Florent Molinier

Investment Thesis

W.W. Grainger (NYSE:GWW) should benefit from the strong demand for its product in the second half of FY22, despite the concerns of recession in the market. The company is implementing strategic initiatives across its business portfolio to improve its revenue. These initiatives includes remerchandising, marketing to improve brand recognition and gain market share, KeepStock inventory management system, and focus on Technology. The company’s revenues benefited from these initiatives in Q2 FY22 and this strength is expected to continue in 2H FY22. However, margin outlook is mixed with a sequential decline expected in the second half of this year. Also, the stock looks fairly valued, trading inline with its historical valuations. So, I have a neutral rating on the stock.

GWW’s Q2 FY22 Earnings

W.W. Grainger recently reported its second quarter FY22 financial results that were better than expected. The net sales in the quarter were up 19.6% Y/Y at $3.8 bn (vs. the consensus estimate of $3.7 bn). The EPS in the quarter was up 68.4% Y/Y to $7.19 (vs. the consensus estimate of $6.65). The net sales grew due to the strong performance across the High-Touch Solutions and Endless Assortment segments, partially offset by the unfavorable impact of a negative 2.4% foreign currency translation. The gross margin in the quarter grew 255 bps Y/Y to 37.6% due to the absence of pandemic-related product headwinds. The operating margin expanded 350 bps Y/Y to 13.9% due to the improvement in gross margin and a 100 bps improvement in SG&A as a percentage of revenue. As a result, the EPS in the quarter grew by 68.4% Y/Y.

Strong Revenue Growth Outlook

The company’s daily sales grew 19.6% Y/Y with in Q2 FY22. The growth was due to the strong performance across both the segments and the high tech segment performed especially well outgrowing the U.S. MRO market by 1,000 bps. Solid execution of strategic initiatives, including investments in remerchandising, data-driven programs, the KeepStock inventory management system and technology, and strong returns on inventory and supply chain investments drew this growth.

GWW’s merchandising team is increasing its assortment to help its customers choose from a variety of products on the company’s website. The company is also investing in marketing, especially in areas such as paid search, digital, and radio ads, helping the company to gain market share and brand recognition. Additionally, the company has been investing in technology and developing new product information and marketing support systems. The company also invested in the KeepStock inventory management system, which helps its customers manage their inventories and offers them valuable insights to save money and time. This, in conjunction with e-Procurement services, has helped its customers.

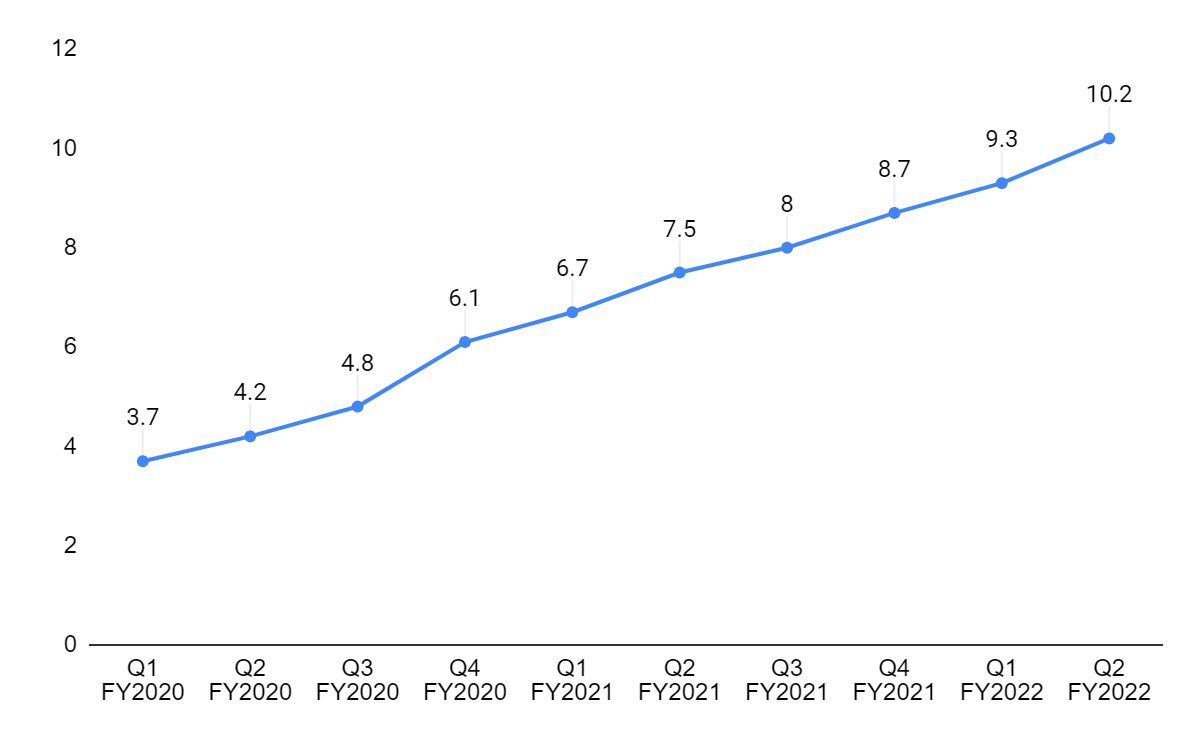

The daily sales of the High-Touch Solutions segment were up 22.2% Y/Y in the quarter due to broad-based double-digit growth across all geographies and over 20% growth in both midsized and large customers in the U.S. In the U.S., daily sales grew 23.1% Y/Y with double-digit volume growth and ~11% price realization, whereas in Canada, daily sales grew 11.1% Y/Y. The Endless Assortment (‘EA’) segment’s daily sales increased 11.1% Y/Y or 21.1% Y/Y on a local day constant currency basis after normalizing for the significant impact of the declining Japanese Yen. On a constant currency and local day basis, GWW’s online channels – MonotaRO and Zoro U.S. – grew 21.9% Y/Y and 23.2% Y/Y. The EA segment growth was driven by new customer acquisitions at both Zoro and MonotaRO, as well as enterprise and repeat customer growth at MonotaRO. The total registered users across MonotaRO and Zoro combined was up 18% Y/Y in the quarter, with 16% growth in MonotaRO users and 18.7% growth in Zoro U.S. users. The total active SKUs for Zoro U.S. was also up 36% Y/Y at 10.2 million SKUs in Q2 FY22.

Total Active SKUs (in millions) (Company data, GS Analytics Research)

Looking forward, through its strategic initiatives and tailwinds from its inventory position, the company is targeting to achieve 300 to 400 bps of annual market outgrowth each year in its High Touch business. With 1000 bps of outperformance last quarter, the company is easily outperforming this target and I expect this trend to continue. The company has been increasing its inventory position since mid-FY21 to maintain its service levels and handle the supply chain constraint efficiently. The company also plans to open two new distribution centers in Inagawa and Amagasaki for MonotaRO in FY22 and is ramping its investment in the region. In its Zoro business, the company is also investing in marketing, payroll costs, and technology to drive the business’s long-term growth. The company has also been adding new SKUs in the Zoro U.S. business and is targeting 2 million SKU additions in FY22, which is most likely to be exceeded as the company has already added 1.5 million SKUs in 1H FY22 itself. Management plans to continue adding new SKUs over the coming years and is targeting 20 million+ SKUs in the next four to five years. The company experienced strong demand for its products in 1H FY22, which is expected to continue in the second half. As a result, the company raised its daily sales guidance range to 14.5% to 16.5% for the full year 2022 from the previous range of 11% to 14%.

Mixed Margin Outlook

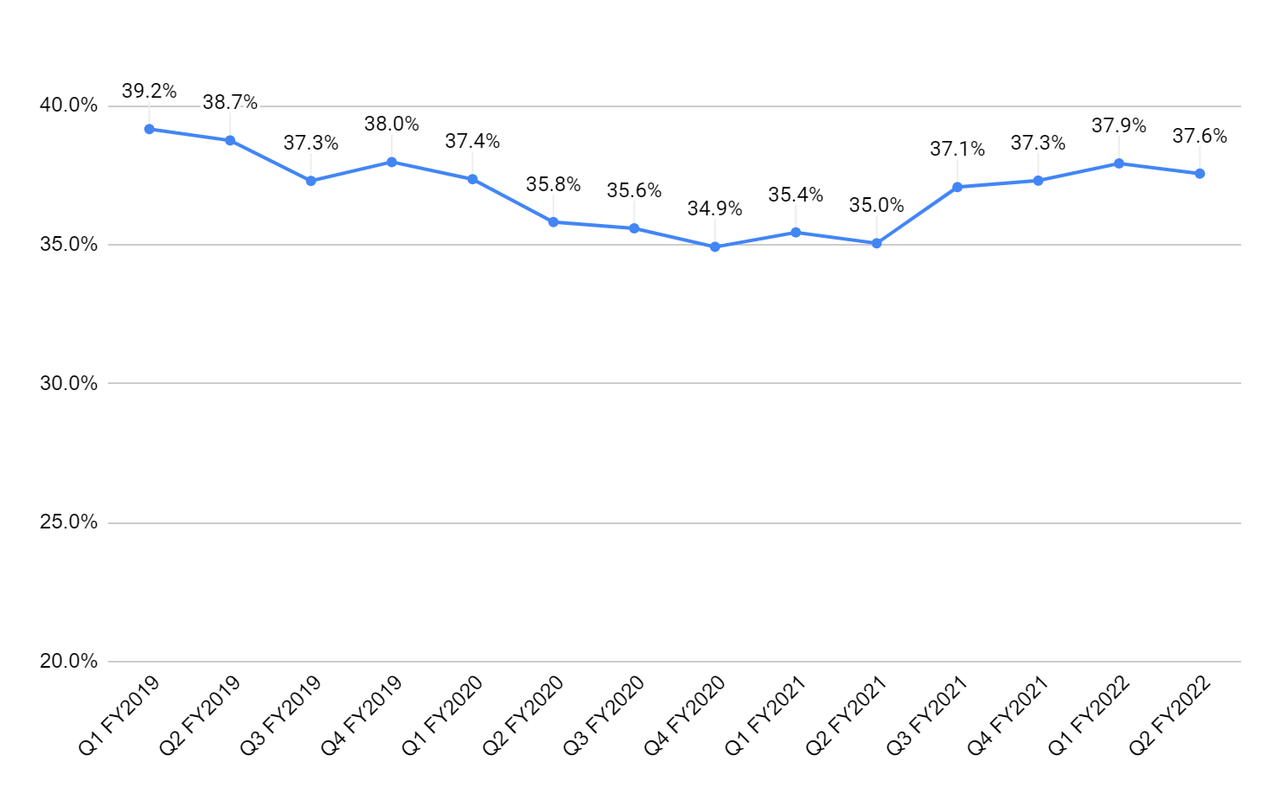

The company’s gross margin started to decline from Q3 FY20 as it had been selling lower margin pandemic-related products compared to non-pandemic products. Additionally, the company had placed large orders for certain products in Q2 FY20 and with the rapidly changing supply-demand characteristics, the company had to revalue its inventory levels, leading to lower gross margins. The company had sold almost all its pandemic-related products by 1H FY21 which led to an improvement in margins.

GWW’s gross margin (Company data, GS Analytics Research)

The gross margin of the company improved by 255 bps Y/Y in Q2 FY22, primarily due to the absence of the pandemic-related inventory adjustments. Excluding this adjustment, the company grew its margin by 60 bps Y/Y due to strong results across both segments. The gross margin for the High-Touch Solutions segment improved 275 bps Y/Y to 39.7%, driven primarily by lapping the pandemic product inventory adjustment in the prior year. However, excluding the adjustment, the margin grew 25 bps due to a favorable product mix and a neutral price/cost spread, partially offset by heightened freight costs. The operating margin improved by 425 bps Y/Y to 15.6% due to gross margin recovery and volume leverage. The gross margin of the Endless Assortment segment expanded 100 bps Y/Y driven by freight efficiencies as average order volumes increased at both Zoro and MonotaRO, as both continue to focus on B2B customers. The segment operating margin declined 25 bps Y/Y in the quarter due to the new Distribution Center at MonotaRO and continued investment in technology, marketing, and payroll costs to support growth at Zoro.

Looking forward, during this inflationary period, the company is trying to remain price/cost neutral by taking price hikes in terms of product costs and covering the majority of any incremental freight costs. The operating margin of the MonotaRO business should be impacted in 2H FY22 due to the investments in building two new distribution centers and this might impact the Endless Assortment margin as well. The margins of the High-Touch business are also seasonally weak in the second half. While the company has raised its total gross margin range to 37.2% to 37.5% and its operating margin range to 13.6% to 14%, it still implies sequential decline in margins in the second half. The Y/Y comparisons are also getting tough in the back half of this year. So, I am not too optimistic on the near term margin outlook.

However, the longer term margin prospects look good. The company’s margins are still below pre-Covid levels and with the supply chain related disruptions easing and GWW continuing to make investments in technology to improve the processes, the margins should improve in the long term. I expect the operating margin to normalize to pre-Covid levels in FY23. Further, the profitability of the Zoro business should improve going forward and reach high single digits over the next several years due to the company’s continuous investment and addition of new SKUs.

So, the margin outlook is mixed with a sequential decline in the second half of FY22 but long term improvement opportunity.

Valuation & Conclusion

GWW is currently trading at 19.86x FY22 consensus EPS estimate of $27.68 which is almost in line with the five-year average forward P/E of 19.87x. So, the stock looks fairly valued at the current levels. I believe the demand for the company’s products and the strategic initiatives should help drive market share and revenue growth. The company is also investing in opening new distribution centers which should help them better serve customers. So, the revenue outlook is good. However, margin outlook is mixed with a sequential decline expected in 2H FY22 and an improvement expected in FY23 and beyond. Mixed margin outlook and fair valuations keeps me on the sidelines despite good revenue growth prospects. Hence, I have a neutral rating on the stock.

Be the first to comment