ChrisHepburn

The Quarter:

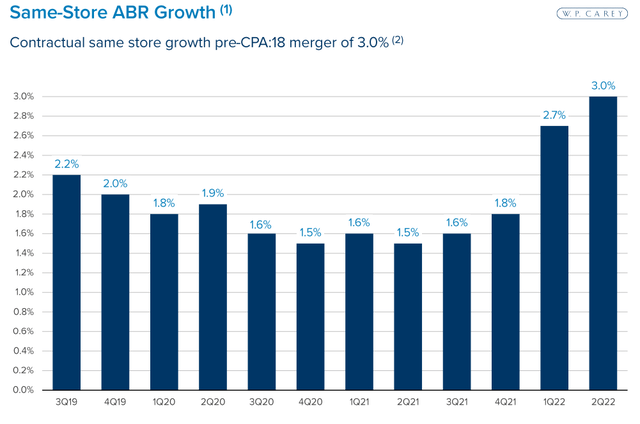

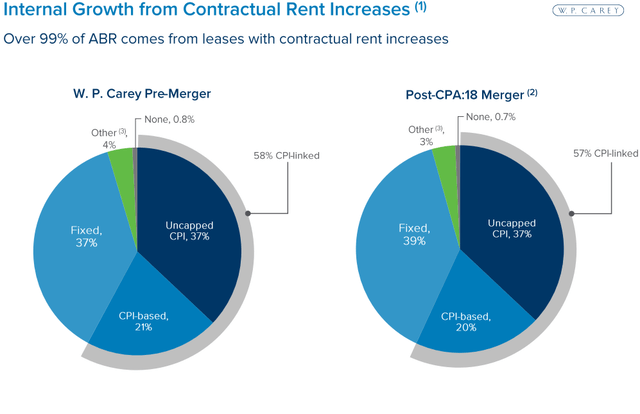

W. P. Carey (NYSE:WPC) reported another slow and steady growth quarter this morning (July 29th). AFFO came in at $1.31/share, ahead of estimates of $1.29/share and $1.27/share from last year’s second quarter. This 3% growth reflects how the company is starting to see the benefits of having close to 60% of its real estate lease portfolio being tied to CPI, with 37% of the total being uncapped. As I have written in the past, I believe WPC is unique in the triple net lease REIT space by having such a big percentage of its portfolio able to grow with CPI. This CPI-linkage becomes particularly important when CPI rises in the high-single-digit range and the company’s weighted average lease term is 11 years.

WPC Same-Store ABR Growth (WPC Q2 company presentation)

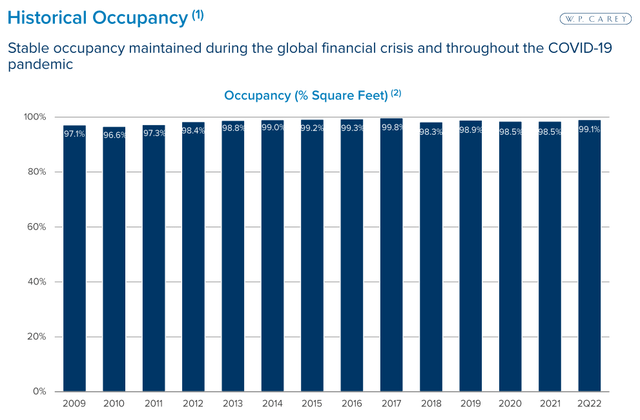

Occupancy and contractual base rent collections came in at 99.1% and 99.6% respectively. Ironically, I have heard people point to these strong numbers as negatives as it leaves little room for organic improvement. I consider high occupancy and rent collection a strength as these numbers barely wobbled during Covid when other triple-net REITs such as Realty Income (O) and National Retail Properties (NNN) saw drop-offs in occupancy as tenants went out of business and weakness in rent collections. WPC did not face the same issues. When it comes to real estate, particularly where income is a large component of the investment thesis, I want steady and dependable rather than volatility.

WPC Occupancy (WPC Q2 company presentation)

The quarterly beat allowed the company to raise the bottom end of its AFFO range for the year. It now expects $5.22-$5.30. This range compares to $5.03/share in 2021. The numbers are not necessarily apples-to-apples, given asset purchases and disposals and the soon-to-be complete merger with CPA:18. Still, the company gets criticized for its steady use of ATM equity issuance to fund growth. I counter that such issuance is ok with me as long as the balance sheet remains as strong as it has, credit quality of tenants does not decrease, the rent base remains largely tied to CPI or is composed of assets that allow for regular rent increases, and overall AFFO/share grows.

In WPC’s case, total consolidated debt/gross assets (my preferred metric for balance sheet strength) remains low at 39.8% and net debt/Adjusted EBITDA of 5.6x with an incredibly low average interest rate of 2.6%. Credit quality of tenants is evident in the occupancy rates and rent collections. Lastly, the majority of the portfolio is tied to CPI as I mentioned above. This CPI-based drops a smidgeon because of the CPA:18 deal, but the company is adding self-storage facilities, which can turnover leases faster.

WPC breakdown of lease types (WPC Q2 company presentation)

Risks:

Provided funding is in place, any real estate company’s primary risk is keeping its properties occupied and tenants paying on time. WPC has shown that its mix of properties and tenants allows for high occupancy and lease collections. 33% of the portfolio is in Europe, which causes some concern on tenant credit quality as I believe the continent is already in a nasty recession. That said, the biggest tenants in Europe are all better-quality credits and none represents more than 2% of ABR except for government offices leased by the State of Andalucia in Spain. Still, it is a consideration as is weakness in the Euro adding currency volatility.

Conclusion:

As I have written almost every quarter about this company, I greatly value the high quality, slow and steady growth. I also believe such a high percentage of CPI-linked leases offers somewhat unique protection against the high inflation rates we’re currently experiencing worldwide. In such times, I believe investors want fixed assets where inflation increases replacement value and cash flows. I believe WPC offers both and therefore serves as an excellent inflation hedge.

Be the first to comment