Zephyr18/iStock via Getty Images

TrueShares Low Volatility Equity Income ETF (NYSEARCA:DIVZ) is an actively managed concentrated portfolio calibrated using the dividend, quality, value, and low volatility factors.

At first glance, this is a strategy perfectly prepared for a market storm we have been watching this year, as it should be capable of filtering out overpriced companies with poor balance sheets and fickle margins, those that are poised to suffer amid capital scarcity and, in the gloomiest scenario, a recession. Yet out of it, the portfolio will more likely underperform the S&P 500. The low volatility factor could reduce drawdowns marginally but when the market rebounds, less volatile equities typically languish, which raises a major question of whether it is worth chasing them for downside protection at all. This is an essential risk that safety-focused income investors should pay attention to, and I am uncertain whether DIVZ’s tilt toward high-quality equities will mitigate that.

Another vulnerability is its comparatively small AUM of just around $65 million, even though the flows trends look overall encouraging. As a reminder, funds with smaller assets have a greater risk of liquidation, and vice versa. In sum, I am of the opinion this vehicle deserves a Hold rating.

Investment strategy, performance, portfolio

Incepted in January 2021 during the heyday of vaccines-induced capital rotation, DIVZ is a comparatively novel investment vehicle, and thus its strategy has not been properly tested for now. Yet what we see at the moment is already fairly encouraging.

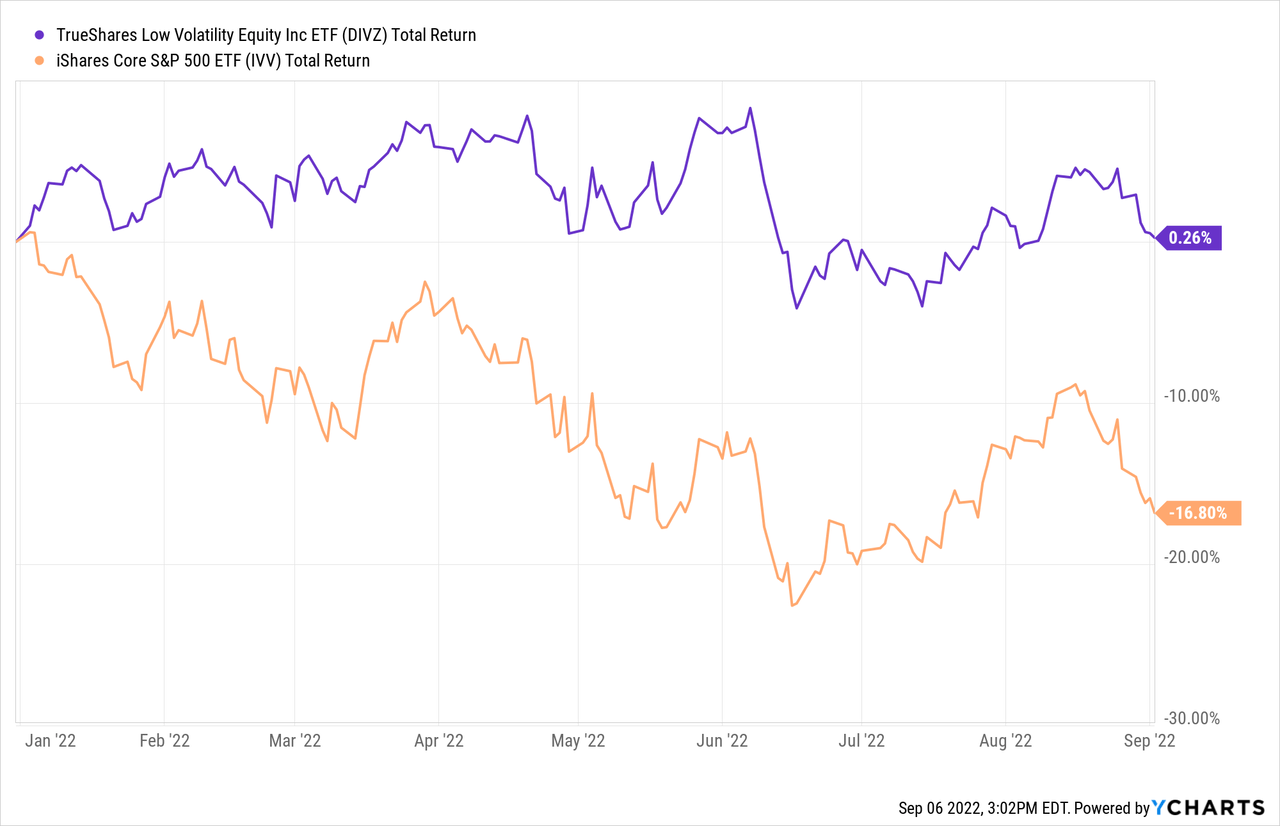

First and foremost, DIVZ eked out a gain of around 26 bps since the beginning of the year while the iShares Core S&P 500 ETF (IVV) declined by ~16.8%.

During a perfect storm with growth premia becoming slimmer, the U.S. dollar rally, inflation, omnipresent hawkishness, energy crisis, and even stagflation fears in the mix, this is something to be justly proud of.

