da-kuk

Thesis

This article is intended to highlight both positive and negative aspects for investing globally primarily in focusing on emerging markets and specifically on the Vanguard FTSE Emerging Markets Index Fund Shares (NYSEARCA:VWO).

Throughout the past decade, many investors have continued to stay away from global investing. Some of these actions can be explained by two well-known biases. The first is over-investing in the country where you reside and feel comfortable which is known as home-country bias. The second is recency bias which is defined as favoring recent events over historical ones. Both of these behavioral tendencies can deceive unaware investors when considering how they design their portfolios.

Investing globally and across different markets historically had many barriers for investors which de-incentivized them to seek out those investments. Unfortunately, this has led to many portfolios that have holdings that are too centralized and highly correlated which increases portfolio risks.

Fortunately, global markets accessibility has drastically improved and quantitative analysis supports opportunities for retail investors to diversify their portfolios through the use of good products. Having varying correlational investments across asset classes and globally is important. Investing into emerging markets can benefit portfolio potential returns while decreasing volatility if appropriately sized.

Why Emerging Markets

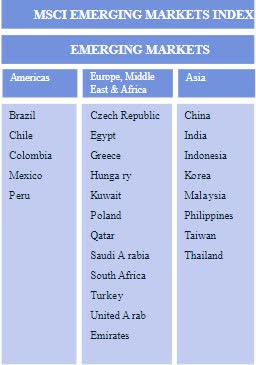

An emerging market economy is one from a developing nation that is growing and engaging more into global markets. Emerging market countries are those that share some, but not all developed market features. Some of these features include higher per capita income, stronger capital markets development, higher liquidity of financial assets, and the legal/regulatory framework conducive for market economies. The category of emerging markets includes countries like China, India, Taiwan, Brazil, Greece, and Saudi Arabia among others (Figure 1).

Figure 1. MSCI emerging markets index (MSCI)

The risks of investing into emerging markets range from geo-political to currency instability. These risks typically demand a greater premium for investment simultaneously creating greater opportunities if the outcomes unfold positively.

Correlation

When exploring assets to invest in, seeking out lower correlation assets helps to diversify investors’ portfolios. Correlation is a “statistical measure that expresses the extent to which two variables are linearly related.” What this means is that high correlating assets tend to move together while low correlating assets don’t move as well together. As an example, large U.S. companies are typically more highly correlated when measured against one another while equities and other assets like gold typically show a lower correlation.

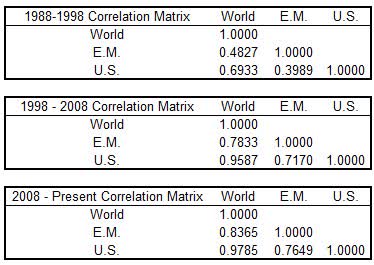

Sourcing data from the MSCI website allowed for the analysis of how different groups of assets relevant to this discussion move together throughout different time-periods (Figure 2). From 1988 to 1998, emerging markets and the United States had a low correlation of 0.3989. The correlation increased to 0.717 between 1998 and 2008 while also increasing to 0.7649 from 2008 to the present. What this shows is a trend of increasing correlation though they are not perfectly correlated.

Figure 2. Correlation matrix over multiple periods (Author)

Utilizing these relationships aids in the portfolio design for investors. What is supported so far is that emerging markets are not perfectly correlated with the U.S. markets and that would support a diversification benefit to investing into them.

Historical Portfolio Optimization

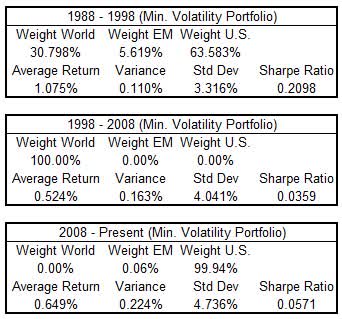

Expanding on that concept means that different assets and markets can perform very differently through different time-periods. Figure 3 depicts that over three different time-periods (1988 – 1998, 1998 – 2008, and 2008 – present, randomly selected) the minimum volatility portfolio optimization of these holdings consisted of vastly different holdings allocations. This works because the individual markets and global markets performed differently over each time-period and the optimization of the three holdings (world, emerging markets, U.S.) would have been different over each time-period. This analysis shows that individual investors in U.S. markets since 2008 have had a complete dominance of the lowest volatility thus supporting a large migration to invest in their assets though the prior two periods portray a different story. Minimum volatility investors would have been better off in the world portfolio from 1998 to 2008 and having a mix of all three in the decade prior. This summarily portrays that different periods of time have different results in best performing assets.

Figure 3. Min volatility portfolio design over multiple periods, monthly (Author)

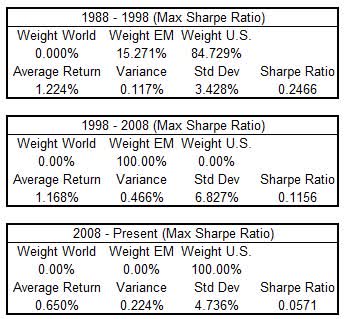

If the goal of the investor is to maximize their Sharpe ratio which is a measure of risk adjusted return, then they would have benefited prior to 2008 by having holdings in emerging markets (Figure 4). From 2008 to the present showed that only holding large U.S. holdings would have provided the strongest Sharpe ratio. The period since 2008 highlights how recency bias could be affecting younger investors who had not invested prior to 2008. This once again portrays that different periods of time have different results in best performing assets and in optimal portfolio designs.

Figure 4. Max Sharpe ratio portfolio design over multiple periods, monthly (Author)

Why VWO

Utilizing Exchange Traded Fund (ETF) products is a great tool to utilize for passive investing strategies. These products can be designed in a wide variety of ways to help investors achieve their goals. VWO is a great product for investors seeking to take a position into emerging markets.

Vanguard

Vanguard is one of the leading asset management fund firms in the United States and offers some of the most competitive products to investors. The Vanguard VWO portfolio management team average tenure is over 10 years and the fund has been active since 2005 (which makes historical data analysis more difficult for this product).

Cost

One of the most significant advantages to VWO and many Vanguard funds is the low cost advantage that is offered. The VWO net expense ratio is 0.08% having decreased from 0.18% since 2012. The competitor category average net expense ratio is 0.18% currently which is over double that of the VWO cost. While this is not a significant as a percentage, it has implications when compounded over longer periods of time and in regards to larger sums.

Broad Exposure

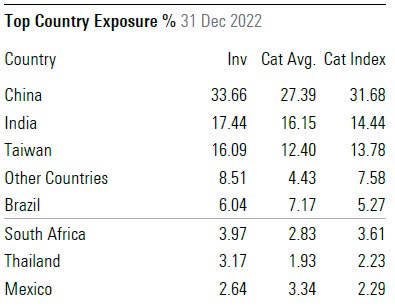

According to Morningstar, the top 5 country exposures for VWO is China, India, Taiwan, Brazil, and South Africa. The total holdings is 4,677 with approximately 10% in the Americas, 15% in Greater Europe (includes Africa/Middle East), and 75% in Greater Asia. In order to mitigate home-country bias, it is important for investors to branch out into other investments. One issue many investors have is that they aren’t well exposed educationally to other countries and would have a difficult time choosing strong investments individually. Having broad exposure and diversifying allows investors with this barrier to spread their risk more widely thus mitigating it to some degree. It also allows investors to not have to spend a considerable amount of time conducting their due diligence on specific individual investments.

Figure 5. VWO country exposure (Morningstar)

Better Valuations

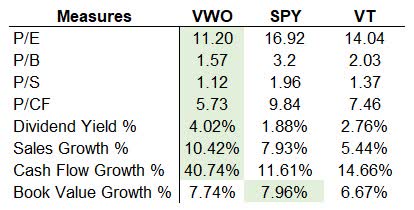

Another benefit of emerging markets is the ability to invest at better valuations due to the increased risk expectation and growth potential (Figure 6). When comparing VWO to the SPDR S&P 500 (SPY) and Vanguard Total World Stock Index Fund (VT), it is clear that VWO trades at a better valuation in most value and growth categories. It is important for long-term investors to add exposure like this to their portfolios to increase their volatility and upside potential.

Figure 6. Metrics comparison (Author)

Larger Market Capitalization Focus

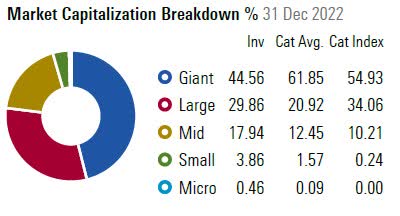

According to Morningstar, the VWO market capitalization breakdown is mostly allocated towards large and giant firms with moderate exposure to mid-cap and mild exposure to small and micro-cap sized firms (Figure 7). This could be considered a strength of this ETF since investors may not have the same news access globally as they do in the U.S. so the more well-followed and transparent firms are likely to be the ones with more capital hopefully decreasing risk.

Figure 7. VWO market capitalization allocation (Morningstar)

Recency Bias

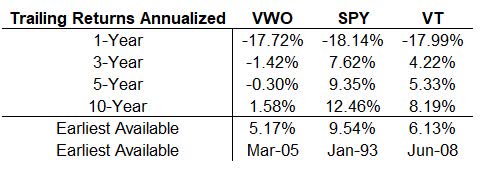

When observing VWO, SPY, and VT returns, there are clear outperformers since the funds inceptions and through different periods (Figure 8). SPY has the best performance over the 1, 3, 5, and 10 year periods. This was demonstrated earlier as well and many investors look to these more “recent” past performance trends as likely trajectories going into the future. The analysis conducted earlier in figures 3 & 4 demonstrated how only looking over the past decade could provide investors with a form of tunnel vision that doesn’t consider other potential outcomes.

Figure 8. Trailing returns (Author)

Risks

The risks when investing globally include similar risks when investing domestically plus a few more that connect globally. The currency and exchange rate of the international investments can have fluctuations in exchange rate or a devaluation of their currency which can affect the valuation of the assets in the portfolio. Political risks can also decrease the ability for a market economy to function more efficiently and the relationships across borders can also create barriers for investing into different countries. The transparency risk is that investors are typically less aware of specific foreign firms actions and some markets do not have the same regulatory requirements for transparency which could increase the likelihood of fraud or practices not in the best interest of shareholders.

Investors also must deal with a greater degree of uncertainty in global markets which adds complexity simply due to the scale of global interactions.

VWO specific risks include decreased confidence in financial markets which could lead to large cash outflows to VWO decreasing the price action. The management team and Vanguard must also maintain the confidence of their investors so as not to trigger any substantial outflows from the firms managed assets. Another risk is also in establishing too large a position size in respect to a portfolio though the diversification of VWO does help mitigate that risk.

Conclusion

Having varying correlational investments across asset classes and globally is important. Investing into emerging markets can offer a single aspect of this portfolio design benefit and can be utilized to increase the potential returns while decreasing volatility of a portfolio when appropriately sized. The effects of the behavioral finance biases of home-country bias and recency bias are also important for investors to recognize and develop their capacity to overcome these. Long-term historical returns have shown that emerging markets can outperform U.S. markets and work synergistically if global factors align appropriately.

VWO is a great financial product to hold long-term that offers diversification across multiple emerging market economies at a cost advantage with exceptional valuation premiums supported by a reputable firm.

Be the first to comment