gorodenkoff

Investment thesis

VTEX (NYSE:VTEX) is fairly valued based on my estimates and investors should wait for a cheaper price before investing. VTEX is a leader in the Latin American e-commerce market, and its platform and expertise in local variations and preferences make it difficult to replicate.

Business overview

In the realm of e-commerce, VTEX is a Brazilian tech firm that provides a software as a service platform to both small businesses and multinational corporations. The company provides a wide variety of market entry strategies, giving its customers extensive options for personalization and rapid product launch.

Ecommerce is becoming the norm for consumers, and retailers must adapt

To accommodate modern shoppers, e-commerce has developed. As a result, the ability to accept orders and carry them out was severely constrained by early solutions. These days, companies know they need a direct-to-consumer channel so they can manage their interactions with customers and convey their messages in their own words. The COVID-19 pandemic sped up the adoption of ecommerce, causing a significant shift in shopping habits. Now more than ever, customers count on brands to streamline the entire shopping experience, from browsing to paying to receiving their orders. So, to better meet the needs of their clientele, stores need highly adaptable and scalable enablement platforms.

Consumers’ paths to purchase (including research, discovery, and evaluation) are evolving as a result of digital transformation and new technologies. Thanks to the internet, shoppers can connect with retailers from all over the globe to locate and acquire goods that suit their individual preferences and requirements. In order to provide a positive experience for customers from discovery to delivery, businesses need to take into account a wide variety of touchpoints and sales channels. When a store lacks a strong online presence, it is more likely to be passed over by customers, fall further behind in the industry, and have difficulty growing. Therefore, I think stores of all sizes need to make investments in digital transformation to create innovative approaches to doing business. The use of powerful omnichannel solutions is now expected of any digital transformation plan. Companies need to be able to connect with customers on a deeper level and provide a consistent brand experience throughout the entire shopping journey, which necessitates significant and ongoing innovation in marketing, inventory, payments, and delivery.

VTEX platform solves the challenges

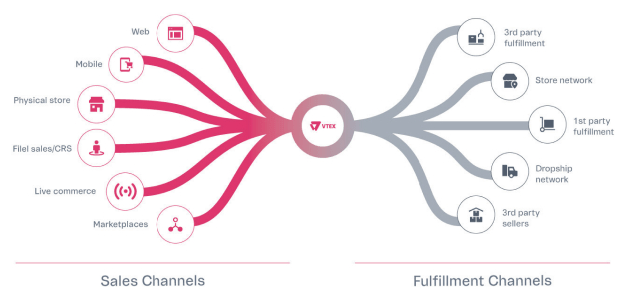

The VTEX platform allows users to implement their commerce strategy, including the establishment of online stores, the coordination of orders across multiple sales channels, and the establishment of marketplaces where goods from different suppliers can be sold together. In addition, the platform’s unified commerce, marketplace, and solutions provide clients with superior enterprise management tools.

VTEX’s primary product is an advanced omnichannel commerce platform that can improve upon preexisting in-store and distribution networks, coordinate and control a wide variety of sales channels, and link together a wide variety of fulfillment centers. The platform is also delivered with a simple architecture and a low-code development environment, which is a huge plus. VTEX’s pre-built integrations and adaptable back-end make it stand out, in my opinion, because not everyone can write code. In addition, the VTEX platform provides an attractive value proposition to its suppliers. Drop-shipping and other forms of digital collaboration between suppliers and customers have made it possible for customers to coordinate inventory and fulfillment with third-party suppliers

S-1

Leading market position with a strong ecosystem built over the years

VTEX is a leading e-commerce solution provider in Latin America, with a strong market position driven by its platform, product localization, and compliance with local tax laws. The company’s scale and longevity have allowed it to create a robust ecosystem that is hard to replicate, which I believe is a key competitive advantage that will help VTEX maintain its leadership in the region. Unlike other companies that simply hire a team of developers to create a platform, VTEX has invested the time and effort to build relationships with key stakeholders, which is a major advantage in the highly competitive e-commerce market.

This ecosystem is crucially important, in my view. By coordinating with customers’ suppliers and hundreds of other integrated partners, VTEX helps them tap into untapped revenue potential. Over a thousand different solutions are part of the VTEX ecosystem, and there are another two hundred system integrators, one hundred different marketplaces, eighty different payment solutions, and fifty different logistics companies (according to VTEX filings). Integrating these partners’ solutions into the VTEX platform facilitates the execution of customers’ commerce strategies, the creation of valuable networks, and the success of marketplaces. As a bonus, the increase in organic leads helps VTEX save money on acquiring new customers.

Scalable platform

VTEX offers its customers a scalable, fast, and customizable platform. It uses a low-code development platform that allows businesses to quickly create unique experiences and deploy them using API-first business capabilities. As a result, businesses can be confident that their employees are always using the latest tools, thanks to VTEX’s standard, global, multi-tenant architecture. This design also offers long-term cost savings by making R&D expenditures more efficient compared to point and legacy solutions. Unlike point and legacy solutions, which require each update to be tailored to a specific version, VTEX only needs to roll out a single update to ensure that all customers receive it.

Competition

In reality, VTEX is not a panacea for every company. I think businesses have to decide between two software solutions: one that is simple to implement but offers few customization options, and another that is flexible but challenging to put into action.

The former refers to narrowly focused software for small and medium-sized enterprises. Integration marketplaces meet the demand for personalization by bringing together a wide range of vendors of varying quality levels. Users are faced with a tough choice: stick with the tried-and-true but unscalable status quo, or branch out and experiment with complex solutions from a variety of vendors.

The second type of platform, which is typically on-premise and open-source, requires a larger initial investment, longer customization and integration periods, and a higher total cost of ownership as a result of increased developer dependency. Although re-platforming can be difficult once it’s been implemented, it’s inevitable in the face of steadily increasing consumer expectations.

I think VTEX has struck a balance between the two, giving customers something they won’t find anywhere else. Each of VTEX customers benefits from the VTEX platform’s rapid time-to-market, intuitive design, and adaptability.

Latest 3Q22 performance reinforces my view on the business

As reported by VTEX, the company’s revenue of $38.8 million is higher than what was expected. Powered by double-digit increases in same-store sales, subscription income was up 23% on a currency-neutral basis, while gross merchandise volume was up 29%. Furthermore, Mexico, the United States, and Europe stood out in terms of GMV growth.

The company’s $26.9 million in non-GAAP subscription gross profit was 40 basis points higher than market expectations, indicating a gross margin of 73.8%. Optimized code (recalling my earlier thesis point, the more VTEX optimizes this, the more cost savings it yields over time), improved server configurations, and scalable support staff have all contributed to VTEX’s continued margin expansion. It’s also worth noting that, despite the possibility of margin volatility during the transition to a non-core cloud provider, management stated during the call that they see room for continued margin improvement.

In terms of brand updates. Giassi B2B in Brazil and Asics in Peru were two examples of new customers coming from regions without any preexisting online stores, while Levi’s in Argentina, Vivara and Farma Delivery in Brazil, Belcorp in Colombia and Chile, Chedraui in Mexico, Claro in Peru, Foschini in South Africa, and WH Candy in the United States were all examples of new customers coming from rival platforms.

Valuation

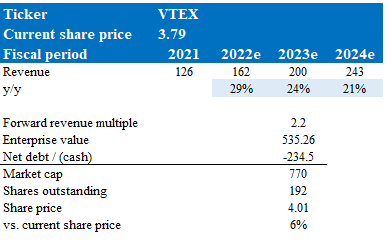

VTEX is currently undervalued by about 6%, according to my model. The model is based on management’s FY22 revenue guidance and my FY23/24 expectations.

VTEX should continue to expand and ride the ecommerce wave by solidifying its market position. In terms of estimates, I used consensus estimates for FY23/24, which are reasonable when compared to the most recent quarter, which was strong and indicates momentum.

VTEX is currently trading at 2.2x forward revenue, which I assumed would remain the case in FY23. However, VTEX used to trade at a much higher multiple, so a re-rating upward is possible.

Based on these assumptions, I estimated that VTEX’s stock will be worth $4.01 in fiscal year 23.

Own estimates

Risks

Technological evolution

Because of how important technology and innovation are to the company’s success, it could take a hit in both revenue and reputation if management drops the ball on customer-facing services, systems, and platforms maintenance and support, or if it can’t fix quality issues and roll out product updates on schedule.

Sales volatility

VTEX’s future profits could be in jeopardy if the company does not take steps to address the arbitrary nature of sales cycle length and the potential problems that could arise from such variations.

Conclusion

If you ask me, VTEX is fairly priced at the moment, and one should hold off on buying until it drops in price. VTEX has a strong market position in the Latin American e-commerce market because its platform and knowledge of regional differences and preferences are difficult to imitate. The platform offers a variety of market entry strategies and customizable options for rapid product launch. VTEX main product is an advanced omnichannel commerce platform that can improve upon existing in-store and distribution networks, coordinate and control multiple sales channels, and link together fulfillment centers.

Be the first to comment