WillEye/iStock via Getty Images

Introduction

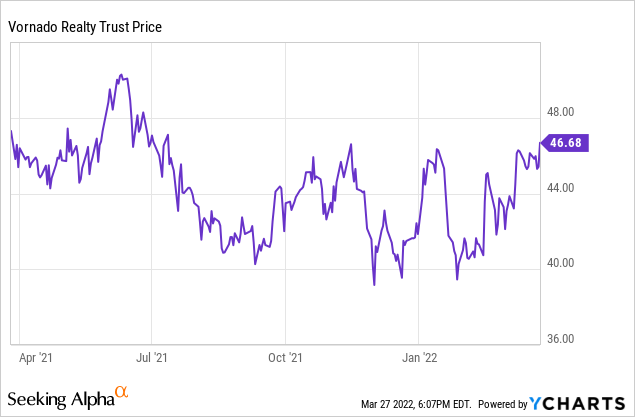

In October last year, I had a closer look at Vornado Realty Trust (NYSE:VNO), a REIT focusing on the New York office market with some retail space available in the same buildings. In New York, Vornado also owns just under 1,700 units in residential properties. In the previous article I had a closer look at the preferred shares issued by Vornado which appeared to be safe in terms of dividend coverage and asset coverage ratios but the returns were rather low (which confirms the market’s perception of these ‘safe’ securities). But as the interest rates are increasing, the yields offered by preferred securities are increasing as well and Vornado’s preferred shares are now trading below par which makes them more appealing.

Vornado reported a decent FFO in FY 2021, but I wouldn’t be a buyer of the common stock

The one metric that really matters for real estate investment trusts is the FFO which is obviously more important than the net income which is generally impacted by non-cash elements like the revaluation of properties. Additionally, the depreciation expenses on real estate assets have a very negative impact on the income statement of a US-based REIT but this obviously is just a theoretical value decrease and the FFO calculation tends to isolate the impact of those non-cash elements.

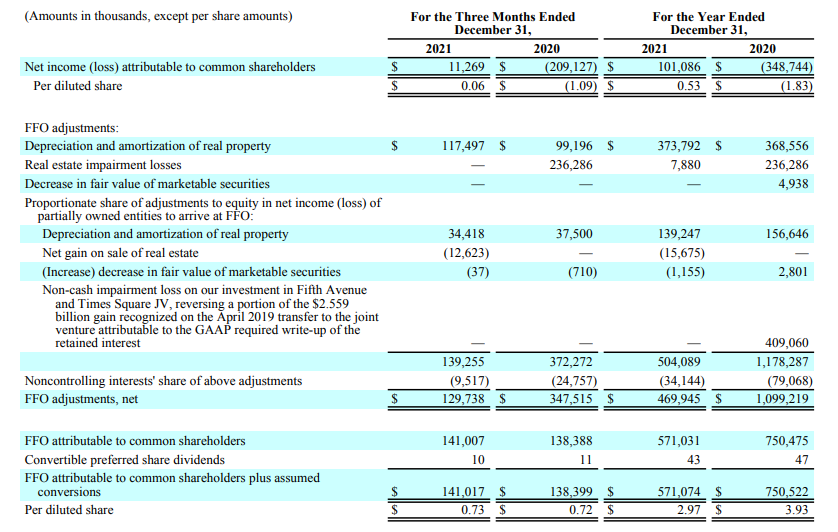

As you can see below, Vornado Realty Trust reported a net income of $11.3M or $0.06 per share in the final quarter of last year. However, once the non-cash elements have been removed, the FFO came in more than ten times higher at $141M on an adjusted basis. That’s approximately $0.73 per share and thus much better than the reported net income.

Vornado Investor Relations

On an adjusted basis (which excludes the items that impact a period-to-period comparability of the results), the FFO was just over $156M or $0.81 per share. For the entire year, the adjusted FFO per share was approximately $2.86/share compared to $2.62/share in FY 2020.

The higher interest rates have pushed the preferred share prices lower

An investor in preferred shares will only care about two things: Is my preferred dividend fully covered, and how is the asset coverage level.

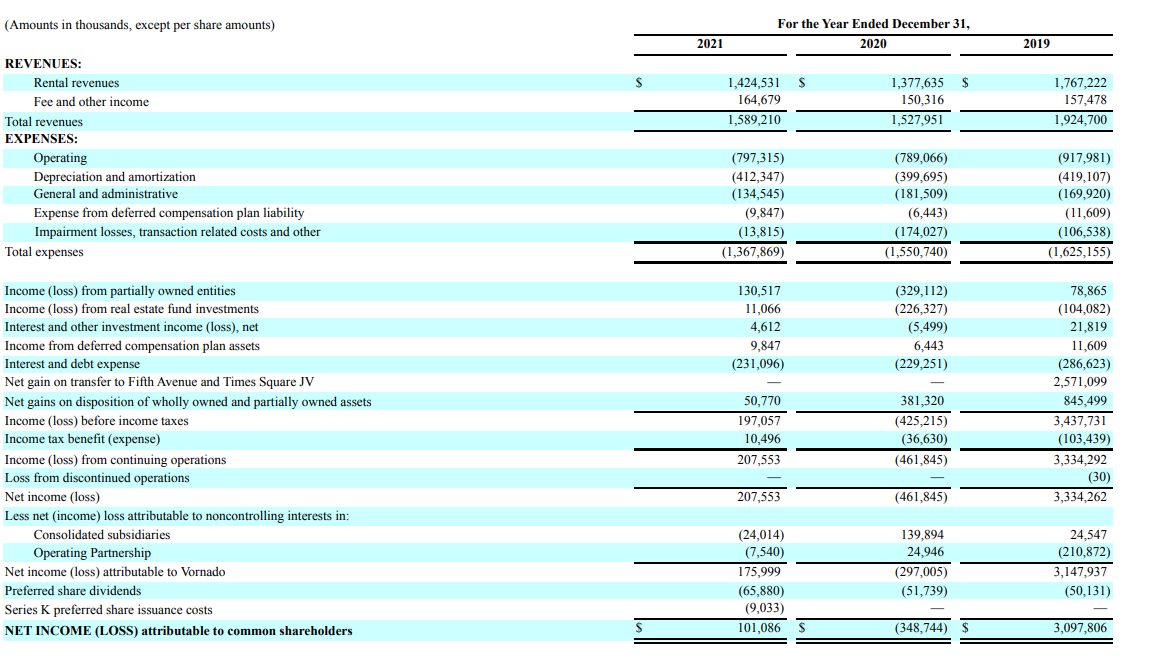

Let’s start with the preferred dividend coverage level. In the image below we see Vornado paid a total of$66M in preferred dividends (note: this will come down a bit in 2022 as the REIT has issued new preferred shares with a lower preferred dividend and has used the proceeds to retire higher-yield preferred shares).

Vornado Investor Relations

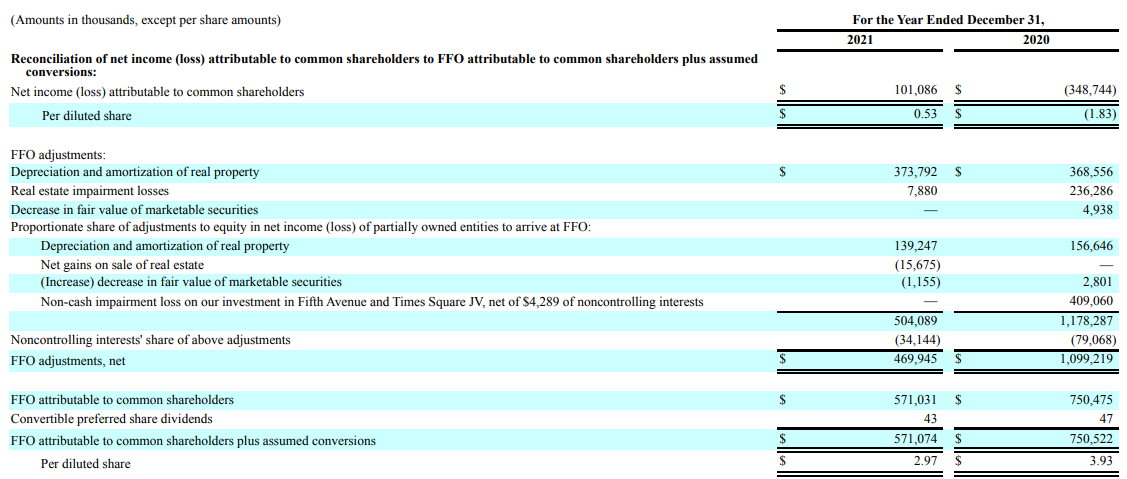

This is an important starting point as the full-year FFO calculation actually starts with the $101.1M net income result as you can see below.

Vornado Investor Relations

We see the reported FFO is $571M, while we know the adjusted FFO is approximately $550M. As the starting point to calculate this FFO is the net income attributable to the common shareholders of Vornado, it already includes the almost $66M in preferred dividend payments.

This means the FFO before making the preferred payments is in excess of $615M resulting in a preferred dividend coverage ratio of in excess of 900%. Even if the FFO drops by 50%, Vornado will still handsomely cover the preferred dividends with a coverage ratio of around 500%. That’s a good enough margin of safety for me.

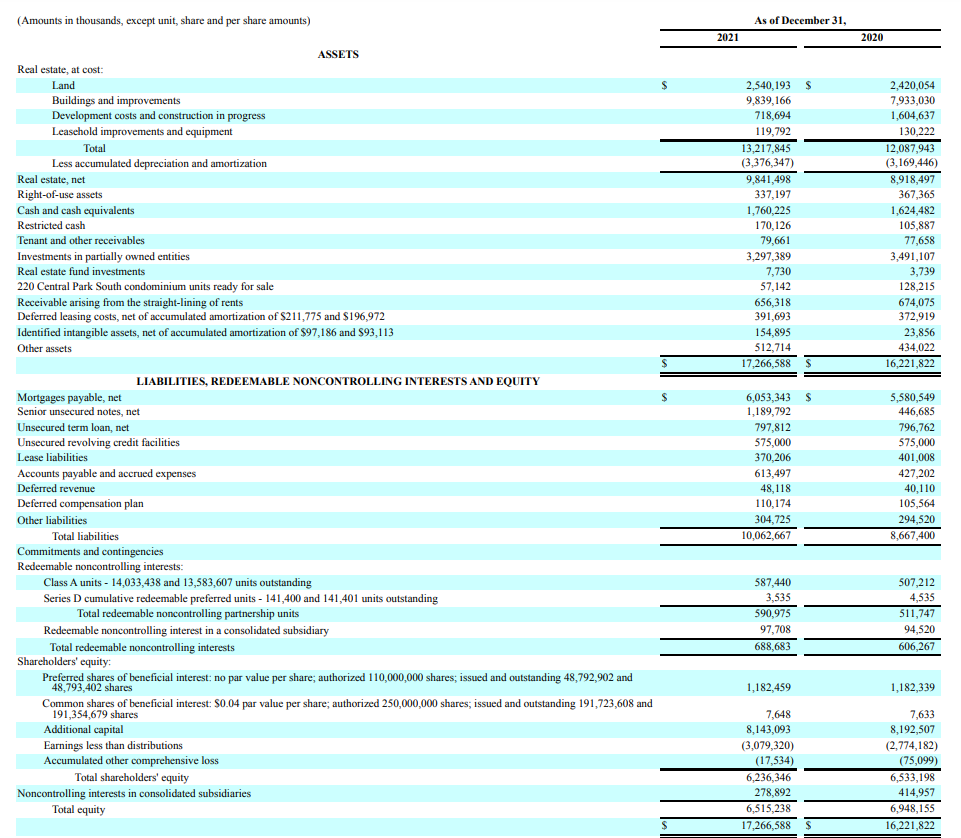

Secondly, we need to look at the asset coverage ratio.

Vornado Investor Relations

We see the total balance sheet size is approximately $17.3B of which $6.24B consists of shareholders equity. There are almost 49M preferred shares outstanding for a total face value of just over $1.2B. This means that based on the book value of Vornado Realty Trust, the asset coverage ratio is in excess of 500%. On top of that, the 6.24B in total equity actually includes the almost $3.4B in accumulated depreciation on the balance sheet. So if we would assume the fair value of the assets is equal to the purchase cost (and it’s not unthinkable the value of some assets may be even higher), the asset coverage ratio would be in excess of 700%. Or in other words, even if Vornado sees the value of its properties drop by another 30% from the current book value, the preferred shareholders would still have full coverage as the common shareholders would take the hit.

Investment thesis

While it may sound counter-intuitive to invest in fixed rate preferred shares in an era where both the inflation rate and interest rates are moving up, but I consider preferred shares to be an important element of my fixed income portfolio where I specifically invest in income generating securities and where capital gains are ranking low on the priority list. I obviously would not invest my entire portfolio in fixed income but I continue to allocate a portion of my investments to income.

I am not very interested in the common units of Vornado Realty Trust but I am getting increasingly interested in some of the preferred shares. In the previous article I specifically looked at the N-series of the preferred shares trading as (NYSE:VNO.PN) which are paying a preferred dividend of $1.3125/year for a 5.25% preferred dividend yield. Those securities are now trading at a discount of almost 10% to the face value of $25 per share resulting in a current yield of around 5.7% which clearly is more appealing than back in October and November. Of course, an investor in preferred shares is basically giving up the potential to generate capital gains in order to have a senior position when it comes to equity distributions.

As all of Vornado’s preferred shares are currently yielding 5.7-5.8%, it doesn’t really matter which one you are buying. The higher yielding securities have a higher share price and thus a lower potential capital gain to reach their face value of $25/share but provide larger quarterly preferred dividend cheques.

I currently have no position in any of the Vornado preferred shares but I am looking to establish a position sooner rather than later as the yields are getting much better while the risks remain relatively low given the current capital structure of the REIT.

Be the first to comment