Pickone

Investment Thesis

Vulcan Materials Company (NYSE:VMC) is the largest construction aggregates company in the US. The demand (tonnage) for aggregates in the US is cyclical. While it delivered credible performance over the past 2 years, VMC’s performance over the cycle is lower than the current results.

Notwithstanding its acquisitions, it did not achieve significant growth in its market share. Shipment tonnage over the past 15 years was stagnant and revenue growth was driven by growth in prices. At the same time, it had unsustainable Reinvestment rates.

Based on its valuation over the cycle, there is no margin of safety at the current price. This low value is due to the low cyclical margins, low revenue base and low cyclical asset turnover.

Thrust of my analysis

I am a long-term value investor hunting for fundamentally sound companies trading at least 30% discount on their intrinsic value. When I analyze companies, I look at their long-term performance and value them on such a basis. My investment thesis for VMC stock is based on such a perspective with the following rationale:

- VMC is mostly a construction aggregates Group.

- The US aggregates demand (tonnage) is cyclical. Thus, VMC is a cyclical company.

- Despite the acquisitions, there is not much tonnage growth. Revenue growth was driven by selling price growth. But the gross profit and SGA margins were cyclical.

- While financially sound, VMC has a high Reinvestment rate that is not sustainable.

- A valuation of VMC based on its cyclical performance showed that there is no margin of safety at the current price of USD 184 per share (7 Feb 2023).

A construction aggregates Group

VMC is the largest supplier of construction aggregates (crushed stones, sand, and gravel) in the US. It is also a major producer of asphalt mix and ready-mixed concrete.

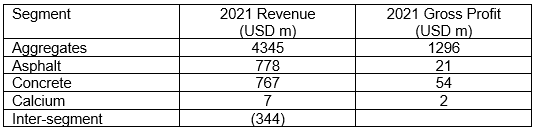

The asphalt and concrete revenue in 2021 was about 27 % of the Group revenue. But the majority of the raw materials used here were aggregates from the Aggregates segment. Refer to the inter-segment revenue as shown in Table 1.

At the same time, the gross profit contribution from the Asphalt and Concrete segments was only about 8% of the Group’s gross profit.

My point is that VMC is effectively an aggregates Group and I would model and value it as such. This is in line with VMC’s position:

“Our strategy for long-term value creation is built on (1) an aggregates-focus business…”

– VMC Form 10-K 2021.

Table 1: Segment Performance (Author)

Cyclical sector

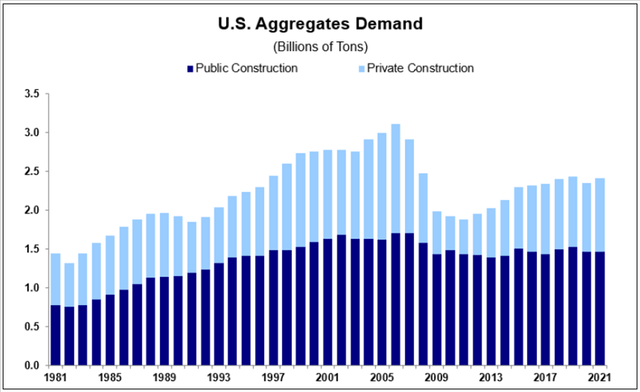

The demand (tonnage) for aggregates is cyclical as can be seen from Chart 1. The current peak-to-peak seems to be from 2006/07 to 2020/21. For my analysis, I shall take the cycle to be from 2007 to 2022 (LTM).

There are 2 major sub-sectors – public construction and private construction. According to VMC, the public sector has historically been more stable and less cyclical. The private sector is primarily residential and non-residential buildings and is more cyclical.

Chart 1: US Aggregates Demand (VMC Form 10-K 2021)

There are 3 takeaways from Chart 1.

- The demand from the public sector is slightly higher than from the private sector.

- The current demand is less than the 2007 peak. Note that the peak of the aggregates cyclical in 2007 coincides with the peak of the Housing Starts.

- From 1981 to 2021, the demand grew at 1.4 % CAGR. This is not exactly a growth sector.

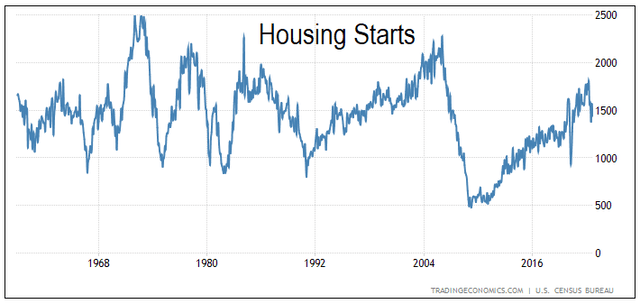

You may argue that with the Biden infrastructure bill, the demand from the public construction sector will grow. But Housing Starts are cyclical with no growth in the long-term annual Housing Starts as can be seen from Chart 2. The Housing Starts appears to have peaked in 2021/22 and is now on its downtrend.

The immediate to short-term demand for aggregates is then driven by these factors. I would not expect double-digit growth. More importantly, demand would continue to be cyclical.

Chart 2: Housing Starts (Trading Economics)

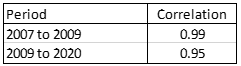

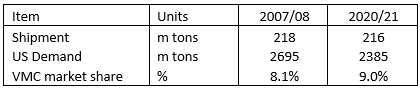

It is obvious that being in a cyclical sector, VMC is also a cyclical company. This is best illustrated by Table 2. It showed the high correlation between VMC aggregates shipping tonnage and the US aggregates demand.

Table 2: Correlation between VMC shipment and US aggregates demand (Author)

Valuation of cyclical companies

As a cyclical company, VMC should be analyzed and valued based on its performance over the cycle. Damadoran has this to say about valuing cyclical companies:

“Cyclical and commodity companies share a common feature, insofar as their value is often more dependent on the movement of a macro variable (the commodity price or the growth in the underlying economy) than it is on firm specific characteristics…the biggest problem we face in valuing companies tied to either is that the earnings and cash flows reported in the most recent year are a function of where we are in the cycle, and extrapolating those numbers into the future can result in serious misvaluation.”

To overcome the cyclical issue, we have to normalize the performance over the cycle. Damodaran suggested 2 ways to do this:

- Take the average values over the cycle.

- Take the current revenue and determine the earnings by multiplying it with the normalized margins.

The challenge with the first approach for VMC is that the size of the company in 2022 is far greater than that in 2007. I thus adopted the second approach.

VMC Performance

From 2007 to 2022 (LTM), VMC revenue grew at 5.3 % CAGR. This is significantly higher than the long-term 1.4 % CAGR for the aggregates demand (tonnage).

But VMC’s growth was a combination of organic growth and acquisitions. There were major jumps in revenue in 2015, 2018, and 2022 following some major acquisitions.

But even this revenue growth can be misleading. If you look at the shipment tonnage or an estimate of VMC market share, I would not say that there is much changes. Refer to Table 3.

Table 3: Comparative shipment and market share (Author)

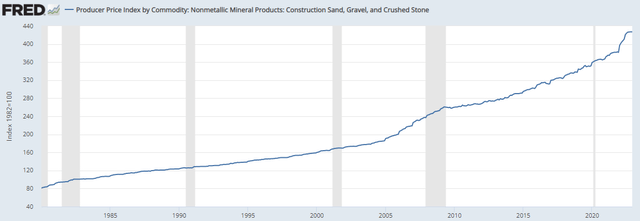

The reason for the revenue growth given the same shipment tonnage is because of the increase in prices. This is illustrated in Chart 3.

Chart 3: Producer Price Index – Construction sand, gravel, and crushed stone (FRED)

Furthermore, data from VMC Form 10-K also showed that the aggregates selling price per ton in 2020/21 is about 50% higher than that in 2007/08.

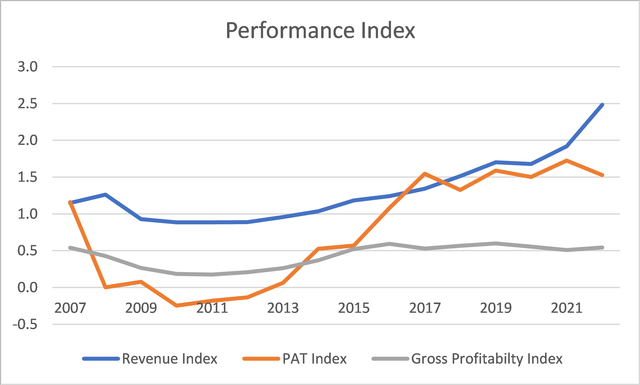

The main point – there is no shipment tonnage growth but there is revenue growth. This is a selling price-driven revenue growth. But even this revenue is cyclical as can be seen in Chart 4.

Operating margins

Profits and operating margins were cyclical.

Chart 4 shows how the profits and gross profitability were reduced during the downtrend part of the aggregates cycle. You can see that despite the jump in revenue between 2019 and 2022, the PAT did not have a similar jump.

From 2007 to 2022 PAT grew at 1.9 % CAGR. At the same time, gross profitability was relatively stable.

Chart 4: Performance Index (Author)

Note to Chart 4: The index for each parameter was derived by dividing the value in a particular year by the respective 2007 value.

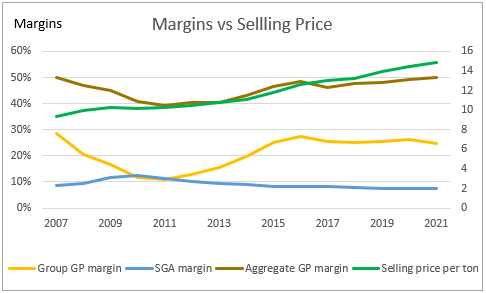

PAT was cyclical because the gross profit margin and the Selling, General, and Administration or SGA margin were cyclical. Refer to Chart 5.

Note that in Chart 5, I plotted the aggregates gross profit margin and the Group gross profit margins.

- The former refer to the margin for the Aggregates segment and is net of freight and other charges.

- The latter refers to the gross profit for the Group. It is based on the GAAP numbers.

I would point out an important feature of the gross profit margins. In its Form 10-K, VMC presented its aggregates selling price per ton and aggregates gross profit per ton. The data from the various years shows an increasing trend for both.

But when you chart the aggregates gross profit margin, you have a cyclical pattern. I derived this aggregates gross profit margin = aggregates gross profit per ton / aggregates selling price per ton. Refer to the Aggregate GP margin line in Chart 4.

Furthermore, when you compare the aggregates gross profit margin with the Group gross profit margin you find that the Group margin is lower. There is also a larger peak-to-trough Group gross profit margin compared to that for the aggregates.

The main reason for this is that the aggregates gross profit margin excludes freight and other charges. From a Group perspective, freight and other charges are significant components and should not be ignored.

Apart from being cyclical, there is no significant improvement trends in the Group gross profit margin and SGA margin.

Chart 5: Operating margins vs Selling price (Author)

Note to Chart 5: Aggregate GP margin = aggregates gross profit per ton / aggregates selling price per ton.

Not a sustainable Reinvestment rate

Over the past 15 years cycle, VMC revenue had grown at 5.3 % CAGR. But to drive this growth, VMC spent about USD 7.5 billion in acquisitions.

Growth is never free and there have to be Reinvestments. Over the past 15 years, I estimated VMC average Reinvestment rate to be 177 %.

Reinvestment rate = Reinvestment / EBIT(1-t).

Reinvestments = Net CAPEX – Depreciation & Amortization + increase in Net Working Capital + Net Acquisitions.

