Investment Thesis

Volkswagen AG (OTCPK:VWAGY) is a huge global player in the automotive industry. Their strong core brands combined with a varied and far-reaching product portfolio have allowed the company to target a multitude of consumer groups with their vehicles.

Continued strong sales and revenues in 2022 have led to a hugely profitable year for the company. When combined with a huge push for electrification of their powertrains and a transition towards solely producing electric vehicles, there is evidently a huge amount of potential future value yet to be unlocked.

While some short-term headwinds do still exist for the company in late 2022 moving into 2023, strong fundamentals suggest that in the long-term Volkswagen stock could be significantly undervalued.

Company Background

Volkswagen is a German automaker consortium known primarily for their wide range of automobiles and motorcycles. They are headquartered in Wolfsburg, Germany.

The VW group comprises ten distinct brands: Volkswagen, Skoda, Seat, Cupra, Audi, Lamborghini, Bentley, Porsche and Ducati. This extensive brand portfolio allows the company to target consumers across a variety of market segments which allows the firm to maximize brand penetration and reach within the automotive marketplace.

VW is actively pursuing an electrification strategy across their brands in hopes of gaining a lasting competitive advantage over their competitors in electric vehicle (EV) powertrains technologies. The group also hopes to develop a sustainable reputation and brand image with consumers across their brands in the new era of battery electric vehicles (BEV).

The transition to BEVs is also largely due to the increasing pressures governments and social groups have placed on automakers to comply with ever tightening emissions regulations.

This has placed automakers such as VW under incredible stresses as they attempt to continue innovating their product offerings whilst navigating a tumultuous macroeconomic environment.

Arguably, such pressures on the firm culminated in the 2015 “Diesel Gate” emissions scandal, which found VW guilty of cheating emissions tests with software in their cars. The push for an increasingly sustainable and environmentally conscious image through electrification is paramount for VW to mitigate the poor ESG reputation they developed through this scandal.

Economic Moat – In Depth Analysis

The primary driver for VW’s economic moat is their extensive portfolio of intangible assets and recent push for portfolio electrification. The brand image VW brands such as Porsche, Lamborghini, Audi and Bentley have developed over the years allows VW to command a premium price for vehicles sold under these brands.

On average, these premium cars sell with much larger profit margins due to the increased price consumers are willing to pay for these “status” vehicles.

The significant and successful presence VW has in many racing categories such as the Le Mans LMD and LMDh segments allow the firm to curate a high-end and attractive brand image which resonates particularly with a more youthful market category.

By also selling more midrange vehicles under the Volkswagen, Skoda and Seat brands, VW is able to engage with a much larger volume of consumers thus increasing their brands penetration within the automotive marketplace. These higher-volume brands also offer VW increased stability in recessionary periods as unit sales are less effected due to the more utilitarian nature of these products compared to their premium counterparts.

New “Electrified” Volkswagen Logo (right) vs Old Logo (left) (Brand New.com)

Vehicles sold under the groups “Volkswagen” branding benefit from a recent “New Volkswagen” rebranding campaign which focuses on realigning the Volkswagen brand towards an exciting, electric future. By 2025, the VW brand aims to have over 20 EV models on offer to consumers with the target of having sold over one million BEVs.

Along with this rebranding in 2019, VW launched their first mass-market EV: the VW ID.3. The company has followed-up the ID.3 with the ID.4, ID.5 and Plug-In Hybrid variants of their current internal combustion engine (ICE) vehicles.

Infotainment screen running VW’s “We Connect Start” software (Volkswagen Press Release)

VW aims to combine this push for powertrain electrification with a significant focus on ensuring a high level of “connected smart devices” functions within their automobiles.

The Volkswagen “We Connect Start” ecosystem digital ecosystem should allow VW vehicles to connect with smart-home devices and increase the inter-compatibility with preexisting smart devices consumers may already own.

While this drive for increased technology and EVs in general aligns with the prevailing consumer tastes of the current decade, there is little to suggest VW has developed any distinct competitive advantage with their current product offerings. VW group EVs continue to exhibit average efficiency both in terms of battery densities and KW/100km consumption metrics.

Furthermore, while the infotainment systems on VW group vehicles have developed significantly over the past five year, they still lag behind competitors’ offerings such as BMW’s iDrive system.

Unfortunately, the truth remains that VW is engaged in the incredibly competitive global automotive manufacturing industry. This means they are subject to customers who have continuously changing tastes.

While VW group customers exhibit high levels of brand loyalty towards the automaker’s premium brands in particular, the truth is that switching costs for consumers are essentially non-existent. Across VW’s entire brand portfolio, it would be just as easy for a customer to buy a Kia, Mercedes-Benz or Ferrari as it would to purchase a Skoda, Audi or Porsche.

I believe VW has a very narrow economic moat. Their broad portfolio of brands and push for electrification aligns with prevailing consumers tastes, but non-existent switching costs for consumers combined with a lack of tangible technological advantage provide VW with little influence over customer decisions.

Financial Situation

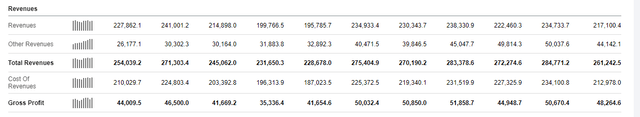

Seeking Alpha – VWAGY Financials

Volkswagen has had a relatively profitable history, especially given the prevalent abundance of loss-making companies in the automotive industry. Looking at the income statement, the company once again has delivered a robust gross profit in FY21 of $50.7B. This represented an increase of 12.9% over their 2020 figures. Gross profit in FY22 is expected to surpass even their hugely successful FY21.

Already in the first three quarters of FY22, VW has achieved a gross profit of $33.8B representing a gross margin of 19.3%, compared to just 18.1% in FY21. Automotive department sales revenues in FY22 also grew by 6.6% compared to Q1-Q3 FY21 largely due to the rise in price positioning abilities for the firms products.

The primary brands under the VW group responsible for these increased sales revenues were the Volkswagen Passenger Cars brand along with solid performance from both Audi and Porsche. Interestingly, sales volumes of Skoda cars increased by 13.5% but actually resulted in a decrease in operating revenue of 4.8%.

Skoda vehicles sell at a lower price-point compared to their VW or Audi counterparts while still utilizing many of the same core components thus resulting in decreased margins. However, it is crucial to understand that this implies VW Group has been selling at least some of their Skoda vehicles at prices resulting in a loss-making position.

Nonetheless, the profitability of the VW passenger cars brand along with the other premium brands more than offsets the small losses encountered by the Skoda division. Furthermore, Skoda is currently driving a strategy of increasing their brand penetration in the marketplace which suggest these losses are controlled and most likely only for the short-term.

Overall, VW has shown healthy and continued growth on their income statement which has resulted in their TTM ROIC growing to 5.21% compared to only 4.96% in 2021. Their five-year average ROIC is 4.8, which highlights the magnitude of Volkswagen’s current operational prowess and profitability.

Volkswagen has also been steadily growing their operating margins post-pandemic from just 4.51% in 2020 to a TTM of 6.89 in December, 2022.

Deliveries of vehicles to customers has decrease year-on-year by 12.9% due to the limited availability of parts caused by the ongoing supply chain disruption induced by the COVID-19 pandemic. However, the sale of their all-electric BEVs has increased 25% representing a total group share of 6% in delivery volumes.

Considering automotive revenues continued to increase even with a slowing in deliveries, it is not a factor that places the value or future ability to generate shareholder returns into jeopardy.

Such a slowdown in deliveries is not unique to Volkswagen and has been experienced by almost all automakers including BMW (OTCPK:BMWYY) and Mercedes-Benz (OTCPK:MBGAF).

Unfortunately for VW, their COGS for the period Q1-Q3 FY22 have increased by 8.2% compared to the same period last year. This was primarily due to the fiscal effects of the weakening euro resulting in import costs for components having increased drastically. $2.1B in increased losses were attributed to the direct effects of the Russia-Ukraine conflict.

Even with the increased COGS, VW’s operating result increased 61% in Q1-Q3 FY22 compared to FY21 primarily thanks to the aforementioned robust sales revenues seen in the automotive department. This suggests VW’s key intangible assets (brands) continue to remain popular and desirable to consumers, with particular reference given to the high-end premium identities.

Total group earnings before tax decreased 27% to just $2.1B. This was primarily due to the large impairment costs associated with the shutting down of Argo AI, an autonomous driving company owned in partnership (42% each) with the Ford Motor Company (F).

While the shutting-down of Argo AI places the future of Volkswagens autonomous driving possibilities into a precarious balance, from a current fiscal perspective it was necessary. Argo AI was unable to return profits posting large losses each year since 2016. Therefore, from a shareholder perspective for the next five years, this comes as welcomed news.

Volkswagen’s balance sheet looks to be in healthy shape much akin to their income statement. Their total current assets for the TTM are $227B, while current liabilities only amount to $172B. VW has a respectable quick ratio of 0.93 (current assets minus inventory divided by current liabilities).

Their current ratio is even more attractive at 1.21 (current assets divided by current liabilities. VW exhibits healthy financial stability and is not current struggling with any major liquidity risks.

As a result of the transactions involved in the launch of the Porsche (P911) IPO, the Volkswagen Group’s equity increased by €19.2 billion as of September 30, 2022, of which €10.8 billion is reported as noncontrolling interests. This is reflected on their Q1-Q3 FY22 interim balance sheet resulting in the Volkswagen Group having total assets of €574B on September 30, 2022. This is an increase of 8.6% compared to the end of 2021.

VW’s Automotive Division’s intangible assets were up €32.5B at the end of September 2022, due mainly to higher capitalized development costs. Property, plant and equipment declined slightly, due primarily to depreciation in excess of additions.

Inventories included in this figure increased, primarily for production-related reasons, and were attributable to disruptions in the logistics chain. In addition, changes in exchange rates due to the weakening Euro had a negative effect resulting in the increase in financial liabilities.

Volkswagens balance sheets are in excellent condition following the Porsche IPO which proved to be a successful venture for the company. This IPO allowed the true worth of the Porsche brand and company to be valued correctly both as its own stock and as part of the Volkswagen Group.

Volkswagen has also been consistently decreasing their long-term debt from €43B in 2020 to €40B in 2021. Furthermore, Volkswagens average cost of debt decreased in the same period from 1.5% to just 1.3%. While little detail is given on the exact nature of VW’s debt instruments their proactive stance to reducing this burden is encouraging and welcomed by investors.

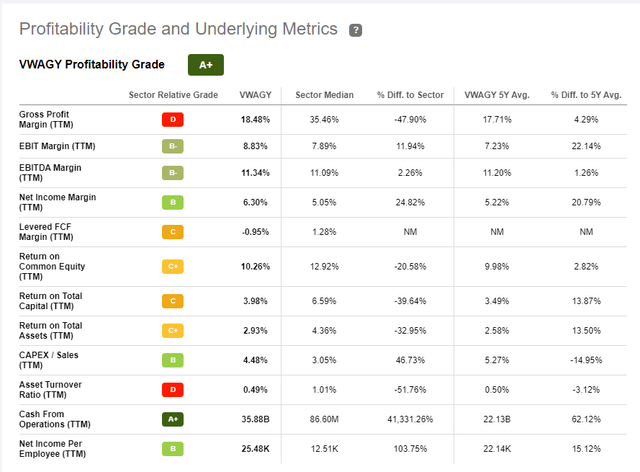

Seeking Alpha – VWAGY Profitability

Seeking Alpha’s Quant assigns Volkswagen with a profitability grade of A+ which I believe is representative of the cash flow and general value generation abilities of the company. Cash flow from operations for VW AG amounted to $44B in 2021, with the past TTM totaling $36B.

While their return on total assets and on total capital are a little lower than investors would like to see, this is largely attributable to their large spending on research and development programs in the race to electrify their vehicle portfolio.

Spending on R&D over the past nine months increasing to $13.8B (from $11.4B in 2021). I believe these strategic capital expenditures are necessary for VW to catch-up to other manufacturers when it comes to EV efficiency.

VW estimates that they anticipate a further increase of around 8% in spending on R&D in the upcoming year due to the need for development of “new technologies.” These most likely revolve around the electrification of powertrains.

Valuation

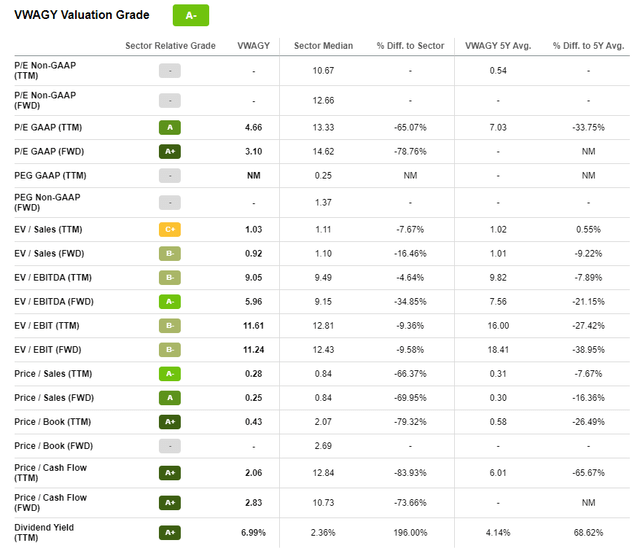

Seeking Alpha – VWAGY Valuation

Seeking Alpha’s quant system has assigned an A- Valuation rating for VW, which I am mostly inclined to agree with. Their FWD P/E GAAP of 3.10 is excellent, especially considering a sector median of 15.24.

