We Are

Volatility gets you in the gut. – Peter Bernstein

Twitter

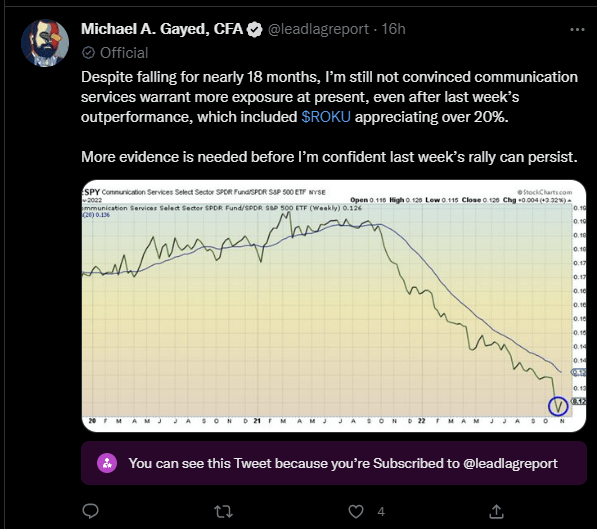

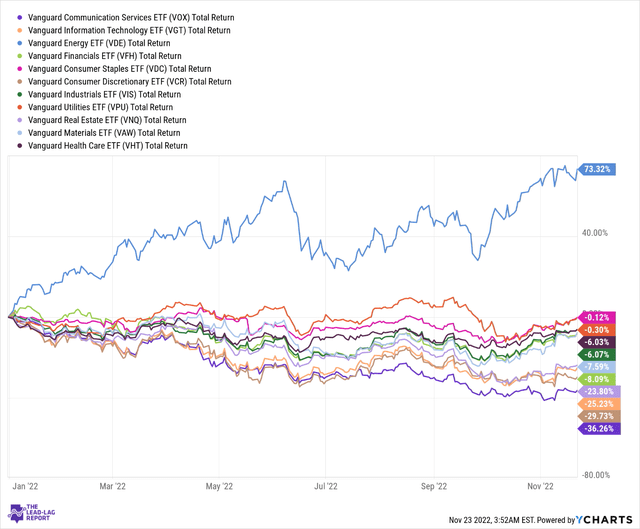

If you’re a super follower of The Lead-Lag Report Twitter account, you’d note that I recently put out a tweet highlighting how oversold the communication services sector looked relative to its peers from the S&P 500. It isn’t just the degree of underperformance vs. the benchmark index; adding to the ignominy of it all, one should also note that this is hands-down the worst-performing sector of the year. As you can see from the image below, the Vanguard Communication Services ETF (NYSEARCA:VOX), the ETF I’ll be covering today has lost 36% of its value this year, well ahead of all the other 10 sub-sectors of the broader markets.

Given the brutal selling witnessed over the last 11 months, could this product benefit from some mean-reversion? Well, here are a few things to consider

What To Consider?

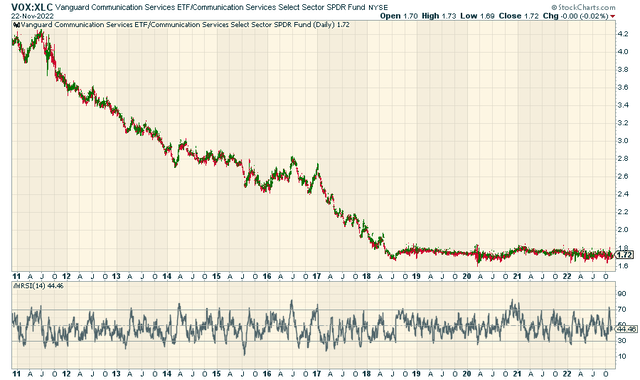

The image in the tweet at the start of the article focuses on the relative strength ratio of the Communication Services Select Sector SPDR ETF (XLC), which is a more focused play on communication services (with XLC, you only get exposure to the communication stocks that make up the S&P 500, which is around 25 stocks. In effect, large-cap stocks account for 96% of this total portfolio.

On the other hand, with VOX, investors get exposure to a much wider pool of communication services stocks (112 in total). Needless to say, this also results in a useful dose of micro, small, and mid-cap stocks (19% of the total portfolio). Is that a good thing? Well, that depends.

If you’re looking for good value, I reckon it would make greater sense to rotate to VOX as its portfolio looks enormously oversold relative to XLC (which as we know looks oversold in itself relative to the S&P 500)

Having said that, if you’ve followed my work over the years, you know I track a lot of inter-market signals to gauge risk sentiment in the market, and the movements last week suggest that risk-off conditions could be here.

