97/E+ via Getty Images

Investment Thesis

VOXX International Corporation (NASDAQ:VOXX) Is a leading electronics manufacturer and distributor, headquartered in headquartered in Orlando, Florida. In this thesis, I will primarily analyze the quarterly results of VOXX and its future growth prospects. I will also be analyzing the impact of chip shortage and supply disruption on company’s performance.

Company Overview

VOXX Is a leading global manufacturer and distributor of Automotive Electronics, Consumer Electronics, and Biometrics products. The company has worldwide operations with more than 30 global brands under its control. The company has segregated its business into three main segments; Automotive Electronics, Consumer Electronics, and Biometrics. The Automotive Electronics segment designs, manufactures and distributes driver distraction products, automotive security, remote start systems, location-based services, turn signal switches, automotive lighting products, heated seats, and satellite radio products. The Consumer Electronics segment offers home theater systems, cinema speakers, flat panel speakers, wireless and Bluetooth speakers, karaoke products, personal sound amplifiers, and many more Consumer Electronic products. The Biometrics segment manufactures and markets iris identification and biometric security products. The Consumer Electronics segment contributes the maximum revenue at 69% of the total revenue, followed by Automotive Electronics at 30.5%. The company relies on suppliers and manufacturers based in Pacific Rim countries, including China, Hong Kong, Indonesia, Vietnam, South Korea, and Taiwan, for several products and components procurement. VOXX operates in a highly competitive space with competition from some of the giants like Sony, LG, Bosch, GE, Bose, and many others.

Q1 2023 Results

VOXX reported a severely underperforming quarter, missing market estimates on both EPS and revenue. The company missed the market’s EPS estimates by an astonishing 212% and the revenue estimates by 4%. The company failed to impress on all the parameters, including the net profit margins. The company suffered from the supply chain and chip shortage issues more than the company had anticipated. I believe Q1 2023 result highlights the fault lines in the company’s supply chain and inventory management. The company failed to impress me with Q1 2023 results.

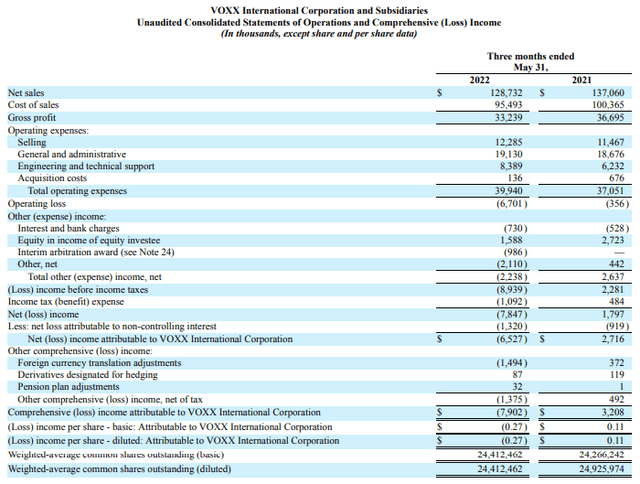

VOXX reported net sales in the Automotive Electronics segment at $39.6 million, a fall of 7.2% compared to $42.7 million in the prior year’s quarter. As per my analysis, the reason for this fall can primarily be attributed to the chip and component shortage resulting in delayed execution of orders. The Consumer Electronics segment’s net sales fell 5.5% to $88.9 million, compared to $94.1 million in Q1 2022. I believe the fall was majorly due to lower-than-expected sales of premium home theater speaker systems. The company reported a total net sales of $128.7 million, a 6% fall compared to $137 million in Q1 2022. The company reported a gross margin of 25.8%, compared to 26.8% in the prior-year quarter. The increased tariffs, shipping costs, and the component procurement cost were the main reasons behind the contracted gross margins. VOXX reported a net loss of $6.5 million compared to a net income of $2.7 million in the prior year’s quarter, a drastic 340% fall. The fall was primarily due to increased operating costs and, on the other hand, lower net sales. The diluted loss per share was reported at $0.27, a fall of $0.38 compared to EPS of $.11 in Q1 2022.

Pat Lavelle, President and Chief Executive Officer, commented,

During the Fiscal 2023 first quarter, we continued to experience supply chain issues though the biggest impact was the lack of chips which directly impacted our automotive OEM and aftermarket business. Retailer buying also slowed in March given high inventory positions which impacted sales in our Consumer Electronics segment. While these challenges will persist, we are still poised for growth and expect to have a strong second half of the year based on new Automotive programs, increased production and sales of Onkyo products, along with expanding worldwide distribution, and a host of new products coming to market.

I believe the company could face the supply chain issues in the coming quarters to the same extent that they have faced in Q1 2023. The chip shortage is the most significant cause of concern for the company, restricting its ability to execute orders on time. Given the macro-economic environment and the slowdown of chip production in the south Asian countries, the chances of recovery for the company appear to be slim. As per my analysis, the gross margins of the company might remain stressed even in the coming quarters. The earnings are expected to improve in H2, but the gross margins may remain stressed throughout fiscal 2023.

Key Risk Factor

Supply Chain Issues: The company is experiencing supply chain issues that have created a scarcity of chips. The chips shortage has adversely impacted the automotive OEM and aftermarket business as the chips are essential for manufacturing new vehicles and certain automotive products. The global chip scarcity will delay or stop the production of new cars, which can adversely affect the company’s earnings. The prices of the chips are cyclical, and in the high inflationary environment, this issue can decrease the profitability and can have adverse effects on the growth prospect of the company.

Valuation & Quant Rating

The company is going through a rough patch due to the supply chain disruption due to covid-19. It is continuously missing the street expectation about quarterly results by huge margins. According to the quant ratings, the company has a D+ in profitability, which I believe is the correct grade to reflect the current financial conditions of the company. The company’s earnings depend on the supply of the chips, and rising inflation can adversely affect the company’s growth as the demand for electronic products can decrease with increasing prices. The quant grade for the growth is D- which aligns with the company’s headwinds. The company might fail to gain momentum as we can expect negative events in the coming period. I’m afraid I have to disagree with the A grade of the valuation.

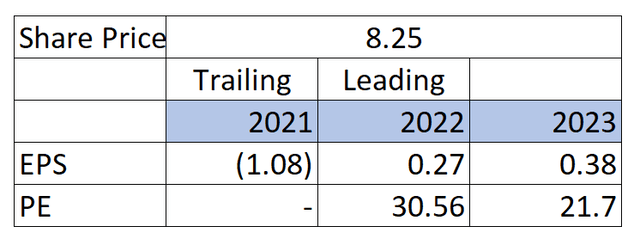

The company is currently trading at $8.25 with a market cap of $197.48 million. I estimate the full-year EPS of FY2023 will be $0.27, which gives the leading PE multiple of 30.56x. As I have stated above, the company has limited growth potential currently, and that’s why I believe the company’s current PE multiple is quite high. I estimate the company will trade at a PE multiple of 28x with a target price of $7.56, which shows that the company is 8.4% overvalued as compared to the current price level of $8.25.

Conclusion

The company is currently facing supply chain disruption and economic headwinds, which has led me to conclude that the company is experiencing declining profitability and limited growth potential. It is presently trading at a high PE multiple compared to its growth prospect, which shows the current share price is higher than the company’s intrinsic value. The factor grades of the seeking alpha also align with my thesis of limited growth potential as it has assigned a D- for the company’s growth prospect. After considering all these factors, I assign a sell rating for VOXX.

Be the first to comment