Michael M. Santiago/Getty Images News

Inflation is your #1 enemy in the long term

This article analyzes Walgreens Boots Alliance (NASDAQ:WBA) and CVS Health (NYSE:CVS) under the context of a long-term holding in our family retirement portfolios. Both are good examples to illustrate our investment strategy and the philosophy of our newly launched marketplace service. We have been holding both for several years and have exited our CVS position recently due to its valuation expansion (to be detailed later), and we are still holding WBA.

You will see why they are good candidates to fight the surging inflation, the #1 enemy for long-term financial security. You might feel a bit strange that we hold a stock like WBA or CVS for this purpose. You are probably more familiar with the idea of using high-yield stock to fight inflation. And WBA’s dividend yield is “only” 4% and CVS about 2%.

A key lesson we’ve learned is that at any stage in life, we always need to clearly delineate short-term issues from long-term issues. So contrary to the popular advice of building “a” retirement portfolio or “the” perfect retirement portfolio, we suggest you always build 2 portfolios – one for the long term (for example, to take care of things 30 years later and estate planning for kids/grandkids) and one for the short term (in case you need to visit the ER next month). This is diversification at a grand level!

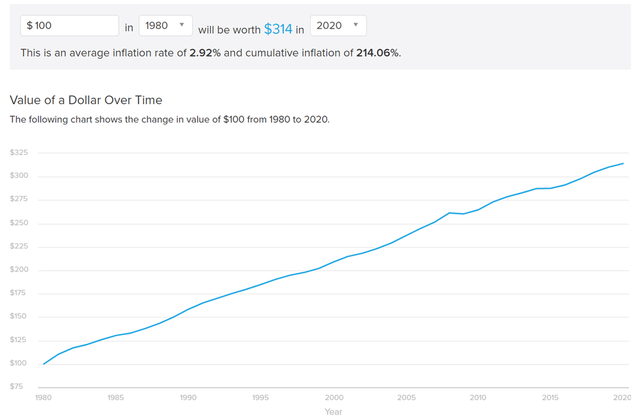

And inflation is your #1 enemy in the long term, as you can see from the following chart. In 40 years, you will need more than $314k to maintain the same purchasing power of a current $100k income if inflation averages 2.92% – the average inflation in the US from 1980 to 2020. Also, note that the inflation rate between 1980 and 2020 is relatively mild. If you shift the timeframe by 10 years to 1970 to 2010, the average historical inflation rate would be 4.45%, and more than $562k would be needed to maintain the same purchasing power of a current $100k income.

Source: smartasset.com/investing/inflation-calculator

Under this background, hope it now feels less strange why we consider WBA and CVS for anti-inflation purposes in our retirement portfolios. The considerations are for their long-term prospects, not for the current income or short-term gain. You will see from this article why they can be a key hedging piece against several long-term risks. In particular:

- Both WBA and CVS have demonstrated pricing power in the long term to not only hedge inflation risk but also to fight back. They both enjoy secular support in the long term because healthcare cost has and will continue to surpass inflation.

- Furthermore, both also provide an earnings yield that is well above treasury rates, therefore providing you with a safe cushion against interest uncertainties.

- Both feature a reasonable valuation, both in relative and absolute terms. In WBA’s case, it features a large discount, providing a further margin of safety.

- And finally, both enjoy bright growth prospects in the coming years. As to be detailed later, for WBA, I am optimistic about the new leadership team and their initiatives on growth, especially the in-store healthcare clinics. For CVS, it enjoys growth opportunities from its vertical integration and the aggressive roll-out of its virtual and in-store clinics. Finally, the growth stagnation due to COVID vaccination should be only temporary in my view.

WBA and CVS: Staying power and pricing power

You are probably more familiar with the idea of using high-yield stock to fight inflation. However, in the long term, pricing power and staying power are the ultimate hedges against inflation. And both WBA and CVS have demonstrated plenty of pricing and staying power.

Firstly, both are aided by a secular tailwind in the long term. The healthcare sector is a great place for value investors because it caters to a fundamental human need that is not going to change or go away anytime soon. All signs show that the need will only intensify with population growth, longer life expectancy, more interconnected world, et al. The following projection from the US Medicare and Medicaid center highlights such long-term secular support. National health spending is projected to grow at an average annual rate of 5.4%, far exceeding inflation, for 2019-28 and to reach $6.2 trillion by 2028.

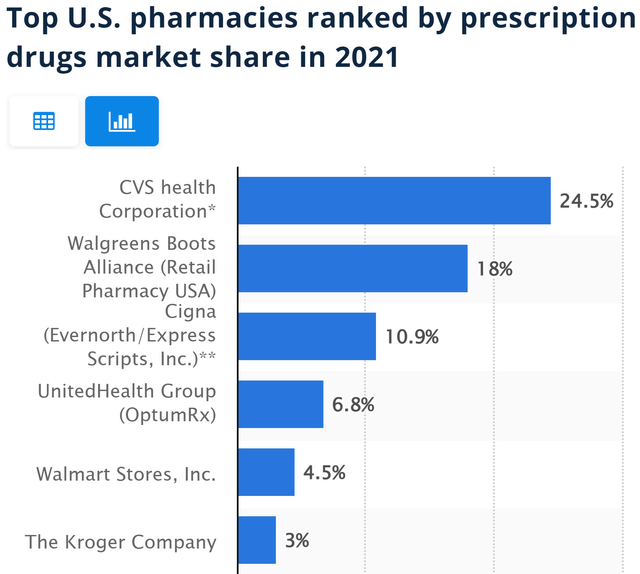

Besides the secular support, both also enjoys a wide moat due to their scale and depth of reach. CVS and WBA are the top 2 pharmacies by prescription drugs, as you can see from the following chart, and I am optimistic that they will stay as the scale leader. The market has worried about the competition from new online entrants such as Amazon several years ago. However, I think the market exaggerated the competition and overacted to it. Let’s put things under historical perspective and examine a recent case study when Walmart entered the retail pharmacy market. At that time, WMT was as formidable a force as Amazon is today. Yet, it took more than a decade for Walmart to grab about 4.5% of its market share today. And the market share grabbed by Walmart came from the weaker players, not the top players like WBA or CVS. Since Walmart entered the retail pharmacy, the market shares of WBA (and CVS too) have actually grown.

Source: Largest U.S. pharmacy by prescription revenue share from Statista

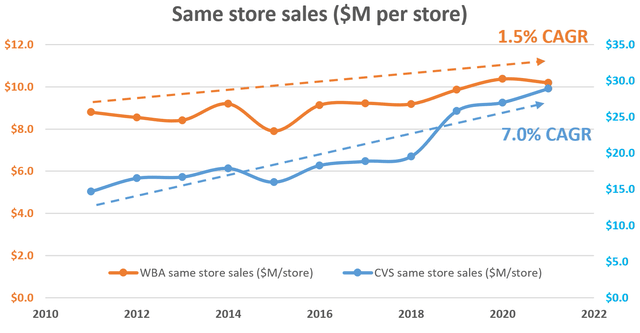

Another very telling indicator of their competitive advantage is the same-store sales, as shown in the following chart. First, again, both WBA and CVS have actually been growing both in scale and profitability since Amazon decided to join the pharmacy space. The number of stores increased from 8,210 at the beginning of the decade to about 14,000 today. And at the same time, their same-store sales have also increased as seen from the chart below. In WBA’s case, it increased from about $8.5M per store in 2011 to more than $10M per store now, at an annual CAGR of 1.5%. CVS’ case is even more impressive. It increased from about $14.7M per store in 2011 to almost $29M per store now, at an annual CAGR of 7.0%. A large reason of CVS’ better same-store metrics involves its acquisition of Aetna in 2018. The acquisition of Aetna created substantial vertical consolidation opportunities and accelerated the same-store growth as you can see by the uptick after 2018 in the chart below.

But in both cases, the same-store sales are quite healthy and competitive. To put things under perspective, the sales of a Walmart store on average are about $50 million, about five times that of a WBA store and two times of a CVS store. But think about how much larger a WMT store is compared to a WBA or CVS store to make the extra sales.

WBA and CVS: Earnings yield far above interest rates

Another factor inseparable from inflation is the risk-free rates. If treasury bonds yield significantly above inflation, then fighting inflation would be pretty straightforward. For example, if 30-year Treasury bonds yield 4%, then purchasing them would protect against inflation up to 4% for the next 30 years.

However, the current low interest rate environment certainly makes fighting inflation very challenging for ordinary investors. With the current 10-yr treasury bond yield rate near 2.3% and inflation expected to be 7%+, bond investors would be actually losing money – quite a bit at least in the short term. Although note that this discussion largely depends on the timeframe. I do not expect the current 7%+ inflation rate to sustain itself in the long term. And in the case that it does, then the Treasury yields would have to adjust and won’t remain only at 2.3%. But under the current conditions and in the near term (not sure how long this will last), bond investors would be taking return-free risks instead of enjoying the risk-free return that bonds are supposed to offer.

This is where WBA and CVS can help in a second way.

Many investors only consider dividend yield as “yield”. Admittedly, for investors who seek current income, only a cash dividend matters. However, for other long-term investors, earning yield is what’s really matters. The reason is that it doesn’t really matter how the business uses the earnings (paid out cash dividends, retained in the bank account, reinvested to further grow the business, or used to repurchase stocks), as long as used sensibly (as both WBA and CVS has demonstrated in the past), it will be reflected as a return to the business owner. That is why earning yields are more fundamental for long-term shareholders.

In particular, I especially favor the use of pretax earnings (or EBT, earnings before taxes) yield for the following reasons as detailed in my other writings:

• After-tax earnings do not reflect business fundamentals. Taxes can change from time to time due to factors that have no relevance to business fundamentals, such as tax law changes and capital structure change. Plus, there are plenty of ways to lower the actual tax burden of a company.

• Pretax earnings are easier to benchmark, say against bond earnings. The best equity investments are bond-like, and when we speak of bond yield, that yield is pretax. So a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond.

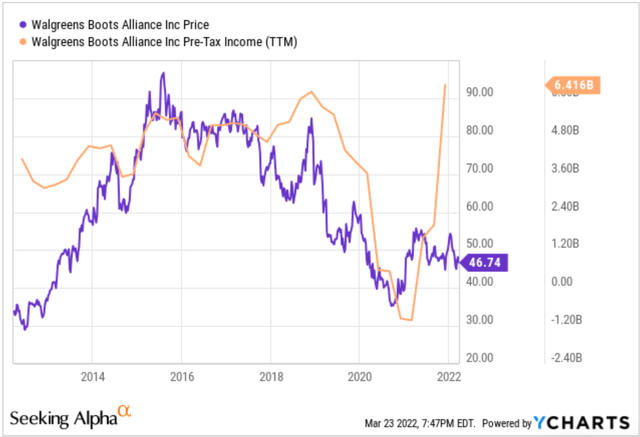

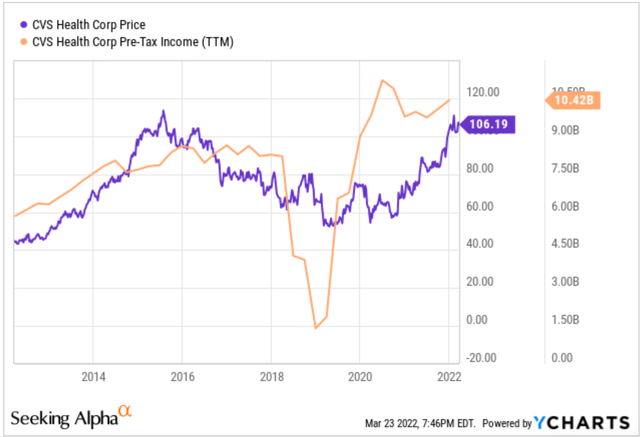

And as of this writing, WBA is trading at about 7.8x FW EBT and CVS at about 9.3x FW EBT, therefore both equivalent to an equity bond yielding 10%+.

Seeking Alpha and YCharts Seeking Alpha and YCharts

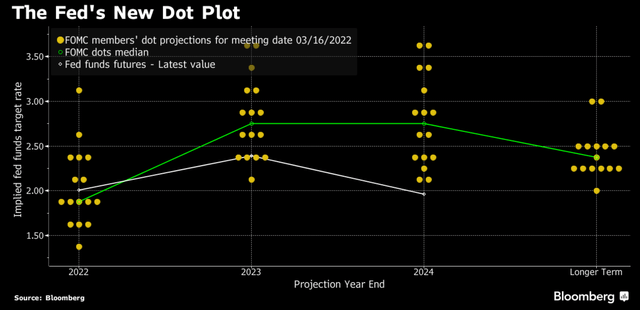

Now, let’s consider the worse scenario for the interest rates in the next few years based on the Fed’s dot plot as shown below in the chart below the table. The chart shows the dot-plot from the most recent Fed meeting minutes. And their longer-term projections are in the range of 2% to 3%, on average 2.5% above the current near-zero rates. Let’s suppose the interest rates do rise according to this dot plot. And to make a worst-scenario forecast, let’s further assume that A) the rates rise to the ceiling of this dot plot, and B) the 10-year treasury rates always stay about 2% above the Fed fund rates. Under these assumptions, the 10-year treasury rates will be about 5% in the long term.

As seen, even under these dramatic assumptions, both WBA and CVS still provide a yield spread comfortably above or on par with the 10-year treasury rates – even if their earnings completely stagnate for the next few years.

Source: Fed’s latest dot-plot released Mar 2022.

WBA and CVS: Both reasonably valued

Finally, let’s take a look at their valuations.

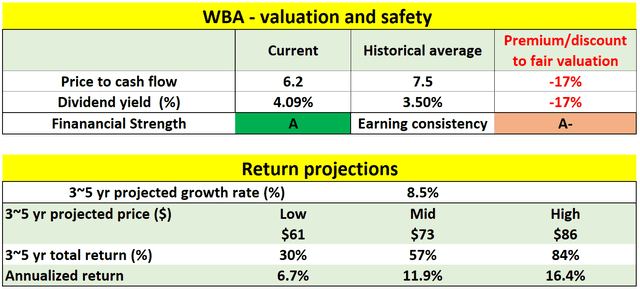

For WBA, as you can see from the table below, it is substantially undervalued, by about 17%, both in terms of dividend yield and price to cash flow multiples. For the next 3-5 years, an upper single-digit annual growth rate is expected (about 8.5%) in my analysis. And the consensus projects an even higher growth rate, about 11% CAGR to 2026. Even with an 8.5% growth rate, the total return in the next 3-5 years is projected to be in a range of 30% (the low-end projection) to about 84% (the high-end projection), translating into a healthy 6.7% to 16.4% annual total return. The key growth drivers in my analysis are:

- The new leadership team and their initiatives on growth. WBA has appointed Rosalind Brewer as the new Chief Executive Officer, and Stefano Pessina as Executive Chairman of the Board. Brewer is a 35-year consumer and retail industry veteran with deep experience in transformational, operational, and digital strategies. Pessina is an industry legend who built the WBA as it is today. And he holds a 16.5% stake in WBA, and the majority of his personal fortune is vested in WBA. I am very optimistic about this new management team – a very capable CEO and a board chair who has real skin in the business.

- And I welcome many of the new initiatives that they are undertaking. Walgreens is investing in in-store healthcare clinics and undertaking major portfolio reshaping. It has recently acquired majority stakes in VillageMD and CareCentrix. These investments should reignite earnings growth in fiscal 2023 and thereafter.

- Lastly, at its current undervaluation, share repurchases will be very effective and accreditive to boost shareholder returns.

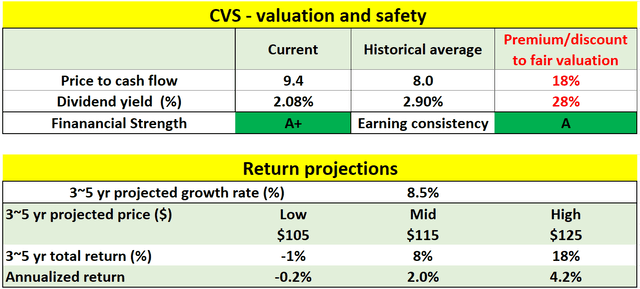

For CVS, as you can see from the table below, it is moderately overvalued, by about 18% in terms of its historical price to cash flow multiples and by about 28% in terms of its historical dividend yield. For the next 3-5 years, a similar growth rate is expected (about 8.5%) considering its Aetna integration and rollout of clinics. Due to its current valuation, the total return in the next 3-5 years is projected to be in a range of -1% (i.e., breaking even) to about 18% (translating into a 4.2% annual total return). It is not the most exciting return. However, it is more appealing than on the surface when adjusted for risks if you consider its super financial strength (A+), earning consistency (A), and also the secular tailwind aforementioned. Looking forward, the key growth drivers include:

- Each of CVS’ three business units inked between 9% and 10% advances. In particular, CVS has been aggressively rolling out its virtual and in-store healthcare clinics.

- Due to the slowing projection of Covid-19 vaccination rates, management is expecting stagnation for 2022. However, the growth rate is projected to pick up again, and management expects high single-digit growth in 2023 and double-digit starting 2024 to 2026 – very consistent with the consensus estimates.

- Finally, there is also a possibility for that additional COVID-19 shots may be approved and provide another catalyst for CVS.

Risks

Though both stocks face some risks – risks common to both and also risks unique to each of them.

Both stocks face some downside risks due to the pandemic. Both stocks were impacted on the front end and pharmacy sales during the COVID-19 outbreak. Although the vaccination is progressing extensively, the pandemic is far from over yet, and uncertainties like new variants still exist. The interruptions continue to hurt store foot traffic.

Both (and the healthcare sector in general) are exposed to policy uncertainties too. Reimbursement pressure, higher prescription attrition from Part D relationships, and the risk of disruptive force entering the supply chain (such as Amazon) all pose risks to its fundamental profitability.

For WBA, there are some uncertainties with its undergoing initiatives. The leadership is undertaking a range of strategic restructures. Some of the key efforts include the recent divesture of Alliance Healthcare, its recent $970M investment in Shields Health Solutions, and a potential takeover of healthcare IT firm Evolent Health. I am bullish about these strategic initiatives myself. However, these initiatives have high uncertainty and high reward flavor, and all have a degree of uncertainty in their outcomes.

For CVS, it depends more heavily on debt financing after its Aetna acquisition, and there are some risks with Fed’s plan to raise interest rates in the near term. CVS’s current long-term debt is about $58B. Hence, a 1% increase in its interest rate would translate into $580M of additional interest expenses. Its net profit is about $10.4B in 2021. Therefore, the additional interest expenses are about 5.5% of its net profit, a non-negligible risk. Although, the reality is more complicated and could be better or worse than my estimate here. For example, there’s always the possibility that the interest rates rise more dramatically than the Fed’s current dot-plot, or that its borrowing rates rise faster than the Fed rates. On the other hand, CVS’s debt (like any sensible company) is well-laddered. So the effects of higher interest costs will be gradual and not abrupt to give management time to respond and adapt.

Conclusion and final thought

This article analyzes WBA and CVS under the context of a long-term holding for our retirement portfolios. First and foremost, we suggest you always delineate short-term and long-term financial needs and build 2 portfolios correspondingly. Second, always recognize the danger of inflation in the long term.

Under this background, the thesis of this article is that both WBA and CVS provide effective hedges against several fundamental risks in the long term. In particular,

- In the long term, staying power and pricing power are the ultimate hedge against inflation. And both WBA and CVS have demonstrated plenty of both thanks to their scale and the secular tailwind of our increasing need for better healthcare.

- Both WBA and CVS also provide earnings yields that are far above treasury rates or the projected treasury rates. They thus provide investors with a safe cushion against future interest rates uncertainties.

- Finally, WBA’s current valuation features a substantial discount. And CVS features a reasonable valuation both in absolute terms and especially in relative terms. Compared to the overall market, both provide a hedge against market valuation risks.

Be the first to comment