M A X I M

It’s easy to find a low yielding stock among REITs with a strong underlying business model. However, those searching for higher yield will have to dig a little deeper to find value. In other words, one needs to apply second level thinking and in the words of Kevin O’Leary, be willing to put capital at risk in order to get out-sized gains.

Such was the case with energy companies like Exxon Mobil (XOM) and Chevron (CVX) through much of 2020 and 2021, with many investors including supposedly seasoned pension fund and university endowment managers not even willing to touch those names with a ten-foot pole, only to see those names sky rocket this year.

This brings me to Vornado Realty Trust (NYSE:VNO), which has investors spooked due to its exposure to the office space. This article highlights why now may be a great time for contrarian investors to layer into this name while the market sentiment is negative, so let’s get started.

Why VNO?

Vornado Realty is a well-known and respected REIT that’s focused on owning and leasing out prime-located commercial properties in New York City, where it generates 90% of its net operating income. Beyond NYC, Vornado also owns the iconic 555 California Street which is located in the heart of San Francisco’s Financial District, and THE MART in Chicago’s River North District.

VNO appears to be doing just fine, with FFO per share growing by 14% YoY to $0.81 during the third quarter. However, it’s worth noting that much of this increase was due to accrual adjustments for the tax-assessed value of the Mart property. removing this one-time benefit, adjusted FFO was about flat, driven by commencement of new office and retail leases, partially offset by higher interest expense.

Notably, same-store cash NOI for the New York portfolio was up by 1.1% YoY and new leases signed in NYC had 1.8% higher cash rents. This helps to dispel the popular notion that all office properties are in decline. It also proves that high quality properties are continuing to attract tenants who are willing to shed lower quality rental sites in favor of consolidating their office footprint at prime locations that attract business and clients.

Moreover, VNO is making moves to protect its BBB- rated balance sheet, by extending unsecured revolving lines of credit totaling $2.5 billion, with just $575 million outstanding through 2026 and 2027, thereby providing the company with plenty of liquidity over the next 4 to 5 years. Also encouraging, management reduced the total percentage of variable debt from 47% to 27% in the first nine months of this year, making VNO less susceptible to continued interest rate increases by the Federal Reserve.

One potential source of risk and opportunity is VNO’s continued development of the PENN district. While it remains to be seen what the long-term prospects for this development will, management did state that PENN 1’s lobby and amenities are complete, and PENN 2’s skin and bustle are now very far along. CEO Steven Roth left open the idea of a potential spin out of this asset and noted that protection of the balance sheet is the number one priority.

Importantly for dividend investors, the dividend could be at risk for a cut in 2023, as what SL Green (SLG) recently did. This was noted by management during the recent conference call:

I want to comment on our dividend. Our policy is to payout dividends equal to our taxable income. We now expect our taxable income to be lower in 2023. We will not have income from 220 Central Park South. We assume no asset sales and we are budgeting to the interest rate yield curve. As such, our Board of Trustees plans the right size our dividend in 2023 commensurate with our protection of taxable – projection of taxable income. This will allow us to retain more cash.

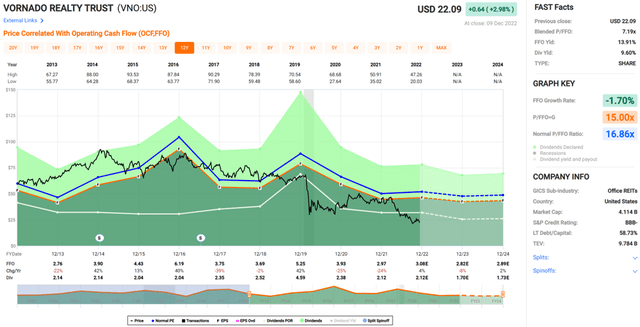

Nonetheless, I don’t see a potential dividend cut as being a deal breaker for the stock, especially considering how cheap it is at the current price of $22.09 with a forward P/FFO of just 7.2. As shown below, this sits at less than half of VNO’s normal P/FFO of 16.9 over the past decade. Analysts have an average price target of $27 and Morningstar has a fair value estimate of $35.50, implying potential for strong double digit returns for patient investors.

Investor Takeaway

Vornado Realty Trust is an interesting opportunity in the REIT space given the quality of its assets and its relatively cheap valuation. The company has made moves to protect its balance sheet, which should provide it with plenty of liquidity over the next few years.

That said, investors should be aware that there could be a dividend cut in 2023 with the expectation of lower taxable income. Nonetheless, VNO’s share price already bakes in a lot of headwinds, setting up long-term investors for potentially big returns.

Be the first to comment