marchmeena29

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Value or growth. Large cap, mid cap, small cap or micro cap. Those represent some of the variables stock investors face when building out their portfolio. Which, in either set, is the better short-term choice has some relationship to where investors think we are in the US and/or global economic cycle. Here’s a link to RBC’s take on Understanding the Economic and Stock Market Cycles.

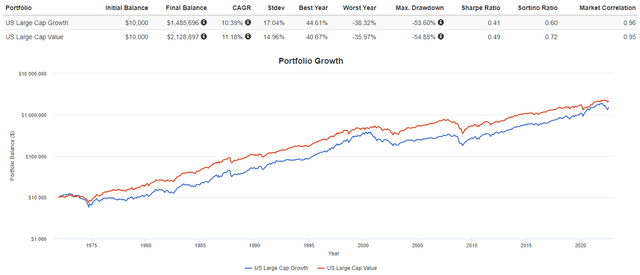

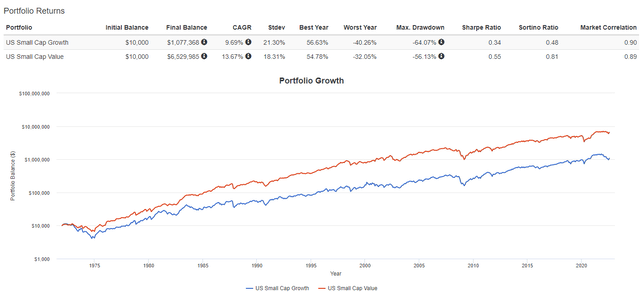

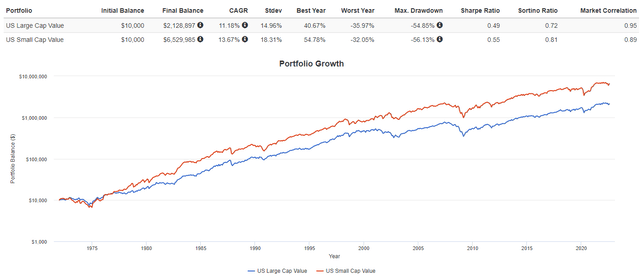

For investors with long time horizons, that’s less important as the various categories seem to differ little – with exceptions of course! The next set of charts show how Large-Cap Growth and Value stocks have performed back to 1972, then the same for Small-Cap stocks. Since this article focuses on Value stocks, the third chart compares LC and SC Value results.

portfoliovisualizer.com

portfoliovisualizer.com

portfoliovisualizer.com

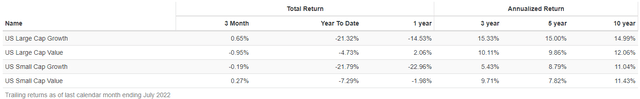

Since 1972, Value is ahead at both market-cap levels, with Small-Cap Value being the best performer. Small-Cap Value also outperformed Large-Cap Growth stocks. For investors with shorter time frames, the next table shows returns at different intervals.

portfoliovisualizer.com

For the past decade (or more), Large-Cap stocks have topped Small-Cap but Growth shows a split picture where LCG was better but SCV beat SCG.

Examining the Indices

Both ETFs use an index provided by CRSP, the Center for Research in Security Prices. They provide an overall description for their Value indices:

The CRSP U.S. Value Style Indexes are part of CRSP’s investable index family. Once securities are assigned to a size based market cap index, they are made eligible for assignment to a value or growth index using CRSP’s multifactor model. CRSP classifies value securities using the following factors: book to price, forward earnings to price, historical earnings to price, dividend-to-price ratio and sales-to-price ratio.

