Justin Sullivan

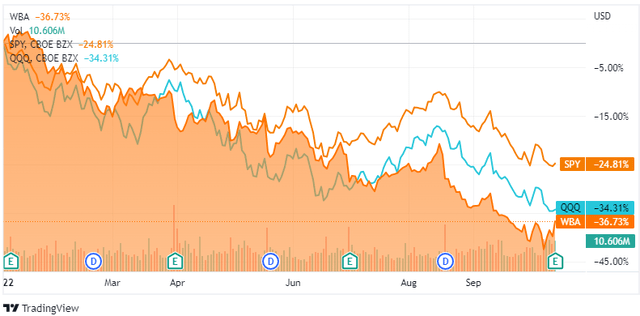

Walgreens Boots Alliance (NASDAQ:WBA) has underperformed the broad markets in 2022, falling -36.05%, while the SPDR S&P 500 Trust (SPY) has declined -24.81%, and the Invesco QQQ ETF (QQQ) has fell -34.31%. This has pushed this Dividend Aristocrat’s yield past 5.5% as WBA’s share price has swung from $55 to $30.40, peak to trough, and is now bouncing off the lows. WBA just posted a Q4 2022 beat on the top and bottom line and provided some encouraging forward outlook. I don’t believe WBA is going away and while its stock has declined by -6.59% since my first article, it outperformed the S&P 500 by over 3% since 9/5/22. I thought shares were inexpensive at $35.52, and I believe they are a great long-term dividend play under $35. WBA held the $30 level, and with the markets turning after the hot inflation report, a bottom in WBA may have been established.

Seeking Alpha

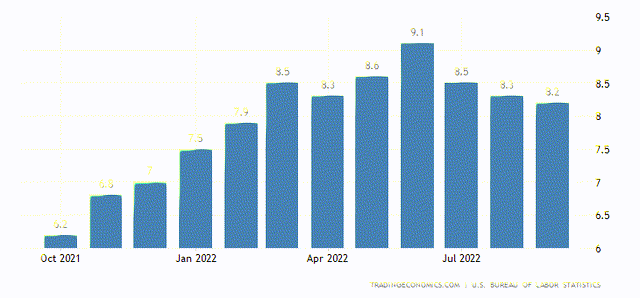

As inflation runs hot, WBA managed to beat on the top and bottom line in Q4

On Thursday, 10/13, the investment community received the latest CPI report, which indicated that inflation slowed for the 3rd consecutive month since June’s 9.1% print, but inflation remained above 8%, and above the consensus. The annual inflation rate came in at 8.2% and has remained above 8% since February 2022. WBA has shown that in the face of adversity, they can execute their long-term strategic plan.

