franckreporter

Vornado Realty Trust (NYSE:VNO) is trading fresh off their most recent earnings release, which generally came in better than feared, with occupancy and leasing-related metrics on track, with continued recovery noted in the NYC market.

Other than the effects of higher interest rates, which is expected to weigh on earnings in subsequent periods due to the company’s elevated exposure to variable-rate debt, the overall release didn’t include any material adverse developments.

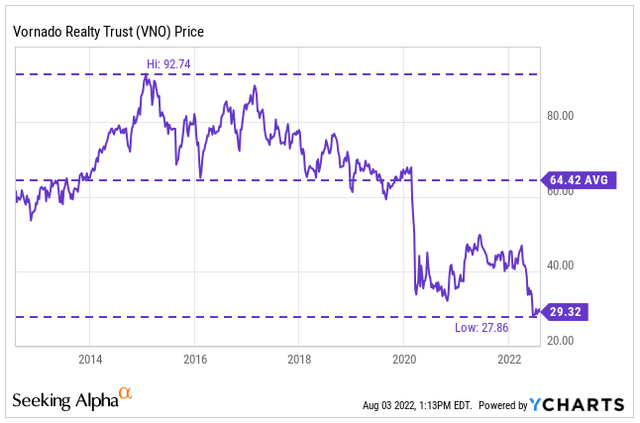

Shares initially benefited from a post-release bounce but have returned to a rangebound position at their lows. Presently, the stock is trading at multi-year lows and appear to be stuck in desolation.

YCharts – VNO’s Share Price History

At current levels, VNO appears ripe for a deal-making opportunity. Their portfolio of assets within the Penn District are prized interests that could benefit over the long-term from a strategic spinoff. Additionally, Alexander’s, Inc (ALX), which is 30% owned by VNO, was recently pressed by an activist investor to overhaul their strategic direction. The close relationship between the two companies warrants speculation of a potential combination.

For investors, any developments in deal-making relating to VNO that would indicate a change of course in the direction of the company would likely result in share-price appreciation to levels in excess of $40/share, which would represent material upside and a valuation of about 13x forward FFO.

The Penn District

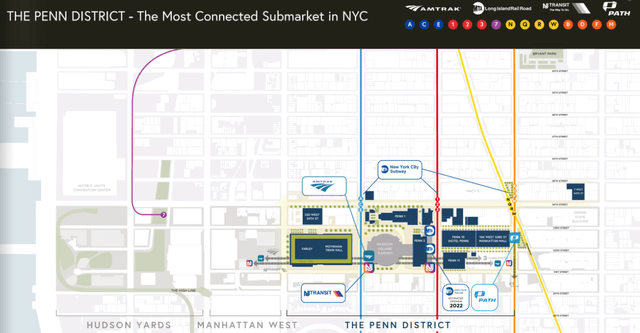

The Penn District is located in the heart of Manhattan and is considered one of the largest connected submarkets in NYC. It includes renowned city fixtures such as the Empire State Building and the Macy’s Department Store. In addition, the area surrounds New York’s Penn Station, which is the busiest transportation hub in North America.

VNO’s Brochure of The Penn District

In recent years, the nearby area has attracted significant development, some of which were completed by VNO. Examples of some major projects include the High Line, the Hudson Yards, and the Moynihan Train Hall. At present, the district remains one of VNO’s trophy development opportunities. Plans for the district involve transformative change to existing buildings, additions of new buildings, and the expansion of public plazas supporting retail and food and beverage destinations.

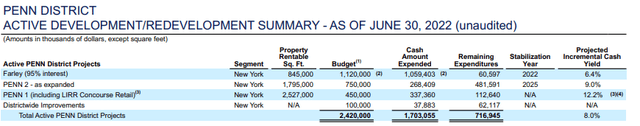

Ongoing projects include PENN 1 and 2 and the Farley building. These are expected to reach stabilization over the next several years. There are also a number of other opportunities in the pipeline, one of which is the Penn Station Plan, which is shaping up to be the grandest and, arguably, the most controversial.

Q2FY22 Investor Supplement – Summary of Active Development Within The Penn District

The Penn Station Plan

Recently, New York’s economic development agency, the Empire State Development Corporation, approved the general project plan (“GPP”) for the Penn District. The plan, first proposed by former Governor Andrew Cuomo, and now embraced, with a few modifications, by both current Governor Kathy Hochul and Mayor Eric Adams, envisions a complete revitalization of the Penn Station into a city centerpiece.

A key component of the plan is the construction of ten towers around Penn Station on sites that are primarily owned by VNO. Of the ten sites involved in the plan, VNO owns four and part of a fifth. The redevelopment of the area is expected to be among the largest real estate projects in U.S. history, with the creation of approximately 18M square feet of office space, nearly 2K residential units, and retail/hotel space. At the centerpiece of this campus would be the newly renovated Penn Station.

The Complexities

While the plan appears straightforward on the surface, the details get murky and controversial when considering the complexities of the funding, the politics, and the timetable to completion. While New York’s Metropolitan Transportation Authority (“MTA”) is leading the +$7B renovation project at the station, the state expects the federal government, Amtrak, and New Jersey to contribute most of the money. This can easily turn into a funding dispute, especially if political winds begin to shift against the project.

In addition, an agreement was made between the city and the state to allow payments from the developers of the ten sites, which includes VNO, to cover part of the renovation costs. This would be in the form of payments in lieu of taxes (“PILOTs”). Under this plan, VNO would essentially provide the state with a specified portion of their revenues earned from the properties developed on the site in exchange for a tax break that is estimated to be around +$1.2B.

Concerns regarding the plan are widely documented via commentary and watchdog reports. CEO Steve Roth’s political ties to the project have also been cited as potential red flags. From a purely business perspective, one issue that comes to mind is the timetable. Given the historic nature of the project and its public-private structure, there is a real risk of development morass.

Opposition and Risks of Development

Opposition within the local community is already evident. And a dispute between the city and the state regarding the funding arrangement is likely in the near-medium term. Vocal opposition and funding disputes are two setbacks that are likely to extend the life of the project. Not to mention the sheer scale of the project itself, which is already expected to be a massive undertaking. And this would be on top of the other ongoing projects that the company has that are still pending delivery.

Additionally, much of the PILOT agreement is wagered against future revenues generated from VNO’s properties. Suppose the revenues derived from the buildings are substantially less than expected. How would the state respond? Would they try to claw back some of the tax breaks? As office-oriented buildings, the development is exposed to the risk of the continuing popularity of hybrid/remote work. If stabilization comes in under expectations, revenues earned on the development very well may be less than what the state was expecting.

A Prized Portfolio Worthy of A Spinoff

Despite the open questions regarding the ongoing developments at the Penn District, the area remains VNO’s marquee portfolio holding. Through Q2FY22, VNO has substantially completed the renovations at PENN 1, and they are more than halfway through PENN 2. Together, these are expected to contribute an additional incremental +$300M of NOI through stabilization, though some analysts are skeptical of this estimate, given management’s past misses.

Nevertheless, the district remains the most attractive growth opportunity to VNO. With VNO’s stock price down to multi-year lows, a valid argument can be made that the market is significantly mispricing the future value of these developments. Part of this relates to the company’s non-core portfolio holdings that are underperforming.

One potential strategy would be to spin off the district, perhaps as a tracker security. This was referenced on their most recent earnings call by Mr. Roth, who had also mentioned that he has long believed in separating the district to a separately tradable security. Though timing was mentioned as one consideration, it would not come as a surprise if it happened sooner than later, especially considering the numerous concerns regarding the pending Penn Station project.

A Circling Activist

As of June 30, 2022, VNO owned a 32.4% stake in ALX, which is a REIT that is managed by, and whose properties are leased and developed by, VNO. Mr. Roth is also the Chairman of the Board and CEO of the company. Included in their portfolio are six properties in the NYC metropolitan area. Their top tenant is Bloomberg L.P. (“Bloomberg”), who represents over 50% of their total revenues.

In July, an activist investor, Lionbridge Capital, LP, issued an open letter to ALX’s shareholders outlining their concerns regarding the current state of affairs in the company. Among their chief concerns was the significant underperformance of the shares in relation to its estimated intrinsic value, which Lionbridge pegged at over $425/share.

To maximize shareholder value, the activist recommended a few steps, one of which was the internalization of management. Another recommendation was to commence a strategic review process, including a possible take-private transaction. The letter even states that it has identified interest from an institutional investor that has indicated it is willing to purchase ALX outright.

Mr. Roth addressed this letter during VNO’s most recent earnings call in a lengthy response from a question from Piper’s Alexander Goldfarb. In his response, he referenced the activist’s suggestion to internalize management. In his view, this would do little but significantly drive-up expenses at ALX. In addition, he cited the activist’s views on increasing ALX’s leverage to pay out a special dividend and the unwillingness of the board to proceed down that route.

He then went on to cover the existing cash balance at ALX, which stands at about +$540M, and the return on investment that VNO has received over the years through their stake in the company. This includes +$520M in cumulative dividends received.

While he did cite his reply as a formal response to the letter, it was not exactly a clearly worded rebuttal. He was pressed again later on the call from Michael Bilerman at Citi regarding the future of VNO/ALX. In his response, Mr. Roth alluded to the prospect of a possible combination between the two companies but seemed to discount that idea due to the difficulties in settling on a price that would satisfy shareholders of each company. Still, other than mentioning that he has addressed the topic in the past many times, he didn’t exactly rule it out.

Significant Upside on Any Deal-Making Developments

Down to multi-year lows, VNO appears ripe for external activity. Their interests in the Penn District are some of the company’s most prized assets, yet the development is being significantly undervalued by the market. This is partly due to the company’s other non-core assets that haven’t performed as expected.

Additionally, though VNO doesn’t have any significant near-term debt maturities, they do have greater exposure to floating-rate debt. This is expected to weigh on earnings in coming periods as interest rates continue to rise.

One potential path forward would be a spinoff of the Penn District. This would likely maximize the future growth potential of the development to shareholders and may also alleviate some of the political concerns regarding the upcoming project at Penn Station.

The activist letter to ALX, who is managed by VNO, is one potential warning sign that change may be brewing. Though the activist is small, they still received a good deal of attention on the most recent earnings call. While a combination of the two companies was discounted due to the difficulties of arriving at an acceptable price to shareholders of both companies, it wasn’t ruled out in its entirety.

With shares trading at less than 10x forward FFO and near their 52-week lows, along with activists on the prowl at a related company, it wouldn’t be surprising to see VNO engage in deal-making themselves. For investors, any action that would indicate a change of course in current operations would likely be met with significant share price appreciation.

Be the first to comment