ImagePixel

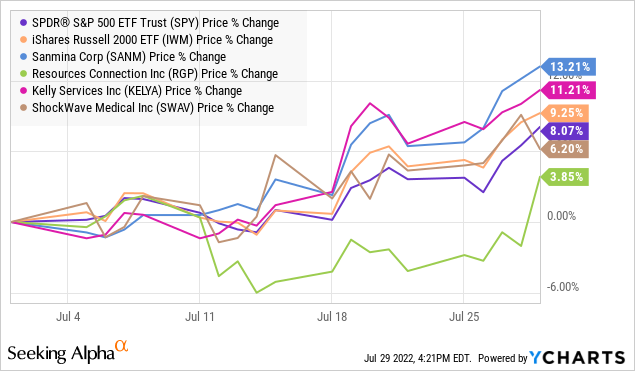

We finally have some big winners over the last week to discuss from previous VBR lists, namely JAKKS Pacific (JAKK) and Resources Connection (RGP). JAKK blew out expectations this week with a huge quarterly profit announcement linked here, far surpassing forecasts of a small loss. RGP also soundly beat already high expectations for its latest operating quarter, linked here.

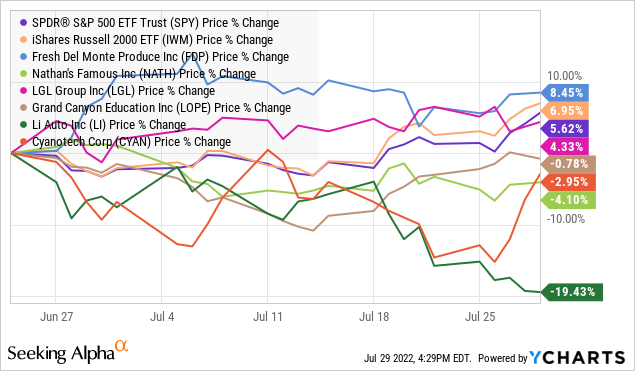

In addition to these two big winners late in the week, a growing number of picks have been outperforming the S&P 500 and Russell 2000 indexes since highlighted by the VBR, including Immatics N.V. (IMTX), CECO Environmental (CECE), Target Hospitality (TH), Green Brick Partners (GRBK), Ormat Technologies (ORA), Sanmina (SANM), Kelly Services (KELYA), and Fresh Del Monte Produce (FDP). The one standout loser has been Chinese EV maker Li Auto (LI), down almost 20%. If you own that name, and want to bail, I totally understand. Keeping individual losses to a minimum is critically important.

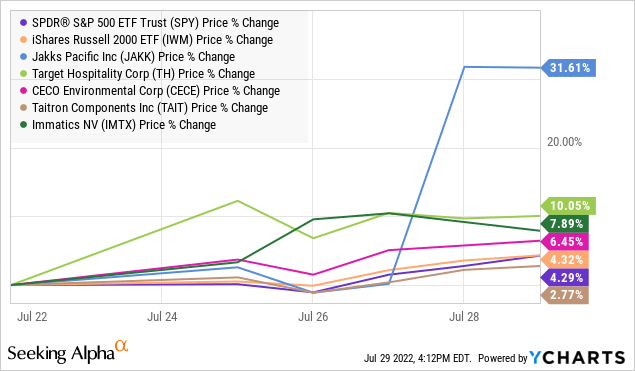

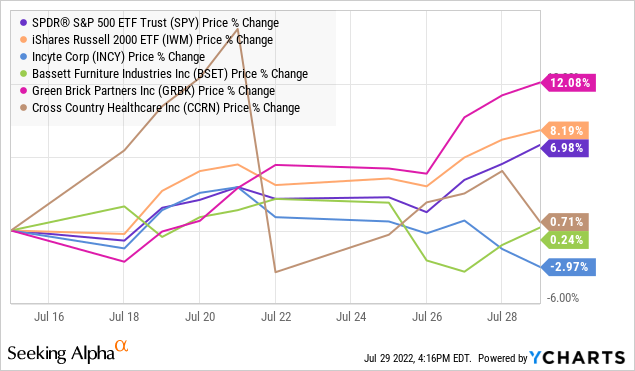

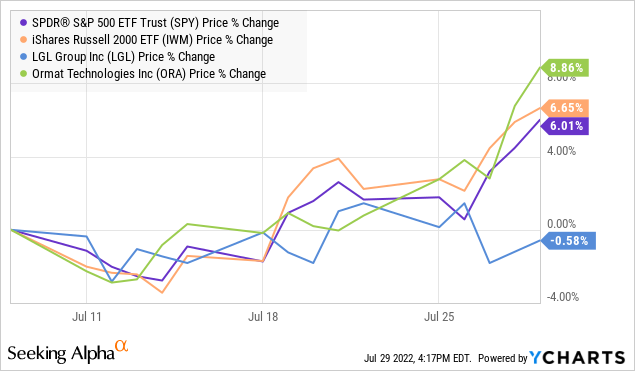

We’re up to 20 picks since late June, with 5 more to highlight this week. My performance calculations on the group strengthened demonstrably this week. Not only are actual nominal gains appearing across the board, but “underperformance” vs. the market indexes approaching -2% last week (using an equal weighting of picks) has now clawed back to nearly -1%. If we get another week of solid advance in my VBR names, it is entirely possible the whole list (including new ideas) could be “outperforming” Wall Street in the days ahead. Below are graphs reviewing VBR price gains/losses vs. market index fluctuations, using Friday closing values before publication of my selections.

YCharts, VBR Picks from July 22nd YCharts, VBR Picks from July 15th YCharts, VBR Picks from July 8th YCharts, VBR Picks from July 1st YCharts, VBR Picks from June 24th

New VBR Buy Signals

Reading International

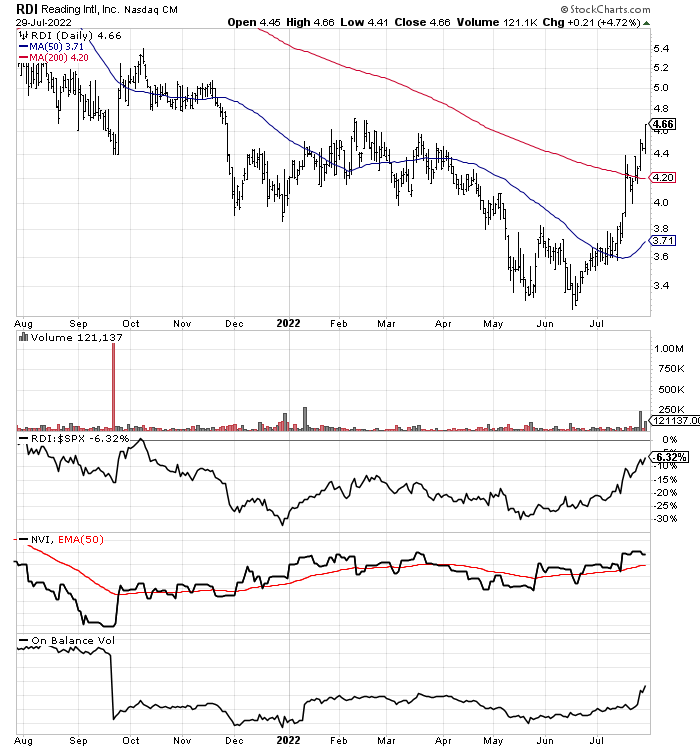

One of the biggest discounts I have ever seen in a nonvoting equity class vs. a voting class of shares is now available in Reading International (NASDAQ:RDI). The nonvoting shares trade under the RDI ticker symbol with 20.36 million Class A units outstanding. RDIB is the trading symbol for 1.68 million voting Class B shares controlled by the Cotter family. At current market prices, the combined classes work out to $130 million in equity capitalization. You can review below the wide and growing distance in pricing between the two classes since 2017. Using a 5-year “average” 60% discount for RDI vs. RDIB, the stock should be trading closer to $9.

YCharts

Reading International’s business model is upscale cinema and live theater ownership in New York, Los Angeles, Australia, and New Zealand. However, the company also owns/controls development properties and mixed-use real estate including retail. At the end of March, $67 million in cash and a net depreciated total of $530 million in real estate are either owned or controlled through long-term leases.

The good news is real estate holdings are likely worth a great deal more than accounting book values. $800 million represents the “purchase” pricing for property ownership, with more than half of this number held for greater than 10 years. For example, in early 2021, several properties were sold at prices well above book value to raise capital during pandemic theater closures, especially in Australia and New Zealand. Management has stated the $145 million in real estate sold included less desirable long-term assets, still recording $92 million in gains on the transactions. A new retail lease agreement was announced in February on its historic and iconic 44 Union Square property in New York City. My view is the $4.21 in book value per share could be understating underlying real estate worth by $5 to $10 in a robust live-entertainment attendance world.

Company Website – 44 Union Square, New York City

In the end, RDI is a play on (1) the massive difference in share class pricing being closed in the future, (2) a rebound of physical in-person movie and theater attendance after the COVID-19 pandemic, and (3) real estate values continuing to gallop higher with inflation, not yet under control by the world’s central banks.

Technically speaking, a down-sloping trendline can be drawn through a number of high trades all the way back to early 2019. And this trendline was respected and tightly hugged for months this year. However, in July, it appears a major price breakout has begun.

StockCharts, Author Reference Points StockCharts

REX American Resources

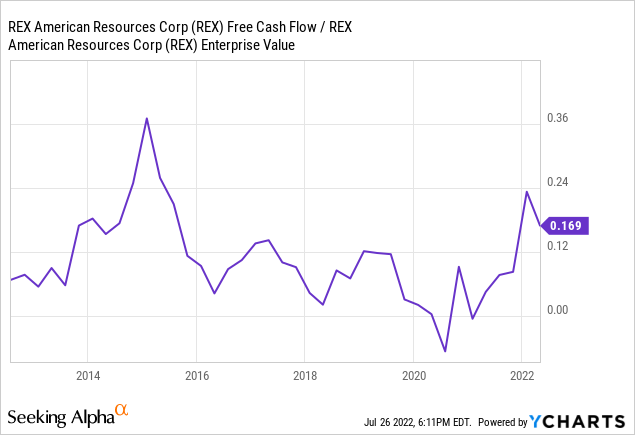

I mentioned REX American (REX) in a full-length story this past week here. It is primarily an ethanol refiner, producing renewable energy, corn-derived additives/substitutes for gasoline. Huge cash holdings (about 40% of the stock value) and zero debt have generated nice levels of free cash flow and earnings over the years. It is a defensive idea with future upside tied to gasoline shortages in America. With gasoline refining capacity in the U.S. stagnant to falling in future years (no new plants are being built), auto drivers may become increasingly dependent on substitutes like ethanol. At the very least, improved demand for ethanol should lead to higher margins in the industry potentially for years.

REX specifically is well prepared for higher sales and margins, and investors can scoop up shares for a P/E ratio close to 10x forward results (10% earnings yield) before adjusting for its cash position. After enterprise value adjustments, the trailing free cash flow yield is nearly 17%, likely rising above 20% annually in 2023-24. The overall valuation is approaching a decade low.

YCharts

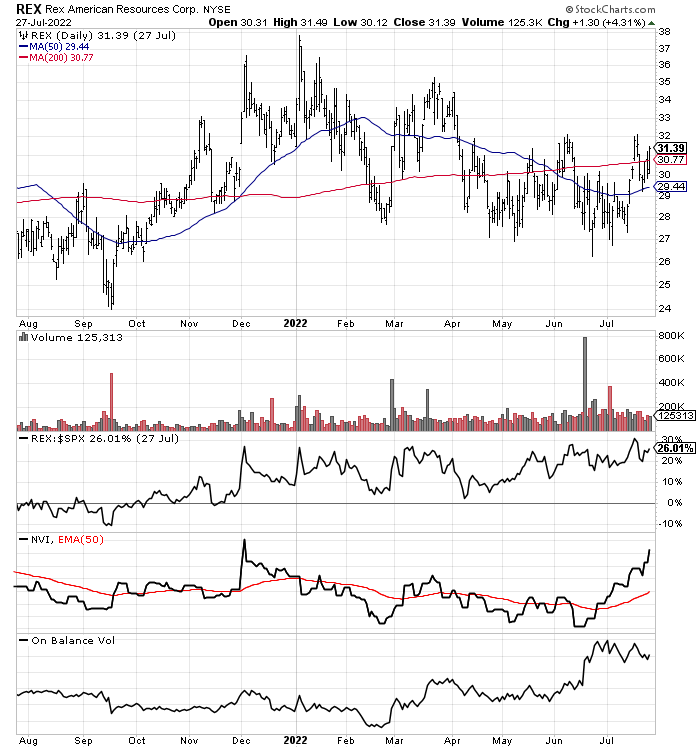

The company is undertaking a 3-for-1 stock split as we speak, with price moving from the mid-$90s to low-$30s per share. Of course, trading data has not been fully adjusted correctly by tracking outfits like StockCharts, so I am using a cleaner chart version below, through Wednesday with the new price. Shares have been under heavy accumulation since June.

StockCharts

Associated Capital

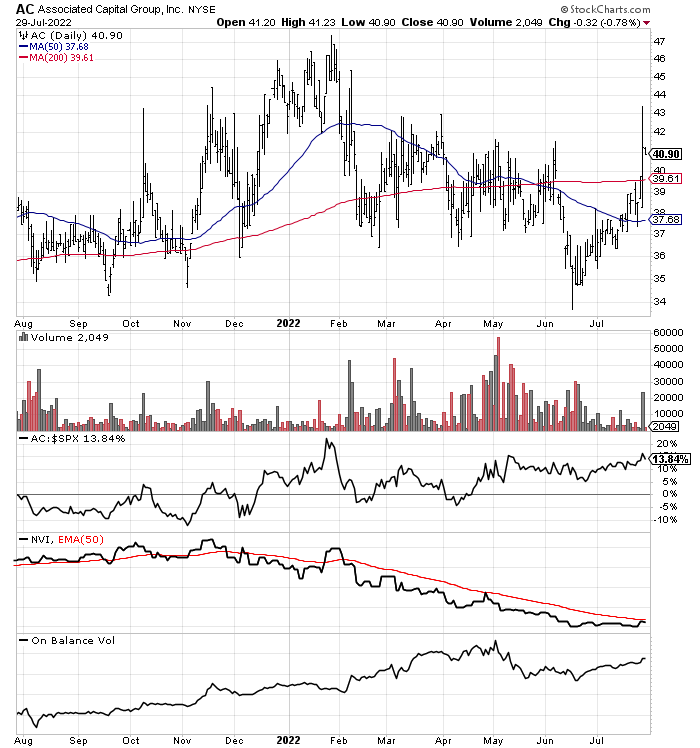

Associated Capital (AC), 85% controlled by famed investor Mario Gabelli, is largely a merger arbitrage vehicle shooting for regular and conservative annual shareholder returns. The company is an advisory firm with a focus on alternative investments. The total return achieved by the stock is around +50% since it was spun off from GAMCO Investors (GBL) in late 2015, about the same as the Russell 2000 index total return including dividends. Selling close to net asset book value, this defensive equity investment appears to be under accumulation in my momentum research. While I do not have grand expectations for gains moving forward, a 10% return over the next 12 months may prove a winning proposition if U.S. stocks stagnate in a recessionary, high-inflation macro environment. If interested in buying AC shares, Seeking Alpha contributor EG Capital wrote an excellent explanation of the business in early July here.

StockCharts

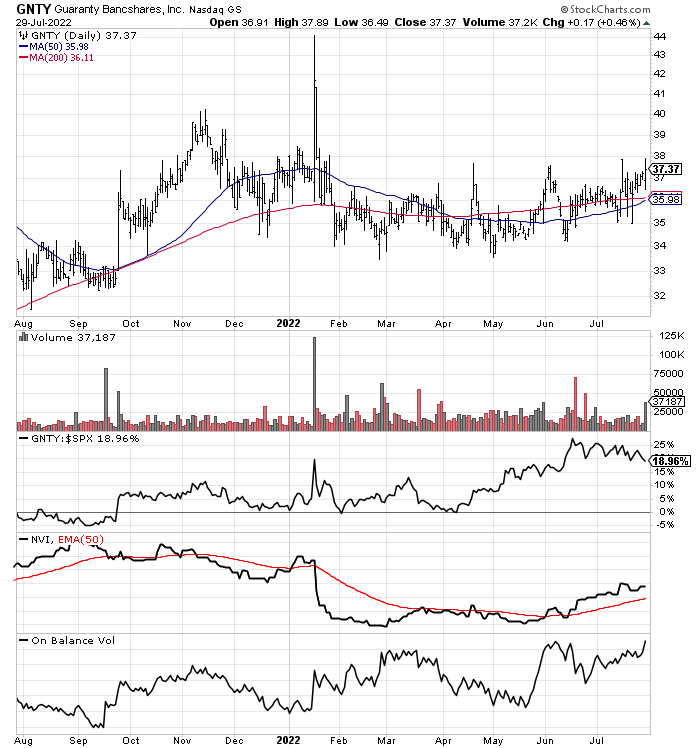

Guaranty Bancshares

Another defensive idea in the financial sector is Guaranty Bancshares (GNTY). GNTY has been showing up on my top momentum sorts for weeks, without the high-volume trading of months ago. However, on Friday, better volume buying took place. It’s a small regional bank with 32 branches operating in the booming Texas economy, supported by skyrocketing oil/gas prices in 2022. The stock is trading for 11x EPS with a 2.2% dividend yield. Total returns of 10% (possibly 15%) over the next 12 months are my forecast. If Wall Street succumbs to a recession and declines in price the rest of 2022, steady low-volatility gainers will be in demand by investors. Positive performance vs. the weakening financial sector overall in 2022 is a major ingredient for my bullish stance. Because of its minor size, this bank is also a clear takeover candidate.

StockCharts

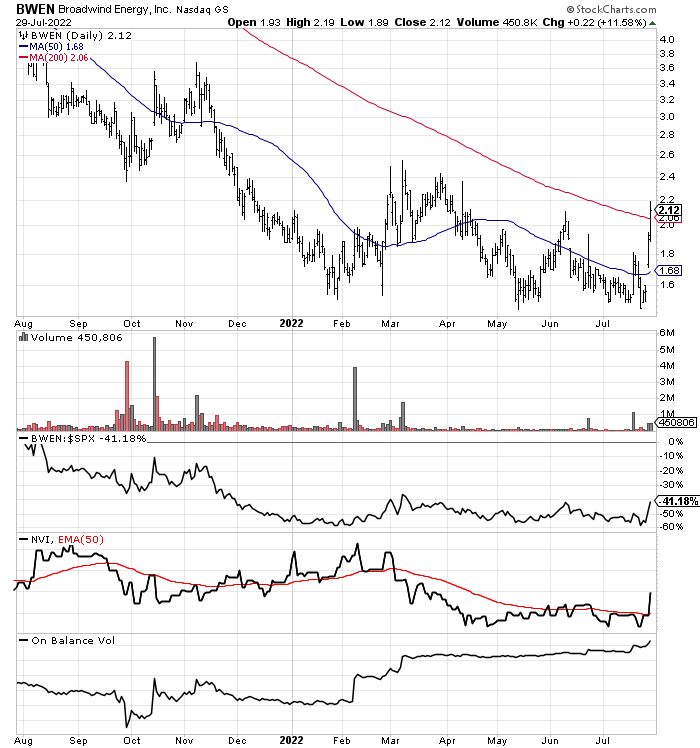

Broadwind Energy

With the surprise announcement this week of a deal by the Biden administration and Democratic leaders in Congress to fund climate change, global warming fixes, solar and wind names have moved straight up. In terms of a small pick few investors know about, Broadwind (BWEN) produces the large steel bases and gearing systems for windmills and the booming oil/gas industries. It appears sellers in BWEN shares have completely disappeared over the last few trading days.

With minor operating losses projected before this Washington bill is passed, the stock has been quietly trading all of 2022. Friday’s $2.12 price is still below its relatively conservative balance sheet setup, book value of $2.42 in March. The company held $64 million in current assets like cash, receivables, and inventory vs. $79 million in total liabilities. Price to sales of 0.25x is exceptionally low if business booms in 2023-24, bringing substantial operating profitability in the not-too-distant future. Note: this pick is more speculative, with greater downside risk to match monster upside potential.

StockCharts

Final Thoughts

If you are interested in finding stock ideas with volume breakout patterns, please come back and read future VBR efforts. I use as many as 15 uniquely-designed momentum indicators of health on daily computer sorts of thousands of equities, in addition to high-volume buying characteristics. The first post in this series was on June 25th here, with a goal of writing weekly summaries of my research formulas, crossed with 35 years of experience dissecting company financials. You can find a good explanation of what kind of gains are possible in my July 9th Volume Breakout Report here.

I suggest readers take the time to do further research into any of the VBR selections that appeal to you, a function of your risk appetite or sector exposure needs in portfolio construction. Please understand small-cap picks should be a limited portion of portfolio design. Holding a diversified number of stocks (at least 20-30) is the prudent risk-adjusted way to play them. Volatile price swings are part of the investing process for smaller companies on Wall Street. Please consider using preset stop-loss sell orders to reduce downside potential in individual names. Depending on your risk tolerance, 10% to 30% stop levels are recommended.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment