AvatarKnowmad/iStock via Getty Images

Risk Mitigating US Lithium Miner

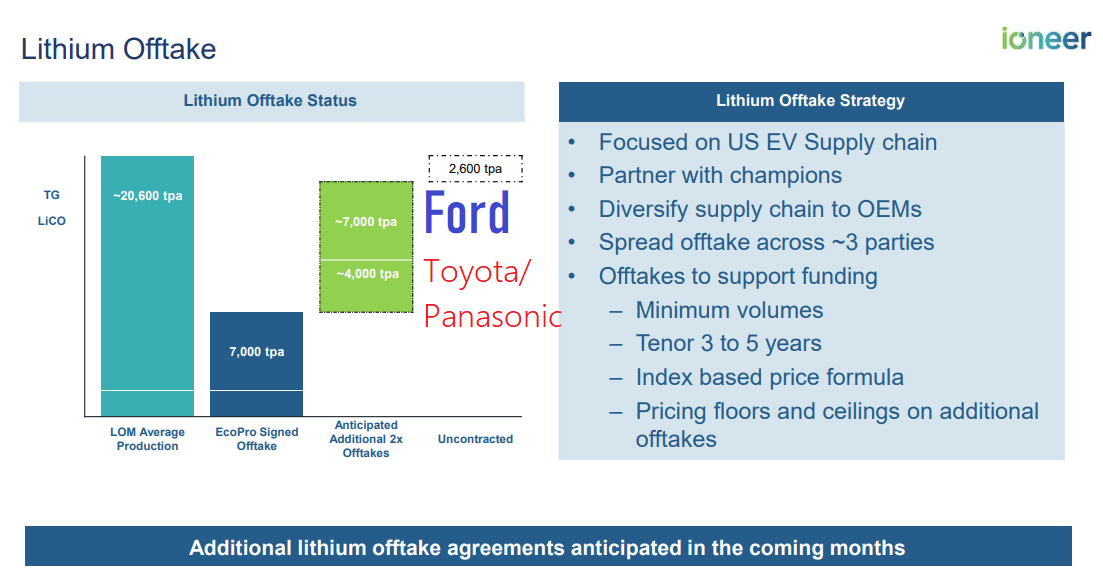

The battle continues over the battery supply chain. Exacerbated by geopolitical tensions, growing demand, and limited supply, Toyota (TM, OTCPK:TOYOF) and Panasonic (OTCPK:PCRFY, OTCPK:PCRFF) have formed a joint venture in search of securing lithium supplies for battery production. In comes ioneer Ltd (NASDAQ:IONR), an Australian company that has recently secured the rights to the Rhyolite Ridge lithium-boron sedimentary deposits. While operations have yet to commence, the company expects full production in 2025, and support by multinational customers may provide the necessary funding and bureaucratic expertise to succeed.

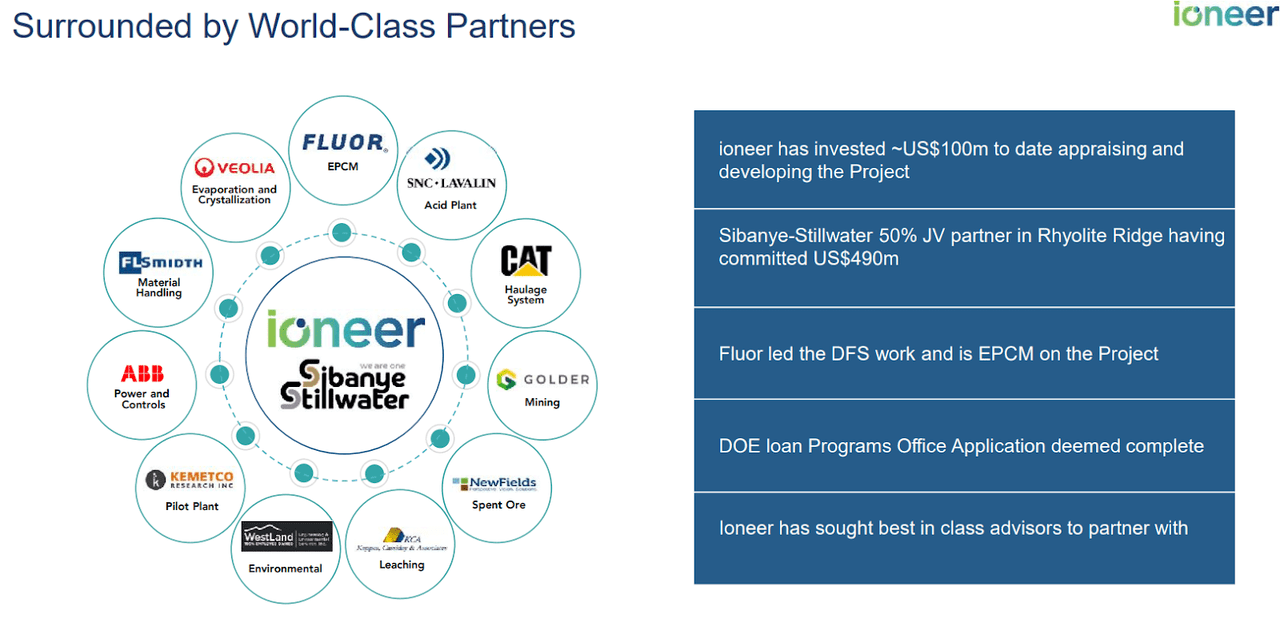

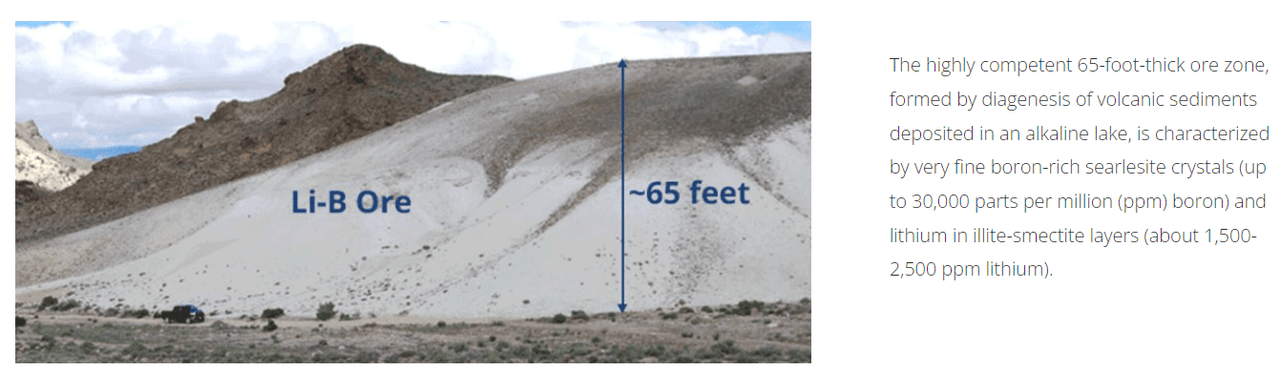

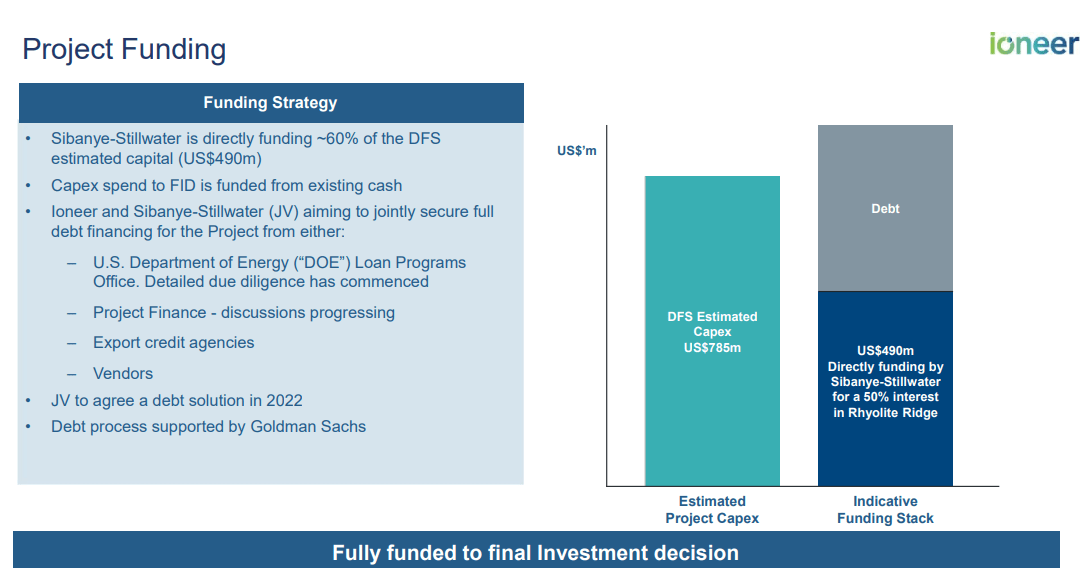

ioneer’s assets are unique in that Rhyolite Ridge has the potential to be quite profitable thanks to the local reserves containing both boron and lithium. Both elements have growing use and necessity, especially as the U.S. lacks true self-sufficiency across many areas of raw material supply. ioneer has a few additional catalysts that support a positive outlook, including sharing 50% of the Rhyolite Ridge project with experienced Sibanye Stillwater (SBSW, OTCPK:SBYSF) and a strong team of technical and advisory support, highlighted below.

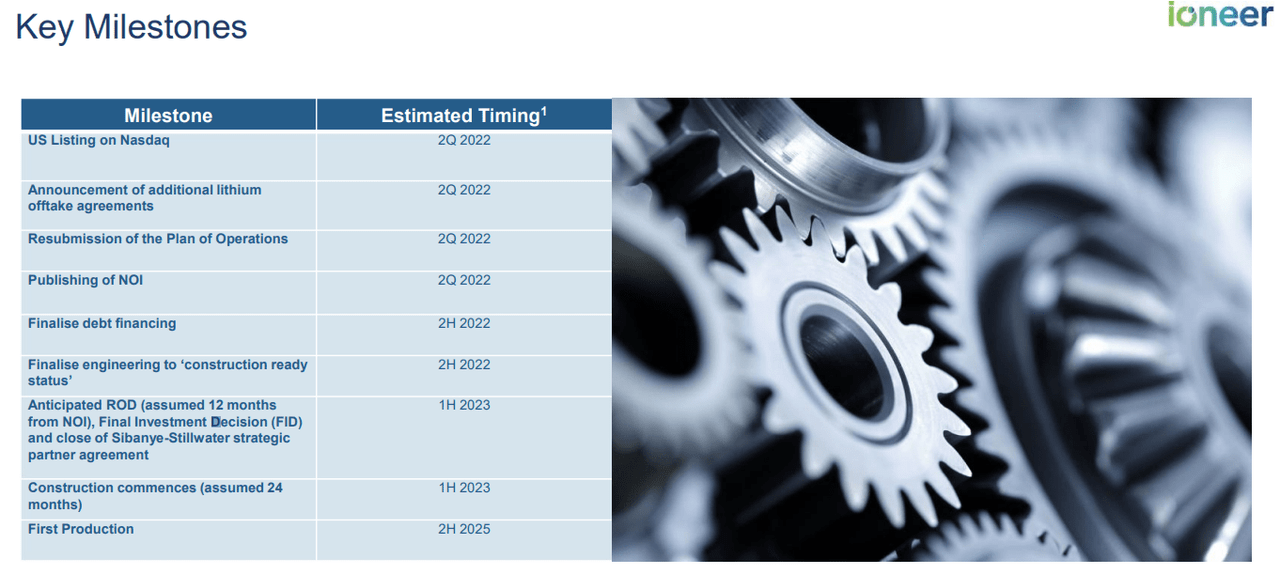

ioneer May Investor Presentation

The location in western Nevada also has the benefit of close access to Panasonic’s joint Gigafactory with Tesla (TSLA), and final contracted supply is expected to be enough to produce up to approximately 150,000 EVs per year. This backs up other contracts that ioneer has established with Ford (F) and EcoPro (South Korea listed). Unfortunately, we must still wait for the necessary permitting process to conclude before any sales can occur, and this always increases the risk.

ioneer website

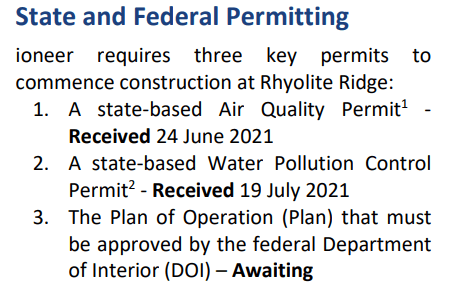

Down to the Hardest Permit Sequence

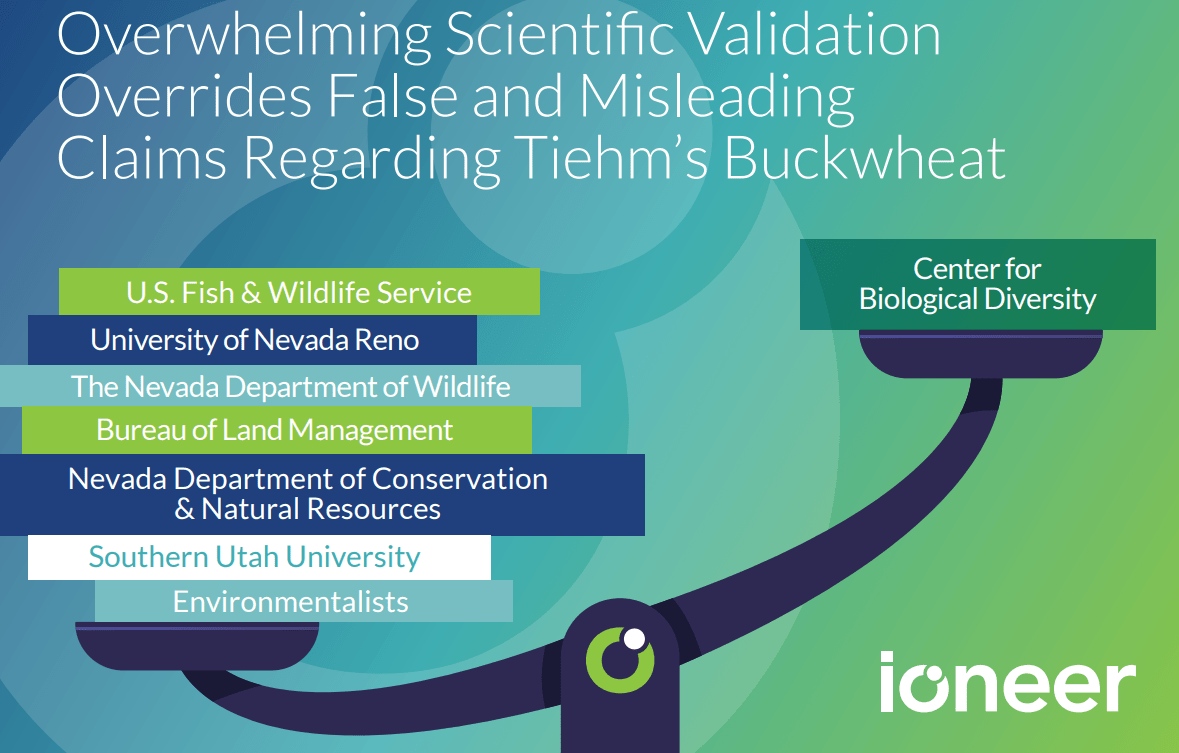

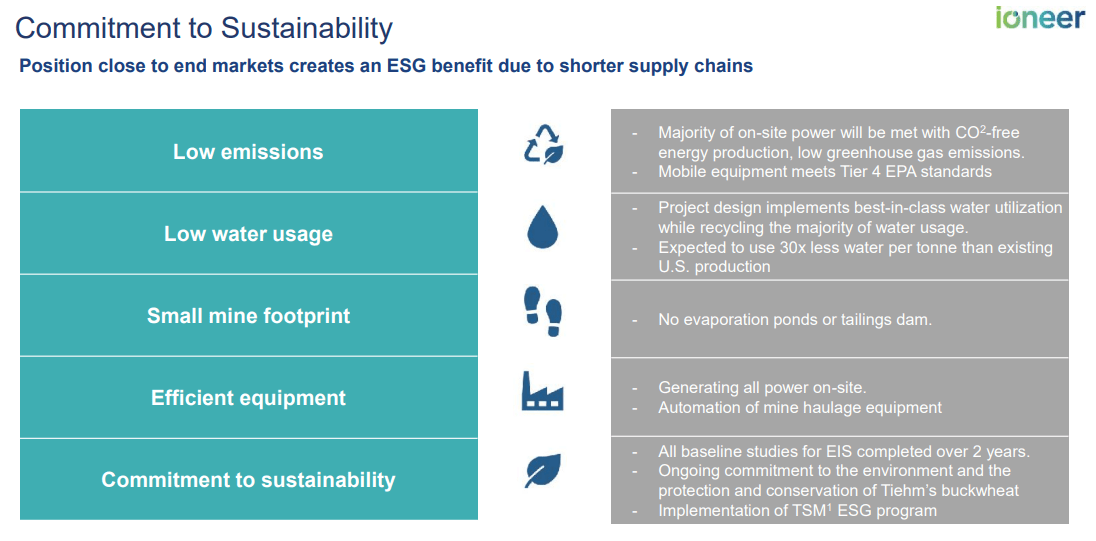

As is typical, one major impact that has led to a longer permitting process is the avoidance of a rare species: Tiehm’s Buckwheat. While an original plan had ioneer moving a few plants that may have been impacted by operations, the company now must leave all plants undisturbed and is actively growing additional ones to plant. Parties on both sides of the coin, whether pro-conservation or pro-lithium mining, must concede the fact that neither are completely in the clear. As greenhouse repopulation has been a meaningful way to increase the population size, more agencies have agreed that as long as the populations are not directly disturbed, the plant should coexist with nearby sustainable mining.

Ioneer Website

For investors, this means being thoughtful about the operations of the mine and being willing to spend less than 1% of expected earnings on being as eco-friendly as possible. Unfortunately, delays are only the fault of management because these risks should have been addressed prior to submitting any plans. At the same time, I would hope environmentalists ease off now that the final plan of operation is being heavily scrutinized and revised. Considering the U.S. has far stricter environmental standards than other countries, I would rather have mining operations based here rather than pushed abroad.

Based on current survey progress and operation revisions, I expect that approval should be obtained by the end of 2023. However, there will be another round of public comment, and this may be a risk point to consider as critical to pass unobstructed. Based on the recent progress of Rio Tinto and BHP’s far larger Resolution Copper mine in Arizona, I expect public sentiment is in general supportive of further raw material production to support the U.S. economy, when performed with the area in mind. Look to the new Plan of Operations to be submitted in the coming quarter.

ioneer July financial update ioneer May Investor Presentation

Other key points of the Rhyolite Ridge project include the following risks and innovations:

-

Due to the surface location of the deposit, the initial mining will be done with traditional pit-mining techniques, but ioneer has partnered with Caterpillar (CAT) to provide significant automation infrastructure to increase efficiency and reduce risk.

-

The lithium-boron deposit is easily extracted with dilute sulfuric acid, which will be produced on site, and cogenerated energy production will support all site operations.

-

The unique mineralogy and available processing systems will allow the project to not require evaporation ponds or tailings, two environmentally harmful processes.

Other factors such as low emissions and water usage technologies are also in place to improve the environmental footprint. Whether these mitigations are enough to persuade an approval is unknown, but I remain optimistic for the time being. Now, we need to determine whether the financials are reaching a point to allow for development if the project is allowed to proceed.

ioneer website

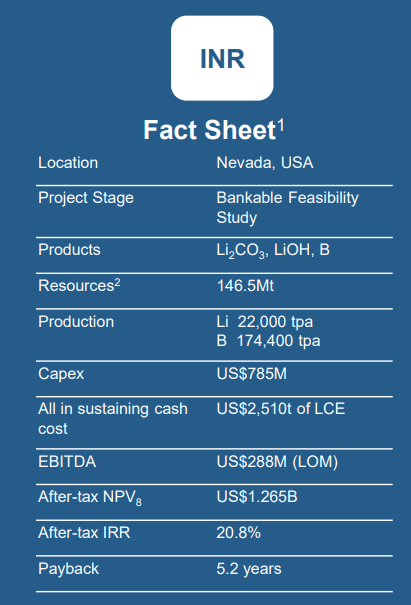

Financial Summary of Rhyolite Ridge

Current quarterly losses for the project are less than $10 million, with cash on hand equaling $94 million USD. The current estimated capex for the project is $785 million USD, although the current after-tax NPV is expected to be $1.265 billion USD. With ioneer set to earn their money back after just five years, the project would be a fairly profitable endeavor compared to other lithium mines. Also, 50% partner SBSW has pledged over $400 million USD to the project, and this will limit the amount of additional funding that will be necessary over the next few years.

ioneer

Offtake Partners

To secure cash flows in the future, ioneer has already done extensive work to find suitable long-term customers. First came EcoPro, a Korean renewables company, who obtained the first allocation of 7,000 tpa (tons per annum) of lithium. Then in July, Ford was announced as the other 7,000 tpa recipient. Lastly, with an announcement at the end of July, a press release noted that a JV between Toyota and Panasonic was allocated the final 4,000 tpa offtake slot.

Lithium Offtake data, with notations by author added. (ioneer )

Excess production may remain unallocated, but it is good to know that the majority of annual production already has financially viable companies to sell to. This is important because if production was allocated to an early-stage company, the possibility for that entity to be unable to meet contractual purchases. Also, as lithium prices remain far higher than anticipated, hovering around $70,000 per ton, these customers have the capital to continue paying high prices rather than smaller entities who are trying to make ends meet.

Conclusion

For the most part, ioneer seems to be doing well to create a low-risk endeavor. While it is always risky to put all your eggs in one basket, as Rhyolite Ridge is their only project, the risk-reward profile is worth consideration. The only problem now will be to watch for any headwinds in regards to the final permitting process. Around that time, I believe it will be important to reassess ioneer and determine fair value based on lithium pricing trends and capital generation. Also, do not forget that ioneer will also have boron sales as well, but these may be lower margin due to the larger commoditized industry.

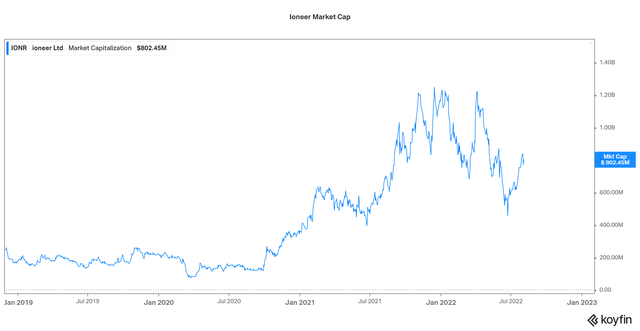

After an uplisting to the Nasdaq in July, ioneer’s share price has shot up, mostly thanks to the customer announcements. This means that a market cap below $200 million, which was seen as recently as late 2020, may be unattainable. However, based on management’s expectations of a net present value of $1.27 billion USD, there is some room for positive sentiment to keep the share price elevated.

Due to the lack of future development possibility and lack of diversification, I would have to see a highly compelling entry point to be bullish. Instead, I believe 50% partner Sibanye-Stillwater has a better investment profile for the time being as short-term headwinds cause the share price to fall. Altogether, I believe there will be more time to wait for lower entry point from the current market cap of $800 million, along with further clarity on the future of the project.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment