Nikada/E+ via Getty Images

Investment Thesis

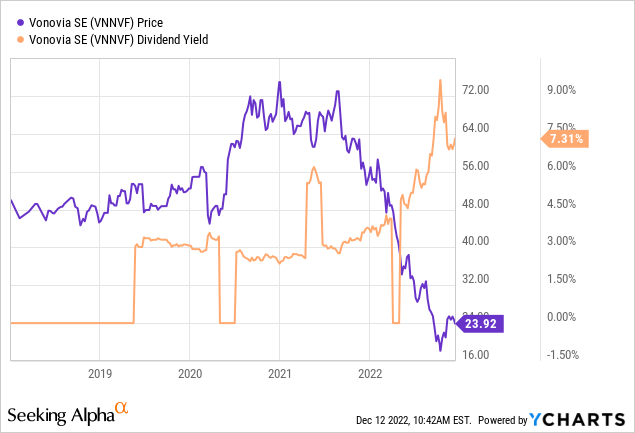

Vonovia (OTCPK:VNNVF, OTCPK:VONOY) is currently very cheaply valued by historical comparison and offers the highest dividend yield in years. However, the share is also suffering particularly badly from the current interest rate turnaround and can hardly generate sufficient revenue to meet the maturities of the next few years. Therefore, they are now selling part of their portfolio and scaling back investments. But I like these steps and think the company should be in a much healthier position in a few years than it is today. Even though there are some challenges at the moment, I think they are already sufficiently priced in, and overall the company has excellent assets in a tight housing market.

Company Overview

Vonovia is one of Germany’s largest real estate companies and the largest residential real estate company in Europe. The company’s IPO was in 2013, and since then, Vonovia has grown rapidly, expanded its portfolio, and become a leading company in the German rental housing market. The company has a diversified portfolio in Germany, Austria, and Sweden. Moreover, it owns over 500k residential units and over 160k garages and parking spaces.

The reasons for the share price decline

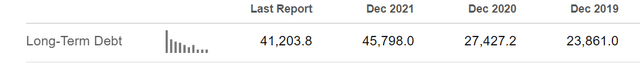

YTD, the stock is down 57%, even though it is a REIT that generates predictable income. This means it has lost significantly more than comparable U.S. companies. What is the reason for this share price decline? In 2021, the company acquired its competitor Deutsche Wohnen for €19B. This not only involved issuing a large number of new shares but also a massive increase in debt. At the moment, the market capitalization $19.56B, and the total debt is $45.37B.

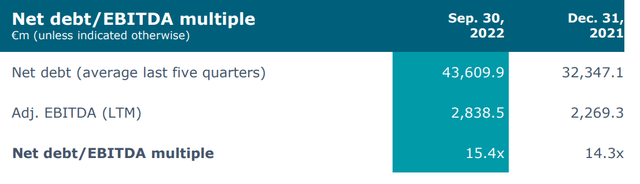

During this acquisition, the company has not anticipated that the central bank’s policy would change. Recently, the European Central Bank raised the interest rate by 0.75% to 2%. To operate sustainably, Vonovia relies on a higher return on its properties than its interest expenses. But its high debt ratio lowers Vonovia’s credit rating, making it even more expensive to take on new debt, for example, to pay off old debts. As a result, there was recently a credit rating downgrade by Moody’s (from A3 to Baa1).

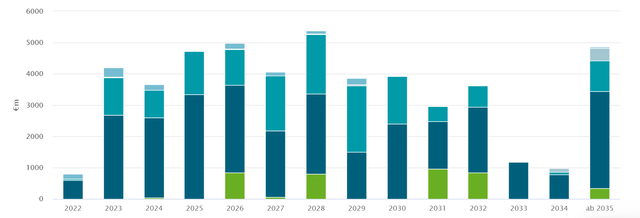

The maturities of the liabilities are evenly distributed, although Vonovia will have to repay an average of four billion euros per year to creditors over the next few years.

However, revenue amounted to only €4.6B in the first nine months of 2022, while FFO was €1.6B. On September 30, the net debt/EBITDA ratio was 15.4x. That means Vonovia depends on generating capital through new debt or selling residential units from the portfolio to repay its debts. Therefore, the management has already announced its intention to sell 66,000 apartments and raise around €13 billion to reduce debt. This is a complete switch from last year’s strategy of expensive takeovers.

Vonovia is thus under pressure and may have to sell during a falling market. Additionally, there is time pressure, a situation that potential buyers can take advantage of. The reported value of the properties is already around 10% lower than at the end of 2021.

What solutions does the company have for these problems?

However, management is trying to calm investors. On the one hand, they say that the real estate value shown in their books is far below the current market prices, which means that there could be a potential surprise upside in the sales prices. In addition, they refer to the still prevailing housing shortage in Germany because, for years, less has been built than there is demand. This should ensure that the price cannot fall too much. The company points out that in the past, prices for real estate had dropped sharply when vacancy rates were high. But these are very low due to the housing shortage. In the case of Vonovia, currently 2%.

Recent results & Valuation

The costly takeover of Deutsche Wohnen in 2021 will also provide more revenue this year. As a result, FFO rose 35% year-on-year in the first nine months. However, FFO per share rose by only 4% as the number of shares also increased by 30%. Organic rental increases amounted to 3.3%.

There are 796M shares outstanding, and for the entire year, FFO is expected to be around €2B, corresponding to an FFO per share of €2.5. The share price in Euro is currently about €23, so the price/FFO is 9. The average of the last years was a price/FFO valuation of 20. Also, regarding book value, the share is trading at a significant discount, with a price/book of 0.59. I doubt whether such a high discount is justified, especially if one believes the company’s current book value is still significantly below market prices.

The dividend yield is currently at a historically high level. It should remain at least at a similar level next year if management’s forecast that earnings per share will be slightly below 2022 is correct (see next section).

2023 outlook

For next year, management expects total revenues to be around €7B, which is about 10% more than this year. However, FFO per share is expected to be slightly lower. In addition, investments in new projects are expected to be significantly reduced to €850M, a reduction of about 40% compared to previous years.

Group FFO slightly below 2022E as higher interest expenses and disposal taxes cannot be fully compensated.

investor presentation page 4

The above-described financing problems are leaving their mark on the business forecasts. The synergies from the acquisition of Deutsche Wohnen, which Vonovia estimates at around €135M per year, could provide some relief.

Risks

Several additional risks are beyond the control of the company. They now suffer from rising interest rates as this increases their interest payments and ensures that their real estate prices are worth less. It is unclear how high the ECB will raise interest rates and how long they will remain at higher levels.

In addition, there is political risk. The current left-green government poses a risk of hindering the free market. A few years ago, the local Berlin government introduced a rent cap that would have sharply lowered property values in one fell swoop. Ultimately, this was reversed by a high court, but I have heard several statements from the current government that they are not opposed to such major market interventions. The risk of such interventions rises as the financial burden on people increases.

Another risk is that the company will not be able to sell as many apartments in the current market environment at desired prices to reduce debt as planned. At least the company is in a bad negotiating position, as possible buyers might rightly speculate that prices for real estate will fall even further. As mentioned, however, the company’s counter-argument is that the reported value of its real estate is currently well below market prices anyway.

Conclusion

The debt is absurdly high, but the sale of 66k apartments should bring €13B into the coffers, which could significantly reduce the debt. And this represents only slightly more than 10% of the total units. Probably with this step the company will be out of the worst problems. Given the very low valuation, both in historical comparison and to book value, I believe that as a long-term investor, you will most likely make money with the stock. If interest rates stagnate or are lowered again in the future, the stock should benefit very enormously.

But overall, I consider this a high-risk, high-reward investment as I see many uncertainties. There is a combination of several factors:

- a very high level of debt

- the need to sell real estate in a bad market phase

- the uncertainty of how high interest rates will rise (they have risen but compared to the FED and given the inflation, interest rates are still very low)

- the generally poor economic outlook for Germany, in my view

- the tendency of the government to intervene in free markets, solving problems in the short term but creating new ones in the long term. For example, recently, a price cap for gas was passed, which relieves consumers, but does nothing to solve the real problems because there is neither interest in saving gas nor new supply being added.

Ultimately, however, it is always a question of price, and the valuation is so low that I consider the most significant risks to be sufficiently priced in. I do not expect that there will be any problems with the sale of the apartments, and it makes sense to lower their leverage. In a few years, the company should be in a much healthier position than it is today.

Be the first to comment