gradyreese/E+ via Getty Images

In life and in business it is important to develop good friendships. Although I’m currently forty two years old, I’ve been very lucky, blessed even, to have found some important mentors along the way. My first mentor in business was a man named W. Rodney Thomas. I met Rodney during my junior year of high school, when I was a junior member at my local golf course, in the town I grew up in. Back then, I was a pretty good golfer and played on the High School golf team (regularly shooting in the high seventies and low eighties). Rodney was new to the club, a good golfer and athlete that was looking to play competitive and high stakes matches ($5 per side, $2 for birdies, and $1 for sandies ; ) ), during the summer and early fall afternoons, post work. As it turned out, Rodney was a financial advisor, with Dean Witter. Back then, just like present day, I was fascinated and closely followed financial markets and knew I wanted to be an equity analyst. Anyway, a college basketball scholarship to Eastern Nazarene college, a Division III college in Quincy, MA brought Rodney up to Massachusetts. It is my understanding that during his Senior year in college, he was the third leading scorer in all of Division III basketball. Although he was exceptional, and he did get a tryout with the Boston Celtics, at only six foot two, he didn’t have NBA size or quickness.

To make extra money, during college, as he came from a modest financial family background, he drove limousines. As luck would have it, and Rodney had incredible personality, he crossed paths with Rick Ryan, who at the time ran the Wellesley, MA Dean Witter office. Later, he met Phil Purcell. As an aside, as many of the younger reader might not know, Morgan Stanley (MS) bought Dean Witter, and this was one of the smartest things Morgan Stanley ever did.

Anyway, I interned for Rodney, two summers in college (the summers of 1999 and 2000). Talk about a tale of two cities (markets), as I saw the boom times associated with the roaring bull market, of 1999, when things were in full swing, and then saw the crash, as the market peaked in Q1 2000. We were friends and stayed in touch, long after the internships ended. Unfortunately and very sadly, Rodney died, at the age of 47, in July 2014, of complications associated with Type 1 Diabetes. As me and Rodney spoke on the phone at least once a month, and we always got together for our annual golf match and one day reunion, usually at least once and sometimes twice a summer (if twice, the second time was for a charity golf tournament), despite his hectic schedule, including a family with four children, from 1999 – 2014, I saw the arc of his career. At the time of his untimely death, here is a guy who started in the bullpen, making cold calls, with no business connections, and he reached the pinnacle of the industry.

He literally started at the ground floor and without a fancy business degree, from the likes of say a Harvard or Boston College, as after all, we are talking about parochial Boston here, sheer grit, street smarts, common sense, well roundedness, and ambition propelled him to the upper echelons of his field. For perspective, we are talking the Top 1 percent of all financial advisors, as he had nearly $1 billion in assets under management, at the time of death. I saw, from a far, the incredible relationships he cultivated with families (he called his core client base – ‘Ma and Pa’ investors), and this includes people from all stations and walks of life. Given Boston’s dynamic economy, over the course of Rodney’s career, he also attracted entrepreneurs and scientists, as clients. His biggest and most important client was a man named Mark Saab. Back in the mid 1980s, Rodney inherited Mark’s account, then I think valued around $3,000 dollars. Despite the relatively low account value, Mark liked Rodney, but he needed the money to go start a business. To make a long story short, Mark goes onto develop, patent, and then sell important medical devices to Johnson & Johnson (JNJ). I think Rodney told me Mark fetched close to $27 million, from J&J, and then later, Mark Saab took that capital and founded Advanced Polymers, in 1989. As it turns out, that $3k account, the one from the mid 1980s, later, as in roughly twenty five years later, turned into a $400 million account. After Mark eventually sold Advanced Polymers, I distinctly remember Rodney telling me that he and his then team built a diversified and very high quality municipal bond portfolio for the Saab’s.

Although, there are so many lessons and wise stories I learned from Rodney, today, I want to focus a very important one – There Are No Shortcuts!

This applies to both life, in the broadest sense as well as in business and definitely in investing. And I would argue the vast majority of readers could benefit from this one.

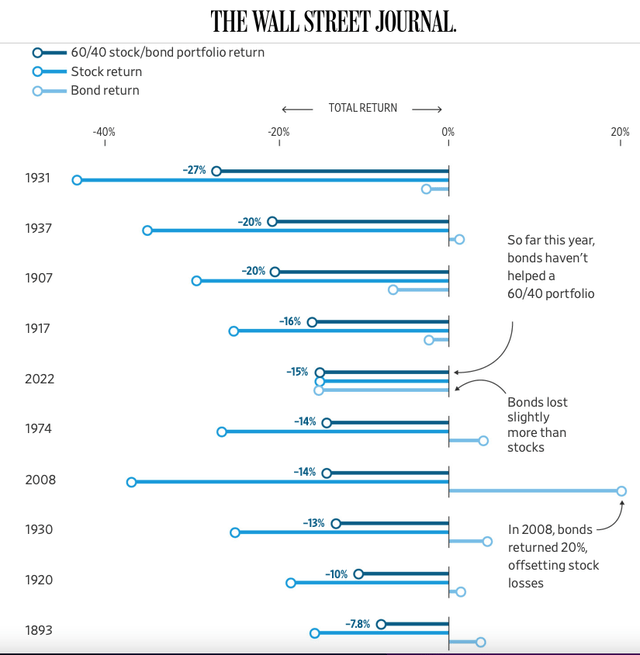

As we are in the throes of a pretty nasty bear market, let’s not sugarcoat things, year-to-date 2022 has super difficult for a traditional 60/40 portfolio- 60% stocks, 40% bonds. This topic has been widely covered throughout the media and there are various charts depicting the abysmal returns, going back 100 years. Given the wide adoption of this 60/40 framework and strategy, it is no wonder how much attention this has garnered.

