Khaosai Wongnatthakan/iStock via Getty Images

Simple investing strategies have worked in this market for some time. Well financial experts often try to tailor investment strategies to their clients’ needs, the best way to invest for most of the last bull market we have seen has been to focus on large cap companies and broader indexes.

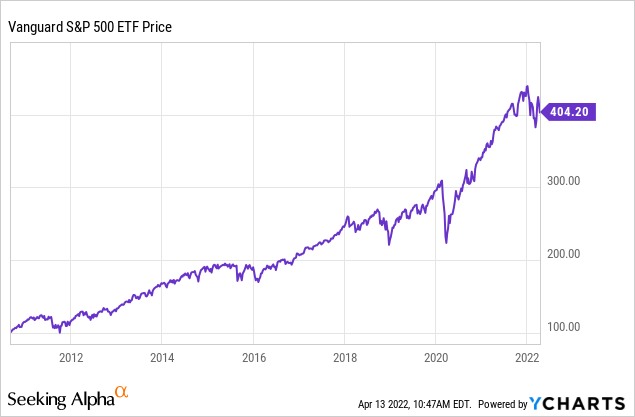

One of the most successful investment strategies during this recent bull run has been as simple as buying the S&P 500 (SPY), or exchange traded funds that are indexed to this index, such as the Vanguard S&P 500 ETF (NYSEARCA:VOO).

The S&P 500 has performed very well over the last decade.

This Vanguard S&P 500 ETF has risen from nearly $117 a share 10 years ago in 2011, to nearly $404 dollars today. The dividend growth this fund has offered during the current bull market has also been solid, although the yield has remained below 3% every year over the last decade. Even though this fund has never yielded over 2.6% since 2010, the average 10-year dividend growth rate 9%, and the 5-year dividend growth rate of 6%.

This fund has an expense ratio .03%, $258 billion dollars in assets under management, and a current yield of 1.37%. The holding of this fund, which is of course indexed to the S&P 500, are 25.5% technology, 13.5% financials, 13.3% health care, 11.6% consumer cyclical, 9.6% communication, 8.2% industrials, 6.59% consumer defensives, 3.7% energy, 2.6% real estate, 2.6% Utilities, and 2.25% basic materials. The 2 largest holdings are Apple (AAPL) and Microsoft (MSFT), with stock being a nearly 6% holding.

Still, if investing for the future simply was simple as looking solely at recent past performance, investing would be easy. Despite the strong multi-year run the S&P 500 has been on over the last decade, the S&P 500 has very little exposure to energy, basic materials, and commodities in general, and funds indexed to the S&P 500 such as the Vanguard S&P 500 ETF should underperform moving forward for several reasons.

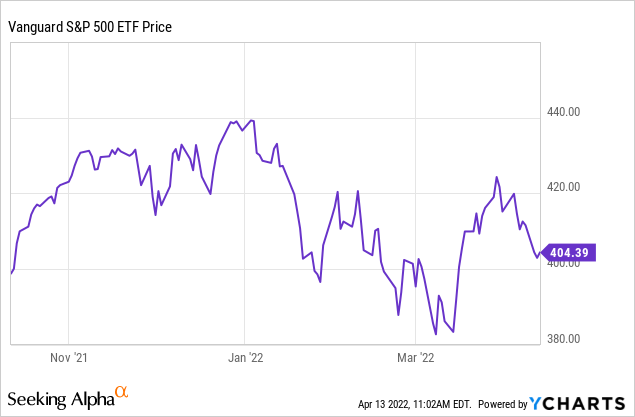

Today inflation rates are at 40-year highs, geopolitical tensions are raging, Covid outbreaks are still occurring, and signs of an economic slowdown are starting to mount. Unsurprisingly, most markets, including the S&P 500, have been volatile and range bound and volatile for some time.

Well 6 months is obviously a very short timeframe for any long-term investors, the core issues that have resulted in the S&P 500 being rangebound over the last 6 months should persist.