Source: crsp.org Index PDF

crsp.org/ crsplcv1

crsp.org crspscv1

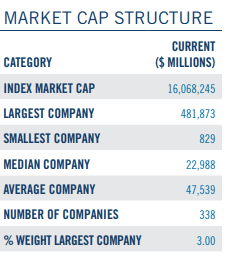

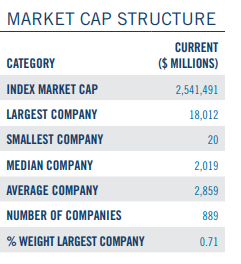

The left data is the Large-Cap index; the right is the Small-Cap index. CRSP defines Large-Cap as the top 15% in size; Small-Cap between the 85-98% percentile in size.

crsp.org crsplcv1

crsp.org crspscv1

crsp.org crsplcv1

Size matters to some sectors more than others. Both sets of index data should be closely reflected in each ETF. For details on the CRSP Index Methodology, they provide a detailed PDF.

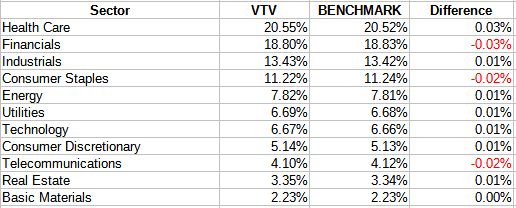

Vanguard Value ETF (NYSEARCA:VTV) review

Seeking Alpha describes this ETF as:

The Vanguard Value ETF invests in large-capitalization value stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Large Cap Value Index, a broadly diversified index predominantly made up of value stocks of large U.S. companies. VTV started in 1992.

Source: seekingalpha.com VTV

VTV has $146.7b in AUM and provides investors with a 2.4% yield. Vanguard charges only 4bps in fees.

VTV holdings review

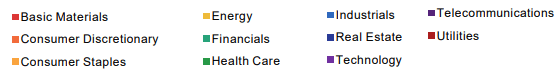

advisors.vanguard.com VTV sectors

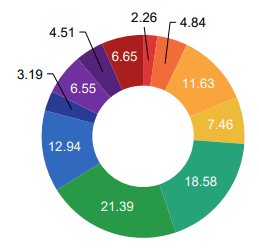

Compared to a S&P 500 index ETF like the SPDR S&P 500 ETF (SPY), the largest sector is less dominate than technology in that ETF, though still over 20%. Even so, 64% of the portfolio is in the top four sectors, about the same concentration as SPY. When analyzing a factor-based ETF, how it differs from a standard one is important as sector performance varies.

advisors.vanguard.com VTV holdings

VTV holds about 334 stocks, with the Top 10 representing 22% of the portfolio. Unlike S&P 500 Index ETFs, no individual stocks dominate the ETF.

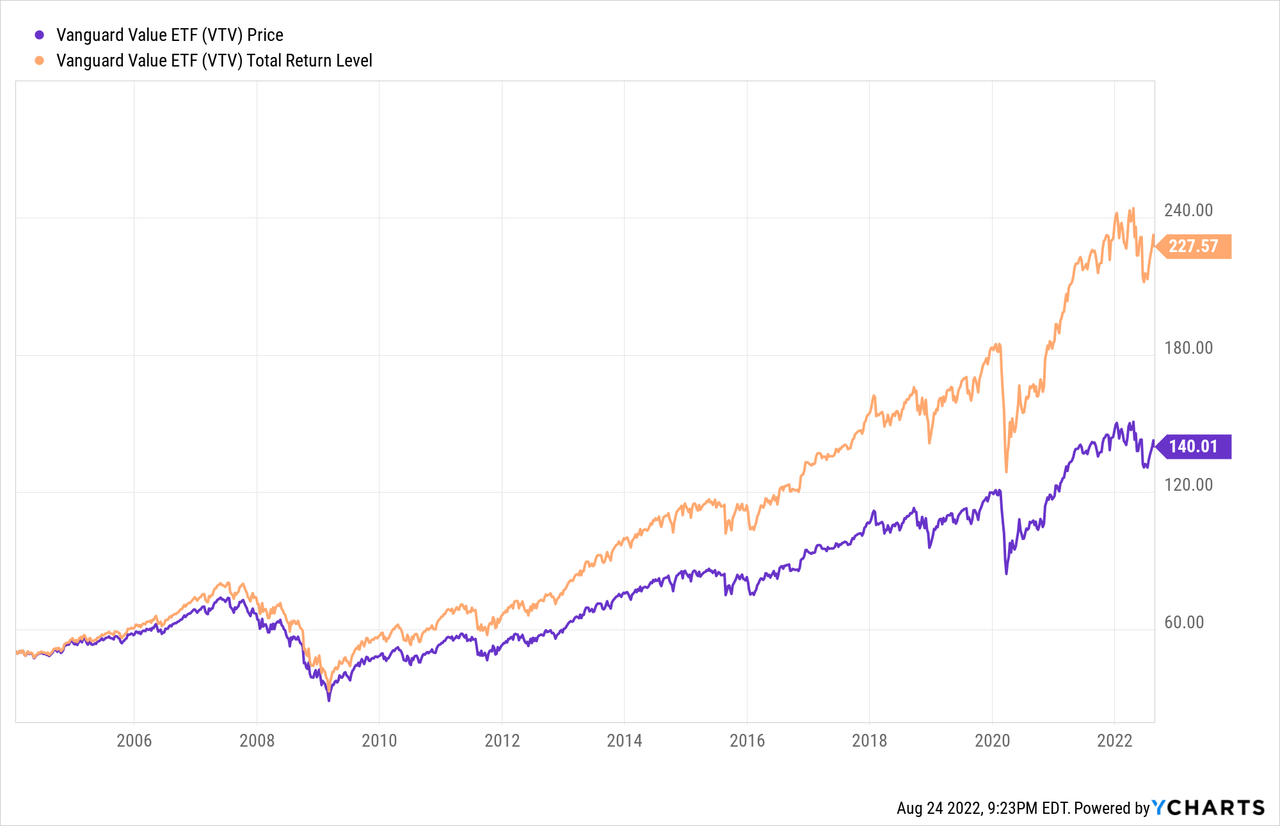

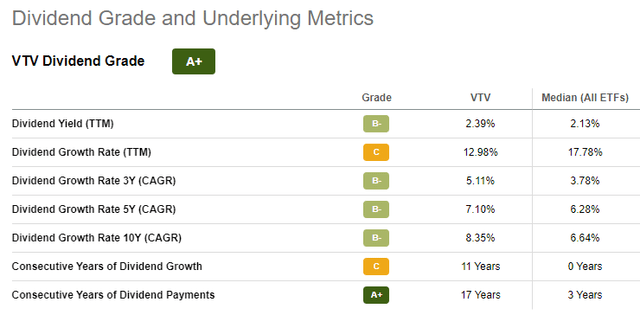

VTV distribution review

seekingalpha.com VTV DVDs

This is the data pattern income investors want to see. Except for the dip during the GFC, payouts have shown steady growth. Seeking Alpha gives these results a A+ rating.

seekingalpha.com VTV scorecard

Vanguard Small-Cap Value ETF (NYSEARCA:VBR) review

Seeking Alpha describes this ETF as:

Vanguard Small-Cap Value ETF invests in stocks of companies operating across diversified sectors. It invests in value stocks of small-cap companies. It seeks to track the performance of the CRSP US Small Cap Value Index. VBR started in 1998.

Source: seekingalpha.com VBR

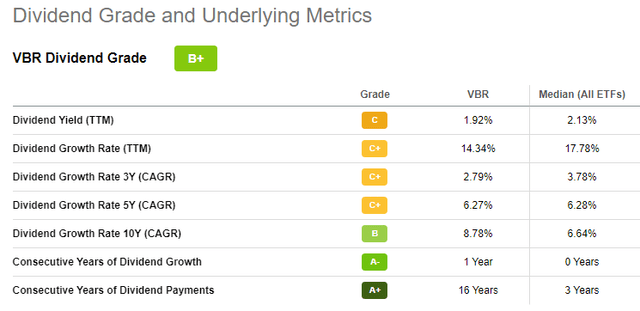

VBR has $46.4b in AUM and provides investors with a 1.9% yield. Vanguard charges 7bps in fees, 3bps more than VTV.

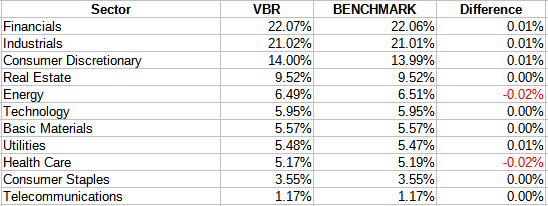

VBR holdings review

advisors.vanguard.com VBR sectors

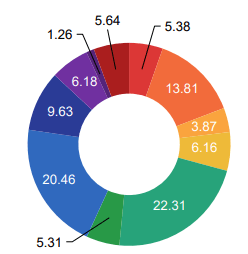

Like VTV, VBR has over 66% in its top four sectors, but here VBR is more tied to its biggest two than VTV is. Both ETFs are paralleling their benchmark well.

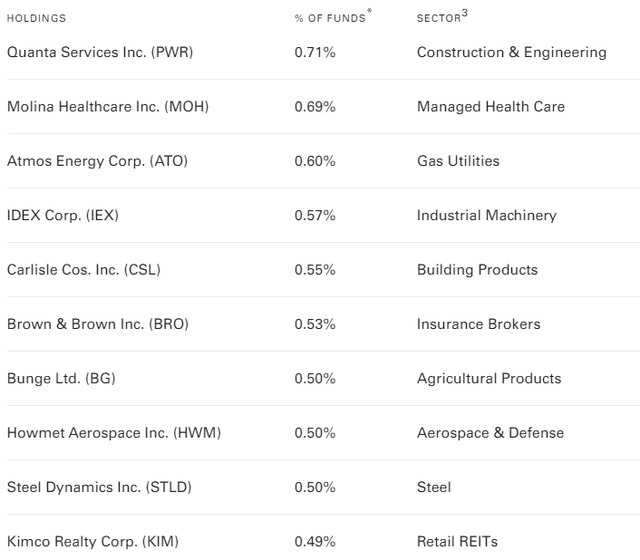

advisors.vanguard.com VBR holdings

With a much higher asset count (890), no VBR position is more than 1% of the portfolio, with the Top 10 under 6% of the total weight. This diversity potentially should make VBR less volatile than VTV, but the volatility of Small stocks overall seems to offset that advantage. The higher positions count also means no individual holding can become a “home run” for the ETF.

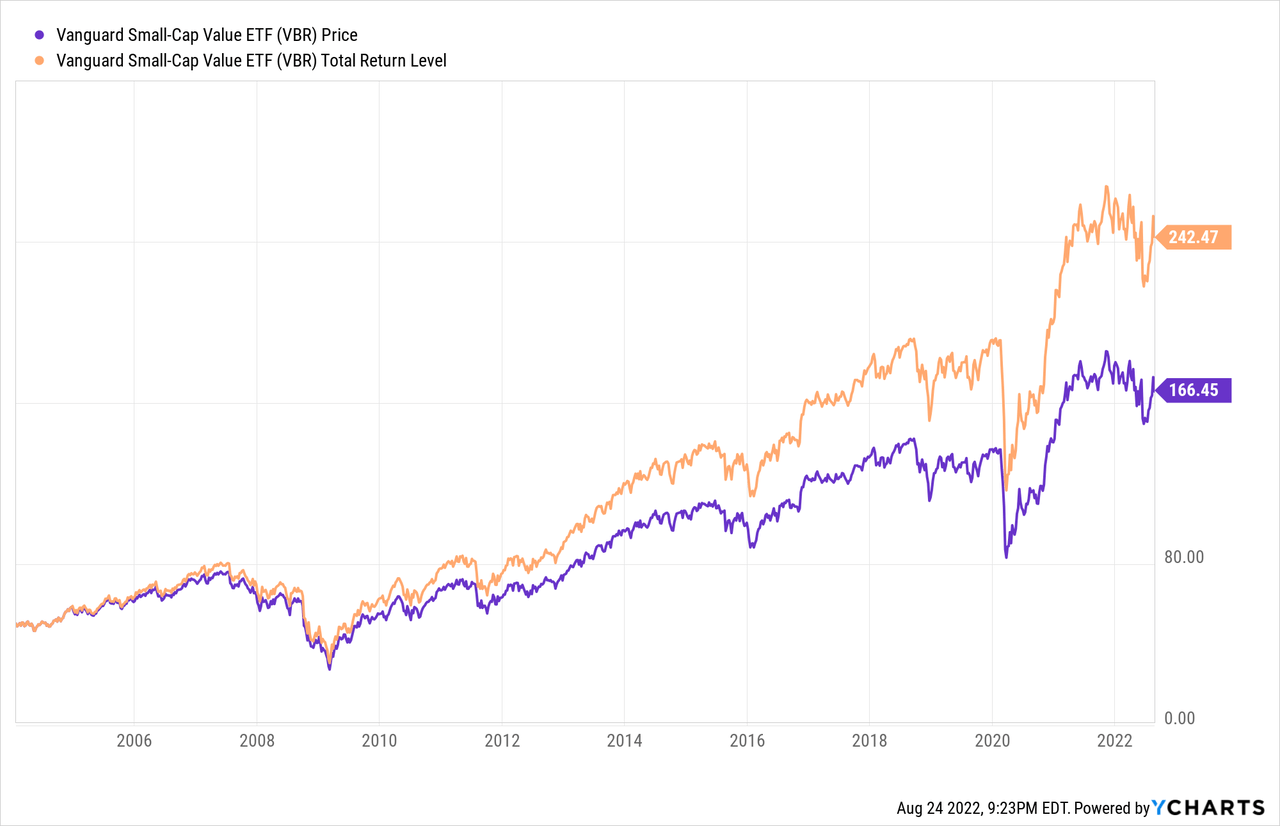

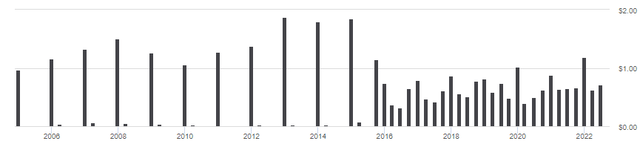

VBR distribution review

seekingalpha.com VBR DVDs

VBR switched from semi-annual to quarterly payouts in 2015. Since then, VBR doesn’t show the payout growth that VTV does, and this is reflected in their lower dividend grade of B+.

seekingalpha.com VBR scorecard

Comparing ETFs

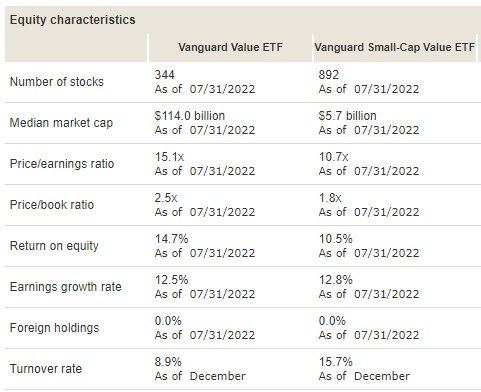

Using the most recent data, Vanguard provides comparisons for the following data points.

investor.vanguar.com compare

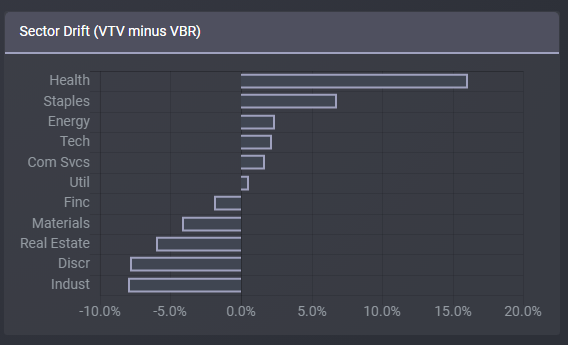

The two price ratios favor VBR – the ROE favors VTV, and the Earnings Growth rate slightly favors VBR. Activity within the Small-Cap world results in VBR having a higher turnover ratio. There are some wide sector differences between the two ETFs.

ETFRC.com

According to the same site, the two ETFs actually hold a few stocks in common, amounting to 1% overlap in portfolio size.

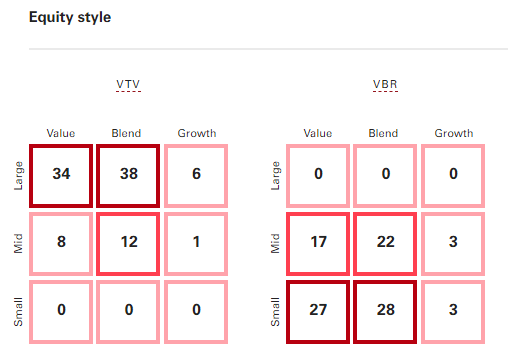

advisors.vanguard.com Compare

Notice both ETFs hold 50% of their holdings in stocks Vanguard’s system classifies as Blend, not Value. This reflects the different methodology used by different data providers, in this case Vanguard and CRSP.. That might explain why VBR seems to drift outside their target stock size more often than VTV does.

advisors.vanguard.com Compare

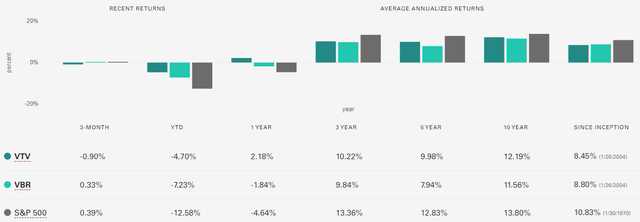

Except for the recent market rally, VTV has better results than VBR for each time period until you go to inception data. Recent data also shows both Value ETFs outperforming the S&P 500 Index.

Risk comparison

Using PortfolioVisualizer data, VTV shows a lower StdDev rate for both 3-Yr and 5-Yr periods. At the 5-Yr mark, VTV was 16.7, versus 22.2 for VBR.

Portfolio strategy

Along with the two ETFs reviewed, Vanguard also has one focused on Mid-Cap stocks, the Vanguard Mid-Cap Value ETF (VOE), which is the top performer of these three since its launch in 2006. While others are available that cover broader market-cap segments, I only found one, the Dimensional US Marketwide Value ETF (DFUV), covering the whole spectrum as it invests based on the Russell 3000 Value Index. Even so, only 11% of the assets are below Mid-Cap, with the vast majority Large-Cap.

The fact there are ETFs that segment the market is a plus for investors as they can decide for themselves what their market-cap allocation should be, not the index provider. Also by using Value ETFs combined with Growth ETFs, each investor controls that allocation too. Maybe add some international exposure, and you are all set.

Final thoughts

Both of these ETFs perform well against their peers and are worth a BUY rating for investors looking to add Value stocks to their equity allocation. Using these, and maybe the Mid-Cap ETF mentioned above, would allow each investor to set their weighting amongst the market-cap segments.

Being that I have a Value slant to my personal portfolio, I have reviewed several Value ETFs besides those here. Here are links to some of those articles:

Be the first to comment