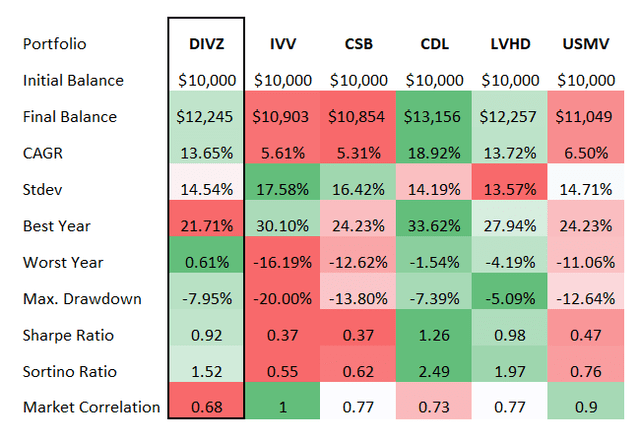

Created by the author using data from Portfolio Visualizer

Zooming out, we also see fairly decent performance compared to IVV over the period since its inception, when the markets were influenced mostly by the pent-up demand and capital rotation narratives before inflation became the primary concern; DIVZ trounced the S&P 500 ETF, delivering an almost 2.5x higher CAGR. It also looks rather strong compared to a few of its passively-managed peers seeking lower volatility and dividends, namely the Franklin U.S. Low Volatility High Dividend Index ETF (LVHD), VictoryShares US Small Cap High Div Volatility Wtd ETF (CSB), and VictoryShares US Large Cap High Div Volatility Wtd ETF (CDL). Yet it was not the best as it trailed CDL and LVHD.

Besides, it seems the fund delivers on the low volatility factor, with the standard deviation over the period observed being around 3% below the result of IVV, and only marginally above those of LVHD and CDL.

Its maximum drawdown is another robust advantage, more likely secured by its large exposure to stocks less prone to frenetic price swings and the value factor. Also, investors seeking diversification and safety over gains would note here that the fund has the lowest correlation with the market, at just 0.68.

Next, if we look at the returns of the iShares MSCI USA Min Vol Factor ETF (USMV), which I added to bring a bit more color, we would notice that it was not the low volatility factor alone that has contributed to DIVZ’s outperformance this year, as USMV’s CAGR is fairly lackluster, so quality and sector selection were more likely of greater importance.

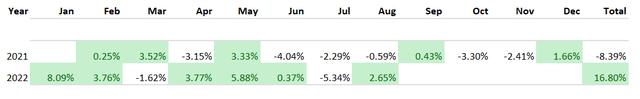

For better context, the table below shows that the ETF outperformed IVV 11 times during its first 19 full trading months, with 2022 being especially robust, except for July when risk-on sentiment returned for a moment.

Created by the author using data from Portfolio Visualizer

So what is specific about its strategy? First, it is proprietary, with few details available. According to the factsheet, the fund favors 25-35 stocks demonstrating resilient dividends with the potential to go up over time, while they also should be valued comfortably. It is added that

The portfolio seeks to deliver lower volatility and higher dividends than the overall market (represented by the S&P 500 Index) while providing capital appreciation opportunities for investors.

In the prospectus, the free cash flow yield was mentioned among the metrics considered.

In the current version, we see 30 stocks, with the top ten accounting for around 44.5% and Devon Energy (DVN) being the major investment with a 5.6% weight. Overall, the energy sector has an approximately 22.6% of the net assets being the fund’s favorite, followed by healthcare with around 15.8%. We also see meaningful exposure to consumer staples, with an especially noticeable presence of heavyweight tobacco players Philip Morris International (PM), Altria (MO), and British American Tobacco (BTI). DIVZ does not see opportunities in real estate and materials. It is worth noting that the fun can also venture into the non-U.S. equity universe, i.e., we see the above-mentioned UK-based BTI and Canada-based Enbridge (ENB) with weights of around 2.9%.

Turning to factor exposure, what I especially like about the portfolio is that all the holdings have either a Hold, Buy, or Strong Buy Quant rating. Almost 27% of the portfolio demonstrates value characteristics, with Valuation ratings of B- or better. Tobacco stocks account for a lion’s share of this cohort. At the same time, around a fifth of the net assets are allocated to richly priced names (a D+ rating or worse), and this is much lower compared to large-cap blend ETFs that typically have a 50-60% or higher share of underappreciated companies. This implies the fund’s proprietary valuation screen works well. In terms of profitability, there is nothing to criticize, as only Avangrid (AGR) has issues with margins, while over 86% of the portfolio is invested in stocks with an A (-/+) rating.

Final thoughts

In sum, at least for now, comparatively burdensome fees of 65 bps look justified as with 19 full trading months in the books, DIVZ outperformed IVV 11 times, delivering a CAGR almost 2.5x higher, with the lower standard deviation, and much stronger risk-adjusted returns. This highlights not only the advantages of the strategy but also the proficiency of its managers since the fund does not simply follow an index but picks stocks actively. Besides, its profitability characteristics are nothing short of exemplary as discussed above, while its valuation is fairly adequate.

As a long-term proponent of quality/value mixes, I greatly appreciate that. There is also a layer of dividend safety and consistency, with just two stocks in the portfolio having a D (-/+) Quant Dividend Safety grade, namely BTI and AT&T (T). And with 61% of the holdings having an at least B- Yield grade, the fund sports the standardized yield of 3.4%.

Yet when looking at the encouraging results, please do note that low-volatility stocks tend to underperform during market recoveries, with the 2020 rally being the most recent vivid example of how relatively safer portfolios could lag. That is to say, I believe DIVZ does not deserve a Buy rating since more likely it will perform softer compared to the market during the next bullish phase. There is also a recession scenario when the bellwether ETFs continue slipping and less volatile quality stocks chug along. Yet this is not my base case at the moment. Thus I prefer to remain on the sidelines.

Be the first to comment