Trading Economics

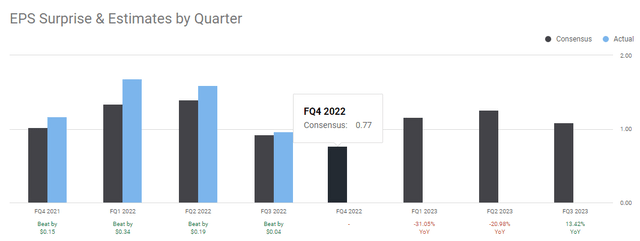

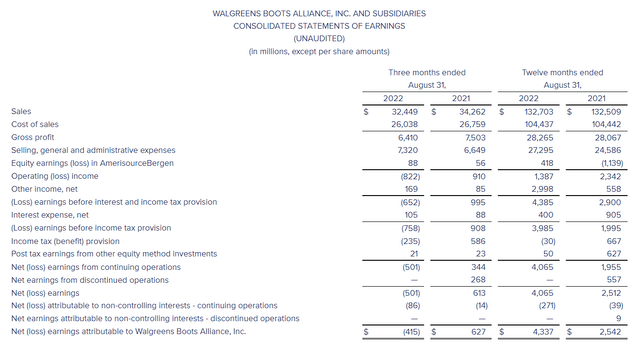

WBA delivered $32.45 billion of revenue in Q4, which was a beat by $280 million, and produced $0.80 of non-GAAP EPS, which was a beat of $0.03. WBA has added to its string of quarterly EPS beats and is delivered a solid 2022 fiscal year. For 2022, WBA generated $5.01 in EPS which was an increase of 117.6% compared to $2.30 in their 2021 fiscal year. WBA’s 2022 revenue increased 0.10% to $132.7 billion. WBA’s net income grew to $4.34 billion from $2.54 billion, which reflected a $2.5 billion after-tax gain in Q1 due to the remeasurement of the WBA’s investments in VillageMD and Shields Health Solutions, and a $1.2 billion charge from WBA’s equity earnings in AmerisourceBergen.

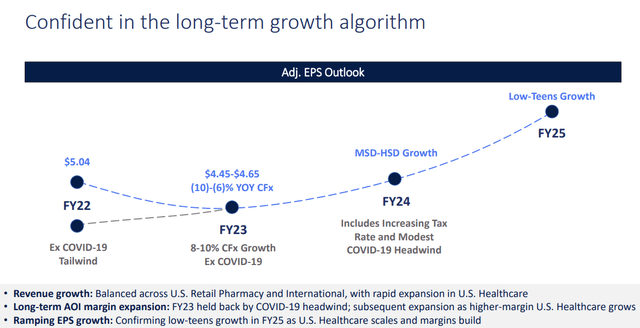

The analyst’s consensus in 2023 was for WBA to generate $4.49 in EPS from $134.36 billion in revenue. WBA guided for $4.45 to $4.65 of EPS in 2023 and raised its U.S Healthcare 2025 sales target to $11-$12 billion from $9-$10 billion. WBA expects to generate positive EBITDA from U.S Healthcare by fiscal year 2024.

Seeking Alpha

When I look through WBA’s financials, there are several aspects that I like. Inflation has had an average rate of 7.91% over the TTM, and WBA has managed to keep its cost of sales in-line. YoY, WBA’s cost of sales actually declined by -$5 million, rather than increasing as costs rose. WBA’s EPS increased from continuing operations increased from $2.30 to $5.01, even though a significant portion was due to other income, which was non-existent in 2021. While some may be concerned that such a large increase on a per share level was due to “other income” which isn’t reoccurring, WBA did forecast between $4.45 to $4.65 of EPS in 2023. WBA’s selling general and administrative expenses increased by $2.71 billion YoY, so I wouldn’t be surprised if this line item declines in 2023 to offset a portion of the other income that will not be generated.

Walgreens Q4 Earnings

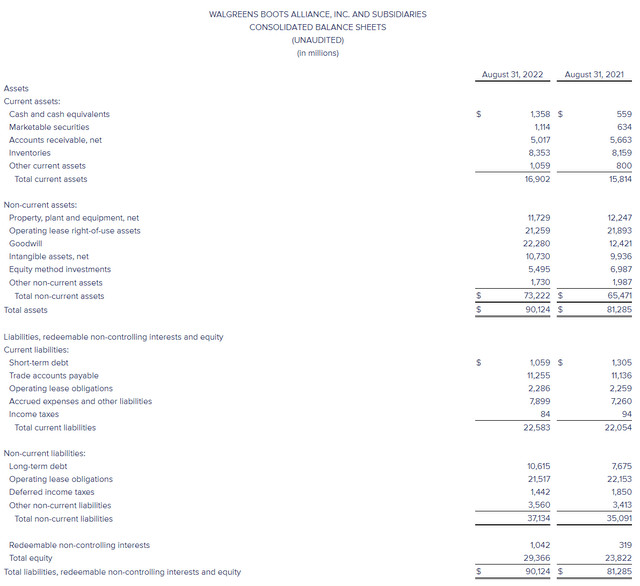

WBA has a market cap of $28 billion, and based on its balance sheet, it looks as if the market is discounting WBA. WBA’s total cash position between cash and cash equivalents and marketable securities increased by 107.21% from $1.19 billion to $2.47 billion. WBA isn’t a debt-ridden company, as they have $1.06 billion in short-term debt and $10.62 billion in long-term debt for a total of $11.67 billion between the two. WBA has 21.18% of its total short and long-term debt as cash on hand while generating billions in net income and FCF. WBA has a strong balance sheet with the means to facilitate its debt obligations. WBA also has $29.37 billion of equity on the books, which exceeds its market cap by $1.37 billion, which places WBA’s stock at a -4.49% discount to its equity.