Twitter

The movement of Lumber, utilities, and treasuries all suggest that something unpleasant is brewing in the markets. I recognize that some people have taken their seatbelts off, but in my Lead-Lag Live discussion with Simon Rae we explored why volatility is likely to make a comeback.

The reason I bring up volatility is that VOX has not done particularly well in the face of harmful volatility. One can get a sense of this by looking at the respective Sortino ratios of VOX and XLC. VOX’s average Sortino ratio works out to 0.41, whilst XLC’s is a lot better at 0.73. Of course, past results are no guarantee of future performances but investors need to understand what product their dealing with.

One thing that reflects well on VOX is that post the brutal drawdowns this year, the valuations of its major holdings look rather tasty. For instance, let’s consider the top-10 stocks which currently account for an elevated aggregate weight of 62%.

|

Forward P/E |

Forward P/E- 5Yr Average |

Difference |

|

|

Alphabet Class A |

19.91 |

26.97 |

-26% |

|

Alphabet Class C |

19.95 |

26.99 |

-26% |

|

Meta |

12.12 |

23.54 |

-49% |

|

Walt Disney |

23.26 |

40.73 |

-43% |

|

Verizon |

7.46 |

11.13 |

-33% |

|

Netflix |

27.49 |

75.18 |

-63% |

|

AT&T |

7.25 |

9.06 |

-20% |

|

Comcast |

9.47 |

15.18 |

-38% |

|

T-Mobile |

59.57 |

36.82 |

62% |

|

Activision Blizzard |

24.56 |

24.43 |

1% |

|

Average |

21.10 |

29.00 |

-27% |

Source: Seeking Alpha

With the exception of T-Mobile and Activision Blizzard, all these other stocks are trading at steep forward P/E discounts ranging from 20-63%. The average discount of the top 10 works out to 27%.

Whilst the valuation landscape looks tantalizing, don’t forget that there are still some pressing concerns over the outlook of these firms. For instance, consider VOX’s major holdings- Alphabet and Meta Platforms. Both companies came out with some fairly underwhelming numbers in the recently concluded quarter. Crucially, both these companies are heavily reliant on online advertising momentum, and whilst it is difficult to see how this flourishes with a recession well underway. Typically, when faced with a deteriorating demand environment C-suite execs almost always cut advertisement budgets first, before moving on to other areas. In addition to ad spend pressure from clients in traditional industries such as financial services, and insurance, this time, also don’t dismiss the pronounced effect of diminished crypto-related ad spend.

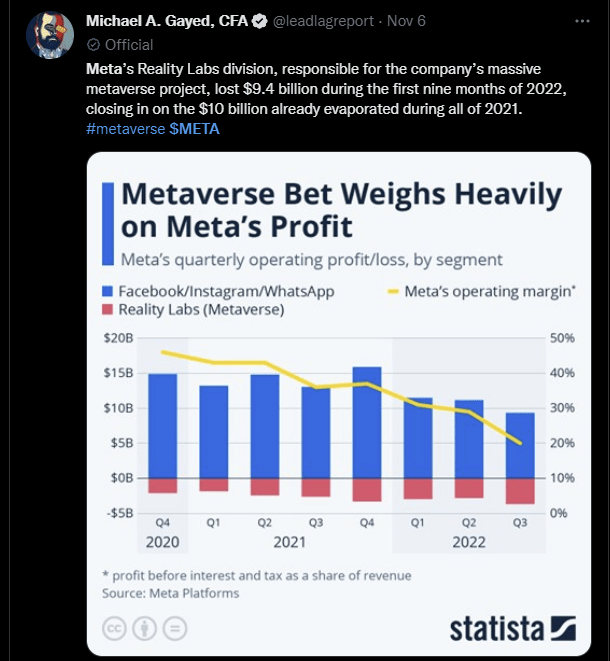

Twitter

As noted in The Lead-Lag Report, for something like a META it isn’t just pressures emanating from ad spending; investors also have to deal with this relentless outlay towards meeting its metaverse ambitions. In a normalized macro environment, investors could wait patiently to see some semblance of ROIs, but in the current recessionary era where the base cost of capital continues to get levered up, they’ll have little patience for a company that continues to burn over $10bn every year.

Twitter

To counter these challenges, we’ve seen some massive readjustments in the workforce. Towards the end of last month, I pointed out how headcount additions in Alphabet would drop significantly in the current quarter. Recent reports suggest that it isn’t just the weak pace of hiring, the company is also in the midst of trimming its existing employee base. Alphabet is not alone, even Meta has put in place some deep cuts in the employee base after admitting that their reading of the market was wrong. These workforce adjustments will no doubt be unpleasant for those involved, but it’s also important for these communication service companies to burn some of the excesses they had gained post the pandemic, and make the cost-base more palatable.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment