15%. The stock has a market cap at just 8x the minimum EBITDA targets for 2023. Investors need to remember this valuation is just 1x sales.

The MSO has net debt of $178 million at the end of Q3, but Jushi has built up a large PP&E balance approaching $200 million in the process. The company hasn’t built up the net debt position due to operating losses.

Ultimately, the big key to the stock will be the ability of management to navigate the company towards larger gross margins and strong adjusted EBITDA profits in the future. Jushi will need to improve the financial position during a tough economic environment of the next 6 months, or the stock could languish.

Takeaway

The key investor takeaway is that Jushi remains a cheap stock similar to other MSOs. The stock could become a buyout target on any changes in the legal landscape of owning cannabis investments.

Investors should continue using the weakness in the US cannabis space to build positions in stocks like Jushi.

Be the first to comment