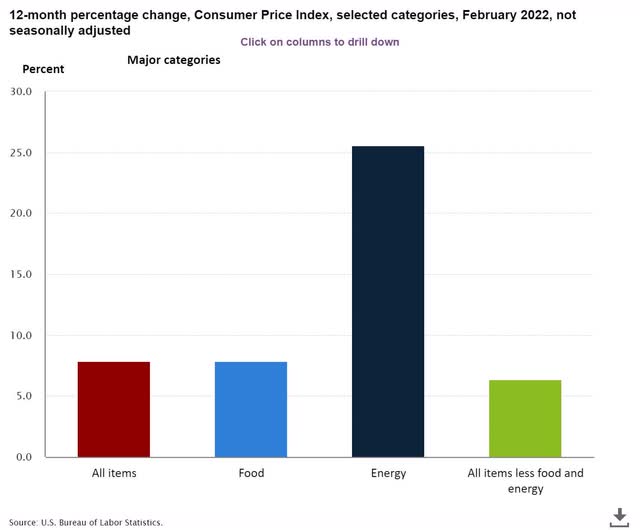

Inflation recently came in at a 40-year high, at 8.5%, and prices across the board have consistently risen for more than a year now.

A Chart Showing Inflation (U.S. Gov)

Well, some of the recent record high inflation is coming from the Russia-Ukraine conflict’s impact on commodities such as grain and energy, inflation rates have consistently been over 5% of more than a year now.

Inflation is hurting large cap funds such as this indexed Vanguard fund in several ways. Growth rates are falling in countries such as China and India, in part because of inflation. Growth in China has slowed from over 8% last quarter, to below 5% this quarter, and recent Covid outbreaks continue to force shutdowns in the world’s second largest economy. Estimates for growth next year in India have also fallen from 6.7% to 4.6% this year on fears of more restrictive monetary policies because of inflationary risks. Global growth rates were also already expected to fall from 3.6% to 2.6% in significant part because of inflation, and those economic estimates will likely fall further as inflation rates should continue to increase. Also, in addition to the fact that energy and commodity stocks have been some of the best performing stocks in the market over the last year, many consumer defensives and consumer cyclicals have faced margin compression from rising prices.

Even though this fund does have exposure to a weak dollar because of the large cap holdings, this Vanguard ETF is effectively underweight inflation since the fund has less than 6% invested in energy and commodity stocks. Well the financials tend to of course do better during periods of inflation and rising interest rates, this fund has less than 15% of the assets invested in stocks in this sector as well.

Inflation isn’t the only risk that market currently faces, either. There have been a number of recent signs that growth in the US and globally is slowing down as well. December retail sales were down almost 2% from November, applications for new businesses with paid workers fell to an annual low, and signs of a slowdown in the housing market have emerged as well. Between December of 2020 and December of 2021, housing prices rose by nearly 19%, which is 4x the national average since 1989. Prices for Manufactured homes have also leveled off, and in some cases dropped in consecutive months for the first time in over year. Sales of single-family homes in March were also at the lowest levels seen since June of 2021. There are no signs of a recession, but inflation clearly has slowed growth rates in the US and worldwide.

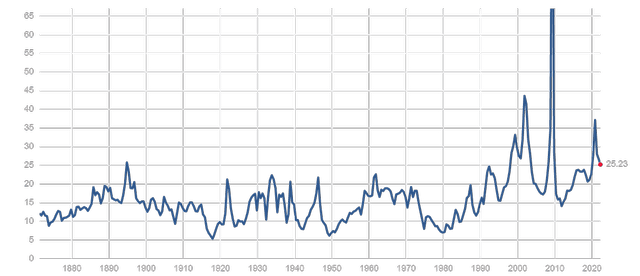

The S&P 500 isn’t cheap either using a number of different metrics. The cyclical price to earnings ratio, or the PE looking at years of normalized earnings, is at historic highs as well. The S&P 500 trades at 25x earnings estimates, which is at the higher end of the historical range that this index has traded within.

A Chart showing S&P 500 PE’s (multpl.com)

Well stocks have traded at or above the current price to earnings ratio of 25x earnings before, there have almost always been corrections, and often strong corrections, when stocks have reached the current valuation levels. If growth estimates fall even slightly, most large cap companies will likely see significant multiple contraction from current elevated levels.

The S&P 500 has had a strong run over the last decade, and investors of all types have seen impressive returns during this period. Still, past results aren’t always good predictors of future performance. With elevated levels of inflation likely to remain for some time, geopolitical tensions high, and sign that prices increases are starting to impact growth estimates, markets are likely to remain range bound for some time. Well stocks have performed well as an asset class during periods of inflation in the past, indexes such as the S&P 500 currently have very minimal exposure to energy and commodity stocks, and many consumer companies that make up this index are seeing significant margin compression. With inflation and volatility levels likely to remain for some time, investors should be able to find better value in the current market than in funds indexed to the S&P 500.

Be the first to comment