niphon

Investment Thesis

Vulcan Materials Company (NYSE:VMC) is witnessing a strong demand environment in the infrastructure and non-residential end markets which should help it in offsetting the slowdown in the single-family residential end market. The pricing momentum from 2022 is expected to carry forward in Q4 FY22 and in FY23, benefiting both revenue and margins. VMC is working on its strategic initiatives to improve sales and operating efficiency. The company is also improving its business portfolio through acquisitions and greenfield investments. This is benefiting the company’s revenue as well as margins. The stock is trading at a discount to its historical levels and given the good growth prospects, I have a buy rating on it.

VMC’s Q3 FY22 Earnings

Last month, VMC reported better-than-expected Q3 FY22 financial results. The revenue in the quarter was up 38% Y/Y to $2.09 bn (vs. the consensus estimate of $2 bn). The adjusted EPS was up 15.6% Y/Y to $1.78 (vs. the consensus estimate of $1.70). The revenue growth in the quarter was driven by double-digit growth in the company’s legacy operations as well as acquired operations. The improvement in revenue benefitted the adjusted EPS in the quarter.

Revenue growth prospects

In Q3 FY22, the shipment volumes in the aggregates segment improved by 9% Y/Y to 65.4 mn tons. The pricing momentum continued in the quarter, growing from mid-single digits in the first quarter to high single digits in the second quarter to double digits in the third quarter. The average selling price (ASP) of aggregates increased 12.5% Y/Y to $16.8. In the Asphalt, Concrete, and Calcium segment, the volume and pricing of the asphalt business increased 13% Y/Y and 26% Y/Y to 3.6 mn tons and $74.8. The improvement was widespread across geographies, with Arizona and California particularly strong. The volumes and pricing in the concrete segment improved by double digits to 2.9 mn tons and $153.5 due to the growth in the company’s operations as well as acquired operations.

In August 2021, VMC completed the acquisition of U.S. Concrete for $1.3 bn. This acquisition complements VMC’s aggregates business in California, Texas, and Virginia and gives access to new platforms in New York and New Jersey. The company is currently working on the integration of the U.S. Concrete business and this should be beneficial for the top and bottom lines.

Looking forward, management increased aggregates shipment volume guidance range for the full year 2022 from between 5% and 7% increase to between 7% and 8%. The guidance range provided by management suggests that volumes in the fourth quarter are expected to be flat Y/Y primarily due to difficult comps. Last year’s November and December shipping rates were the highest in 10 years. Additionally, the inclement weather conditions have started to impact the fourth quarter volumes. The hurricane in Florida and low water levels in the Mississippi River impacted the first week of the fourth quarter. However, the bookings and backlogs were strong entering the fourth quarter of 2022. Pricing in the fourth quarter is expected to be similar to Q3 i.e., grow ~12% Y/Y. The healthy backlog and higher price realization should help offset the weather-related headwinds and tough comps in the fourth quarter.

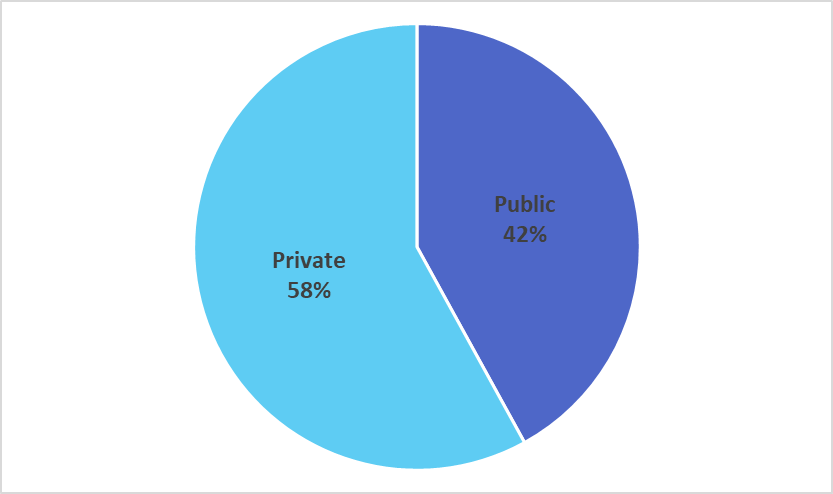

The demand environment for VMC remains dynamic across different end markets. The single-family housing market is facing headwinds due to rising interest rates, construction inflation, home prices, and mortgage rates. Housing permits and starts are declining due to these headwinds. However, multifamily housing and private non-residential starts are still showing signs of growth. Multifamily permits and starts remain positive. Private non-residential demand and leading indicators are currently healthy, and the trailing 12-month private non-residential starts are up 21% Y/Y. Additionally, leading indicators are positive, with the Architectural Billing Index (ABI) still greater than 50 and the Dodge Momentum Index at high levels.

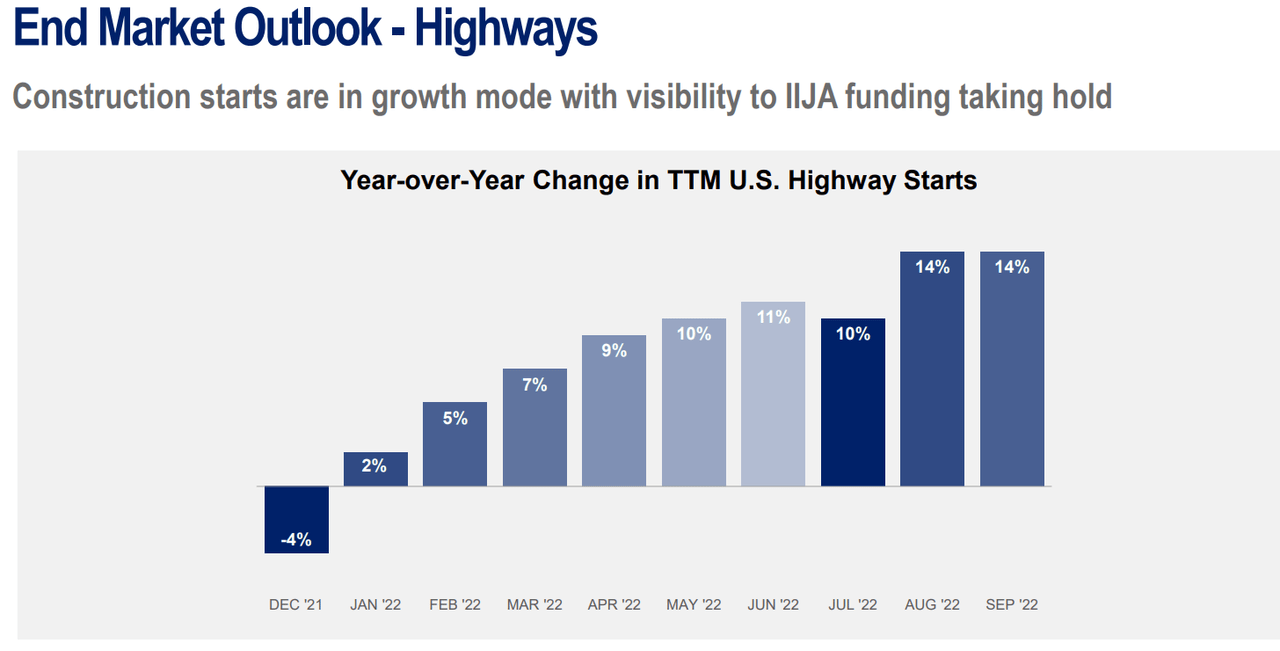

Highway End Market Outlook (VMC Investor Presentation)

On the public side, leading indicators for highways and other infrastructure are positive and reflect strong tax revenues and increased funding from the Infrastructure Investment and Jobs Act (IIJA). The trailing 12-month highway starts were up 14% Y/Y in September 2022. The fundamentals for multi-year growth in highways and infrastructure are very good. I believe the strong infrastructure funding environment, the current strength in the private non-residential, and increased public funding should help offset the contracting residential demand. Additionally, the strong pricing momentum from 2022 should be carried into FY23, benefiting the company’s revenue growth. So, I am optimistic about the company’s growth prospects.

VMC’s end markets ( Company data, GS Analytics)

Vulcan’s Strategy

The company is working on its “two-headed” strategy to drive long-term growth and efficiency. The first part of this strategy is to enhance its core execution by using the Vulcan way of operating, and the Vulcan way of selling. The second part includes expanding its reach and improving its portfolio through greenfields and acquisitions. The Vulcan way of selling is about commercial excellence and logistics innovation, whereas the Vulcan way of operating includes operations excellence and strategic sourcing. Both the Vulcan way of selling and the Vulcan way of operating were developed in 2017. The Vulcan way of selling has accomplished three things since it was developed. First, the company developed custom proprietary technology to have real-time insight into all of its end markets. Next, it developed KPIs and performance metrics for its sales teams for better execution. Lastly, it removed all of its administrative work from the sales team, allowing them to spend more time with customers. The Vulcan way of operating is about driving margins by improving operational efficiency through technology, and the company is making good progress in this regard as well. VMC installed tracking systems at approximately 100 plants to have better visibility into its operations and better control and reduce its costs to improve margins.

The company is now implementing the second part of the strategy, which is about expanding its reach and enhancing the portfolio under three guiding principles. First, the company plans to continue its aggregate-focused mix of businesses. Second, it continues to focus on building out in the right markets where it has a leading position. Third, it continues to pursue downstream concrete and asphalt businesses in the selected market that are complementary to its aggregates business. In line with this strategy, the company recently bought some strategic assets in Northern California and coastal Texas to expand its network. VMC is also managing its business portfolio by divesting some assets that are not aligned with its strategy. The company recently finalized the agreement for the disposition of ready-mix assets in New York, New Jersey, and Pennsylvania.

Margin Outlook

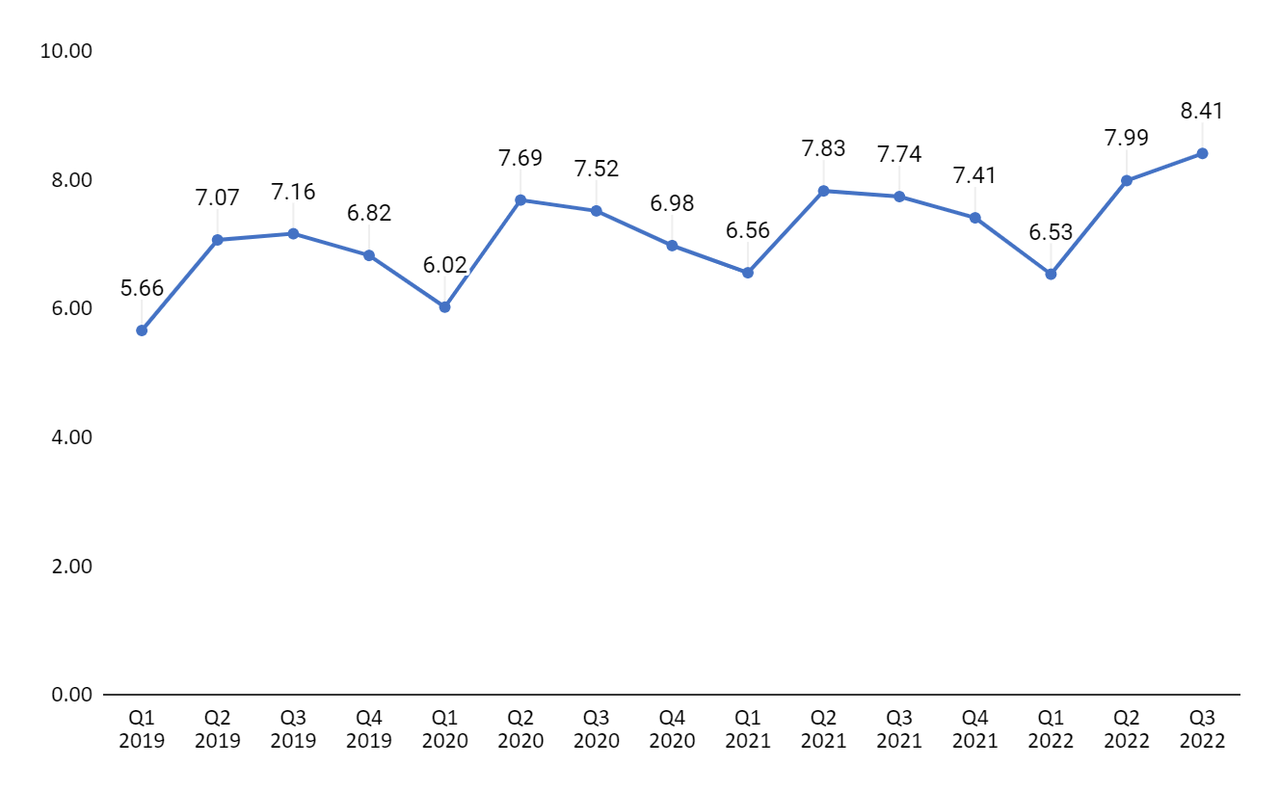

In Q3 2022, the gross profit declined Y/Y but was up sequentially vs. Q2 2022 as the company continued to implement price increases to offset cost pressures. The costs in the quarter were elevated due to inflationary pressures. Diesel was a big headwind with the price per gallon up over 60% Y/Y in the quarter. Despite these headwinds, the cash gross profit per ton (unit margin) in the aggregates segment was up 9% Y/Y to $8.41 per ton. Cash gross profit is a measure of operating performance and is calculated by adding back depreciation, depletion, accretion, and amortization to gross profit.

Aggregates segment cash gross profit per ton (Company data, GS Analytics Research)

Looking forward, cost inflation is expected to remain high in Q4 FY22 and FY23, however, the company should be able to offset this with pricing actions and operating efficiencies. This should benefit the cash gross profit per ton in Q4 FY22. For the full year 2022, the company is expecting cash gross profit per ton to be around $8. Management is targeting cash gross profit per ton between $11 and $12 when it reaches 260 mn to 270 mn tons of shipments and is targeting to generate $2.7 bn to $3 bn in EBITDA. I believe the company should be able to achieve this given the pricing momentum and by achieving operational efficiency through its Vulcan way of operating strategic initiatives.

Valuation & Conclusion

The stock is currently trading at 27.46x FY23 consensus EPS estimate of $6.77 which is at a discount to its five-year average forward P/E of 29.40x. The company’s revenue should benefit from the strong infrastructure and non-residential end markets along with strong pricing momentum. This should help offset the headwinds from the slowdown in the single-family residential end market. The company’s cash gross profit per ton (unit margin) is expected to improve due to higher price realization and by achieving operational efficiency through the Vulcan way of operating. Given the company’s good growth prospects and lower than historical valuations, I have a buy rating on the stock.

Be the first to comment