Incidentally, just this past weekend, there was a big front page WSJ article on this topic.

So now that the tide has gone out, and again, by no means am I discounting that 2022 has been extraordinarily difficult, at least if you are long only, I continue to see that people are drawn to shortcuts, and frankly I see this on a daily basis.

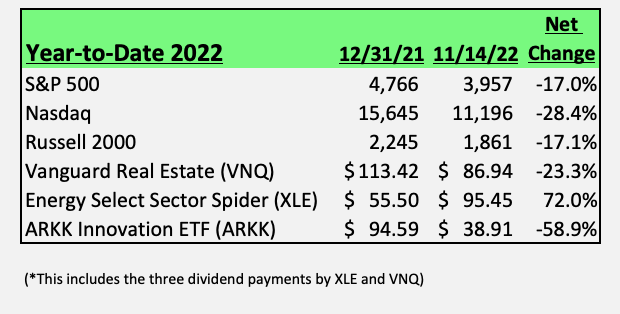

For perspective on how tough it has been in 2022: Year-to-date 2022, through November 14, 2022:

- The high quality Vanguard Real Estate Index Fund (VNQ) is down 23.3%.

- The Nasdaq (QQQ) is down 28.4%.

- The Russell 2000 is down 17.1% (IWM)

- ARK Innovation Fund (ARKK) is down nearly 59%.

The big and notable exception has been energy. And using the Energy Select Sector SPDR (XLE), as a proxy, look at how well this has done. The two largest components, of XLE, are Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX). The big two, and the pride of Texas, at least in the energy world of Texas, have posted both gusher upstream and downstream profits, which has sent both stocks into overdrive, and ultimately the big driver of XLE’s returns.

Author’s Chart

There Are No Shortcuts!

So today, applying what Rodney meant by there are no shortcuts, I will share six important things for readers to consider.

- Don’t chase yield – buying relatively low quality and high yielding dividend stocks, enticed by the prospect of clipping an 8% to low double digit annual dividends, as this just isn’t the pathway to generating superior long-term results. Yet, far too many people get overly excited about these shiny yields, on the front end, but don’t spend enough time stress testing the why, as in, why these securities are priced this way. Secondly, many of these securities tend to have high balance sheet leverage, which can be dangerous to overlook. Far more often than not, these are not the stocks you want to own. Yet, remarkably, these stocks are wildly popular both in terms of reader interest and where some people chose to allocate their investment dollars.

- Swinging for the fences isn’t the ticket – With few exceptions, technology stocks have blown up in 2022. Although some of the higher quality names, eventually, might make a full recovery, there are many tech stocks down 70% to 90%, that simply will never come close to recovering. The valuations got so far out in front and business models have simply not panned out. The robust growth rates never transitioned to generating meaningful operating and free cash flow and many names turned out to be big Covid winners. We are talking about permanent destruction of capital.

- Stop trying market timing – In most cases, two of the greatest stock pickers of all time, such as Warren Buffett and Peter Lynch, will tell you that trying to predict the macro and market timing isn’t a way to create long-term returns. Warren Buffett has discussed the topic ad nauseam and it is well known. Yet, almost every day, I see a new article saying the market will crash or the market will soar and people spend way too much attention on trying to pick bottoms and tops. Sure, at the margins, you can raise cash and be selective about your security selection and timing, but you simply can’t wholesale jump in and out of the market, pretending you can precisely time it. Far more often than not, and 2022 has been a bit of an exception, if you’re buying good businesses, at reasonable valuations to future earnings, then just own them (until your price target is reached or the thesis changes).

- Don’t put all your eggs in one basket – Exogenous shocks can and do happen. Industries can change, management teams can make poor decisions and allocate capital incorrectly. And sometimes, despite the downside and severe penalties, fraud still occurs. Look no further than the blow up at FTX. Regardless of how good you are as a stock picker, how well you think you know the business, the industry, and the macro drivers, never bet more than 15% in any one stock (and that might be too high of a threshold for most). The reason I say 15% is because you can still recover from a big loss on a 15% sized idea. There is no hard and fast rule for the number of stocks you should own, and the optimal sizing, etc. This will vary, based on a number of factors, notably risk tolerance. That said, just remember, you can’t just buy one or two stocks and think that is a golden ticket.

- (Equity) Investing isn’t easy and there is no auto-pilot – If anyone tells you that investing is easy then run the other way. In what field can a person think they can apply minimal effort and achieve above average results? The world, economies, markets, industries, and companies are dynamic. With the exception of a high quality intermediate term Investment Grade bond portfolio, that is well constructed, in the context of absolute yields, which are driven by the U.S. Treasury yield curve, and in terms of diversification and credit selection, there is no auto-pilot in the equity world.

- Play the long game – Now playing the long game is multi faceted. It can be applied directly to investing, as in buying and opportunistically accumulating a number of high quality businesses and owning them for years. For example, Rodney held long term stakes (as in more than ten years) in Kimberly Clark (KMB), Procter & Gamble (PG), Johnson & Johnson (JNJ), and he always took the maximum amount of bonus/overall compensation in the form of Morgan Stanley stock (MS). That said, people have differing investment styles and bailiwicks. However, playing the long game also means staying committed to your endeavors, relationships and the quest to become a better and more informed investor.

In closing, I was both lucky and blessed to have met and been friends with W. Rodney Thomas, for sixteen years. I learned so much from him about business, life, people, relationships, and markets.

In this brutal bear market, and it will end, although your guess is as good as mine, as to the precise timing, just remember ‘There are no shortcuts!’.

Be the first to comment