undefined undefined

Investment Thesis

W.W.Grainger (NYSE:GWW) is experiencing good demand for its products which is benefiting the company’s revenue growth. The company is targeting its High-Touch Solutions segment to outgrow the U.S. MRO market by 400 to 500 bps through its focus on merchandising, marketing, seller coverage, seller effectiveness, and consumer solutions. GWW also plans to grow its Endless Assortment segment by adding two million SKUs to its Zoro business in 2022 and opening a new distribution center (DC) for its MonotaRO business. However, the margin prospects don’t look good and the valuations are in line with its historical levels indicating the stock is not particularly cheap. So, I am on the sidelines for now.

Revenue Growth Prospects

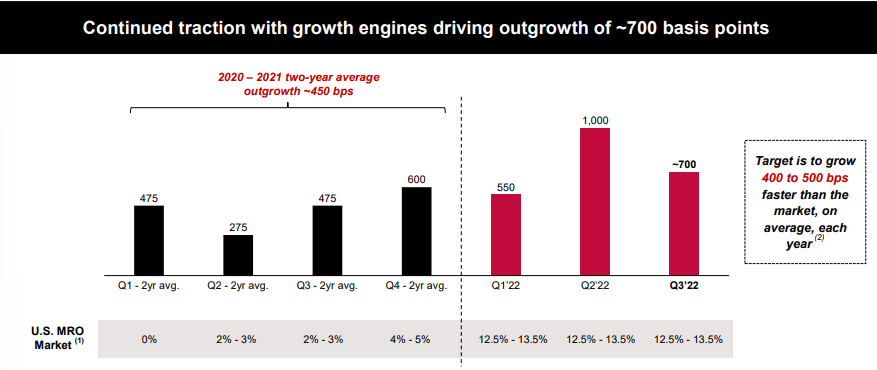

GWW is continuing to experience a dynamic market, with some end markets experiencing weakness, some industries still on the upswing, and some moderating. The daily sales in the third quarter grew 16.9% Y/Y with growth across the High-Touch Solutions and Endless Assortment segments, partially offset by the depreciation of the Japanese yen. The High-Touch Solutions segment’s daily sales grew 19.4% Y/Y. The segment saw growth across all the geographies and ~20% growth from both midsized and large customers in the U.S. The U.S. daily sales grew 20% due to volume growth (7.4% Y/Y) and higher price realization (12.6% Y/Y). The U.S. High-Touch Solutions segment was able to outgrow the U.S. MRO market by 700 bps in the quarter.

GWW’s High Tough Segment Outperformance (Investor Presentation)

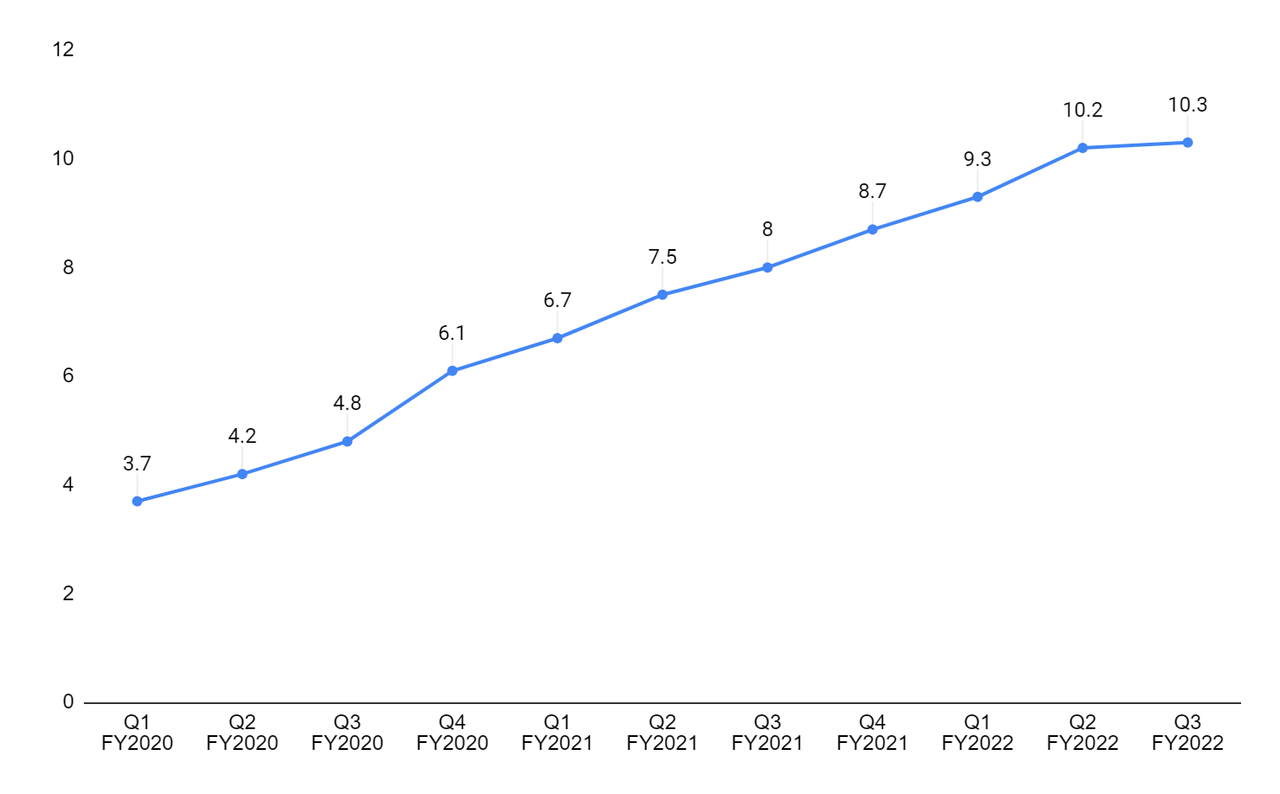

The daily sales in the Endless Assortment segment increased 8.6% Y/Y driven by strong new customer acquisition and enterprise customer growth at MonotaRO, partially offset by a 15.1% impact of negative currency translation due to Japanese yen depreciation. The total registered users in the quarter for Zoro and MonotaRO combined was up 17% Y/Y whereas the total active SKUs for Zoro U.S. was up 29% Y/Y at 10.3 mn.

Zoro U.S. total active SKUs (Investor Presentation, GS Analytics Research)

Management’s target for the High-Touch Solutions segment is to outgrow the U.S. MRO market by 400 to 500 bps. This should be done through the company’s strategic growth engines and the strength of its supply chain. The five growth engines primarily focus on merchandising, marketing, seller coverage, seller effectiveness, and customer solutions. Merchandising is about organizing products and having complete and accurate product information. Marketing includes raising brand awareness through TV advertising, digital advertising, and e-mails. Seller coverage is about expanding the sales force to different business locations. Seller effectiveness is about making its sales force more effective and customer solutions include providing value to its customers by working closely with them.

The growth in Endless Assortment is underpinned by capturing strong repeat and enterprise customer business in the MonotaRO business and rapidly adding SKUs in the Zoro business. Zoro is ramping up its product count quickly by leveraging Grainger’s product assortment and suppliers. Zoro is planning to add two million SKUs in 2022 and has a robust pipeline to meet that goal. The business has already added 1.6 million SKUs until the end of Q3 FY22. The company is ramping up its investment in Japan to open a new distribution center (DC) in Inagawa, Japan, for its MonotaRO business.

Despite the uncertain market conditions, the daily sales growth of GWW in October was trending up 16% Y/Y or 21% Y/Y on a constant currency basis when it reported its earnings in late October. Most of GWW’s products are non-discretionary to its customers, benefiting the company during this time of uncertainty. The daily sales growth in Q4 FY22 is facing tougher comps and should moderate in November and December. The later part of Q4 is also a seasonally slow period due to holidays. Additionally, the foreign exchange headwind due to the depreciation of the Japanese yen is expected to continue. Management has guided daily sales to grow in the range of 15.5% to 16.5% Y/Y for the full year of 2022. This implies that Q4 FY22 sales will grow approximately in the range of 9% to 13% Y/Y.

In the long term, management is targeting $19 bn to $20 bn in revenue by 2025. This target implies meaningful growth versus the current year’s $15.1 bn consensus revenue estimates and is supported by strong growth in both segments, including a 6% to 8% CAGR from the High-Touch Solutions segment and 16% to 18% in the Endless Assortment segment, with 2022 as the base. While the macros are certainly tough and it might not be easy to meet FY25 revenue targets, I believe the company-specific initiatives should enable GWW to meaningfully outperform end-market growth. So, I am optimistic about the company’s long-term revenue growth outlook.

Margin Outlook

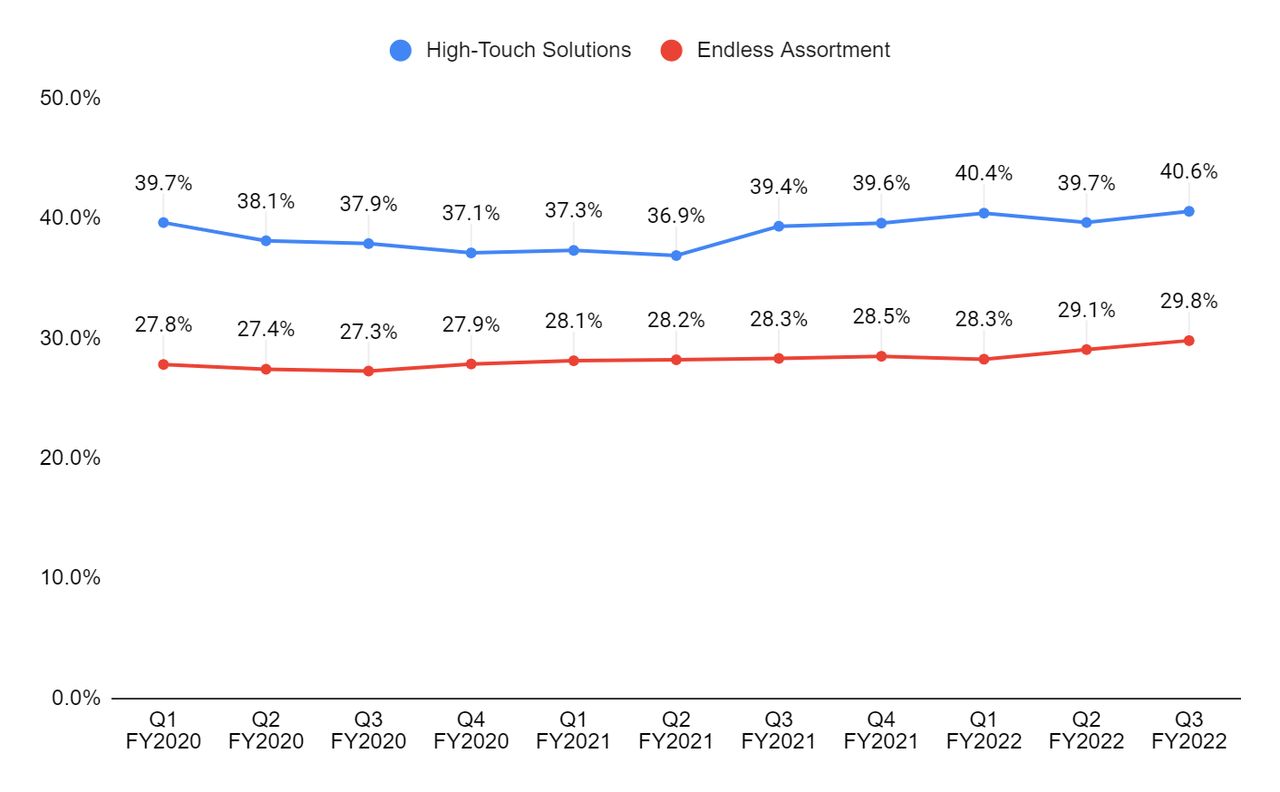

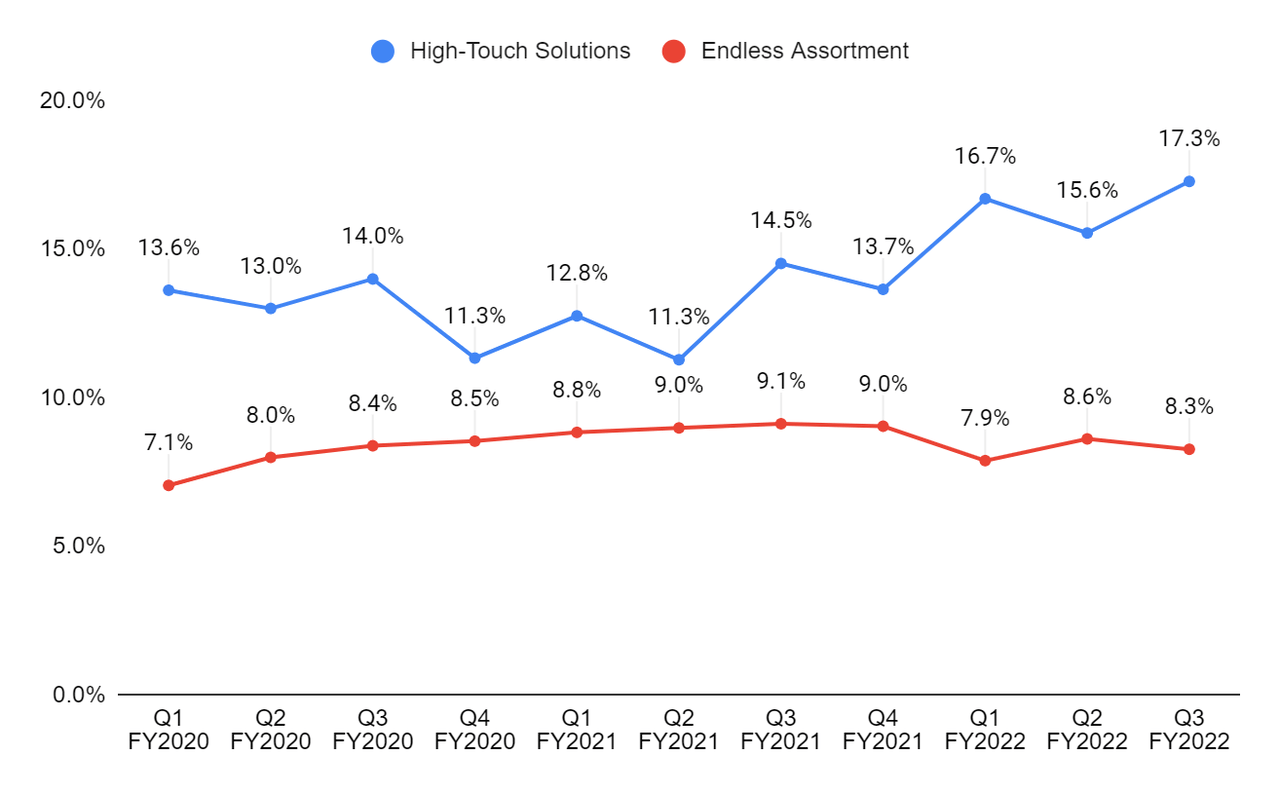

In Q3 FY22, the company’s gross margin improved by 140 bps Y/Y to 38.5% due to product mix tailwinds and price/cost favorability. The strong gross margin performance, coupled with lower SG&A costs, led to a 15.3% operating margin, an increase of 230 bps Y/Y in the quarter. The High-Touch Solutions segment’s gross margin improved by 125 bps Y/Y to 40.6% due to product mix, favorable price/cost spread (50 bps), and timing benefits from the cost negotiations with its suppliers, partially offset by heightened freight costs.

The Endless Assortment segment’s gross margin increased by 130 bps Y/Y to 29.8%, benefiting from the favorable business unit mix as Zoro grew faster than MonotaRO in the quarter. This growth was partially offset by freight inefficiencies due to the increased average order value. However, the segment operating margin declined 95 bps Y/Y to 8.2% due to the start-up costs for the new Inagawa Distribution Center as well as investments to support growth in both businesses.

GWW’s segment-wise gross margin (Company Data, GS Analytics Research)

GWW’s segment-wise operating margin (Company Data, GS Analytics Research)

Looking Forward, in the High-Touch Solutions segment, the company is targeting a consistent gross margin of around 40% going forward. This should be achieved by staying market competitive and targeting price/cost neutrality. The Endless Assortment segment’s margins should be contract driven by the customer mix at MonotaRO as they increase growth with enterprise customers and the supplier mix at Zoro as they continue to add SKUs beyond Grainger’s assortment. For the overall company, since low-margin Endless Assortment is expected to grow at a faster rate than the High-Touch solutions business, it should drag the overall margin lower due to mix impact. While it should be partially offset by the benefits of SG&A leverage due to sales growth, I am not optimistic about the company’s margin prospects.

Valuation & Conclusion

The stock is currently trading at a P/E of 20.71x FY22 consensus EPS estimate of $29.17 and a P/E of 19.86x FY23 consensus EPS estimate of $30.42, which is close to its five-year average forward P/E of 20.02x. Despite the near-term headwinds, the company is experiencing good demand across some of its markets, which is benefiting revenue growth. GWW also has good medium to long-term revenue growth prospects as it is targeting to outgrow the U.S. MRO market through its strategic initiatives, adding new SKUs for its Zoro business, and starting a new distribution center in Inagawa, Japan for the MonotaRO business. However, I am not too optimistic on the margin front due to the mix impact from faster growing endless assortment business. Also, since the stock is already trading in line with its historical levels, it is not particularly cheap. Hence, I would prefer to be on the sidelines and have a neutral rating on the stock.

Be the first to comment