This is supported by a FWD EV/EBITDA of 5.97 compared to a historical 5Y average of 7.56 and a sector median of 9.37. Equally, their Price/Cash-Flow FWD multiple is only 2.83 compared to 11.21 as a sector median.

I believe these metrics combined with the solid financial fundamentals underpinning VW illustrate that shares are currently trading at prices well below their intrinsic market value.

In the short term (3-10 months), it is difficult to say what Volkswagen stock will do. I believe the stock price may still exhibit some bearish tendencies due to the difficult macroeconomic environment. However, strong demand in the new year and the much-awaited Q4 and FY2022 reports should bring a boost to the share price if results are as positive as we are expecting.

In the long-term (2-4 years) their strong position as a profitable automotive mega-conglomerate combined with an efficiency-focused operations model should allow the automaker’s stock to rise back towards a price-point which better reflects its intrinsic value.

If the share price falls another $2-$5, it would in my opinion firmly place the firm in a deep-value position making it an attractive possibility for long-position oriented investors.

Risks Facing Volkswagen

The primary risks for VW arise primarily from the highly cyclical industry in which it operates as well as from fierce industry competition. Careful consideration of global economic factors is critical when investing in the auto industry.

If we consider the current nature of the cycle, I believe we are beginning to near the bottom of the automotive stock crash.

Equally, from an ESG perspective, VW has had a huge exposure towards changing government legislations and social demands regarding the production of carbon emissions. The threat of ever tightening emissions regulations by governments creates a difficult situation for all automakers as they race to produce EV’s and hybrid-powertrains.

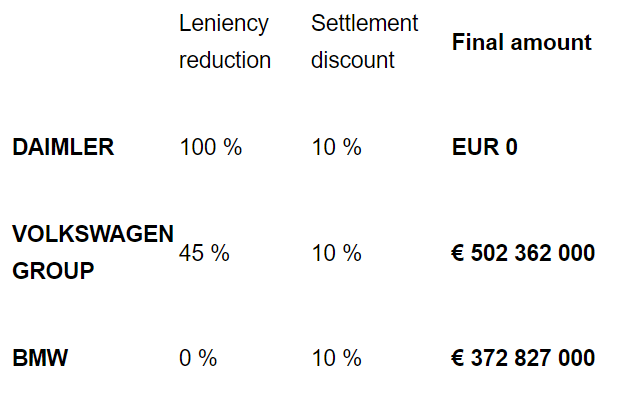

EU Commission – Anti-Trust Diesel Gate

This pressure culminated in VW engaging in emissions cheating by installing software on their vehicles which would reduce critical greenhouse gas emissions during regulatory tests. The resulting anti-trust investigation dubbed “Diesel-Gate” harmed VWs reputation significantly and placed the ethical status of the entire company under doubts.

The European Union concluded investigations by fining the VW Group €525.4M. While this financial damage was not critical fiscally to the firm, the firms image as a reliable and trustworthy automotive brand was tarnished significantly.

The primary uncertainty which arises from this against VW is the potential lack of business ethics present at the firm on a larger scale. However, VW has illustrated an undeniable dedication towards cleaning up their image both through a shuffling of CEO along with their pledge for electrification.

Summary

VW has had a rough couple of years leading-up to 2022. However, solid business fundamentals, strong brand strength and a new focus on efficiency have allowed the company to grow sales volumes significantly while remaining profitable throughout. In my opinion, share prices are yet to reflect the true value generated by the VW group.

As a short-term investment, I believe there is still some volatility for the stock as uncertainty surrounds supply chain costs and potential future demand-side headwinds due to inflationary market pressures. However, in the long-term I believe their undeniable position as a market leader in the automotive segment combined with strong brand strength place VW in the perfect position for a much-awaited rebound.

I will carefully be watching Volkswagen stock for the next couple of months as I believe share prices are reaching the end of their current bearish tendencies. If you are looking to increase your portfolio exposure towards the automotive sector, Volkswagen may potentially be a good pick.

Nonetheless, it is prudent to consider alternatives such as BMW that also present a potentially attractive investment opportunity.

Be the first to comment