Walgreens Q4 Earnings

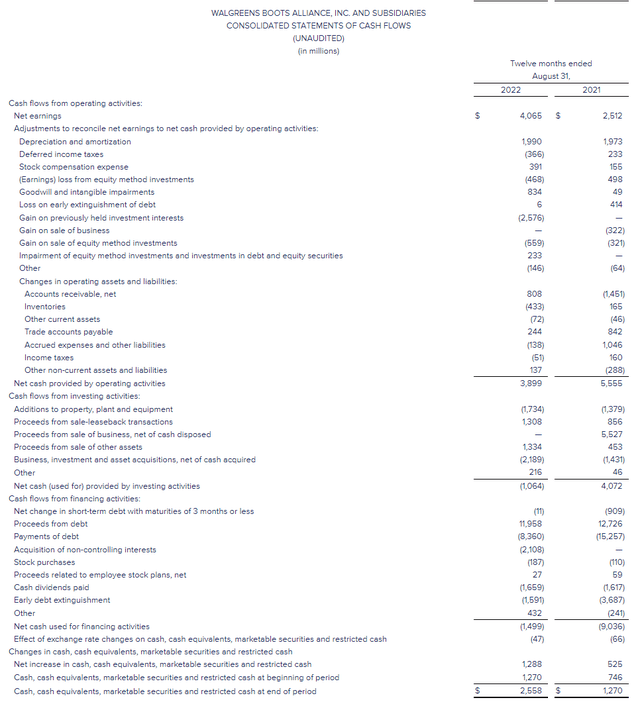

Looking at WBA’s statement of cash flow, WBA’s cash from operations decreased while its Capex increased, creating a decline in FCF. Cash from operations declined by -29.81%, while Capex increased by 25.74%. WBA’s FCF declined by -48.16% from $4.18 billion to $2.17 billion YoY. While WBA’s FCF declined significantly, it’s still trading at a 12.93x price to FCF multiple. FCF has been my favorite metric to understand how companies are valued in the market. FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. With every investment, you’re paying the current value for a company’s present and future cash flow.

There aren’t many companies that are similar to WBA, but I wanted to compare their FCF to other another retail company, so I will look at Target (TGT). TGT hasn’t reported earnings yet, so I will use their current TTM numbers. In the TTM, TGT has generated $427 million in FCF as they have generated $5.16 billion in cash from operations and spent $4.73 billion on capex. This places their price to FCF at 166.47x. WBA is still generating billions in FCF even though their cash from operations has declined, but looking at the company as a whole, it looks attractive at its price to FCF valuation.

Walgreens Q4 Earnings

Walgreens isn’t a one-trick pony and its turnaround story is more than just brick and mortar retail

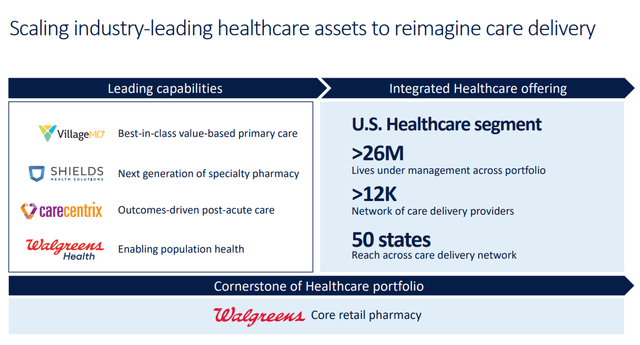

I like the healthcare space because every person utilizes healthcare services from primary care to wellness & prevention. It’s an industry that’s going to become obsolete. WBA has worked on four pillars in its transformation, which includes transforming and aligning the core in its retail pharmacy business, building its next growth engine with consumer healthcare solutions in U.S Healthcare, focusing on the portfolio and optimizing capital allocation, and building a winning team throughout the organization.

Walgreens

In pillar 1, transforming the core, WBA has exceeded its goals. The myWalgreens membership has 102 million subscribers, they have generated $125 million of alternative business profit income in 2022 with a goal of $300 million by 2025, and U.S retail sales growth grew 6.1% YoY. In pillar 2, Walgreens Health exceeded its expectations of covering 2 million individuals with 2.3 million, is on track to have 5 health plan partners, and is on track to have 100+ health corner locations. WBA is also on track to have 200 co0located clinics through Village MD. In pillar 3, WBA has optimized its portfolio to prioritize U.S Healthcare while monetizing assets and simplifying its investment portfolio. In pillar 4, WBA has brought in 3 new U.S executives, including John Driscoll, who has over 25 years of healthcare experience, including being the former President of Castlight Health, founding Surescripts ePrescribing Network, and leading new markets at Medco.

WBA is creating a care model that reaches every section of the value chain. In the wellness and prevention segment, Walgreens retail pharmacy will remain its cornerstone, acting at the last mile of healthcare. The Walgreens health corners will be pharmacist-led locations partnering with physicians. On the primary care side, WBA’s Village MD will create a patient-centered MSO service. Shields Health Solutions will act as their specialty care segment, which will include behavioral and mental health. Lastly, Carecentrix will be the post-acute side delivering home care services.

WBA has raised its outlook for revenue generated from U.S healthcare to $11-$12 billion and outlined a path to profitability. While budgeting for COVID-19 headwinds and increasing tax rates, WBA has indicated that 2023 EPS will come in between $4.45-$4.65, 2024 will look similar to 2022 with around $5.04, and in 2025 they will see growth in the mid-teens. This will allow WBA to strategically deploy capital to growth projects and to reward shareholders through a growing dividend and buybacks.

Walgreens

Walgreens dividend yield is very attractive, above 5%.

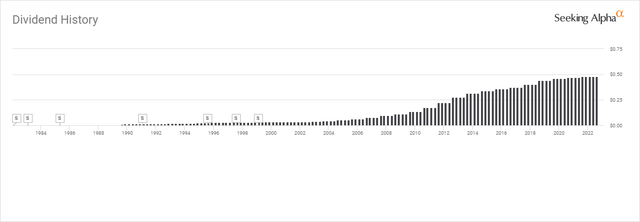

WBA is a Dividend Aristocrat approaching Dividend King status as it increased its annual dividend for 46 consecutive years. WBA currently pays a dividend of $1.92, fully covered by the $5.01 of EPS it generated in 2022. On the low end of 2023’s EPS guidance, WBA would produce $4.45 of EPS, creating a dividend payout ratio of 43.15%. WBA has a large amount of room to provide future dividend increases and join the Dividend King club in several years.

On page 32 of the Q4 presentation, WBA outlined dividend growth as a capital allocation priority. Over the previous 5-years, WBA has had a 4.63% average dividend growth rate, and with such a large spread between the EPS and dividend, I would expect WBA to continue its robust increases. Currently, we’re in a high-yield environment where the 10-year sits around 3.95%, and investors are not starving for yield. WBA offers an alternative to the 10-year with a larger yield and a dividend that should grow sequentially YoY for the foreseeable future. I believe WBA is an attractive dividend opportunity for income investors to consider.

Seeking Alpha

Conclusion

WBA is executing its turnaround plan, and I like what I see in its projections. I feel that WBA shares have become too cheap, and for the 9th consecutive quarter, WBA surpassed the consensus EPS estimate. As an income investor, I think shares of WBA are cheap, under 15x FCF, and a 50% dividend payout ratio. I plan on adding to my position in the low to mid $30s and reinvesting the dividends every quarter. In a high-yield environment, many companies offer smaller yields than the 10-year, but WBA may offer an income and capital appreciation opportunity at these levels.

Be the first to comment