Net CAPEX and Net Acquisitions = amount of cash spent less sale of PPE and divesture of business.

The 177 % meant that the Reinvestment exceeded the annual after-tax operating income by 77%. This is not sustainable.

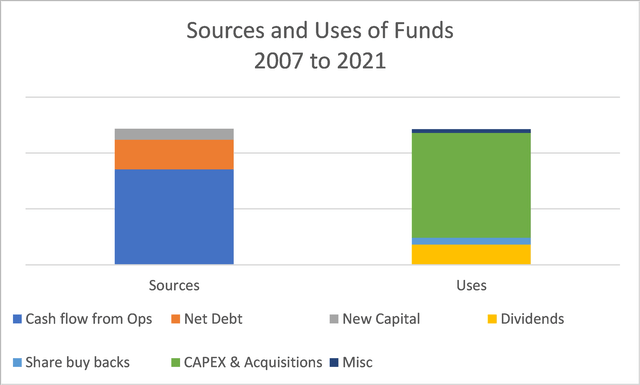

Chart 6 illustrates this situation from the cash flow perspective. You can see that the amount used for CAPEX and Acquisitions exceeded that Cash Flow from Operations and there was a need to increase the Debt.

At the same time because of the high CAPEX and Acquisitions, there was not much left for dividends and share buyback.

Chart 6: Sources and Uses of Funds (Author)

Note to Chart 6: CAPEX and Acquisitions are net of sales of PPE and divesture.

The high Reinvestment rate meant low returns. This can be estimated from the fundamental growth equation.

Growth = Return X Reinvestment rate.

Return = EBIT(1-t) / Total Capital Employed.

Reinvestment rate = Reinvestment / EBIT(1-t).

Total Capital Employed (TCE) = SHF + MI + Debt – Non-operating assets.

Using these equations for the 5.3 % growth, we have

5.3 % = Return X 1.77.

Return = 5.3 / 1.77 = 3.0 %.

You should not be surprised by this low return as the 2007 to 2021 average ROA = 3.3 % and ROE = 6.0 %.

Notwithstanding these returns and the Reinvestment rate, VMC is financially sound.

- It has a D/E ratio of 0.7 as of Q3 2022.

- It had been able to generate positive Cash Flow from Operations every year for the past 15 years.

- I would rate its Debt as AA (Fitch). This is based on Damodaran’s synthetic rating taking into account its interest coverage ratio.

Valuation

VMC is currently trading at > 3 times its Book Value. As a brick-and-mortar company, I find this very strange.

Over the past 15 years’ aggregates cycle, VMC revenue had grown by 5.3 % CAGR. Buts its PAT did not have any significant growth. Even its common Equity only grew at 4.1 % CAGR.

VMC is thus not a high-growth company. Rather I would consider it a mature company in a low-growth sector.

I used the following formula to determine its intrinsic value.

Value = Book Value X (ROE – g) / (Cost of equity – g).

Note that this is derived from the single-stage Dividend Discount Model. Refer to Damodaran for details on how this model is derived. Conceptually, the ROE is a proxy for the earnings and/or cash flows. I chose this model because of the current high Price to Book ratio and I just wanted a rough estimate of the intrinsic value.

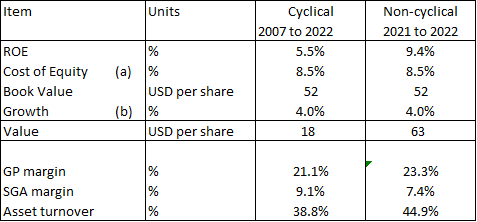

I looked at two scenarios.

- As a cyclical company where the ROE was based on the 2007 to 2022 average.

- As a non-cyclical one where the ROE was based on the 2021 to 2022 average.

The key parameter that changed in both scenarios was the ROE. The ROE for the no-cyclical scenario was higher. This in turn meant better gross profit margins, SGA margins and asset turnover than the cyclical case.

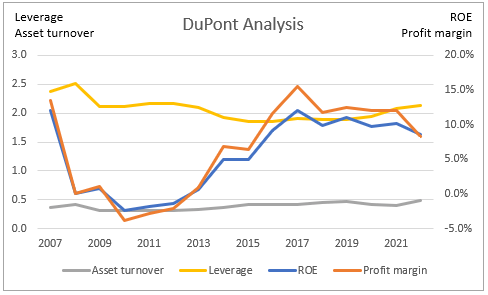

A Dupont Analysis of the ROE as per Chart 7 clearly shows the difference between the cyclical metrics and the non-cyclical ones. Details of the differences are shown in the bottom half of Table 4.

Chart 7: DuPont Analysis (Author)

The results of my valuation are shown in Table 4. You can see that in the cyclical scenario, the ROE is very much lower than the Cost of Equity. You should not be surprised by the low valuation.

Even under the non-cyclical scenario with the ROE of 9.4 %, the intrinsic value at USD 63 per share is only about 1/3 of the current market price.

Table 4: Scenario comparisons (Author)

Notes to Table 4:

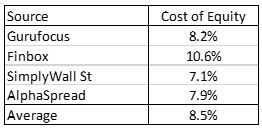

a) Derive from a Google search of the phrase “VMC cost of equity”. Refer to Table 5.

Table 5: Cost of Equity (Various sources)

b) Growth based on the long-term GDP growth rate.

Looking at the results, I can only conclude the market is valuing VMC as a high-growth company.

If I use a 2-stage valuation model, I could find the appropriate base revenue, growth rate, and margins to reverse-engineer the market price. But I have not done this as it will not reflect reality. It will mean growth in shipment tonnage, improvements in margins, and asset turnover. These would be inconsistent with my findings.

Limitations and risks

In my valuation of VMC, I relied on its earnings. You may argue that VMC is a natural resource Group. It reported 15.6 billion tons of proven and probably aggregates reserves in its 2021 Form 10-K.

VMC shipped an average of 185 tons per annum. Assuming 80 % efficiency, the reserves can last for about 50 years. So looking at earnings does not do justice to the value of the reserves.

My argument for ignoring reserves is that I am a retail investor. My investment return is going to be from dividends and capital gains. I think these are more influenced by earnings than reserves.

However, if VMC was a takeover target, the acquirer would value it based on the reserves. This is because the acquirer would be able to change the extraction rates and improve the earnings.

The real question is whether the market is valuing VMC taking into account its reserves.

This then begets the next issue. The value of the firm based on the DCF approach = value of operating assets + value of non-operating assets.

In the normal approach, the non-operating assets are cash and investments in associates.

However, in the case of VMC, the reserves are large. You could argue that a portion of them should be considered as non-operating assets.

Unfortunately, I do not know how the value the reserves. I would be interested to hear from those of you who have better knowledge of:

- How to value the reserves.

- What portion to allocate to non-operating assets.

Until then, I will continue to be conservative and avoid the stock.

Conclusion

Over the past 2 years, VMC had achieved very credible results. Revenue was growing at double-digits and ROE exceeded the Cost of Equity. But I have shown that VMC is a cyclical company and projecting the current performance into the future will be misleading.

VMC may be financially sound, but its cyclical returns are low. While its revenue grew by 5.03 % CAGR from 2007 to 2022, there was no growth in the shipment tonnage. Growth was due to price increases.

The sad part was that the standstill shipment tonnage was despite its acquisitions. On top of this, its reinvestment rate is not sustainable.

You can understand why I have concerns about VMC fundamentals. At the same time, there is no margin of safety at the current price.

If you invest in VMC currently, it must mean that you do not believe that it is a cyclical company. Instead, you believe that it is a high-growth one with not only tonnage growth, but also improvements in the operating margins. Does this reflect reality?

I am not suggesting that there would not be immediate or short-term performance improvements. Rather I am looking at the performance and value over the long term. On such a basis, I would stay away.

Be the first to comment