Torsten Asmus

The sharp selloff in inflation-linked bonds in response to the Fed’s hiking cycle appears to have run its course. The return to positive real yields across the curve over the past few months has driven up the dollar and undermined the real economy, making further tightening unlikely. The rise in Treasury Inflation-Protected Securities yields following the strong jobs report on Friday provides a good opportunity to enter long positions in the asset class in anticipation of a dovish reversal by the Fed. The short end of the yield curve looks relatively attractive given the inverted yield curve, and the Vanguard Short-Term Inflation-Protected Securities ETF (NASDAQ:VTIP) now offers positive real return prospects for the first time since the height of the Covid crisis.

The VTIP ETF

The VTIP tracks an index of U.S. Treasury Inflation-Protected Securities with less than 5 years remaining to maturity, and has an average effective maturity of 2.5 years. The yield to maturity now sits at 2.8%, which is slightly above where markets expect inflation to average over the next 2.5 years. The VTIP is ideal for investors looking to benefit from falling short-term yields while also protecting against continued elevated inflation. The low duration of 2.5 years also ensures that volatility will be low, particularly relative to longer-dated TIPS. The fund charges a minimal expense fee of 0.04%.

Positive Real Return Prospects Are Back

The VTIP has generated positive total returns over the past few months due to high rates of headline inflation, which holders of the ETF receive. However, returns have underperformed inflation for two reasons. Firstly, interest rates have risen, and secondly, inflation expectations have fallen. This combination of factors has seen the yield on 2-year TIPS rise from -3.0% in March to 33bps today. This is the highest level since the Covid recession and suggests that holders of the VTIP should make money in real terms over the next few years. While a few basis points in real returns may not sound great, it is worth noting that the 10-year average yield on the 2-year TIP is -65bps.

US 2 Year TIPS Yield (Bloomberg)

Strong Potential For Capital Gains

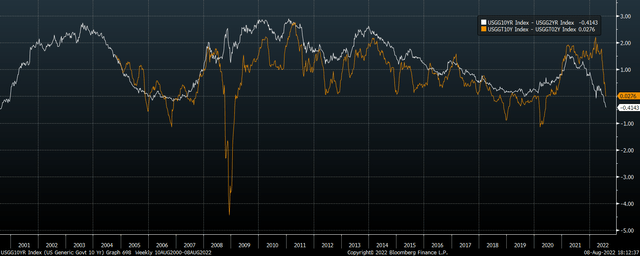

An additional reason for investing in the VTIP from a short-term perspective is the potential for capital gains in the event that real yields begin to decline. We have already seen this take place at the long end of the curve thanks largely to falling nominal yields, and with the yield curve now the most steeply inverted since 2000, downside pressure is building at the short end.

2s-10s Yield Spread And TIPS Yield Spread (Bloomberg)

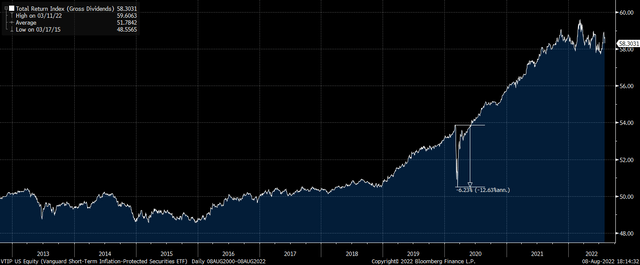

The biggest risk to the VTIP comes from a potential collapse in inflation expectations. During the global financial crisis, and to a lesser extent the Covid crisis, short-term inflation expectations (and indeed subsequent headline inflation readings) fell much faster than short-term nominal yields. As a result, short-term TIPS saw capital losses. However, it would likely take a sizeable credit crunch to bring inflation down from its current level of 9.1% to below the 2.8% level implied by short-term inflation expectations. If this was the case, then the VTIP would likely dramatically outperform everything except cash. During the Covid crash the VTIP posted a sharp 6% peak-to-trough decline, which was far less than the 11% decline seen in longer-dated TIPS or the 34% decline in the MSCI World.

VTIP Total Return Performance (Bloomberg)

A more likely scenario, in my view, is that growing signs of economic weakness cause the Fed to halt its hiking cycle, which in turn causes short-term nominal bond yields to fall while simultaneously putting upside pressure on inflation expectations as the risks of a credit crunch recede. Such a scenario would likely result in high single digit returns in the VTIP as was the case in 2019 following the Fed’s dovish pivot in late 2018.

Summary

The VTIP now offers positive real return prospects on a buy and hold basis over the next 2.5 years, as well as the potential for capital gains in the event that the Fed’s hiking cycle comes to a premature end and the risks of a credit crunch recede. The low duration of the VTIP also ensures that volatility will be low, particularly relative to longer-dated TIPS and stocks, meaning that the VTIP would likely outperform in the event of a credit crunch.

Be the first to comment