JGalione/E+ via Getty Images

Electrifying transportation is one of the most important levers to combat climate change, since it accounts for ~23% of total energy related CO2 emissions. One company helping drive this electrification transition forward is Wallbox N.V. (NYSE:WBX) headquartered in Barcelona, and offering a large number of hardware and software solutions for EV charging.

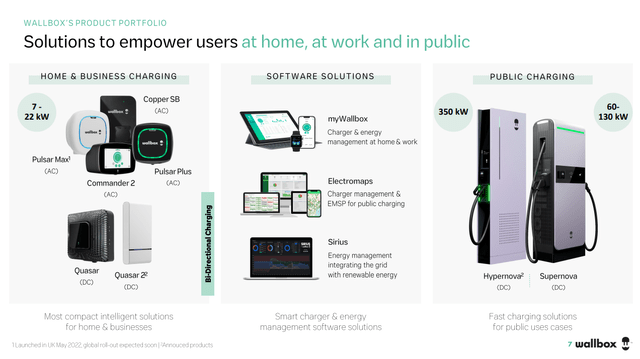

Products include public charger Supernova, as well as home & business charging devices, and Sirius, their proprietary smart energy management platform designed to enable companies to maximize the use of renewable energy.

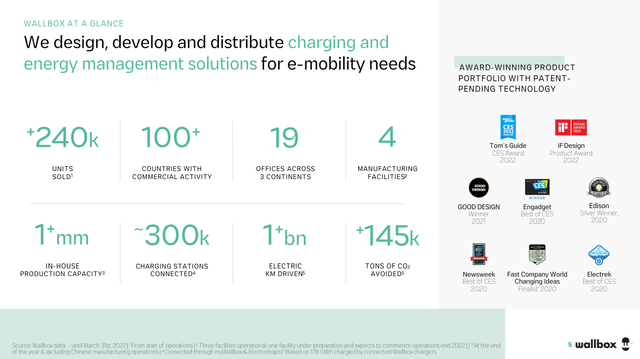

The company is very young, having been founded in 2015, and in many ways, it still resembles a startup. It has grown at breath taking speed, and it is still growing revenue at triple digits, although the revenue amounts remain relatively modest. We believe an investment in a company like Wallbox, that is still far from sustained profitability if they ever achieve it, is very risky. At the same time, it is difficult for investors in public companies to find opportunities where the company is growing at more than 100% per year, with a long runway ahead. There are signs however that the company is maturing, having multiple offices across the world, several manufacturing facilities, more than a thousand employees, and commercial operations in more than a hundred countries.

Addressable Market

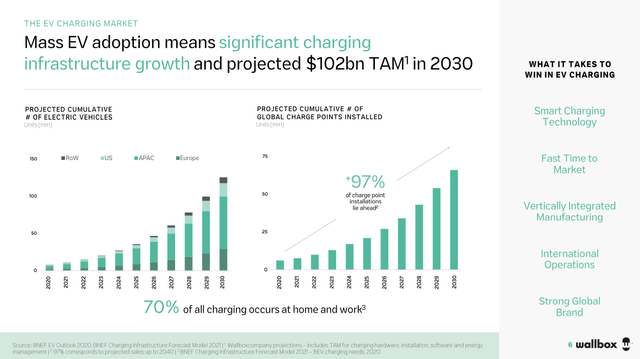

The reason we believe Wallbox might be able to sustain its very high growth rates for a long time, is that EV adoption is still in its infancy. As the company points out, if the growth in EVs is anything close to what is expected, then the number of charge points installed already is only a very small percentage of the total that will be needed. In other words, charge points will grow together with EV adoption, and the company estimates a TAM of $102 billion in 2030.

Financials

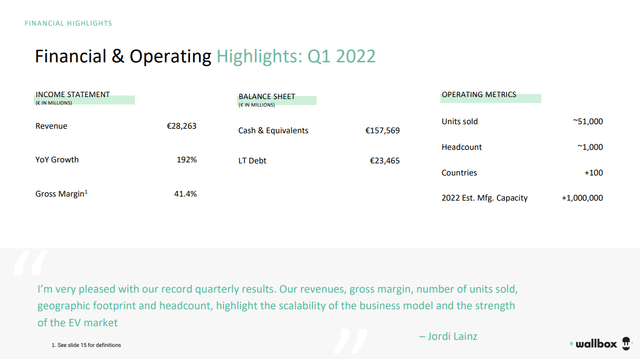

Wallbox is at a point in its development where their main financial KPIs are simply revenue, growth rate, and gross margin, with profitability still far away. Also, investing for growth means that losses are likely to be very significant while they remain in the hyper-growth phase. For Q1 2022 they reported 28 million Euros in revenue, which represented a year over year growth rate of 192%, and the revenue came with a gross margin of 41.4%. The number of units sold in the quarter was ~51,000, which annualized would be ~200k. For comparison, their 2022 estimated manufacturing capacity is more than a million units, which means that they are already starting to prepare for ~5x the volumes they delivered in Q1. The company remains well funded with about 157 million Euros in cash & equivalents and only ~23 million Euros in long-term debt.

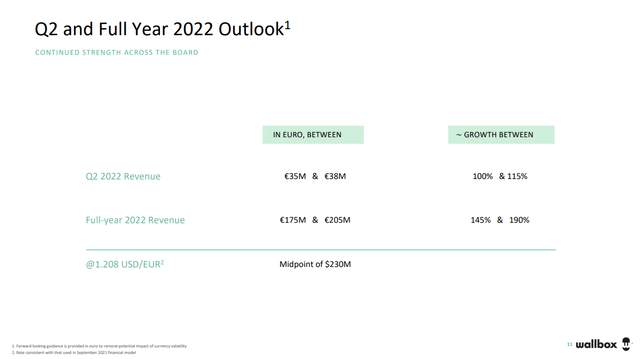

For the full year 2022 the company is guiding for revenues to be between 175 million Euros and 205 million Euros, which translates to growth of between 145% and 190%. Needless to say, very few public companies are growing at anywhere close to these rates, and with the potential to sustain hyper-growth for at least a few more years given the number of tailwinds in their favor.

Valuation

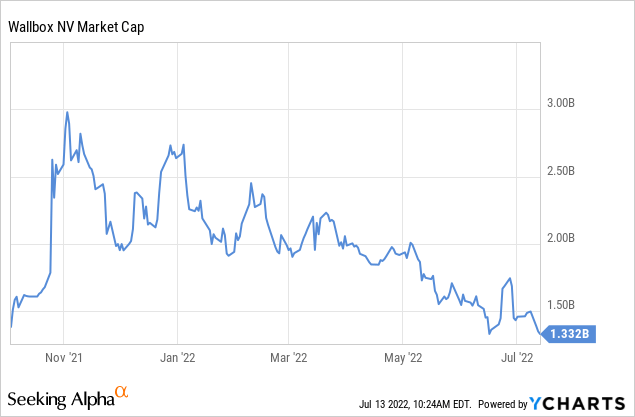

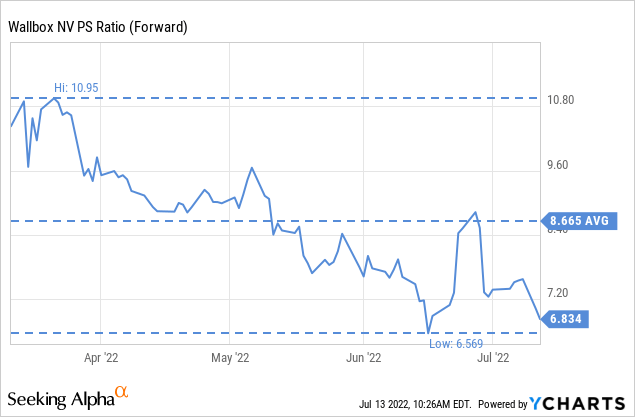

It is extremely difficult to accurately value a company like Wallbox, as it is valued more on its potential that the current financials. If the company can sustain anything close to the current growth rates for a number of years, we believe shares can deliver attractive returns, but should they slow down soon, then shares could be terribly overvalued. In other words, the number of years they can maintain hyper-growth (e.g. >100% y/y growth), will likely determine if long-term investors in the shares end up with good returns or not. We are not going to attempt a precise valuation, but instead put the current valuation in perspective to the cash the company has, and to its expected revenues for the year. Wallbox is currently trading with a market cap of ~$1.3 billion, and given a net cash position of ~$134 million, this means that it has about 10% of its market cap in cash.

The forward price/sales ratio is ~6.8x, which for a company growing so fast does not appear overly expensive.

If we do a simple mental exercise where we assume sales for 2022 are what the company guided for at the midpoint, and then assume 100% growth for 5 years, we get 2027E revenue of ~$6 billion. Even if shares are trading by then at a let’s say 2x PS multiple, that still means close to a 10x return on investment, assuming no share dilution was necessary. All of this to say, that if you believe hyper-growth for the company can last more than 5 years, then shares are probably cheap.

Risks

Wallbox has higher risks than average for a number of reasons. One is that it is still in a phase of its development where it is burning significant amounts of cash to grow, and the company could go bankrupt or need to dilute shareholders if it runs out of cash before it turns profitable. There is also technological risk, given how fast technology is evolving in the EV sector, many designs and devices could become obsolete if much superior technology becomes available. Of course, this is mitigated by the intellectual property, patents, and know-how that the company has accumulated, together with very competent engineering teams that are constantly improving the products. However, given how fast this market is likely to grow, competition in the industry will probably intensify.

Conclusion

Wallbox is a very promising company, that in many ways resembles more a startup than a public corporation. It is still in hyper-growth mode, and how long it can sustain this level of growth is likely to determine whether shares are currently cheap. We estimate that if the company can maintain growth rates above 100% for at least the next 5 years, then shares are likely very cheap and priced to deliver attractive returns. However, do not forget that this is a company with significantly above average risk, and most investors should probably allocate a very small percentage of their portfolio to the opportunity, if they should invest at all.

Be the first to comment