AvigatorPhotographer/iStock via Getty Images

Wallenius Wilhelmsen (OTCPK:WAWIF) is a pretty important company in the Norwegian stock market landscape. It provides logistics and RoRo services primarily exposed to car volumes. Car volumes have been solid on account of semiconductor shortages easing despite economic conditions. Logistics congestion remains high, so S/D dynamics are supported. There’s also some nice lift on earnings from defense spending and transport of NATO equipment closer to Ukraine. The multiple is low as charter rates are cyclical, but the gives and takes make things resilient here, and the multiple therefore looks too low. This stock is a buy, but for the lawsuit against it.

Notes on Q3

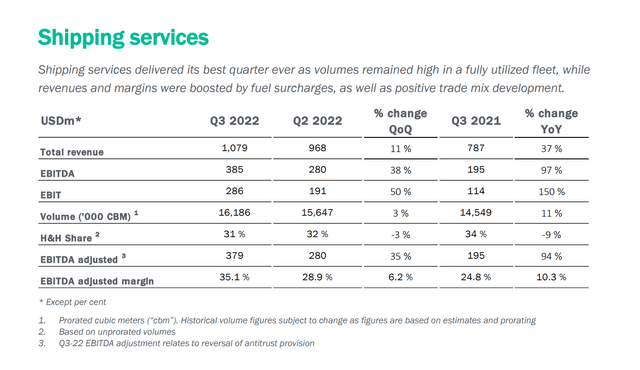

The shipping business is RoRo, or roll-on roll-off shipping, that is primarily geared towards cars but also to other equipment for construction, denoted as high & heavy or H&H. While construction trends might be slowing down on account of higher interest rates, markets are not looking to raise that much more, and in the case of cars, things look good as semiconductor shortages ease and support a pretty good situation in terms of car volumes.

YoY the developments have been great as 2022 is inflated in prices and saw some volume uplift relative to 2021, and the share in H&H declined which means less exposure to construction which is going to be less resilient.

Cars are a nice, slow-burn as pent-up demand starts to draw down on an inventory level that is able to grow faster now that semiconductors are in a bit of a glut.

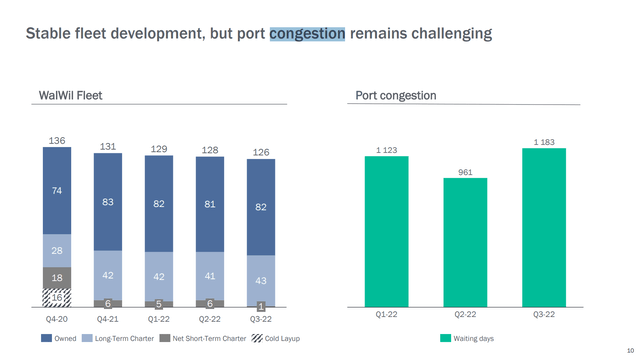

Vessel congestion at ports remain high which is a key supply indicator, and with the demand situation approximately flat for the foreseeable future, charter rates should actually hold pretty well.

Vessel Congestion (Q3 2022 Pres)

Logistics is just the terminaling and other services that are complementary to RoRo. It is going to be less volatile in terms of pricing, but it is a pretty marginal segment at 10% of the EBITDA of shipping.

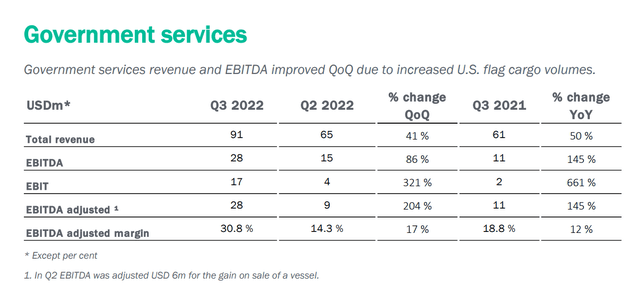

Finally, there is a defense exposure that’s nice. The EBITDA exposure is 5%, but this business is supported by the US government as the only customer, which is paying for RoRo services to get equipment to the Ukraine as they support the Ukraine war effort against Russia.

It’s marginal, but it’s still a nice, secure lift to the earnings profile of the business.

Bottom Line

There’s another tidbit that’s interesting. WW owns more than 70% of the shares in a Norwegian holding company called Treasure ASA (OTC:TRSUF). Treasure has one purpose and one purpose only, to hold an 11% interest in the Korean shipping and logistics company Hyundai Glovis, which is the shipping company responsible for getting KIA Motor cars out of the country. They also do the logistics for KIA internally. The holding company is worth half the market value of its shares. There will be no capital gains taxes or any liability to explain the discount. So the dividend yield of Treasure is 2x the dividend yield of Hyundai Glovis when owned directly. At any rate, there is a $200 million valuation upside equivalent to almost 7% of WW’s upside that comes with no real risk.

Ultimately RoRo is what matters, and that business is a function of charter rates and vehicle volumes. Demand is taking a hit in some markets are vehicle registrations fall according to some of our other coverage, particularly in Europe. In other markets there is growth however, like in North America. It is a mixed picture, but it is saved from unmitigated decline due to the increase in rates thanks to the build-up of demand during COVID-19 and the semiconductor shortages that stopped automotive production from being at full capacity. The higher than average vehicle ages over the last couple of years are coming down cyclically and it helps. Finally, vessel availability remains about as low as before, and charter rates continue to be higher than in 2021.

The 5x PE multiple is really low considering that RoRo has less to fall than general shipping, in particular containership shipping. While some cyclicality is expected, we expect to see some resilience, also with about 15% of EBITDA in less commodified and more infrastructural segments. Overall, Wallenius Wilhelmsen looks interesting to the intrepid and risk-loving investor, but there are additional risks.

There is a class action lawsuit against the company by customers, who are not an irrelevant bunch. So depending on that outcome there could be selling pressure.

While altogether interesting despite risks, we probably pass here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment